概述

本策略是一个基于布林带趋势背离和动态带宽变化的多层级量化交易系统。该策略通过监测布林带宽度的动态变化、价格突破以及EMA200均线配合,构建了一个完整的交易决策框架。策略采用自适应的波动率跟踪机制,能够有效捕捉市场趋势转折点。

策略原理

策略核心基于以下几个关键要素: 1. 布林带计算采用20周期移动平均和2倍标准差 2. 通过连续三个时间点的带宽变化判断趋势强度 3. 结合K线实体与带宽比例关系判断突破有效性 4. 使用EMA200作为中长期趋势过滤器 5. 在价格突破上轨且符合带宽扩张条件时入场做多 6. 在价格跌破下轨且符合带宽收缩条件时平仓出场

策略优势

- 信号系统具有前瞻性,能提前发现潜在趋势转折点

- 多重技术指标交叉验证,显著降低虚假信号

- 带宽变化率指标对市场波动具有良好的自适应性

- 出入场逻辑清晰,易于程序化实现

- 风险控制机制完善,能有效控制回撤

策略风险

- 在震荡市场可能产生频繁交易

- 趋势突变时可能出现滞后

- 参数优化存在过拟合风险

- 市场高波动期可能面临滑点风险

- 需要及时监控带宽指标的有效性

策略优化方向

- 引入自适应的参数优化机制

- 增加成交量等辅助指标验证

- 优化止损止盈条件设置

- 完善趋势强度的量化判断标准

- 加入更多的市场环境过滤条件

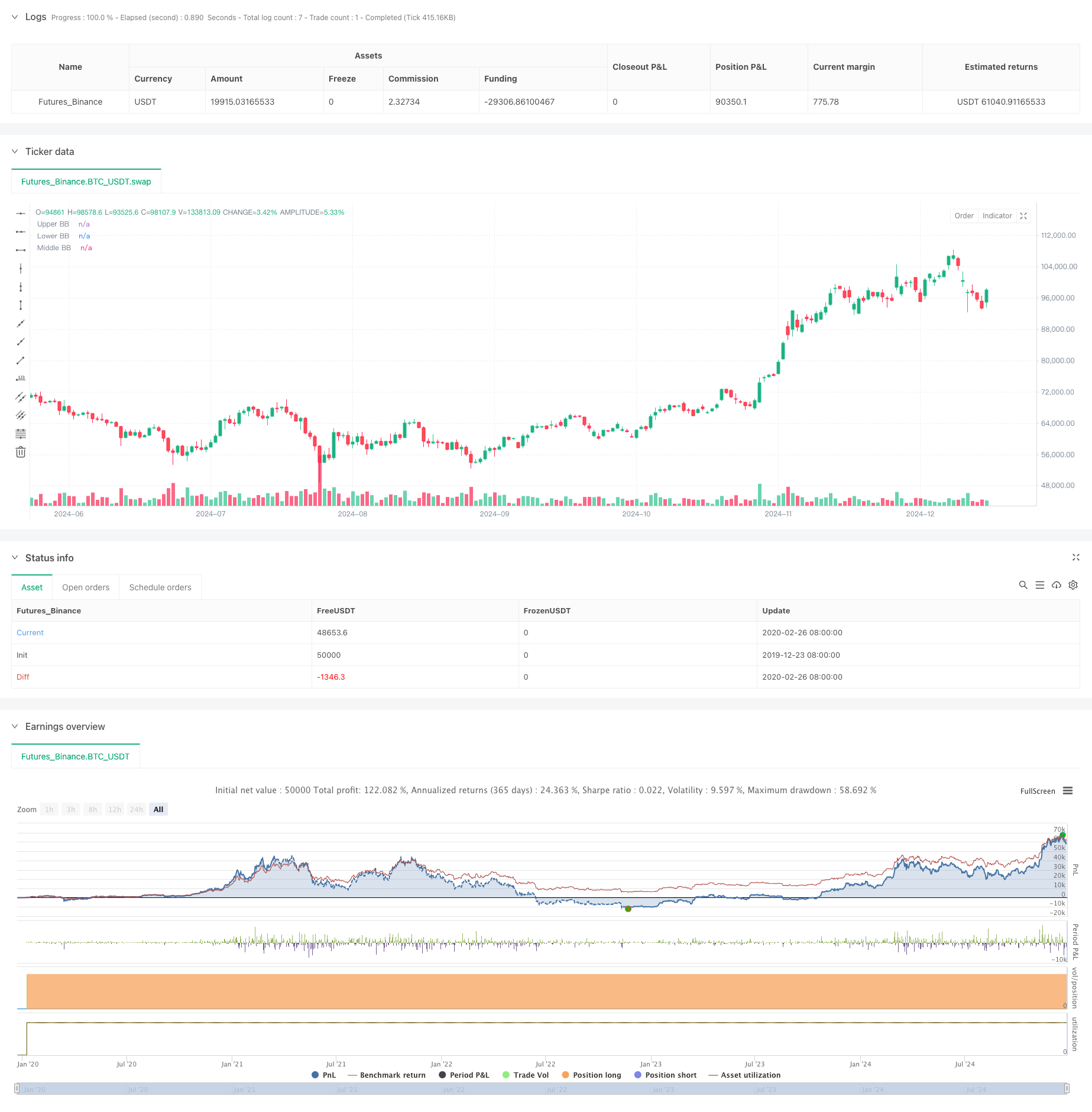

总结

该策略通过布林带趋势背离和动态带宽变化构建了一个稳健的交易系统。策略在趋势市场表现优异,但仍需要在震荡市场和参数优化方面进行改进。整体而言,该策略具有较好的实用价值和扩展空间。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-25 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("BBDIV_Strategy", overlay=true)

// Inputs for Bollinger Bands

length = input.int(20, title="BB Length")

mult = input.float(2.0, title="BB Multiplier")

// Calculate Bollinger Bands

basis = ta.sma(close, length)

deviation = mult * ta.stdev(close, length)

upperBB = basis + deviation

lowerBB = basis - deviation

// Calculate Bollinger Band width

bb_width = upperBB - lowerBB

prev_width = ta.valuewhen(not na(bb_width[1]), bb_width[1], 0)

prev_prev_width = ta.valuewhen(not na(bb_width[2]), bb_width[2], 0)

// Determine BB state

bb_state = bb_width > prev_width and prev_width > prev_prev_width ? 1 : bb_width < prev_width and prev_width < prev_prev_width ? -1 : 0

// Assign colors based on BB state

bb_color = bb_state == 1 ? color.green : bb_state == -1 ? color.red : color.gray

// Highlight candles closed outside BB

candle_size = high - low

highlight_color = (candle_size > bb_width / 2 and close > upperBB) ? color.new(color.green, 50) : (candle_size > bb_width / 2 and close < lowerBB) ? color.new(color.red, 50) : na

bgcolor(highlight_color, title="Highlight Candles")

// Plot Bollinger Bands

plot(upperBB, title="Upper BB", color=bb_color, linewidth=2, style=plot.style_line)

plot(lowerBB, title="Lower BB", color=bb_color, linewidth=2, style=plot.style_line)

plot(basis, title="Middle BB", color=color.blue, linewidth=1, style=plot.style_line)

// Calculate EMA 200

ema200 = ta.ema(close, 200)

// Plot EMA 200

plot(ema200, title="EMA 200", color=color.orange, linewidth=2, style=plot.style_line)

// Strategy logic

enter_long = highlight_color == color.new(color.green, 50)

exit_long = highlight_color == color.new(color.red, 50)

if (enter_long)

strategy.entry("Buy", strategy.long)

if (exit_long)

strategy.close("Buy")

// Display profit at close

if (exit_long)

var float entry_price = na

var float close_price = na

var float profit = na

if (strategy.opentrades > 0)

entry_price := strategy.opentrades.entry_price(strategy.opentrades - 1)

close_price := close

profit := (close_price - entry_price) * 100 / entry_price * 2 * 10 // Assuming 1 pip = 0.01 for XAUUSD

label.new(bar_index, high + (candle_size * 2), str.tostring(profit, format.mintick) + " USD", style=label.style_label_up, color=color.green)

相关推荐