概述

这是一个基于趋势跟踪和动量分析相结合的量化交易策略。该策略利用三重指数移动平均线(TEMA)、多重移动平均线交叉以及MACD变种指标来识别市场趋势和入场时机。策略采用了严格的风险控制机制,包括固定止损、获利目标以及追踪止损,以实现风险收益的最优平衡。

策略原理

策略主要通过三个核心技术指标系统来确定交易信号: 1. 三重指数移动平均线(TEMA)系统用于确认整体趋势方向。通过计算三层EMA并结合其动态变化来判断趋势强度。 2. 快慢均线交叉系统使用9周期和15周期的EMA,用于捕捉中期趋势的转折点。 3. 价格与5周期EMA的交叉作为最后的确认信号,用于精确把握入场时机。

交易信号的触发需要同时满足以下条件: - MACD指标与其信号线形成黄金交叉且TEMA趋势向上 - 短期EMA上穿长期EMA - 价格上穿5周期EMA

策略优势

- 多重确认机制大大降低了虚假信号的影响,提高了交易的准确性。

- 结合了趋势跟踪和动量分析的优点,既能把握大趋势,又不错过短期机会。

- 采用了完善的止损机制,包括固定止损点位和动态追踪止损,有效控制风险。

- 策略参数可调整性强,能适应不同市场环境。

- 入场逻辑清晰,易于理解和执行。

策略风险

- 多重确认机制可能导致入场较慢,在快速行情中错过部分机会。

- 固定止损点位需要根据不同市场波动率进行调整,否则可能过早被止损。

- 在横盘震荡市场中可能产生频繁的虚假信号。

- 追踪止损可能在市场剧烈波动时过早退出优质趋势。

策略优化方向

- 引入波动率指标来动态调整止损和获利目标,使其更符合市场状态。

- 增加成交量指标作为辅助确认,提高信号可靠性。

- 加入市场环境识别机制,在不同市场状态下使用不同的参数组合。

- 开发逆势加仓机制,在回调时适度建仓以提高收益。

- 优化追踪止损算法,使其更好地适应市场波动。

总结

该策略通过融合多个技术指标系统,构建了一个稳健的交易系统。其核心优势在于多重确认机制和完善的风险控制体系。虽然存在一定的滞后性风险,但通过参数优化和功能拓展,策略仍有较大的改进空间。适合追求稳健收益的交易者使用。

策略源码

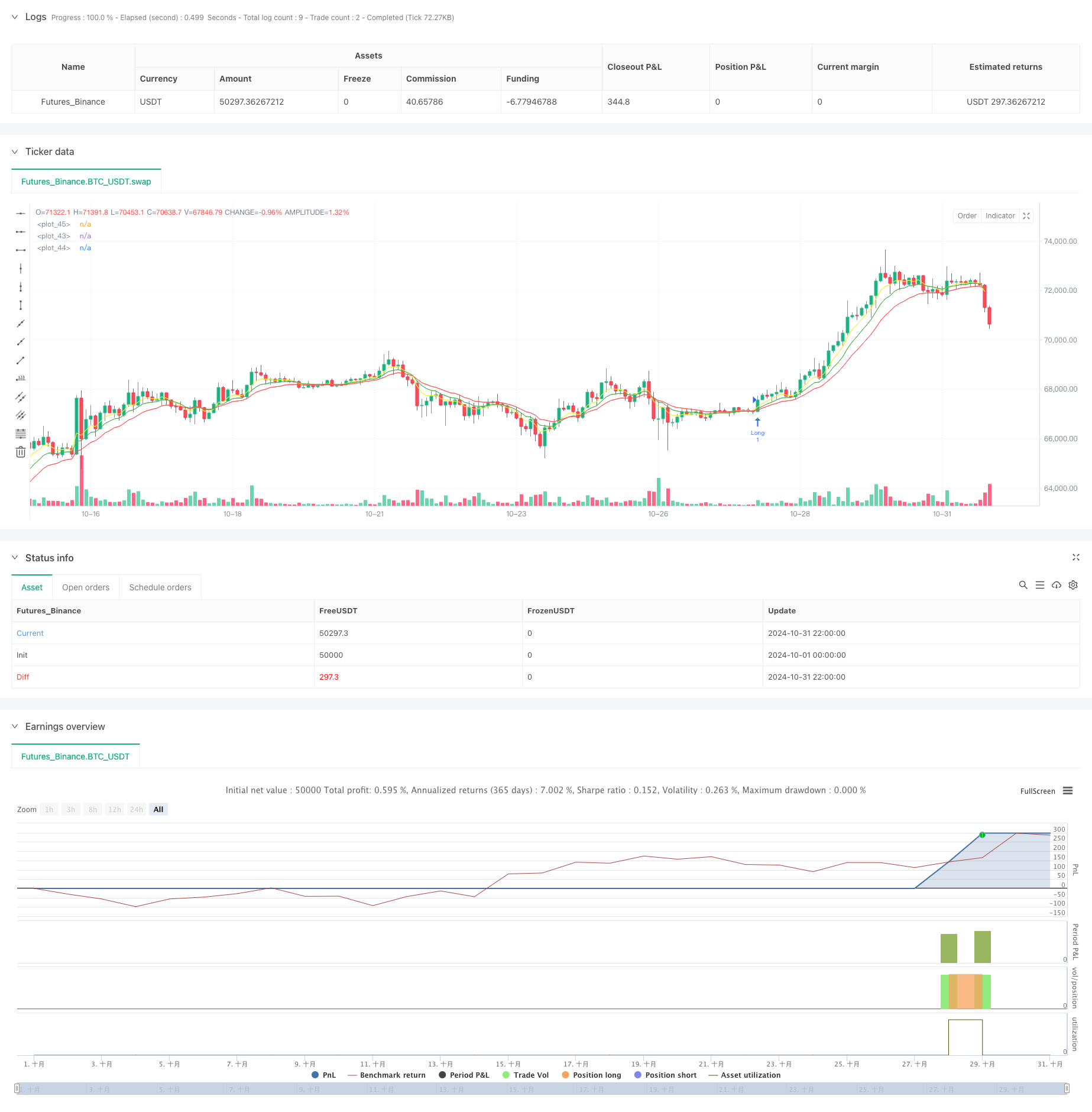

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ITG Scalper Strategy", shorttitle="lokesh_ITG_Scalper_Strategy", overlay=true)

// General inputs

len = input(14, title="TEMA period")

FfastLength = input.int(13, title="Filter fast length")

FslowLength = input.int(18, title="Filter slow length")

FsignalLength = input.int(14, title="Filter signal length")

sl_points = 7 // 5 points stop loss

tp_points = 100 // 100 points target profit

trail_points = 15 // Trailing stop loss every 10 points

// Validate input

if FfastLength < 1

FfastLength := 1

if FslowLength < 1

FslowLength := 1

if FsignalLength < 1

FsignalLength := 1

// Get real close price

realC = close

// Triple EMA definition

ema1 = ta.ema(realC, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

// Triple EMA trend calculation

avg = 3 * (ema1 - ema2) + ema3

// Filter formula

Fsource = close

FfastMA = ta.ema(Fsource, FfastLength)

FslowMA = ta.ema(Fsource, FslowLength)

Fmacd = FfastMA - FslowMA

Fsignal = ta.sma(Fmacd, FsignalLength)

// Plot EMAs for visual reference

shortema = ta.ema(close, 9)

longema = ta.ema(close, 15)

yma = ta.ema(close, 5)

plot(shortema, color=color.green)

plot(longema, color=color.red)

plot(yma, color=#e9f72c)

// Entry conditions

firstCrossover = ta.crossover(Fmacd, Fsignal) and avg > avg[1]

secondCrossover = ta.crossover(shortema, longema) // Assuming you meant to cross shortema with longema

thirdCrossover = ta.crossover(close, yma)

var bool entryConditionMet = false

if (firstCrossover)

entryConditionMet := true

longSignal = entryConditionMet and secondCrossover and thirdCrossover

// Strategy execution

if (longSignal)

strategy.entry("Long", strategy.long)

entryConditionMet := false // Reset the entry condition after taking a trade

// Calculate stop loss and take profit prices

var float long_sl = na

var float long_tp = na

if strategy.position_size > 0 // Long position

long_sl := close - sl_points

long_tp := close + tp_points

// Adjust stop loss with trailing logic

if (close - long_sl > trail_points)

long_sl := close - trail_points

strategy.exit("Exit Long", "Long", stop=long_sl, limit=long_tp)

// Plotting Buy signals

plotshape(series=longSignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

// Alerts

alertcondition(longSignal, title="Buy Signal", message="Buy Signal")

相关推荐