概述

该策略是一个基于抛物线SAR指标与价格之间背离关系的交易系统。通过监测SAR指标与价格走势之间的背离现象来识别潜在的趋势反转点,从而捕捉市场转折机会。策略采用了经典的抛物线SAR指标作为核心技术指标,结合背离分析方法,构建了一个完整的趋势跟踪交易系统。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 使用抛物线SAR指标跟踪价格趋势,该指标具有动态调整加速因子的特点 2. 通过设定回溯期(lookback)来检测价格与SAR指标之间的背离 3. 当出现看涨背离时(价格创新低而SAR未创新低),触发做多信号 4. 当出现看跌背离时(价格创新高而SAR未创新高),触发做空信号 5. 系统通过shape.triangleup和shape.triangledown在图表上标注交易信号 6. 集成了警报功能,可在出现交易信号时及时通知交易者

策略优势

- 指标选择科学

- 抛物线SAR是一个经过市场检验的成熟指标

- 指标参数可根据不同市场特征灵活调整

- 信号机制可靠

- 背离信号具有较强的趋势预测能力

- 结合价格走势和指标走势,降低假信号

- 系统设计完整

- 包含完整的信号生成、执行和监控机制

- 集成图形界面和警报功能,便于操作

策略风险

- 参数敏感性

- SAR参数设置不当可能导致过度交易

- 背离检测周期选择会影响信号质量

- 市场适应性

- 在剧烈波动市场可能产生虚假信号

- 横盘市场中可能频繁出现无效信号

- 风险控制不足

- 缺乏止损机制

- 没有仓位管理系统

策略优化方向

- 增强信号过滤

- 加入趋势过滤器,仅在主趋势方向交易

- 结合成交量指标验证信号有效性

- 完善风险控制

- 添加动态止损机制

- 设计仓位管理系统

- 优化参数调整

- 开发自适应参数系统

- 根据不同市场条件动态调整参数

总结

这是一个基于经典技术指标的趋势跟踪策略,通过背离分析方法捕捉市场转折点。策略设计思路清晰,实现方法简洁,具有良好的可操作性。但在实际应用中仍需要根据具体市场特征进行优化,特别是在风险控制方面需要进一步完善。通过增加过滤机制、完善风险控制系统,该策略有望获得更稳定的交易表现。

策略源码

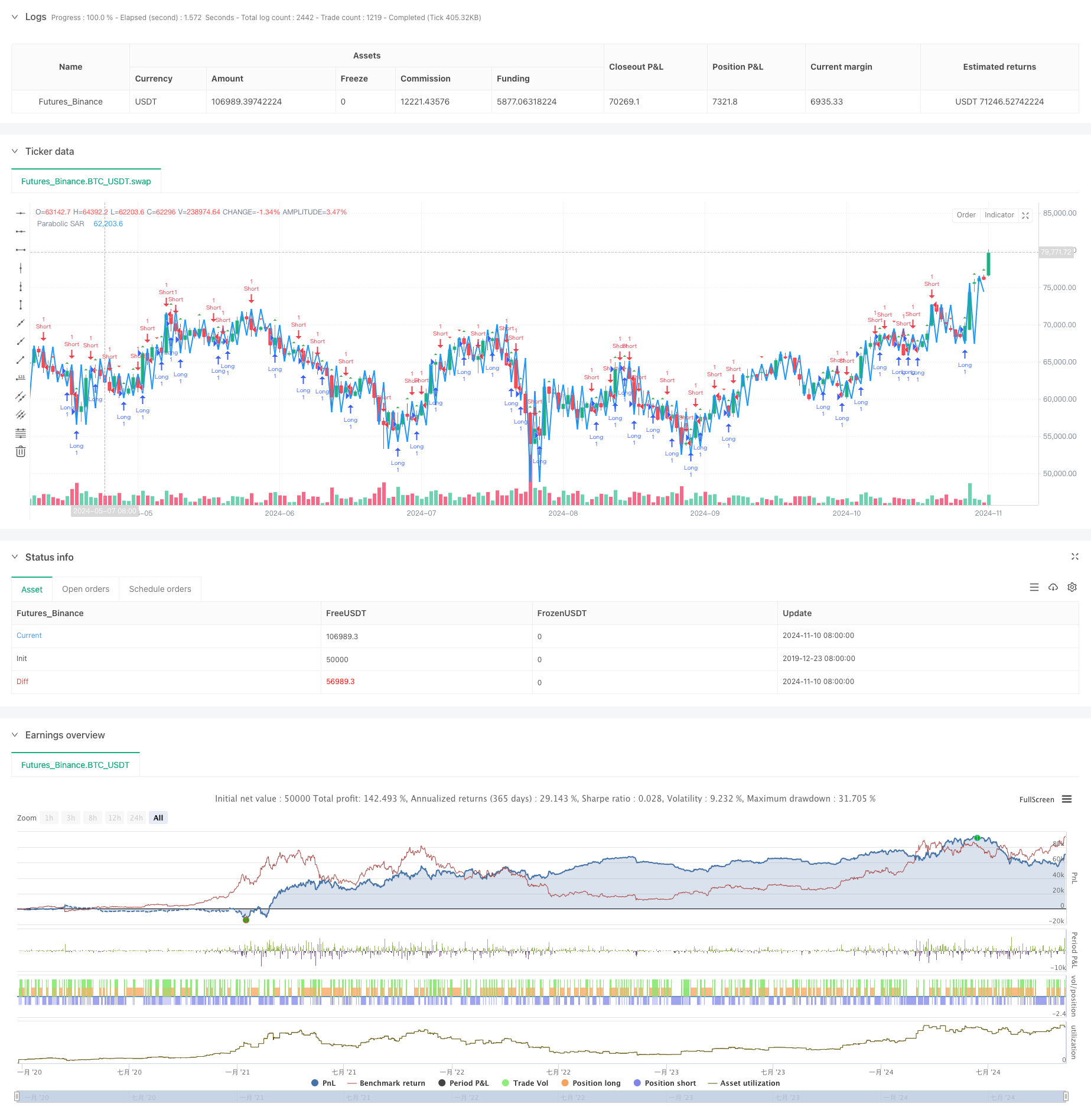

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SAR Divergence Strategy", overlay=true)

// --- Inputs ---

length = input.int(14, title="SAR Length", minval=1)

accelerationFactor = input.float(0.02, title="Acceleration Factor", minval=0.01)

maximumFactor = input.float(0.2, title="Maximum Factor", minval=0.01)

// --- SAR Calculation ---

sar = ta.sar(length, accelerationFactor, maximumFactor)

// --- Divergence Detection ---

lookback = 5

// Bullish Divergence

bullCond = close[lookback] < close[lookback + 1] and sar[lookback] > sar[lookback + 1]

// Bearish Divergence

bearCond = close[lookback] > close[lookback + 1] and sar[lookback] < sar[lookback + 1]

// --- Strategy Logic ---

if (bullCond)

strategy.entry("Long", strategy.long)

if (bearCond)

strategy.entry("Short", strategy.short)

// --- Plotting ---

plot(sar, color=color.blue, linewidth=2, title="Parabolic SAR")

plotshape(bullCond, style=shape.triangleup, color=color.green, size=size.small, title="Bullish Divergence")

plotshape(bearCond, style=shape.triangledown, color=color.red, size=size.small, title="Bearish Divergence")

// --- Alerts ---

alertcondition(bullCond, title="Bullish SAR Divergence", message="Bullish Divergence detected")

alertcondition(bearCond, title="Bearish SAR Divergence", message="Bearish Divergence detected")

相关推荐