概述

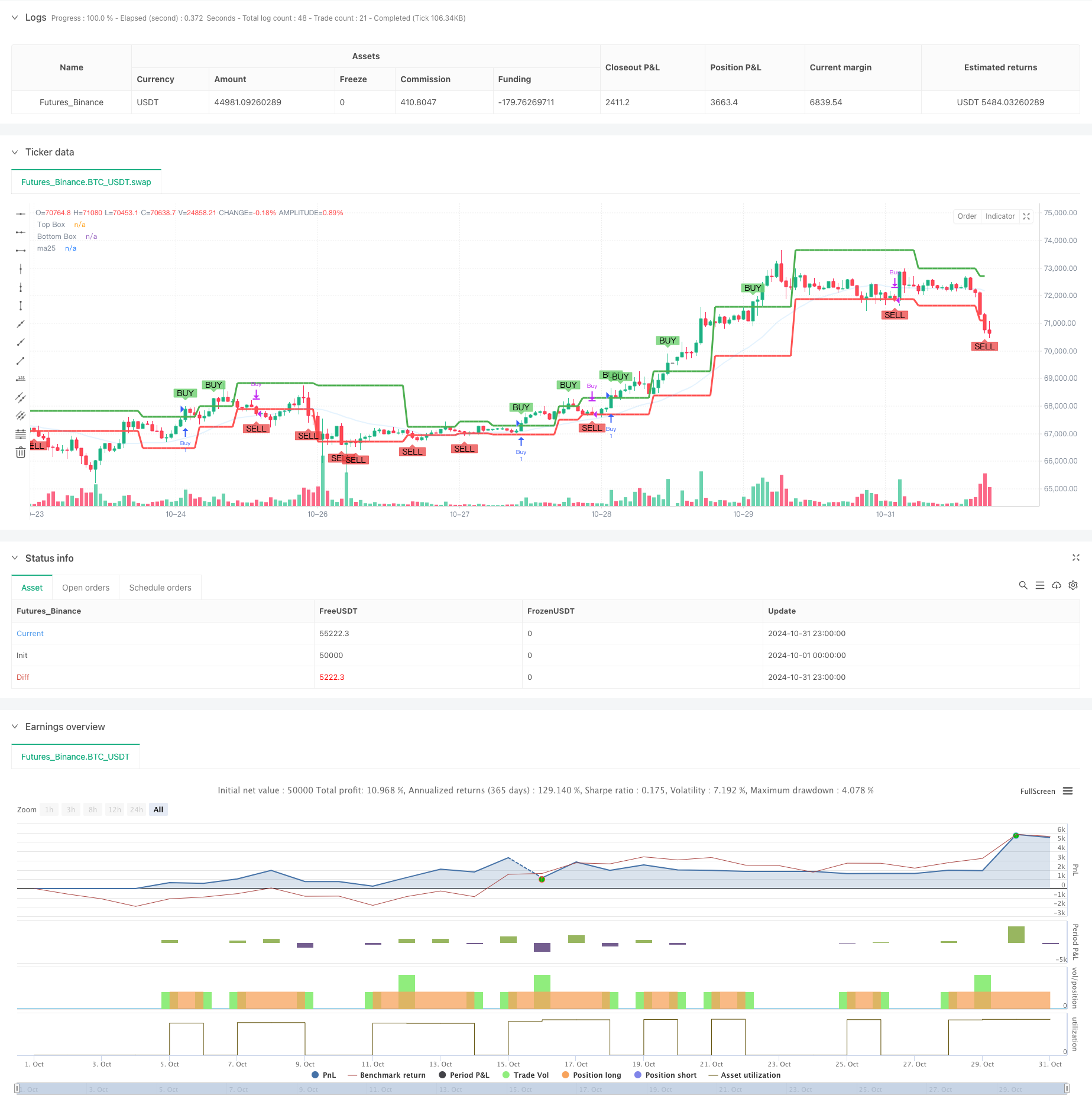

本文介绍的是一个结合达瓦斯箱体(Darvas Box)和25周期移动平均线(MA25)的趋势跟踪交易系统。该策略通过识别价格盘整区间形成的箱体,并结合均线趋势确认,在突破时捕捉强势行情。系统设计充分考虑了趋势延续性和假突破过滤,为交易者提供了一个完整的市场进出场框架。

策略原理

策略主要包含三个核心组成部分: 1. 达瓦斯箱体的构建:系统通过计算过去5个周期的最高价和最低价来确定箱体边界。箱体顶部由新高点确定,底部由相应区间内的最低点确定。 2. 均线趋势确认:引入25周期简单移动平均线作为趋势过滤器,只有当价格位于MA25之上时才考虑开仓。 3. 交易信号生成: - 买入信号:价格突破箱体顶部且位于MA25之上 - 卖出信号:价格跌破箱体底部

策略优势

- 趋势跟踪能力强:

- 通过箱体突破捕捉趋势起始

- 结合MA25过滤,确保在主趋势方向交易

- 信号质量优化:

- 双重确认机制降低假突破风险

- 明确的进出场条件,避免主观判断

- 风险控制完善:

- 箱体底部自然形成止损位

- MA25提供额外的趋势保护

策略风险

- 震荡市场风险:

- 频繁突破可能导致连续止损

- 建议在强趋势市场使用

- 滞后性风险:

- 箱体形成需要时间,可能错过部分行情

- MA25作为中期均线存在一定滞后

- 资金管理风险:

- 需要合理设置每次交易的资金比例

- 建议结合波动率动态调整仓位

策略优化方向

- 参数优化:

- 可根据不同市场特征调整箱体周期

- MA周期可以根据市场周期特征调整

- 信号增强:

- 可添加成交量确认机制

- 考虑引入动态止损机制

- 风险控制增强:

- 添加波动率过滤器

- 实现动态仓位管理

总结

该策略通过结合经典的达瓦斯箱体理论和移动平均线趋势跟踪,构建了一个稳健的交易系统。系统的主要优势在于能够有效捕捉趋势性行情,同时通过多重过滤机制控制风险。虽然存在一定的滞后性,但通过合理的参数优化和风险管理,该策略能够在趋势市场中获得稳定表现。建议交易者在实盘使用时,重点关注市场环境的选择,并根据实际情况动态调整参数设置。

策略源码

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("DARVAS BOX with MA25 Buy Condition", overlay=true, shorttitle="AEG DARVAS")

// Input for box length

boxp = input.int(5, "BOX LENGTH")

// Calculate 25-period moving average

ma25 = ta.sma(close, 25)

// Lowest low and highest high within the box period

LL = ta.lowest(low, boxp)

k1 = ta.highest(high, boxp)

k2 = ta.highest(high, boxp - 1)

k3 = ta.highest(high, boxp - 2)

// New high detection

NH = ta.valuewhen(high > k1[1], high, 0)

// Logic to detect top and bottom of Darvas Box

box1 = k3 < k2

TopBox = ta.valuewhen(ta.barssince(high > k1[1]) == boxp - 2 and box1, NH, 0)

BottomBox = ta.valuewhen(ta.barssince(high > k1[1]) == boxp - 2 and box1, LL, 0)

// Plot the top and bottom Darvas Box lines

plot(TopBox, linewidth=3, color=color.green, title="Top Box")

plot(BottomBox, linewidth=3, color=color.red, title="Bottom Box")

plot(ma25, color=#2195f31e, linewidth=2, title="ma25")

// --- Buy and Sell conditions ---

// Buy when price breaks above the Darvas Box AND MA15

buyCondition = ta.crossover(close, TopBox) and close > ma25

// Sell when price drops below the Darvas Box

sellCondition = ta.crossunder(close, BottomBox)

// --- Buy and Sell Signals ---

// Plot BUY+ and SELL labels

plotshape(series=buyCondition, title="Buy+ Signal", location=location.abovebar, color=#72d174d3, style=shape.labeldown, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.belowbar, color=color.rgb(234, 62, 62, 28), style=shape.labelup, text="SELL")

// --- Strategy execution ---

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.close("Buy")

相关推荐