概述

本策略是一个结合了多种技术分析工具的综合交易系统。它利用指数移动平均线(EMA)交叉、随机相对强弱指标(Stochastic RSI)、成交量价格关系以及蜡烛图形态来生成交易信号。该策略的核心在于通过多维度分析市场动态,提高交易决策的准确性和可靠性。

策略的主要组成部分包括: 1. 基于8期和20期EMA的交叉系统 2. 利用成交量和价格关系计算的趋势指标 3. 随机RSI指标用于确认趋势反转 4. 牛熊背离检测机制 5. 吞没形态识别系统

通过整合这些元素,策略旨在捕捉市场趋势的转折点,同时通过设置止损和获利了结机制来管理风险。

策略原理

EMA交叉系统:

- 当8期EMA上穿20期EMA时,产生买入信号

- 当8期EMA下穿20期EMA时,产生卖出信号

成交量价格趋势计算:

- 通过成交量与收盘价的比值来衡量市场情绪

- 用于检测潜在的牛熊背离

随机RSI:

- 计算14期的随机RSI,用于确认潜在的趋势反转点

牛熊背离检测:

- 比较近期低点/高点与成交量价格趋势

- 当价格创新低但成交量价格趋势上升时,视为牛市背离

- 当价格创新高但成交量价格趋势下降时,视为熊市背离

吞没形态识别:

- 识别牛市和熊市吞没形态

- 用于设置止损点和获利了结点

交易逻辑:

- 在牛市背离或EMA金叉时买入

- 在熊市背离或EMA死叉时卖出

- 第一次出现反向吞没形态时设置止损

- 第二次出现反向吞没形态时平仓获利

策略优势

多维度分析:结合技术指标、成交量分析和蜡烛图形态,提供更全面的市场视角。

趋势跟踪与反转预警:EMA交叉系统有助于捕捉主要趋势,而背离检测和吞没形态则可以预警潜在的反转。

风险管理:通过吞没形态设置动态止损和获利点,有助于控制风险和锁定利润。

灵活性:策略可以适应不同的市场条件,既能在趋势市场中获利,又能在震荡市场中捕捉反转机会。

自动化:策略可以编程实现,减少人为情绪干扰,提高执行效率。

客观性:基于明确的技术指标和图形模式,减少主观判断带来的偏差。

策略风险

过度交易:在震荡市场中,频繁的EMA交叉可能导致过度交易,增加交易成本。

滞后性:EMA和RSI等指标本质上是滞后指标,可能在快速变化的市场中错过重要拐点。

假突破:在横盘整理阶段,可能出现短期的假突破,导致错误信号。

参数敏感性:策略效果高度依赖于EMA周期、RSI参数等设置,不同市场可能需要不同的优化。

市场环境依赖:在强趋势市场中表现可能优于震荡市场,需要考虑市场周期。

信号冲突:不同指标可能产生相互矛盾的信号,需要建立明确的优先级规则。

策略优化方向

动态参数调整:

- 根据市场波动率自动调整EMA周期和RSI参数

- 实现:使用ATR(平均真实波幅)指标来衡量波动率,据此动态调整参数

加入市场情绪指标:

- 引入VIX或PUT/CALL比率等情绪指标

- 目的:在极端市场情绪下过滤可能的假信号

优化止损机制:

- 考虑使用跟踪止损,如ATR倍数止损

- 优势:可以更好地适应市场波动,保护利润

引入时间框架分析:

- 在多个时间框架上验证信号

- 好处:减少假信号,提高交易的可靠性

整合基本面数据:

- 考虑加入经济日历事件、季度报告等基本面因素

- 目的:在重要事件前后调整策略敏感度,避免不必要的风险

机器学习优化:

- 使用机器学习算法优化参数选择和信号生成

- 潜力:可以自适应市场变化,提高策略的稳定性和盈利能力

总结

该”均线交叉、相对强弱指标、成交量价格趋势、吞没形态策略”是一个全面而复杂的交易系统,结合了多种技术分析工具和风险管理技术。通过整合EMA交叉、随机RSI、成交量价格关系分析以及蜡烛图形态识别,该策略旨在提供一个全方位的市场分析框架。

策略的主要优势在于其多维度分析能力和灵活的风险管理机制。通过结合趋势跟踪和反转预警系统,它能够在不同的市场环境中寻找交易机会。同时,基于吞没形态的动态止损和获利机制,为资金管理提供了一个系统化的方法。

然而,该策略也面临一些潜在风险,如过度交易、参数敏感性和市场环境依赖等。为了应对这些挑战,我们提出了几个优化方向,包括动态参数调整、引入市场情绪指标、优化止损机制、多时间框架分析、整合基本面数据以及应用机器学习技术。

总的来说,这是一个复杂而全面的交易策略,具有较强的适应性和潜力。通过持续优化和回测,它有望成为一个强大的交易工具。然而,使用者需要充分理解策略的原理和局限性,并在实际交易中谨慎应用。

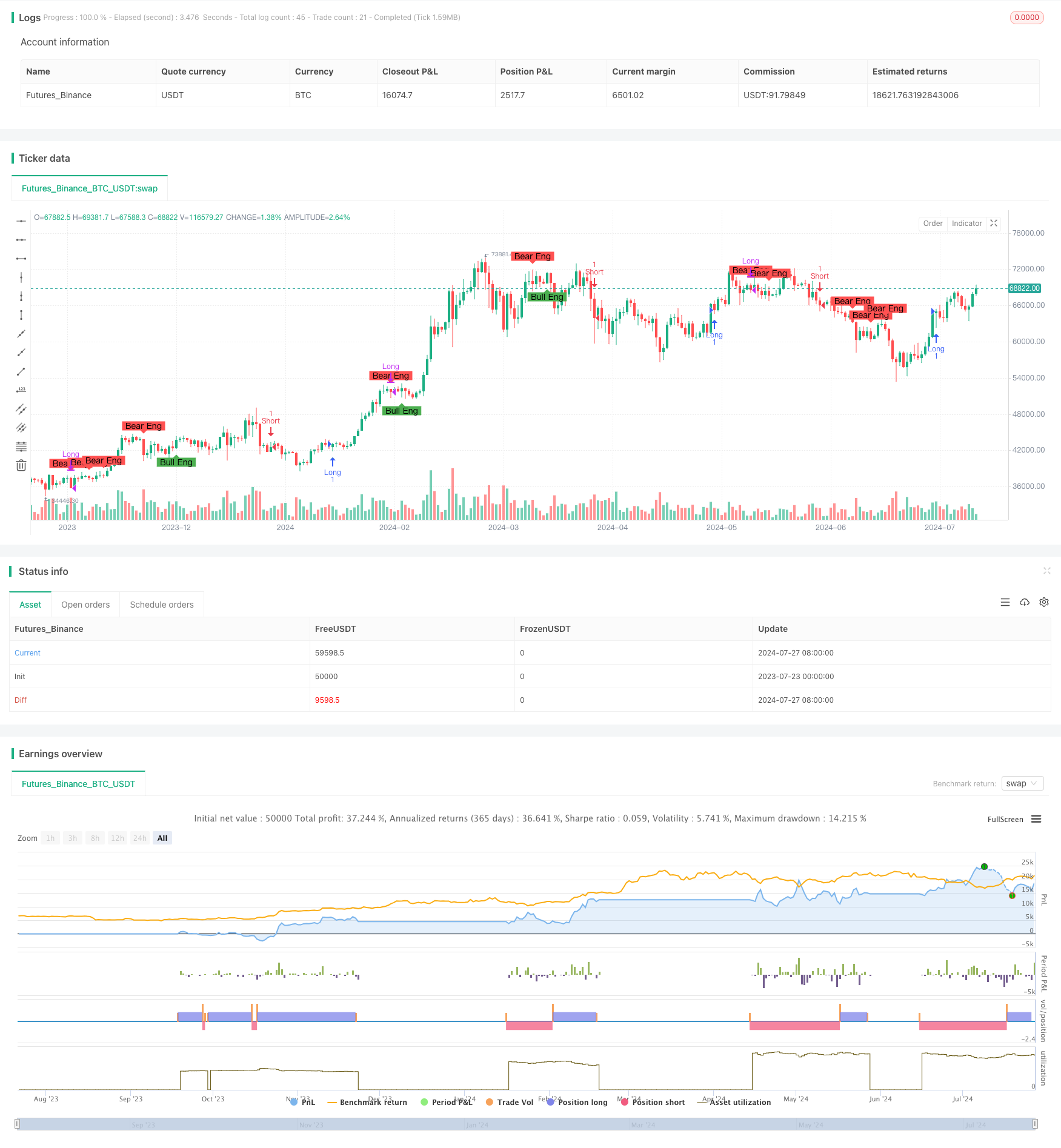

/*backtest

start: 2023-07-23 00:00:00

end: 2024-07-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined Strategy with Custom Signals and Reversal Patterns", overlay=true)

// Extract data

dataClose = close

dataVolume = volume

dataHigh = high

dataLow = low

// Calculate Volume-Price Relation

volume_price_trend = dataVolume / dataClose

// Calculate Stochastic RSI

stoch_rsi = ta.stoch(dataClose, dataClose, dataClose, 14)

// Calculate EMA

ema_12 = ta.ema(dataClose, 8)

ema_26 = ta.ema(dataClose, 20)

// Bullish Divergence

bullish_divergence = ((ta.lowest(dataLow, 6) < ta.lowest(dataLow, 7)) and (volume_price_trend > ta.lowest(volume_price_trend, 6)))

// Bearish Divergence

bearish_divergence = ((ta.highest(dataHigh, 6) > ta.highest(dataHigh, 7)) and (volume_price_trend < ta.highest(volume_price_trend, 6)))

// Check for buy signals

buy_signal = (bullish_divergence or ((ema_12 > ema_26) and (ema_12[1] <= ema_26[1]))) // Previous crossover point

// Check for sell signals

sell_signal = (bearish_divergence or ((ema_12 < ema_26) and (ema_12[1] >= ema_26[1]))) // Previous crossover point

// Plot custom signals

plotshape(buy_signal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(sell_signal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// Optional: Add alerts for buy and sell signals

alertcondition(buy_signal, title="Buy Signal Alert", message="Buy signal detected!")

alertcondition(sell_signal, title="Sell Signal Alert", message="Sell signal detected!")

// Define patterns for Reversal Candlestick Patterns

isBullishEngulfing() =>

bullishEngulfing = close > open and close[1] < open[1] and close > open[1] and open < close[1]

bullishEngulfing

isBearishEngulfing() =>

bearishEngulfing = close < open and close[1] > open[1] and close < open[1] and open > close[1]

bearishEngulfing

// Calculate patterns

bullishEngulfing = isBullishEngulfing()

bearishEngulfing = isBearishEngulfing()

// Plot reversal signals

plotshape(bullishEngulfing, title="Bullish Engulfing", location=location.belowbar, color=color.green, style=shape.labelup, text="Bull Eng")

plotshape(bearishEngulfing, title="Bearish Engulfing", location=location.abovebar, color=color.red, style=shape.labeldown, text="Bear Eng")

// Variables to count occurrences of engulfing patterns

var int bullishEngulfingCount = 0

var int bearishEngulfingCount = 0

// Strategy logic for combined signals and patterns

if (buy_signal)

strategy.entry("Long", strategy.long)

if (sell_signal)

strategy.entry("Short", strategy.short)

// Logic to increment the engulfing pattern counts

if (bullishEngulfing)

bullishEngulfingCount += 1

else if (not bullishEngulfing)

bullishEngulfingCount := 0

if (bearishEngulfing)

bearishEngulfingCount += 1

else if (not bearishEngulfing)

bearishEngulfingCount := 0

// Exit conditions based on engulfing patterns

if (bearishEngulfing and strategy.position_size > 0)

strategy.close("Long")

if (bullishEngulfing and strategy.position_size < 0)

strategy.close("Short")

// Exit conditions for the second occurrence of engulfing patterns for taking profit

if (bullishEngulfingCount == 2 and strategy.position_size < 0)

strategy.close("Short")

if (bearishEngulfingCount == 2 and strategy.position_size > 0)

strategy.close("Long")