概述

这是一个结合EMA趋势、轮回位突破和交易时段过滤的量化交易策略。策略主要基于均线趋势方向判断,配合价格在关键轮回位置的突破形态作为交易信号,同时引入交易时段过滤来提高交易质量。策略采用百分比止损止盈方式进行风险控制。

策略原理

策略的核心逻辑包含以下几个关键要素: 1. 使用20日EMA均线作为趋势判断工具,只在价格位于均线上方做多,位于均线下方做空 2. 在关键轮回位(5美元整数关口)附近寻找吞没形态作为交易信号 3. 仅在伦敦和纽约交易时段内开仓,避开低波动率时期 4. 多头信号需同时满足:看涨吞没形态、价格在EMA上方、处于有效交易时段 5. 空头信号需同时满足:看跌吞没形态、价格在EMA下方、处于有效交易时段 6. 采用1%止损和1.5%止盈的风险收益比进行交易管理

策略优势

- 多重信号确认机制显著提高交易可靠性

- 结合技术分析和价格心理关口,提高胜率

- 时段过滤确保在市场活跃期交易,避免假突破

- 固定百分比止损止盈便于风险管理

- 策略逻辑清晰,易于理解和执行

- 适合波动性较大的市场环境

策略风险

- 在横盘震荡市场可能产生过多假信号

- 固定止损止盈不够灵活,可能错过大行情

- 仅依赖技术指标,未考虑基本面因素

- 在重要新闻公布时可能面临滑点风险

- 交易时段限制可能错过其他时段的好机会

策略优化方向

- 引入自适应止损止盈机制,根据市场波动度动态调整

- 增加成交量确认指标,提高突破可信度

- 加入趋势强度过滤,避免在弱趋势中交易

- 考虑引入市场情绪指标,优化入场时机

- 开发更智能的轮回位识别算法

总结

该策略通过结合均线趋势、价格形态和时段过滤等多重机制,构建了一个逻辑严谨的交易系统。虽然存在一定局限性,但通过持续优化和完善,有望进一步提升策略的稳定性和盈利能力。策略适合作为中长期趋势跟踪系统的基础框架,根据实际交易需求进行定制化改进。

策略源码

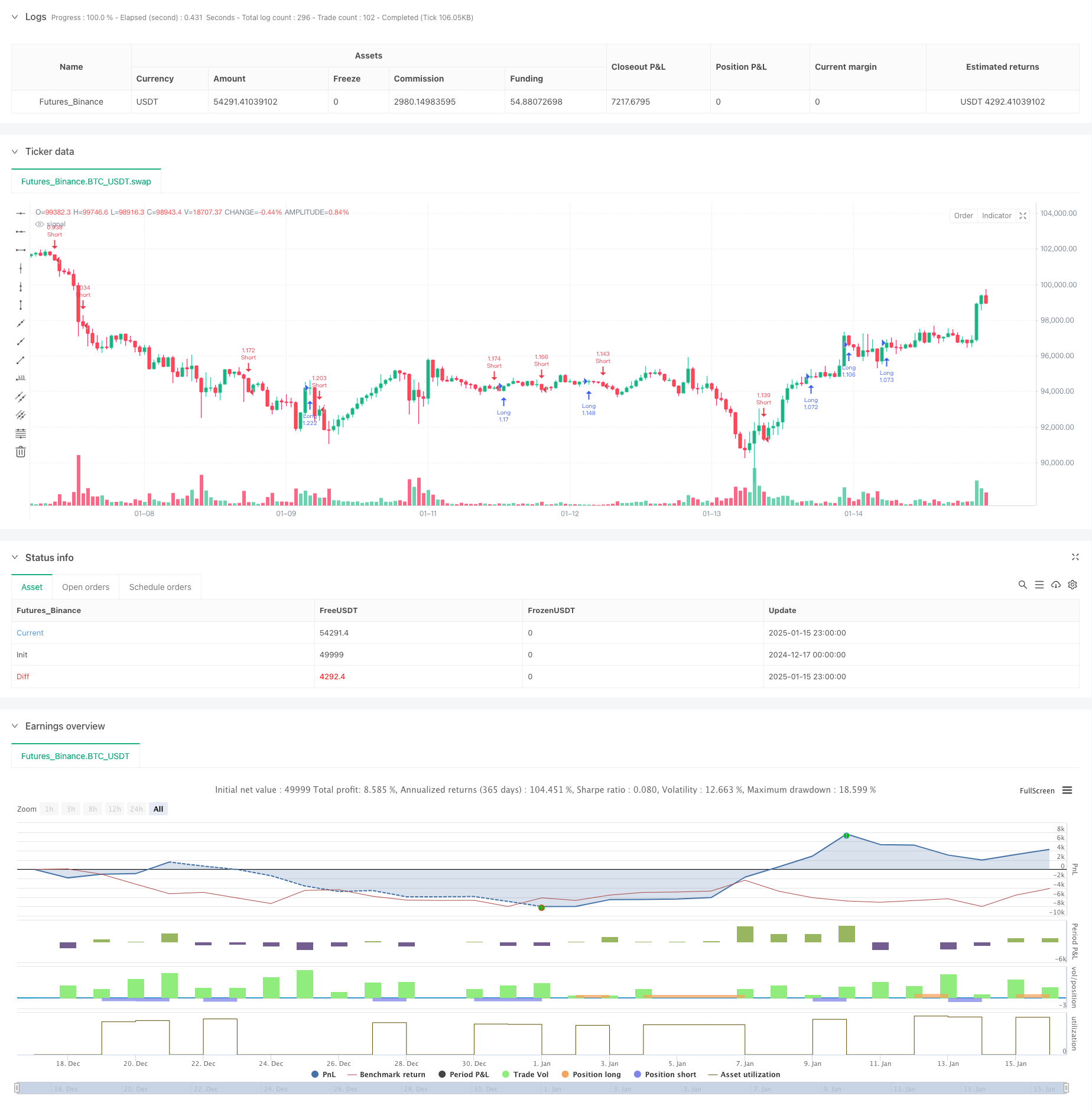

/*backtest

start: 2024-12-17 00:00:00

end: 2025-01-16 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=6

strategy("The Gold Box Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=200)

// Inputs

roundNumberInterval = input.int(5, title="Round Number Interval ($)", minval=1)

useEMA = input.bool(true, title="Use 20 EMA for Confluence")

emaLength = input.int(20, title="EMA Length")

// Session times for London and NY

londonSession = input("0300-1200", title="London Session (NY Time)")

nySession = input("0800-1700", title="New York Session (NY Time)")

// EMA Calculation

emaValue = ta.ema(close, emaLength)

// Plot Round Number Levels

roundLow = math.floor(low / roundNumberInterval) * roundNumberInterval

roundHigh = math.ceil(high / roundNumberInterval) * roundNumberInterval

// for level = roundLow to roundHigh by roundNumberInterval

// line.new(x1=bar_index - 1, y1=level, x2=bar_index, y2=level, color=color.new(color.gray, 80), extend=extend.both)

// Session Filter

inLondonSession = not na(time("1", londonSession))

inNYSession = not na(time("1", nySession))

inSession = true

// Detect Bullish and Bearish Engulfing patterns

bullishEngulfing = close > open[1] and open < close[1] and close > emaValue and inSession

bearishEngulfing = close < open[1] and open > close[1] and close < emaValue and inSession

// Entry Conditions

if bullishEngulfing

strategy.entry("Long", strategy.long, comment="Bullish Engulfing with EMA Confluence")

if bearishEngulfing

strategy.entry("Short", strategy.short, comment="Bearish Engulfing with EMA Confluence")

// Stop Loss and Take Profit

stopLossPercent = input.float(1.0, title="Stop Loss (%)", minval=0.1) / 100

takeProfitPercent = input.float(1.5, title="Take Profit (%)", minval=0.1) / 100

strategy.exit("Exit Long", "Long", stop=close * (1 - stopLossPercent), limit=close * (1 + takeProfitPercent))

strategy.exit("Exit Short", "Short", stop=close * (1 + stopLossPercent), limit=close * (1 - takeProfitPercent))

相关推荐