概述

该策略是一个结合布林带和EMA指标的趋势跟踪系统,通过多层风险控制机制来优化交易表现。策略核心是利用布林带上下轨的突破回归形态来捕捉市场趋势,同时结合EMA趋势过滤器来提高交易的准确性。系统还包含了完整的风险管理体系,包括追踪止损、固定止损、获利目标以及基于时间的平仓机制。

策略原理

策略的交易逻辑基于以下几个核心要素: 1. 使用标准差(STDDEV)为1.5、周期为14的布林带作为主要的交易信号指标 2. 当前一根K线收盘价突破上轨并且当前K线反转时,触发做空信号 3. 当前一根K线收盘价突破下轨并且当前K线走强时,触发做多信号 4. 可选择性地添加80周期EMA作为趋势过滤器,只在趋势方向一致时开仓 5. 当价格穿越布林带中轨时激活追踪止损 6. 可设置固定的止损和获利目标金额 7. 支持基于K线数量的自动平仓机制

策略优势

- 结合了趋势跟踪和反转交易的特点,能够在不同市场环境下表现稳定

- 多层次的风险控制系统提供了全面的资金管理方案

- 灵活的参数设置允许策略适应不同的市场条件

- EMA过滤器有效降低了假突破带来的风险

- 追踪止损机制能够有效地锁定利润

- 时间维度的平仓机制避免了长期套牢的风险

策略风险

- 在震荡市场中可能产生频繁的假突破信号

- 固定金额的止损可能不适合所有市场条件

- EMA过滤可能导致错过一些重要的交易机会

- 追踪止损可能在高波动市场中过早平仓

- 参数优化可能导致过度拟合历史数据

策略优化方向

- 引入自适应的布林带周期,根据市场波动率动态调整

- 开发基于资金管理的动态止损系统

- 增加交易量分析来确认突破的有效性

- 实现智能的参数优化系统

- 添加市场环境识别模块,在不同市场条件下使用不同的参数设置

总结

这是一个设计完善的趋势跟踪系统,通过布林带和EMA的组合提供可靠的交易信号,并通过多层次的风险控制确保交易的安全性。策略的可配置性强,能够适应不同的交易风格和市场环境。虽然存在一些固有的风险,但通过建议的优化方向可以进一步提升策略的稳定性和盈利能力。

策略源码

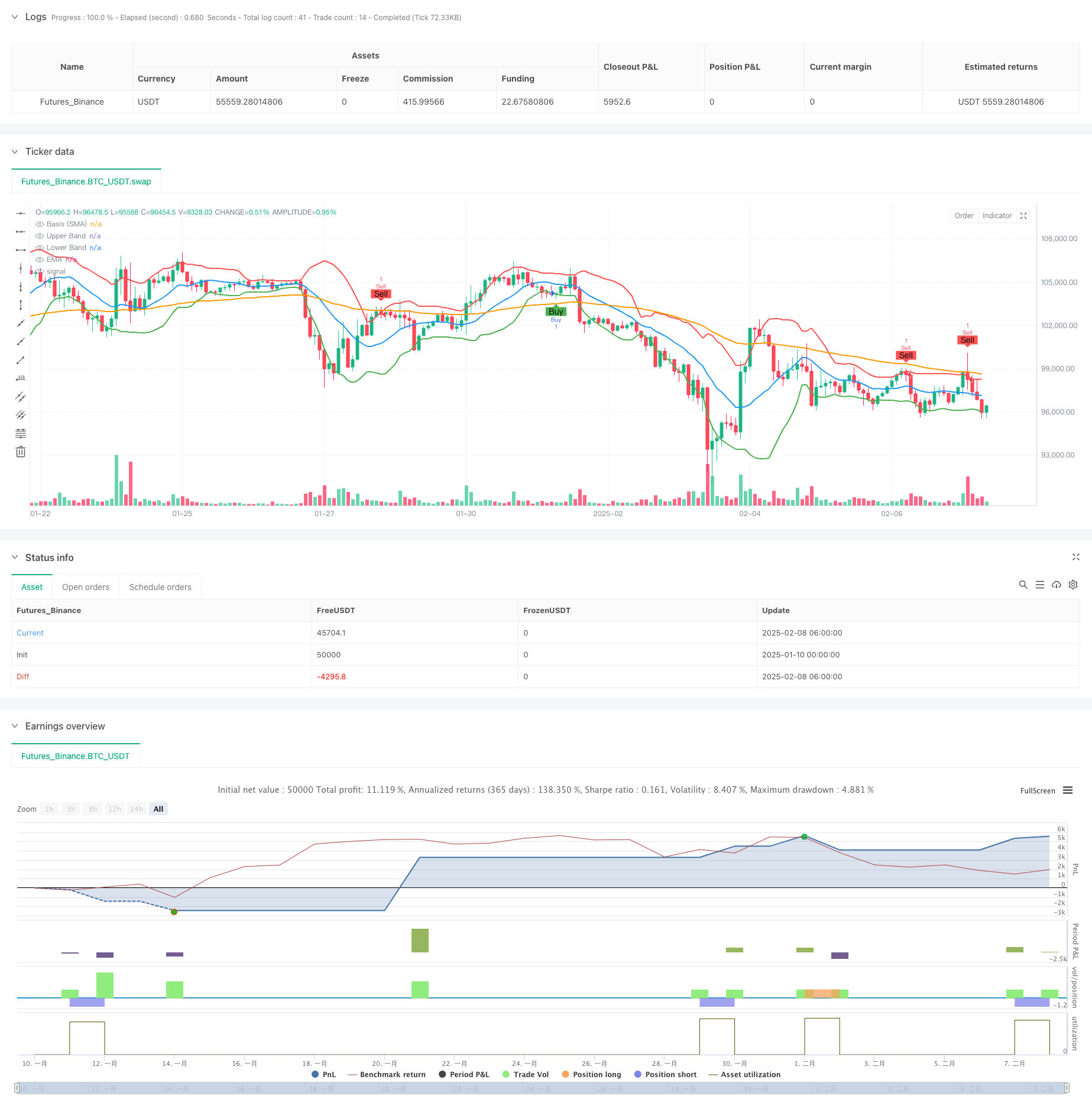

/*backtest

start: 2025-01-10 00:00:00

end: 2025-02-08 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("AI Bollinger Bands Strategy with SL, TP, and Bars Till Close", overlay=true)

// Input parameters

bb_length = input.int(14, title="Bollinger Bands Length", minval=1)

bb_stddev = input.float(1.5, title="Bollinger Bands Standard Deviation", minval=0.1)

use_ema = input.bool(true, title="Use EMA Filter")

ema_length = input.int(80, title="EMA Length", minval=1)

use_trailing_stop = input.bool(true, title="Use Trailing Stop")

use_sl = input.bool(true, title="Use Stop Loss")

use_tp = input.bool(false, title="Use Take Profit")

sl_dollars = input.float(300.0, title="Stop Loss (\$)", minval=0.0)

tp_dollars = input.float(1000.0, title="Take Profit (\$)", minval=0.0)

use_bars_till_close = input.bool(true, title="Use Bars Till Close")

bars_till_close = input.int(10, title="Bars Till Close", minval=1)

// New input to toggle indicator plotting

plot_indicators = input.bool(true, title="Plot Bollinger Bands and EMA on Chart")

// Calculate Bollinger Bands and EMA

basis = ta.sma(close, bb_length)

upper_band = basis + bb_stddev * ta.stdev(close, bb_length)

lower_band = basis - bb_stddev * ta.stdev(close, bb_length)

ema = ta.ema(close, ema_length)

// Plot Bollinger Bands and EMA conditionally

plot(plot_indicators ? basis : na, color=color.blue, linewidth=2, title="Basis (SMA)")

plot(plot_indicators ? upper_band : na, color=color.red, linewidth=2, title="Upper Band")

plot(plot_indicators ? lower_band : na, color=color.green, linewidth=2, title="Lower Band")

plot(plot_indicators ? ema : na, color=color.orange, linewidth=2, title="EMA")

// EMA conditions

ema_long_condition = ema > ema[1]

ema_short_condition = ema < ema[1]

// Entry conditions

sell_condition = close[1] > upper_band[1] and close[1] > open[1] and close < open

if sell_condition and (not use_ema or ema_short_condition)

strategy.entry("Sell", strategy.short)

buy_condition = close[1] < lower_band[1] and close > open

if buy_condition and (not use_ema or ema_long_condition)

strategy.entry("Buy", strategy.long)

// Trailing stop logic

if use_trailing_stop

if strategy.position_size > 0 and close >= basis

strategy.exit("Trailing Stop Long", from_entry="Buy", stop=low)

if strategy.position_size < 0 and close <= basis

strategy.exit("Trailing Stop Short", from_entry="Sell", stop=high)

// Stop Loss and Take Profit logic

if use_sl or use_tp

if strategy.position_size > 0

long_entry = strategy.position_avg_price

long_sl = long_entry - sl_dollars

long_tp = long_entry + tp_dollars

if use_sl and close <= long_sl

strategy.close("Buy", comment="Long SL Hit")

if use_tp and close >= long_tp

strategy.close("Buy", comment="Long TP Hit")

if strategy.position_size < 0

short_entry = strategy.position_avg_price

short_sl = short_entry + sl_dollars

short_tp = short_entry - tp_dollars

if use_sl and close >= short_sl

strategy.close("Sell", comment="Short SL Hit")

if use_tp and close <= short_tp

strategy.close("Sell", comment="Short TP Hit")

// Bars Till Close logic

var int bars_since_entry = na

if strategy.position_size != 0

bars_since_entry := na(bars_since_entry) ? 0 : bars_since_entry + 1

else

bars_since_entry := na

if use_bars_till_close and not na(bars_since_entry) and bars_since_entry >= bars_till_close

strategy.close("Buy", comment="Bars Till Close Hit")

strategy.close("Sell", comment="Bars Till Close Hit")

// Plot buy/sell signals

plotshape(sell_condition and (not use_ema or ema_short_condition), title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

plotshape(buy_condition and (not use_ema or ema_long_condition), title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

相关推荐