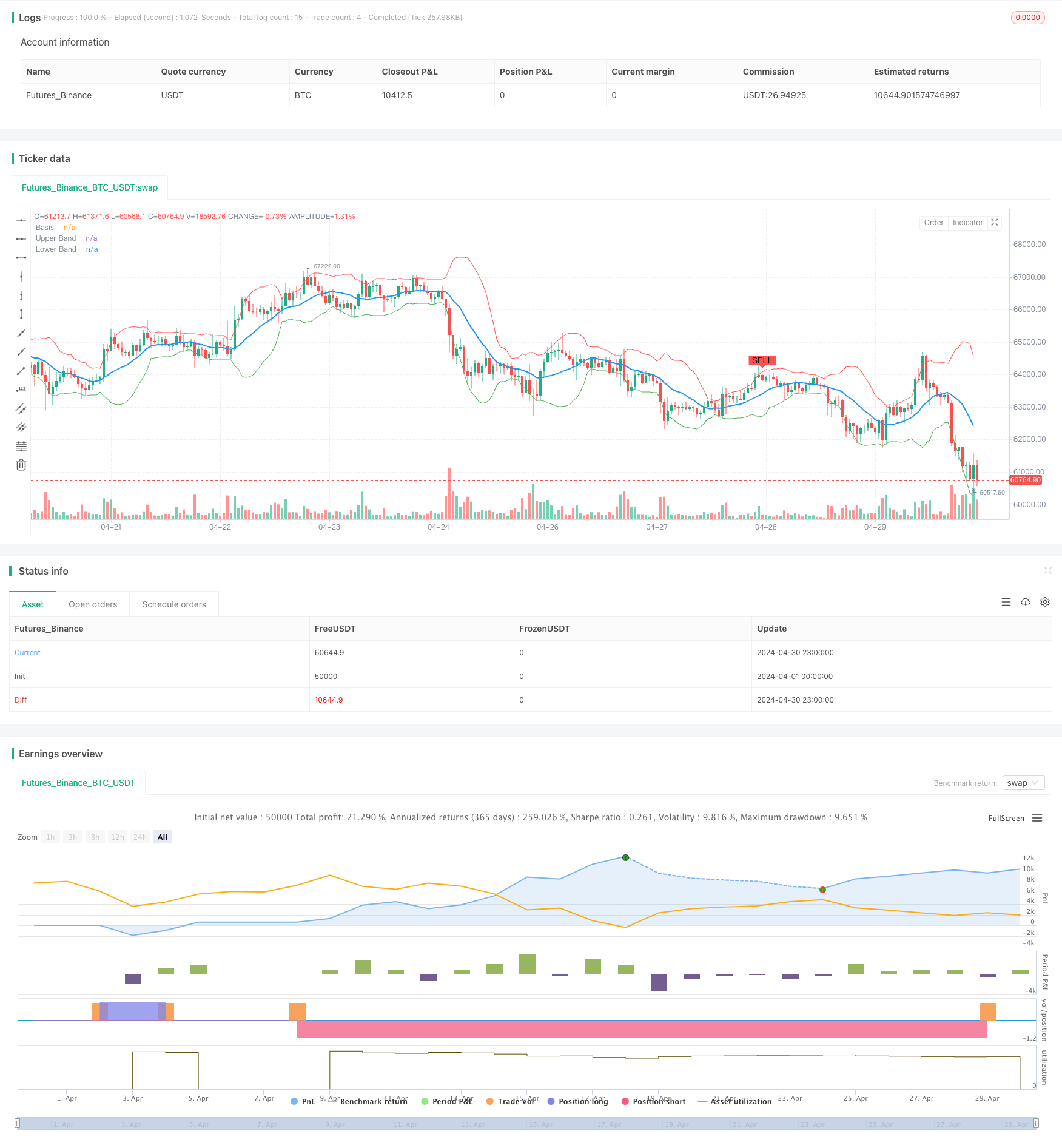

概述

该策略利用波林格带(Bollinger Bands)指标,在价格触及上轨时做空,触及下轨时做多,并设置动态止盈位,当持仓达到1%的盈利就平仓。该策略的核心思想是价格总是在波林格带内波动,具有均值回归的特性,因此可以在价格偏离移动平均线过远时进行反向操作,博取价差收益。

策略原理

- 计算移动平均线和标准差:使用简单移动平均(SMA)计算收盘价的移动平均值(basis),然后计算收盘价相对移动平均线的标准差(dev)。

- 计算上轨和下轨:上轨(upper)为 basis + dev * multiplier,下轨(lower)为 basis - dev * multiplier,其中 multiplier 为波动幅度的倍数。

- 产生交易信号:当收盘价上穿下轨且当前收盘价小于开盘价时产生做多信号;当收盘价下穿上轨且当前收盘价大于开盘价时产生做空信号。

- 动态止盈:开仓后,根据开仓价和止盈比例(takeProfitPercentage)计算止盈价格,当价格达到止盈价时平仓。

- 可视化:在图表上绘制波林格带、移动平均线以及交易信号。

策略优势

- 简单有效:该策略逻辑清晰,只利用了一个技术指标,便于理解和实施。

- 适用性广:波林格带具有普适性,可以用于各种不同的交易标的和市场。

- 动态止盈:与固定止盈相比,动态止盈可以让盈利单的利润最大化,同时控制住风险。

- 有效把握趋势:在趋势行情中,价格触及上轨或下轨后,通常会沿原方向继续运行一段时间,该策略可以有效把握这种趋势机会。

策略风险

- 震荡市中表现不佳:当市场处于宽幅震荡、价格在波林格带内反复突破时,该策略可能会频繁出现交易信号,导致交易次数过多,手续费成本上升。

- 趋势行情中回撤较深:如果趋势持续时间很长,价格长期偏离均线,该策略逆势而为,回撤可能较深。

- 参数选择困难:波林格带的参数(如长度、倍数)对策略表现影响很大,但并没有放之四海而皆准的最优参数。

策略优化方向

- 结合趋势判断:在策略中加入趋势判断指标(如移动平均线),在趋势行情中可暂停交易,或者顺势交易。

- 优化止盈止损:可以根据ATR等波动率指标对止盈止损进行动态调整,以期获得更好的收益风险比。

- 多因子组合:考虑将波林格带与其他技术指标(如RSI、MACD等)结合使用,提高信号准确性,减少虚假信号。

- 基本面过滤:在产生交易信号后,可以通过基本面数据(如财报、行业数据等)进行二次确认,从而提高策略的稳健性。

总结

该策略利用波林格带构建了一个简单有效的交易系统,以价格触及上下轨为信号,同时采用动态止盈的方式控制风险。策略在趋势行情中表现较好,但在震荡市中可能面临频繁交易的问题。后续可以从趋势判断、止盈止损优化、因子组合、基本面过滤等方面对策略进行完善,以期获得更加稳健的收益。

策略源码

/*backtest

start: 2024-04-01 00:00:00

end: 2024-04-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Future Price Prediction", overlay=true)

// Ayarlar

length = input.int(14, "Length")

mult = input.float(2.0, "Multiplier")

showBands = input.bool(true, "Show Bands")

takeProfitPercentage = 1.0

// Ortalama ve Standart Sapma Hesaplamaları

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

// Üst ve Alt Bantlar

upper = basis + dev

lower = basis - dev

// Grafikte Gösterim

plot(basis, color=color.blue, linewidth=2, title="Basis")

plot(showBands ? upper : na, color=color.red, linewidth=1, title="Upper Band")

plot(showBands ? lower : na, color=color.green, linewidth=1, title="Lower Band")

// Al-Sat Sinyalleri

longCondition = ta.crossover(close[1], lower[1]) and close[1] < open[1]

shortCondition = ta.crossunder(close[1], upper[1]) and close[1] > open[1]

// Kar al seviyeleri

float longTakeProfit = na

float shortTakeProfit = na

if longCondition

longTakeProfit := close * (1 + takeProfitPercentage / 100)

if shortCondition

shortTakeProfit := close * (1 - takeProfitPercentage / 100)

// Strateji Giriş ve Çıkış

if longCondition

strategy.entry("Buy", strategy.long)

strategy.exit("Take Profit", from_entry="Buy", limit=longTakeProfit)

if shortCondition

strategy.entry("Sell", strategy.short)

strategy.exit("Take Profit", from_entry="Sell", limit=shortTakeProfit)

// Al-Sat Sinyalleri Grafikte Gösterim

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Bilgi Tablosu

var table data = table.new(position.bottom_right, 2, 2, frame_color=color.black, frame_width=1)

if barstate.islast

table.cell(data, 0, 0, "Current Price", text_color=color.white)

table.cell(data, 1, 0, str.tostring(close))

table.cell(data, 0, 1, "Predicted Basis", text_color=color.white)

table.cell(data, 1, 1, str.tostring(basis))

相关推荐