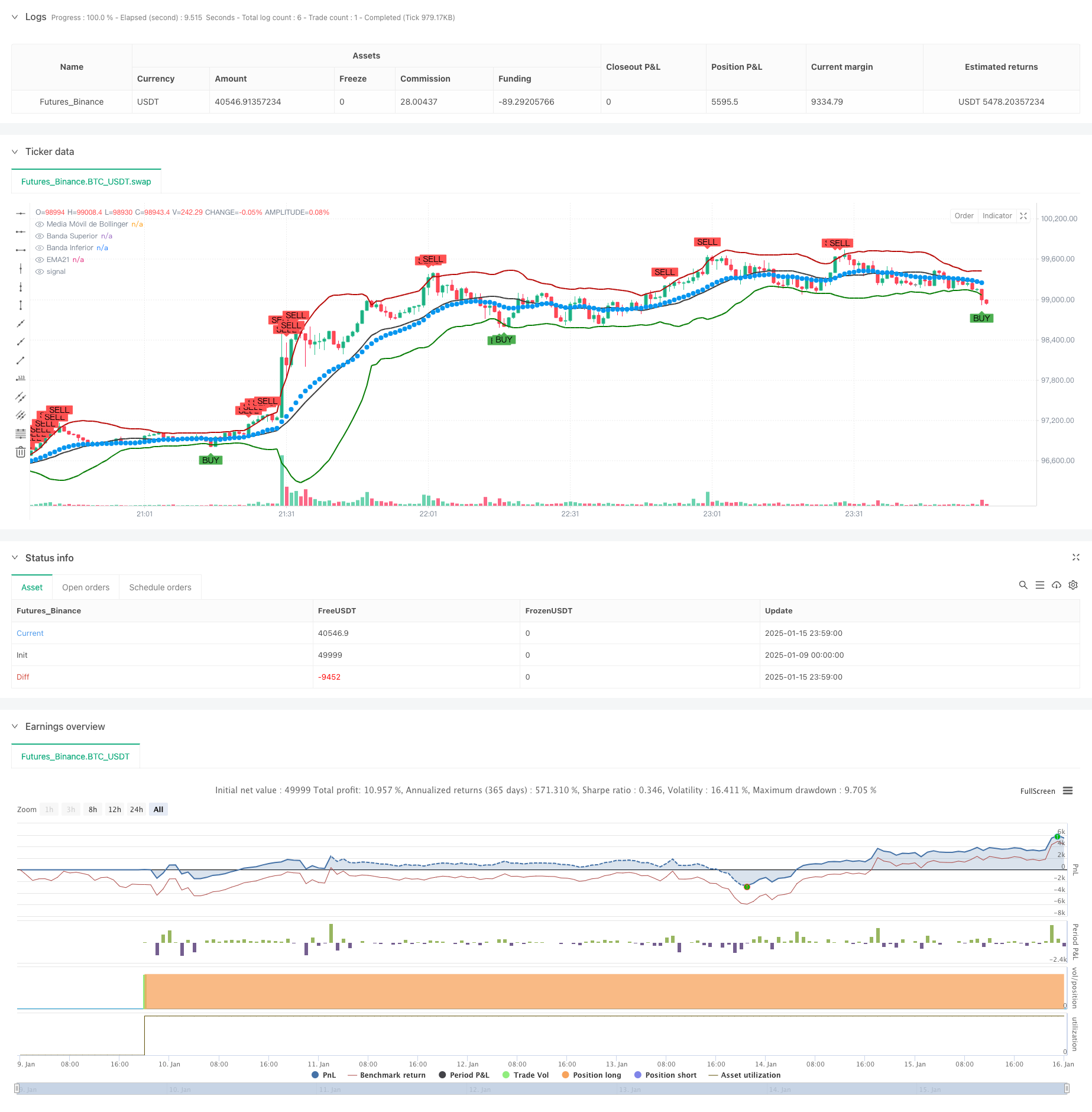

概述

本策略是一个结合了动态支撑阻力、布林带和EMA21均线的多指标交叉交易策略。策略通过识别关键价格水平的突破,结合技术指标的交叉信号来进行交易决策。该策略不仅能够动态识别市场结构中的重要支撑阻力位,还能通过布林带和均线的配合来确认交易信号的可靠性。

策略原理

策略主要基于以下几个核心组件: 1. 动态支撑阻力计算:使用枢轴点方法动态计算市场的支撑阻力水平,通过设定通道宽度和最小强度要求来筛选有效价格区域。 2. 布林带指标:采用20周期、2倍标准差的布林带来界定价格波动区间。 3. EMA21均线:作为中期趋势判断的参考线。 4. 交易信号生成:当价格突破支撑阻力位的同时触发布林带信号时进行交易。

策略优势

- 多维度确认:通过结合多个技术指标,提高交易信号的可靠性。

- 动态适应:支撑阻力位会随市场结构变化而自动调整。

- 风险管理:布林带提供了清晰的超买超卖区域界定。

- 趋势确认:EMA21均线帮助确认中期趋势方向。

- 可视化效果:策略提供了清晰的视觉反馈,便于分析和优化。

策略风险

- 震荡市场风险:在横盘震荡市场可能产生过多假突破信号。

- 滞后性风险:技术指标的计算都具有一定滞后性,可能错过最佳入场时机。

- 参数敏感性:策略效果对参数设置较为敏感,需要针对不同市场环境进行优化。

- 假突破风险:支撑阻力位的突破可能是假突破,需要其他指标配合确认。

策略优化方向

- 引入成交量指标:在突破确认时加入成交量分析,提高信号可靠性。

- 优化参数自适应:开发自适应参数调整机制,使策略更好地适应不同市场环境。

- 增加止损机制:设计更完善的止损策略,控制回撤风险。

- 加入趋势过滤:增加趋势强度判断,避免在弱趋势环境下交易。

- 时间框架优化:研究不同时间框架组合的效果,找到最优配置。

总结

该策略通过结合动态支撑阻力、布林带和EMA21均线,构建了一个相对完整的交易系统。策略的优势在于多维度信号确认和动态适应市场变化,但同时也面临参数优化和假突破风险。通过持续优化和完善风险控制机制,策略有望在实际交易中取得更好的表现。

策略源码

//@version=5

strategy("Support Resistance & Bollinger & EMA21", overlay=true)

// Parámetros de S/R

prd = input.int(defval=10, title='Pivot Period', minval=4, maxval=30, group='Setup')

ppsrc = input.string(defval='High/Low', title='Source', options=['High/Low', 'Close/Open'], group='Setup')

maxnumpp = input.int(defval=20, title='Maximum Number of Pivot', minval=5, maxval=100, group='Setup')

ChannelW = input.int(defval=10, title='Maximum Channel Width %', minval=1, group='Setup')

maxnumsr = input.int(defval=5, title='Maximum Number of S/R', minval=1, maxval=10, group='Setup')

min_strength = input.int(defval=2, title='Minimum Strength', minval=1, maxval=10, group='Setup')

labelloc = input.int(defval=20, title='Label Location', group='Colors', tooltip='Positive numbers reference future bars, negative numbers reference historical bars')

linestyle = input.string(defval='Solid', title='Line Style', options=['Solid', 'Dotted', 'Dashed'], group='Colors')

linewidth = input.int(defval=2, title='Line Width', minval=2, maxval=2, group='Colors')

resistancecolor = input.color(defval=color.black, title='Resistance Color', group='Colors')

supportcolor = input.color(defval=color.black, title='Support Color', group='Colors')

showpp = input(false, title='Show Point Points')

// Parámetros de Bandas de Bollinger y EMA21

periodo_bollinger = input.int(title="Periodo de Bollinger", defval=20)

multiplicador_bollinger = input.float(title="Multiplicador de Bollinger", defval=2.0)

periodo_ema21 = input.int(title="Periodo EMA21", defval=21)

// Cálculo de las Bandas de Bollinger y EMA21

[middle, superior, inferior] = ta.bb(close, periodo_bollinger, multiplicador_bollinger)

ema21 = ta.ema(close, periodo_ema21)

// Ploteo de las Bandas de Bollinger y EMA21

plot(middle, color=color.rgb(60, 60, 60), linewidth=2, title="Media Móvil de Bollinger")

plot(superior, color=color.rgb(184, 11, 8), linewidth=2, title="Banda Superior")

plot(inferior, color=color.rgb(6, 124, 4), linewidth=2, title="Banda Inferior")

plot(ema21, color=color.rgb(6, 150, 240), linewidth=1, style=plot.style_circles, title="EMA21")

// Condiciones para señales de compra y venta

senal_compra = close <= inferior

senal_venta = close >= superior

// Mostrar señales en el gráfico

plotshape(senal_compra, title="Compra", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(senal_venta, title="Venta", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Código de soporte y resistencia

float src1 = ppsrc == 'High/Low' ? high : math.max(close, open)

float src2 = ppsrc == 'High/Low' ? low : math.min(close, open)

float ph = ta.pivothigh(src1, prd, prd)

float pl = ta.pivotlow(src2, prd, prd)

plotshape(ph and showpp, text='H', style=shape.labeldown, color=na, textcolor=color.new(color.red, 0), location=location.abovebar, offset=-prd)

plotshape(pl and showpp, text='L', style=shape.labelup, color=na, textcolor=color.new(color.lime, 0), location=location.belowbar, offset=-prd)

// Calcular ancho máximo del canal S/R

prdhighest = ta.highest(300)

prdlowest = ta.lowest(300)

cwidth = (prdhighest - prdlowest) * ChannelW / 100

var pivotvals = array.new_float(0)

if ph or pl

array.unshift(pivotvals, ph ? ph : pl)

if array.size(pivotvals) > maxnumpp // Limitar el tamaño del array

array.pop(pivotvals)

get_sr_vals(ind) =>

float lo = array.get(pivotvals, ind)

float hi = lo

int numpp = 0

for y = 0 to array.size(pivotvals) - 1 by 1

float cpp = array.get(pivotvals, y)

float wdth = cpp <= lo ? hi - cpp : cpp - lo

if wdth <= cwidth // Ajusta al ancho máximo del canal?

if cpp <= hi

lo := math.min(lo, cpp)

else

hi := math.max(hi, cpp)

numpp += 1

[hi, lo, numpp]

var sr_up_level = array.new_float(0)

var sr_dn_level = array.new_float(0)

sr_strength = array.new_float(0)

find_loc(strength) =>

ret = array.size(sr_strength)

for i = ret > 0 ? array.size(sr_strength) - 1 : na to 0 by 1

if strength <= array.get(sr_strength, i)

break

ret := i

ret

check_sr(hi, lo, strength) =>

ret = true

for i = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

if array.get(sr_up_level, i) >= lo and array.get(sr_up_level, i) <= hi or array.get(sr_dn_level, i) >= lo and array.get(sr_dn_level, i) <= hi

if strength >= array.get(sr_strength, i)

array.remove(sr_strength, i)

array.remove(sr_up_level, i)

array.remove(sr_dn_level, i)

ret

else

ret := false

break

ret

// var sr_lines = array.new_line(11, na)

// var sr_labels = array.new_label(11, na)

// for x = 1 to 10 by 1

// rate = 100 * (label.get_y(array.get(sr_labels, x)) - close) / close

// label.set_text(array.get(sr_labels, x), text=str.tostring(label.get_y(array.get(sr_labels, x))) + '(' + str.tostring(rate, '#.##') + '%)')

// label.set_x(array.get(sr_labels, x), x=bar_index + labelloc)

// label.set_color(array.get(sr_labels, x), color=label.get_y(array.get(sr_labels, x)) >= close ? color.red : color.lime)

// label.set_textcolor(array.get(sr_labels, x), textcolor=label.get_y(array.get(sr_labels, x)) >= close ? color.white : color.black)

// label.set_style(array.get(sr_labels, x), style=label.get_y(array.get(sr_labels, x)) >= close ? label.style_label_down : label.style_label_up)

// line.set_color(array.get(sr_lines, x), color=line.get_y1(array.get(sr_lines, x)) >= close ? resistancecolor : supportcolor)

if ph or pl

// Debido a los nuevos cálculos, eliminar niveles S/R antiguos

array.clear(sr_up_level)

array.clear(sr_dn_level)

array.clear(sr_strength)

// Encontrar zonas S/R

for x = 0 to array.size(pivotvals) - 1 by 1

[hi, lo, strength] = get_sr_vals(x)

if check_sr(hi, lo, strength)

loc = find_loc(strength)

// Si la fuerza está en los primeros maxnumsr sr, entonces insértala en los arrays

if loc < maxnumsr and strength >= min_strength

array.insert(sr_strength, loc, strength)

array.insert(sr_up_level, loc, hi)

array.insert(sr_dn_level, loc, lo)

// Mantener el tamaño de los arrays = 5

if array.size(sr_strength) > maxnumsr

array.pop(sr_strength)

array.pop(sr_up_level)

array.pop(sr_dn_level)

// for x = 1 to 10 by 1

// line.delete(array.get(sr_lines, x))

// label.delete(array.get(sr_labels, x))

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

rate = 100 * (mid - close) / close

// array.set(sr_labels, x + 1, label.new(x=bar_index + labelloc, y=mid, text=str.tostring(mid) + '(' + str.tostring(rate, '#.##') + '%)', color=mid >= close ? color.red : color.lime, textcolor=mid >= close ? color.white : color.black, style=mid >= close ? label.style_label_down : label.style_label_up))

// array.set(sr_lines, x + 1, line.new(x1=bar_index, y1=mid, x2=bar_index - 1, y2=mid, extend=extend.both, color=mid >= close ? resistancecolor : supportcolor, style=line.style_solid, width=2))

f_crossed_over() =>

ret = false

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

if close[1] <= mid and close > mid

ret := true

ret

f_crossed_under() =>

ret = false

for x = 0 to array.size(sr_up_level) > 0 ? array.size(sr_up_level) - 1 : na by 1

float mid = math.round_to_mintick((array.get(sr_up_level, x) + array.get(sr_dn_level, x)) / 2)

if close[1] >= mid and close < mid

ret := true

ret

crossed_over = f_crossed_over()

crossed_under = f_crossed_under()

alertcondition(crossed_over, title='Resistance Broken', message='Resistance Broken')

alertcondition(crossed_under, title='Support Broken', message='Support Broken')

alertcondition(crossed_over or crossed_under, title='Support or Resistance Broken', message='Support or Resistance Broken')

// Estrategia de compra y venta basada en el cruce de niveles S/R

if (crossed_over and senal_compra)

strategy.entry("Compra", strategy.long)

if (crossed_under and senal_venta)

strategy.close("Compra")

相关推荐