概述

该策略是一个结合了多周期移动平均线、RSI超买超卖信号以及价格形态识别的综合交易系统。策略主要通过快速与慢速移动平均线的交叉、RSI指标的超买超卖区域判断,以及看涨、看跌吞没形态来捕捉市场趋势转折点,从而产生交易信号。该策略采用百分比仓位管理方式,默认每次交易使用10%的账户资金,这种方式有助于实现更好的风险控制。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 移动平均线系统:使用9周期和21周期的简单移动平均线(SMA)作为快速和慢速均线,通过均线交叉来判断趋势方向。 2. RSI动量指标:采用14周期的RSI指标,设定70为超买水平,30为超卖水平,用于确认价格动量。 3. 价格形态识别:通过程序化方式识别看涨和看跌吞没形态,作为辅助交易信号。 4. 信号综合:买入信号需满足快线上穿慢线且RSI处于超卖区域,或出现看涨吞没形态;卖出信号需满足快线下穿慢线且RSI处于超买区域,或出现看跙吞没形态。

策略优势

- 多维度信号确认:结合技术指标和价格形态,提高信号可靠性。

- 风险控制完善:采用账户百分比持仓方式,有效控制每笔交易风险。

- 趋势跟踪能力:通过均线系统可以有效捕捉中长期趋势。

- 信号可视化:策略提供清晰的图形界面,包括均线、RSI指标以及交易信号标记。

- 灵活的参数设置:允许调整均线周期、RSI参数等,适应不同市场环境。

策略风险

- 震荡市场风险:在横盘震荡市场中可能产生频繁的假突破信号。

- 滞后性风险:移动平均线本质上是滞后指标,可能错过最佳入场时机。

- 参数敏感性:不同市场环境下最优参数可能存在较大差异。

- 形态识别准确性:程序化识别的形态可能与实际市场形态存在偏差。

策略优化方向

- 引入波动率过滤:建议添加ATR指标来过滤低波动率环境下的交易信号。

- 优化止损机制:可以基于ATR设置动态止损,提高风险控制的灵活性。

- 增加市场环境判断:引入趋势强度指标,在不同市场环境下使用不同的参数组合。

- 完善仓位管理:可以根据信号强度和市场波动率动态调整仓位大小。

- 加入时间过滤:考虑市场时间特征,避免在特定时间段交易。

总结

这是一个设计合理、逻辑清晰的综合技术分析交易策略。通过结合多个技术指标和价格形态,策略在保证信号可靠性的同时,也实现了较好的风险控制。虽然存在一些固有的局限性,但通过建议的优化方向,策略的整体表现有望得到进一步提升。使用者在实际应用中需要注意参数优化和市场环境适配,以达到最佳的交易效果。

策略源码

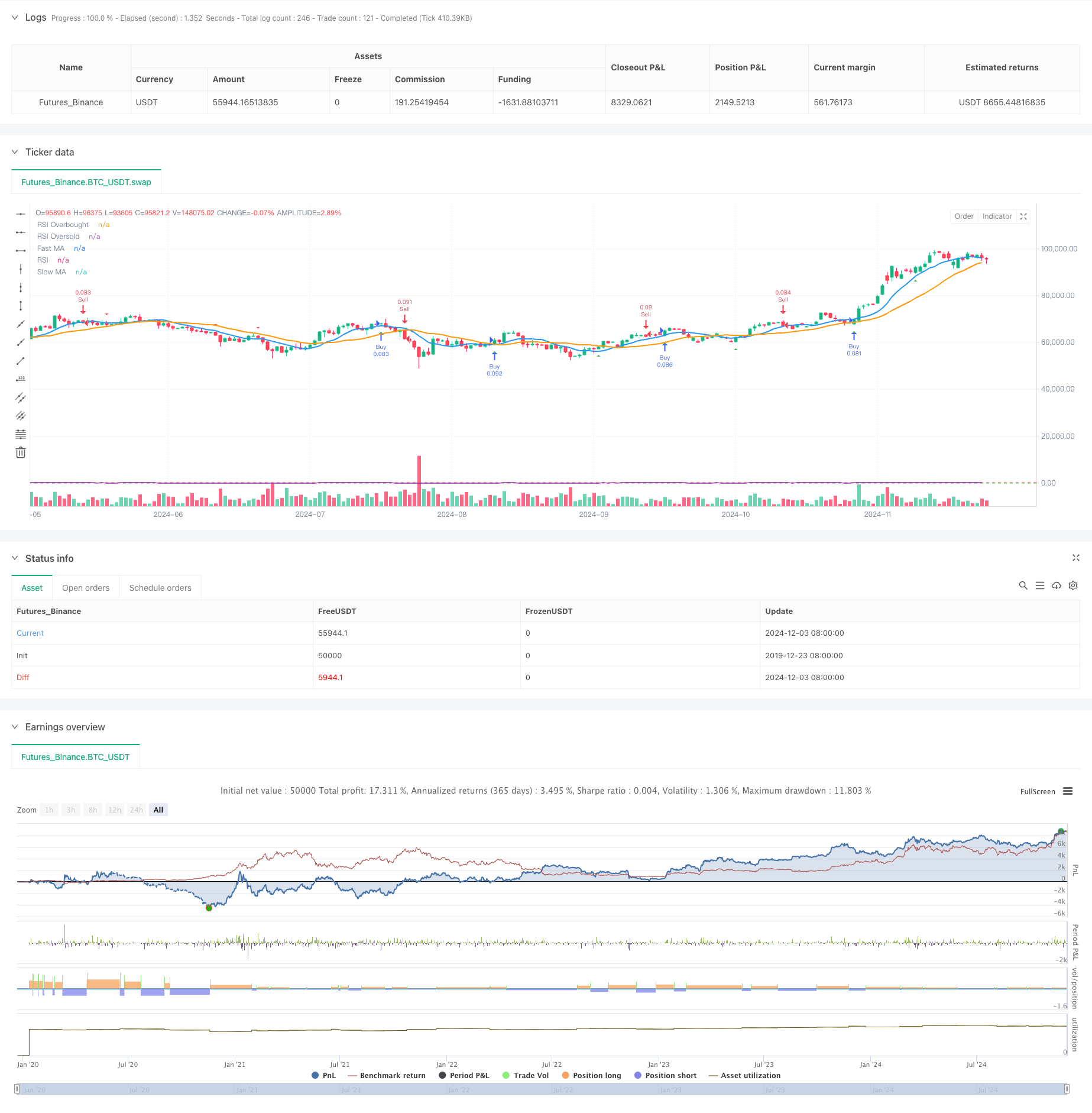

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Comprehensive Trading Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input parameters for moving averages

fastLength = input.int(9, title="Fast MA Length")

slowLength = input.int(21, title="Slow MA Length")

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

// Calculate moving averages

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Detect price action patterns (e.g., engulfing patterns)

isBullishEngulfing = close > open and close[1] < open[1] and open < close[1] and close > open[1]

isBearishEngulfing = close < open and close[1] > open[1] and open > close[1] and close < open[1]

// Define conditions for buying and selling

buyCondition = ta.crossover(fastMA, slowMA) and rsi < rsiOversold or isBullishEngulfing

sellCondition = ta.crossunder(fastMA, slowMA) and rsi > rsiOverbought or isBearishEngulfing

// Execute buy and sell orders

if (buyCondition)

strategy.entry("Buy", strategy.long)

if (sellCondition)

strategy.entry("Sell", strategy.short)

// Plotting

plot(fastMA, color=color.blue, linewidth=2, title="Fast MA")

plot(slowMA, color=color.orange, linewidth=2, title="Slow MA")

hline(rsiOverbought, "RSI Overbought", color=color.red)

hline(rsiOversold, "RSI Oversold", color=color.green)

plot(rsi, color=color.purple, linewidth=1, title="RSI")

// Alert conditions

alertcondition(buyCondition, title="Buy Signal", message="Price meets buy criteria")

alertcondition(sellCondition, title="Sell Signal", message="Price meets sell criteria")

// Plot signals on chart

plotshape(series=buyCondition ? low : na, location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small, title="Buy Signal")

plotshape(series=sellCondition ? high : na, location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small, title="Sell Signal")

相关推荐