概述

该策略是一个结合了指数移动平均线(EMA)和平均趋向指数(ADX)的趋势跟踪交易系统。策略通过EMA50与价格的交叉来确定交易方向,并使用ADX指标过滤市场趋势强度,同时采用基于连续获利K线的动态止损方法来保护利润。这种方法既能捕捉市场的主要趋势,又能在趋势减弱时及时退出。

策略原理

策略的核心逻辑基于以下几个关键要素: 1. 使用50周期指数移动平均线(EMA50)作为趋势方向的判断依据 2. 通过ADX指标(默认参数为20)过滤市场趋势强度,只在趋势明显时入场 3. 入场条件: - 多头:价格收盘价上穿EMA50且ADX大于阈值 - 空头:价格收盘价下穿EMA50且ADX大于阈值 4. 独特的止损机制: - 统计连续获利K线数量 - 当出现4根连续获利K线时激活动态追踪止损 - 止损价位会随着新高/新低动态调整

策略优势

- 趋势确认双重过滤

- EMA交叉提供趋势方向

- ADX过滤确保趋势强度,减少假突破

- 智能止损设计

- 基于市场波动的动态止损

- 连续获利才启动追踪止损,避免过早止盈

- 适应性强

- 参数可调整性高

- 适用于多个交易品种

- 风险控制完善

- 趋势减弱自动离场

- 动态止损保护既有利润

策略风险

- 趋势反转风险

- 在趋势突然反转时可能承受较大回撤

- 建议添加反转信号确认机制

- 参数敏感性

- EMA和ADX参数选择影响策略表现

- 建议通过回测优化参数

- 市场环境依赖

- 在震荡市场中可能频繁交易

- 建议增加横盘市场过滤机制

- 止损执行风险

- 大跳空可能导致止损执行偏差

- 建议考虑设置硬性止损保护

策略优化方向

- 入场机制优化

- 增加成交量确认信号

- 添加价格形态分析

- 止损机制完善

- 结合ATR动态调整止损距离

- 增加时间止损机制

- 市场环境适应性

- 添加市场波动率过滤

- 根据不同市场周期调整参数

- 信号确认增强

- 整合其他技术指标

- 添加基本面过滤条件

总结

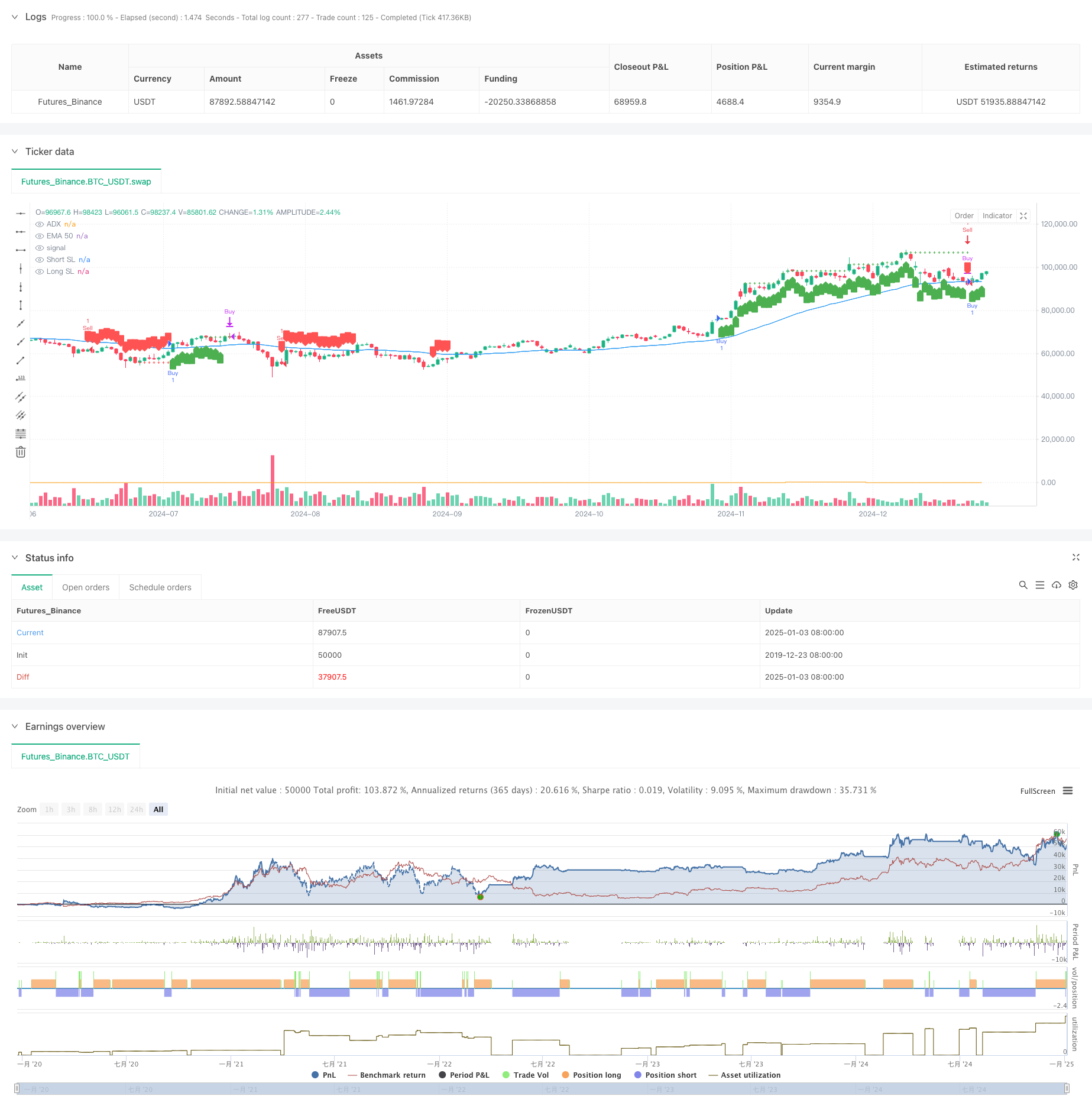

这是一个设计合理的趋势跟踪策略,通过结合EMA和ADX的优势,既能有效捕捉趋势,又能控制风险。策略的动态止损机制特别创新,能够很好地平衡盈利保护和趋势捕捉。虽然存在一些优化空间,但整体框架完整,逻辑清晰,是一个值得在实盘中验证的策略系统。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("Simple EMA 50 Strategy with ADX Filter", overlay=true)

// Input parameters

emaLength = input.int(50, title="EMA Length")

adxThreshold = input.float(20, title="ADX Threshold", minval=0)

// Calculate EMA and ADX

ema50 = ta.ema(close, emaLength)

adxSmoothing = input.int(20, title="ADX Smoothing")

[diPlus, diMinus, adx] = ta.dmi(20, adxSmoothing)

// Conditions for long and short entries

adxCondition = adx > adxThreshold

longCondition = adxCondition and close > ema50 // Check if candle closes above EMA

shortCondition = adxCondition and close < ema50 // Check if candle closes below EMA

// Exit conditions based on 4 consecutive profitable candles

var float longSL = na

var float shortSL = na

var longCandleCounter = 0

var shortCandleCounter = 0

// Increment counters if positions are open and profitable

if (strategy.position_size > 0 and close > strategy.position_avg_price)

longCandleCounter += 1

if (longCandleCounter >= 4)

longSL := na(longSL) ? close : math.max(longSL, close) // Update SL dynamically

else

longCandleCounter := 0

longSL := na

if (strategy.position_size < 0 and close < strategy.position_avg_price)

shortCandleCounter += 1

if (shortCandleCounter >= 4)

shortSL := na(shortSL) ? close : math.min(shortSL, close) // Update SL dynamically

else

shortCandleCounter := 0

shortSL := na

// Exit based on trailing SL

if (strategy.position_size > 0 and not na(longSL) and close < longSL)

strategy.close("Buy", comment="Candle-based SL")

if (strategy.position_size < 0 and not na(shortSL) and close > shortSL)

strategy.close("Sell", comment="Candle-based SL")

// Entry logic: Check every candle for new positions

if (longCondition)

strategy.entry("Buy", strategy.long)

if (shortCondition)

strategy.entry("Sell", strategy.short)

// Plot EMA and ADX for reference

plot(ema50, color=color.blue, title="EMA 50")

plot(adx, color=color.orange, title="ADX", style=plot.style_stepline, linewidth=1)

plot(longSL, color=color.green, title="Long SL", style=plot.style_cross, linewidth=1)

plot(shortSL, color=color.red, title="Short SL", style=plot.style_cross, linewidth=1)

// Plot signals

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")

相关推荐