概述

该策略是一个基于平滑烛线(Heikin-Ashi)与指数移动平均线(EMA)交叉的多重时间周期趋势跟踪系统。通过在不同时间周期上结合Heikin-Ashi烛线的平滑特性和移动平均线的趋势跟踪能力,同时配合MACD指标作为过滤器,实现对市场趋势的准确捕捉。策略采用了时间周期分层设计,分别在60分钟、180分钟和15分钟三个时间周期上进行信号计算和验证。

策略原理

策略的核心逻辑包括以下几个关键部分: 1. Heikin-Ashi烛线计算:通过特殊的开高低收价格计算方法,平滑原始价格数据,减少市场噪音。 2. 多重时间周期EMA系统:在180分钟周期计算Heikin-Ashi EMA,与60分钟周期的慢速EMA形成交叉信号系统。 3. MACD过滤器:在15分钟周期上计算MACD指标,用于验证交易信号的有效性。 4. 信号生成规则:当快速Heikin-Ashi EMA向上穿越慢速EMA,且MACD指标确认(如果启用)时,产生做多信号;反之产生做空信号。

策略优势

- 信号平滑性强:Heikin-Ashi烛线的平滑特性可以有效降低假信号。

- 多重时间周期验证:不同时间周期的配合使用提高了信号的可靠性。

- 趋势跟踪效果好:通过EMA交叉系统可以有效捕捉中长期趋势。

- 灵活的过滤机制:可选的MACD过滤器提供了额外的信号确认。

- 参数可调性强:多个关键参数可以根据不同市场特征进行优化。

策略风险

- 震荡市场风险:在横盘震荡市场可能产生频繁的假突破信号。

- 滞后性风险:多重时间周期验证可能导致入场时机略有延迟。

- 参数敏感性:不同参数组合可能导致策略表现差异较大。

- 市场环境依赖:策略在强趋势市场表现更好,而在其他市场环境下可能效果欠佳。

策略优化方向

- 增加波动率过滤:引入ATR或Bollinger带等指标进行市场波动性判断。

- 优化时间周期选择:可以根据具体交易品种特征调整时间周期组合。

- 完善止损机制:增加追踪止损或基于波动率的动态止损。

- 增加仓位管理:根据信号强度和市场波动性动态调整仓位大小。

- 加入市场环境判断:增加趋势强度指标来区分不同市场环境。

总结

该策略通过多重时间周期的Heikin-Ashi和EMA系统,结合MACD过滤器,构建了一个完整的趋势跟踪交易系统。策略设计充分考虑了信号的可靠性和系统的稳定性,通过参数优化和风险控制机制的完善,能够适应不同的市场环境。策略的核心优势在于信号的平滑性和多重验证机制,但同时也需要注意震荡市场风险和参数优化问题。

策略源码

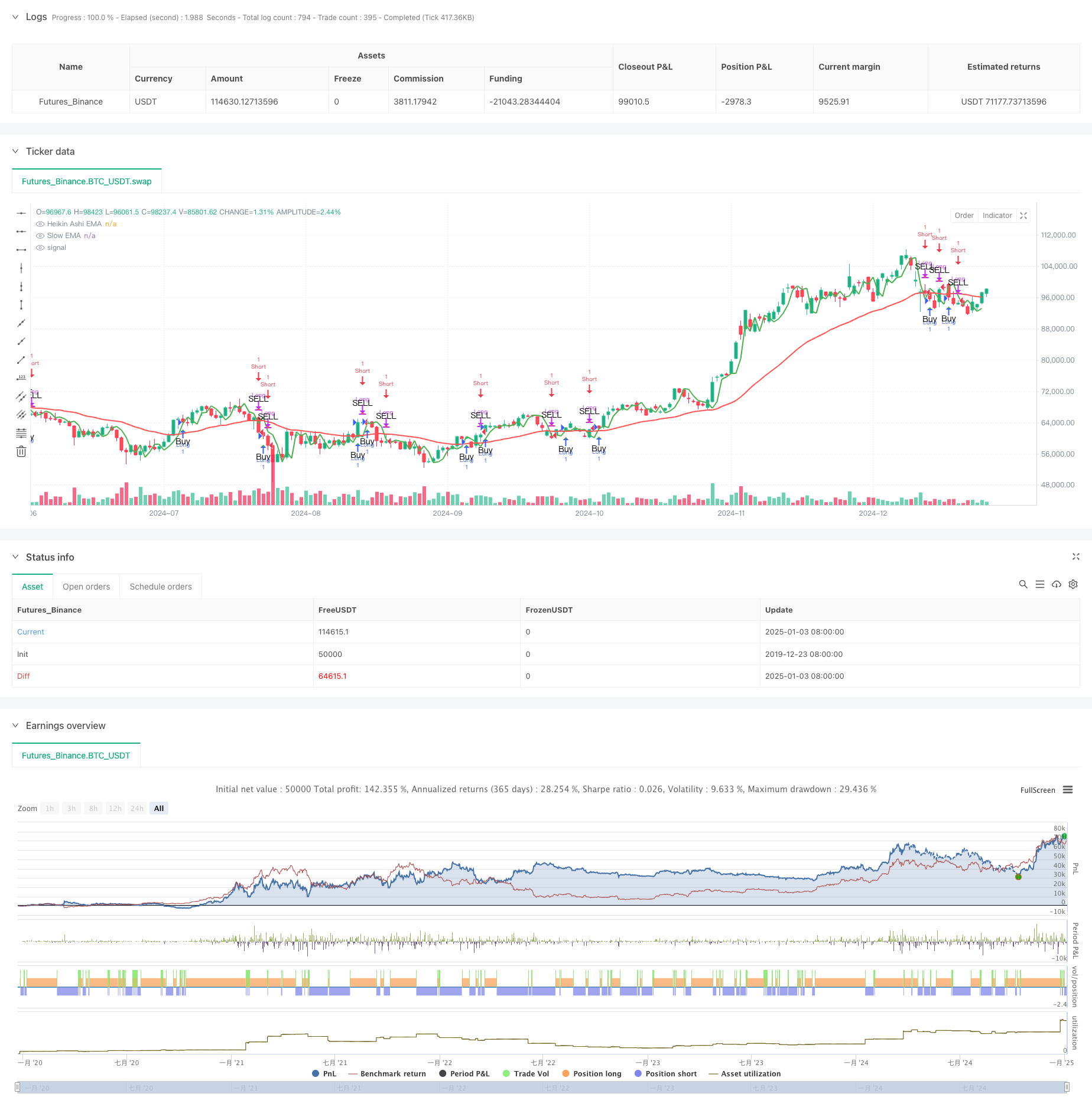

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © tradingbauhaus

//@version=5

strategy("Heikin Ashi Candle Time Frame @tradingbauhaus", shorttitle="Heikin Ashi Candle Time Frame @tradingbauhaus", overlay=true)

// Inputs

res = input.timeframe(title="Heikin Ashi Candle Time Frame", defval="60")

hshift = input.int(1, title="Heikin Ashi Candle Time Frame Shift")

res1 = input.timeframe(title="Heikin Ashi EMA Time Frame", defval="180")

mhshift = input.int(0, title="Heikin Ashi EMA Time Frame Shift")

fama = input.int(1, title="Heikin Ashi EMA Period")

test = input.int(1, title="Heikin Ashi EMA Shift")

sloma = input.int(30, title="Slow EMA Period")

slomas = input.int(1, title="Slow EMA Shift")

macdf = input.bool(false, title="With MACD filter")

res2 = input.timeframe(title="MACD Time Frame", defval="15")

macds = input.int(1, title="MACD Shift")

// Heikin Ashi calculation

var float ha_open = na

ha_close = (open + high + low + close) / 4

ha_open := na(ha_open[1]) ? (open + close) / 2 : (ha_open[1] + ha_close[1]) / 2

ha_high = math.max(high, math.max(ha_open, ha_close))

ha_low = math.min(low, math.min(ha_open, ha_close))

// Adjusted Heikin Ashi Close for different timeframes

mha_close = request.security(syminfo.tickerid, res1, ha_close[mhshift])

// MACD calculation

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

macdl = request.security(syminfo.tickerid, res2, macdLine[macds])

macdsl = request.security(syminfo.tickerid, res2, signalLine[macds])

// Moving Averages

fma = ta.ema(mha_close[test], fama)

sma = ta.ema(ha_close[slomas], sloma)

plot(fma, title="Heikin Ashi EMA", color=color.green, linewidth=2)

plot(sma, title="Slow EMA", color=color.red, linewidth=2)

// Strategy Logic

golong = ta.crossover(fma, sma) and (macdl > macdsl or not macdf)

goshort = ta.crossunder(fma, sma) and (macdl < macdsl or not macdf)

// Plot Shapes for Buy/Sell Signals

plotshape(golong, color=color.green, text="Buy", style=shape.triangleup, location=location.belowbar)

plotshape(goshort, color=color.red, text="SELL", style=shape.triangledown, location=location.abovebar)

// Strategy Orders

strategy.entry("Long", strategy.long, when=golong)

strategy.close("Long", when=goshort)

strategy.entry("Short", strategy.short, when=goshort)

strategy.close("Short", when=golong)

// Alerts

alertcondition(golong, "Heikin Ashi BUY", "")

alertcondition(goshort, "Heikin Ashi SELL", "")

相关推荐