概述

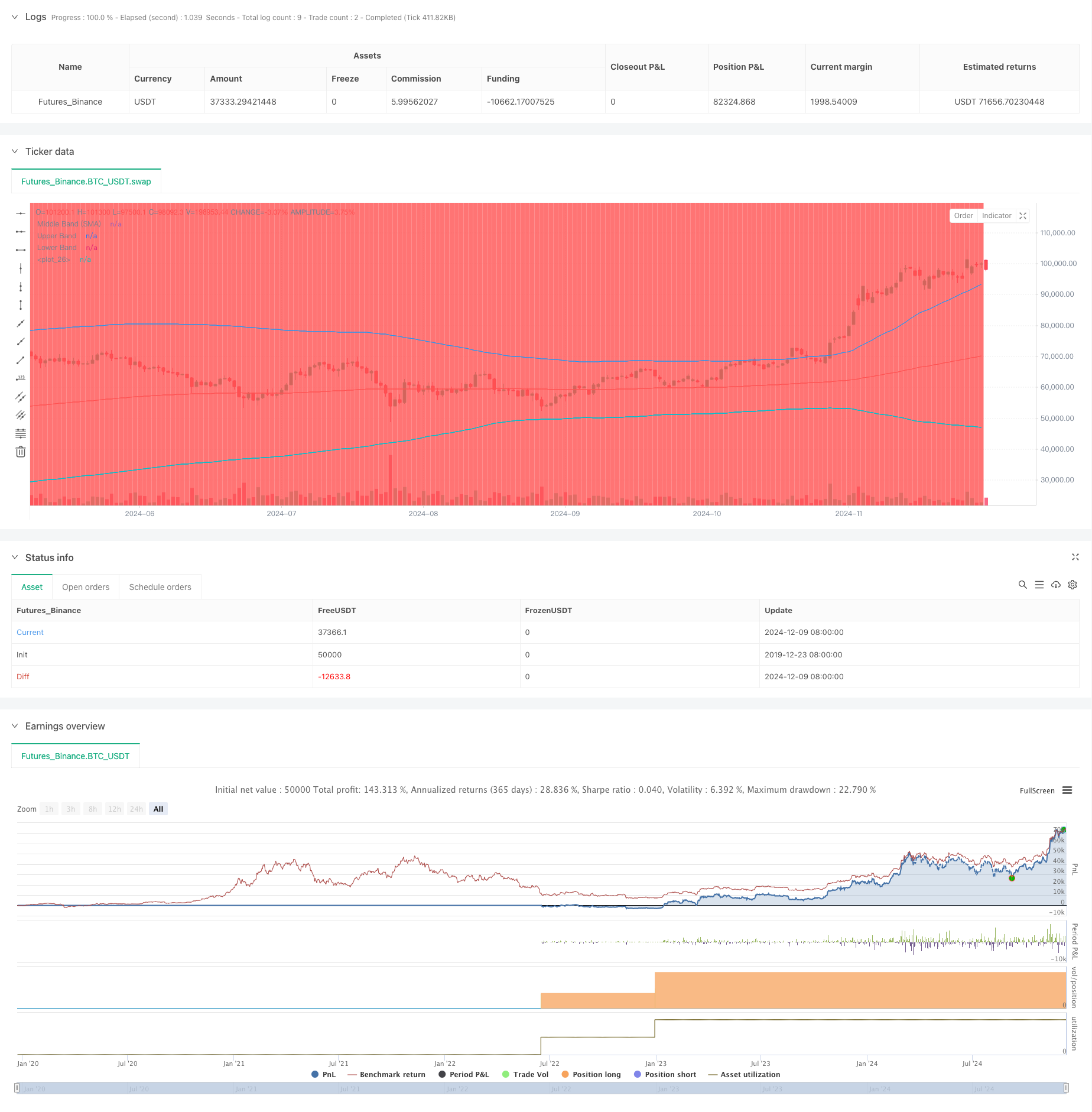

该策略是一个结合了美元成本平均法(DCA)和布林带技术指标的智能投资策略。它通过系统性地在价格回调期间建仓,利用均值回归原理进行投资。该策略的核心是在价格跌破布林带下轨时执行固定金额的买入操作,从而在市场调整时期获得更好的入场价格。

策略原理

策略的核心原理建立在三个基础之上:1)美元成本平均法,通过定期投入固定金额来降低择时风险;2)均值回归理论,认为价格终将回归到其历史平均水平;3)布林带指标,用于识别超买超卖区域。当价格突破布林带下轨时触发买入信号,买入数量由设定的投资金额除以当前价格决定。策略使用200周期指数移动平均线作为布林带的中轨,标准差倍数为2,以此来界定上下轨。

策略优势

- 降低择时风险 - 通过系统性买入而非主观判断来降低人为误差

- 把握回调机会 - 在价格超跌时自动执行买入操作

- 灵活的参数设置 - 可根据不同市场环境调整布林带参数和投资金额

- 明确的进出场规则 - 基于技术指标的客观信号

- 自动化执行 - 无需人工干预,避免情绪化交易

策略风险

- 均值回归失效风险 - 在趋势市场中可能会产生较多虚假信号

- 资金管理风险 - 需要预留足够资金应对连续买入信号

- 参数优化风险 - 过度优化可能导致策略失效

- 市场环境依赖 - 在剧烈波动市场中表现可能不佳 建议采用严格的资金管理制度,并定期评估策略表现来管理这些风险。

策略优化方向

- 引入趋势过滤器,避免在强势趋势中逆势操作

- 增加多重时间周期确认机制

- 优化资金管理系统,根据波动率动态调整投资金额

- 加入获利了结机制,在价格回归均值时获利了结

- 考虑结合其他技术指标,提高信号可靠性

总结

这是一个将技术分析与系统化投资方法相结合的稳健策略。通过布林带来识别超跌机会,配合美元成本平均法来降低风险。策略的成功关键在于参数的合理设置和严格的执行纪律。虽然存在一定风险,但通过持续优化和风险管理可以提高策略的稳定性。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-10 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("DCA Strategy with Mean Reversion and Bollinger Band", overlay=true) // Define the strategy name and set overlay=true to display on the main chart

// Inputs for investment amount and dates

investment_amount = input.float(10000, title="Investment Amount (USD)", tooltip="Amount to be invested in each buy order (in USD)") // Amount to invest in each buy order

open_date = input(timestamp("2024-01-01 00:00:00"), title="Open All Positions On", tooltip="Date when to start opening positions for DCA strategy") // Date to start opening positions

close_date = input(timestamp("2024-08-04 00:00:00"), title="Close All Positions On", tooltip="Date when to close all open positions for DCA strategy") // Date to close all positions

// Bollinger Band parameters

source = input.source(title="Source", defval=close, group="Bollinger Band Parameter", tooltip="The price source to calculate the Bollinger Bands (e.g., closing price)") // Source of price for calculating Bollinger Bands (e.g., closing price)

length = input.int(200, minval=1, title='Period', group="Bollinger Band Parameter", tooltip="Period for the Bollinger Band calculation (e.g., 200-period moving average)") // Period for calculating the Bollinger Bands (e.g., 200-period moving average)

mult = input.float(2, minval=0.1, maxval=50, step=0.1, title='Standard Deviation', group="Bollinger Band Parameter", tooltip="Multiplier for the standard deviation to define the upper and lower bands") // Multiplier for the standard deviation to calculate the upper and lower bands

// Timeframe selection for Bollinger Bands

tf = input.timeframe(title="Bollinger Band Timeframe", defval="240", group="Bollinger Band Parameter", tooltip="The timeframe used to calculate the Bollinger Bands (e.g., 4-hour chart)") // Timeframe for calculating the Bollinger Bands (e.g., 4-hour chart)

// Calculate BB for the chosen timeframe using security

[basis, bb_dev] = request.security(syminfo.tickerid, tf, [ta.ema(source, length), mult * ta.stdev(source, length)]) // Calculate Basis (EMA) and standard deviation for the chosen timeframe

upper = basis + bb_dev // Calculate the Upper Band by adding the standard deviation to the Basis

lower = basis - bb_dev // Calculate the Lower Band by subtracting the standard deviation from the Basis

// Plot Bollinger Bands

plot(basis, color=color.red, title="Middle Band (SMA)") // Plot the middle band (Basis, EMA) in red

plot(upper, color=color.blue, title="Upper Band") // Plot the Upper Band in blue

plot(lower, color=color.blue, title="Lower Band") // Plot the Lower Band in blue

fill(plot(upper), plot(lower), color=color.blue, transp=90) // Fill the area between Upper and Lower Bands with blue color at 90% transparency

// Define buy condition based on Bollinger Band

buy_condition = ta.crossunder(source, lower) // Define the buy condition when the price crosses under the Lower Band (Mean Reversion strategy)

// Execute buy orders on the Bollinger Band Mean Reversion condition

if (buy_condition ) // Check if the buy condition is true and time is within the open and close date range

strategy.order("DCA Buy", strategy.long, qty=investment_amount / close) // Execute the buy order with the specified investment amount

// Close all positions on the specified date

if (time >= close_date) // Check if the current time is after the close date

strategy.close_all() // Close all open positions

// Track the background color state

var color bgColor = na // Initialize a variable to store the background color (set to 'na' initially)

// Update background color based on conditions

if close > upper // If the close price is above the Upper Band

bgColor := color.red // Set the background color to red

else if close < lower // If the close price is below the Lower Band

bgColor := color.green // Set the background color to green

// Apply the background color

bgcolor(bgColor, transp=90, title="Background Color Based on Bollinger Bands") // Set the background color based on the determined condition with 90% transparency

// Postscript:

// 1. Once you have set the "Investment Amount (USD)" in the input box, proceed with additional configuration.

// Go to "Properties" and adjust the "Initial Capital" value by calculating it as "Total Closed Trades" multiplied by "Investment Amount (USD)"

// to ensure the backtest results are aligned correctly with the actual investment values.

//

// Example:

// Investment Amount (USD) = 100 USD

// Total Closed Trades = 10

// Initial Capital = 10 x 100 = 1,000 USD

// Investment Amount (USD) = 200 USD

// Total Closed Trades = 24

// Initial Capital = 24 x 200 = 4,800 USD

相关推荐