概述

本策略是一个结合布林带、RSI指标和200周期EMA趋势过滤器的高级量化交易系统。该策略通过多重技术指标的协同配合,在趋势方向上捕捉高概率的突破机会,同时有效过滤震荡市场中的虚假信号。系统采用动态止损和基于风险收益比的获利目标设置,旨在实现稳健的交易表现。

策略原理

策略核心逻辑基于以下三个层面: 1. 布林带突破信号:利用布林带上下轨作为波动率通道,价格突破上轨视为做多信号,突破下轨视为做空信号。 2. RSI动量确认:RSI位于50以上确认做多动量,位于50以下确认做空动量,避免在无趋势时交易。 3. EMA趋势过滤:利用200周期EMA判断主趋势,只在趋势方向上开仓。价格在EMA之上做多,之下做空。

交易确认需要满足: - 连续两根K线维持突破状态 - 成交量高于20周期均值 - 动态止损基于ATR值计算 - 获利目标基于1.5倍风险收益比设置

策略优势

- 多重技术指标协同过滤,显著提高信号质量

- 动态的仓位管理机制,根据市场波动度自适应调整

- 严格的交易确认机制,有效降低虚假信号

- 完整的风险控制体系,包括动态止损和固定风险收益比

- 灵活的参数优化空间,可适应不同市场环境

策略风险

- 参数优化过度可能导致过拟合

- 剧烈波动市场可能触发频繁止损

- 震荡市场可能产生连续亏损

- 趋势转折点处信号滞后

- 技术指标之间可能出现矛盾信号

风险控制建议: - 严格执行止损纪律 - 控制单次交易风险 - 定期回测验证参数有效性 - 结合基本面分析 - 避免过度交易

策略优化方向

- 引入更多技术指标互相验证

- 开发自适应参数优化机制

- 增加市场情绪指标

- 优化交易确认机制

- 开发更灵活的仓位管理系统

主要优化思路: - 根据不同市场周期动态调整参数 - 增加交易过滤条件 - 优化风险收益比设置 - 完善止损机制 - 开发更智能的信号确认系统

总结

该策略通过布林带、RSI和EMA等技术指标的有机结合,构建了一个完整的交易系统。系统在保证交易质量的同时,通过严格的风险控制和灵活的参数优化空间,展现出较强的实战应用价值。建议交易者在实盘中谨慎验证参数,严格执行交易纪律,持续优化策略表现。

策略源码

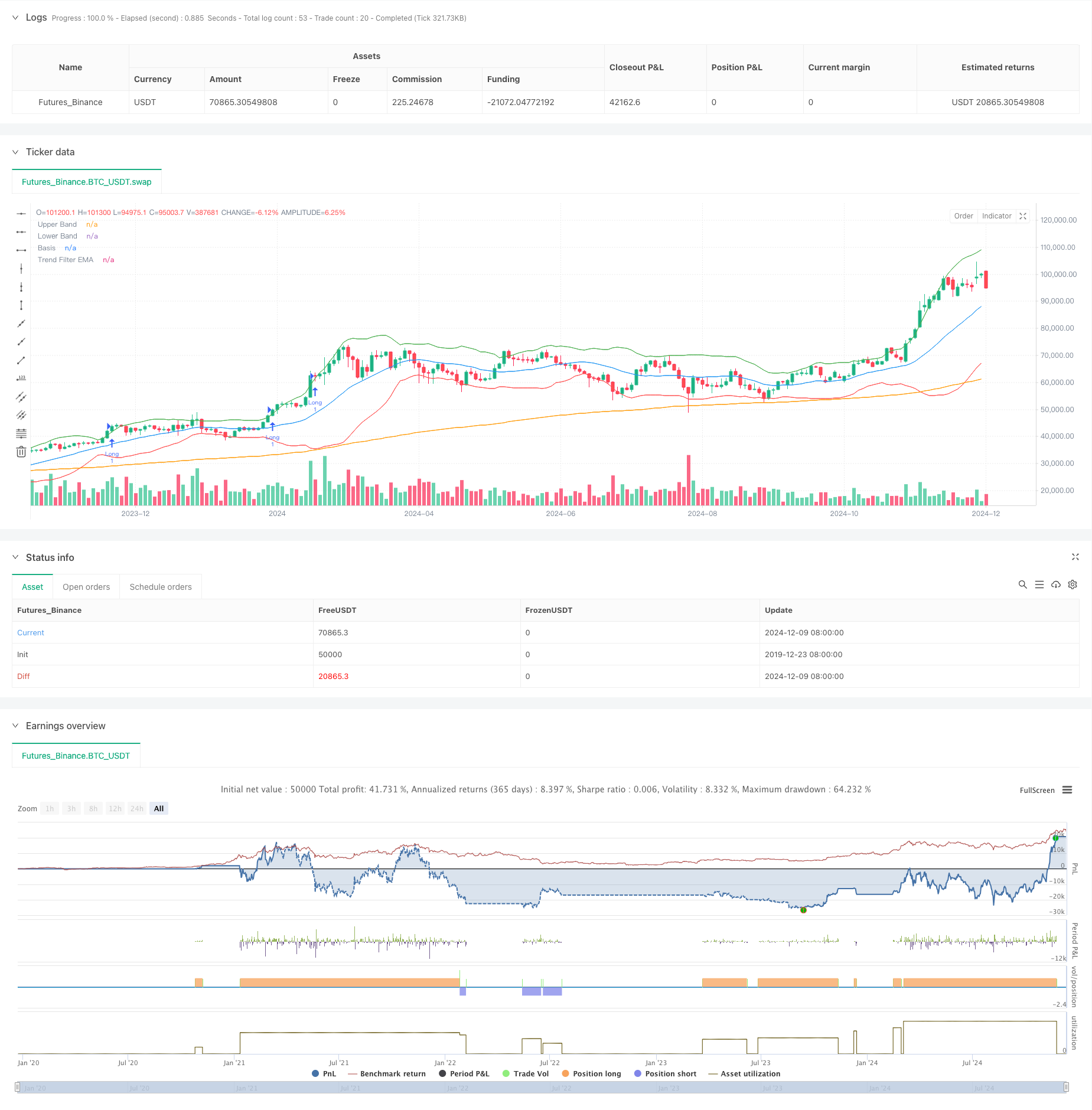

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Improved Bollinger Breakout with Trend Filtering", overlay=true)

// === Inputs ===

length = input(20, title="Bollinger Bands Length", tooltip="The number of candles used to calculate the Bollinger Bands. Higher values smooth the bands, lower values make them more reactive.")

mult = input(2.0, title="Bollinger Bands Multiplier", tooltip="Controls the width of the Bollinger Bands. Higher values widen the bands, capturing more price movement.")

rsi_length = input(14, title="RSI Length", tooltip="The number of candles used to calculate the RSI. Shorter lengths make it more sensitive to recent price movements.")

rsi_midline = input(50, title="RSI Midline", tooltip="Defines the midline for RSI to confirm momentum. Higher values make it stricter for bullish conditions.")

risk_reward_ratio = input(1.5, title="Risk/Reward Ratio", tooltip="Determines the take-profit level relative to the stop-loss.")

atr_multiplier = input(1.5, title="ATR Multiplier for Stop-Loss", tooltip="Defines the distance of the stop-loss based on ATR. Higher values set wider stop-losses.")

volume_filter = input(true, title="Enable Volume Filter", tooltip="If enabled, trades will only execute when volume exceeds the 20-period average.")

trend_filter_length = input(200, title="Trend Filter EMA Length", tooltip="The EMA length used to filter trades based on the market trend.")

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"], tooltip="Choose whether to trade only Long, only Short, or Both directions.")

confirm_candles = input(2, title="Number of Confirming Candles", tooltip="The number of consecutive candles that must meet the conditions before entering a trade.")

// === Indicator Calculations ===

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper_band = basis + dev

lower_band = basis - dev

rsi_val = ta.rsi(close, rsi_length)

atr_val = ta.atr(14)

vol_filter = volume > ta.sma(volume, 20)

ema_trend = ta.ema(close, trend_filter_length)

// === Helper Function for Confirmation ===

confirm_condition(cond, lookback) =>

count = 0

for i = 0 to lookback - 1

count += cond[i] ? 1 : 0

count == lookback

// === Trend Filter ===

trend_is_bullish = close > ema_trend

trend_is_bearish = close < ema_trend

// === Long and Short Conditions with Confirmation ===

long_raw_condition = close > upper_band * 1.01 and rsi_val > rsi_midline and (not volume_filter or vol_filter) and trend_is_bullish

short_raw_condition = close < lower_band * 0.99 and rsi_val < rsi_midline and (not volume_filter or vol_filter) and trend_is_bearish

long_condition = confirm_condition(long_raw_condition, confirm_candles)

short_condition = confirm_condition(short_raw_condition, confirm_candles)

// === Trade Entry and Exit Logic ===

if long_condition and (trade_direction == "Long" or trade_direction == "Both")

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", stop=close - (atr_multiplier * atr_val), limit=close + (atr_multiplier * risk_reward_ratio * atr_val))

if short_condition and (trade_direction == "Short" or trade_direction == "Both")

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", stop=close + (atr_multiplier * atr_val), limit=close - (atr_multiplier * risk_reward_ratio * atr_val))

// === Plotting ===

plot(upper_band, color=color.green, title="Upper Band")

plot(lower_band, color=color.red, title="Lower Band")

plot(basis, color=color.blue, title="Basis")

plot(ema_trend, color=color.orange, title="Trend Filter EMA")

相关推荐