概述

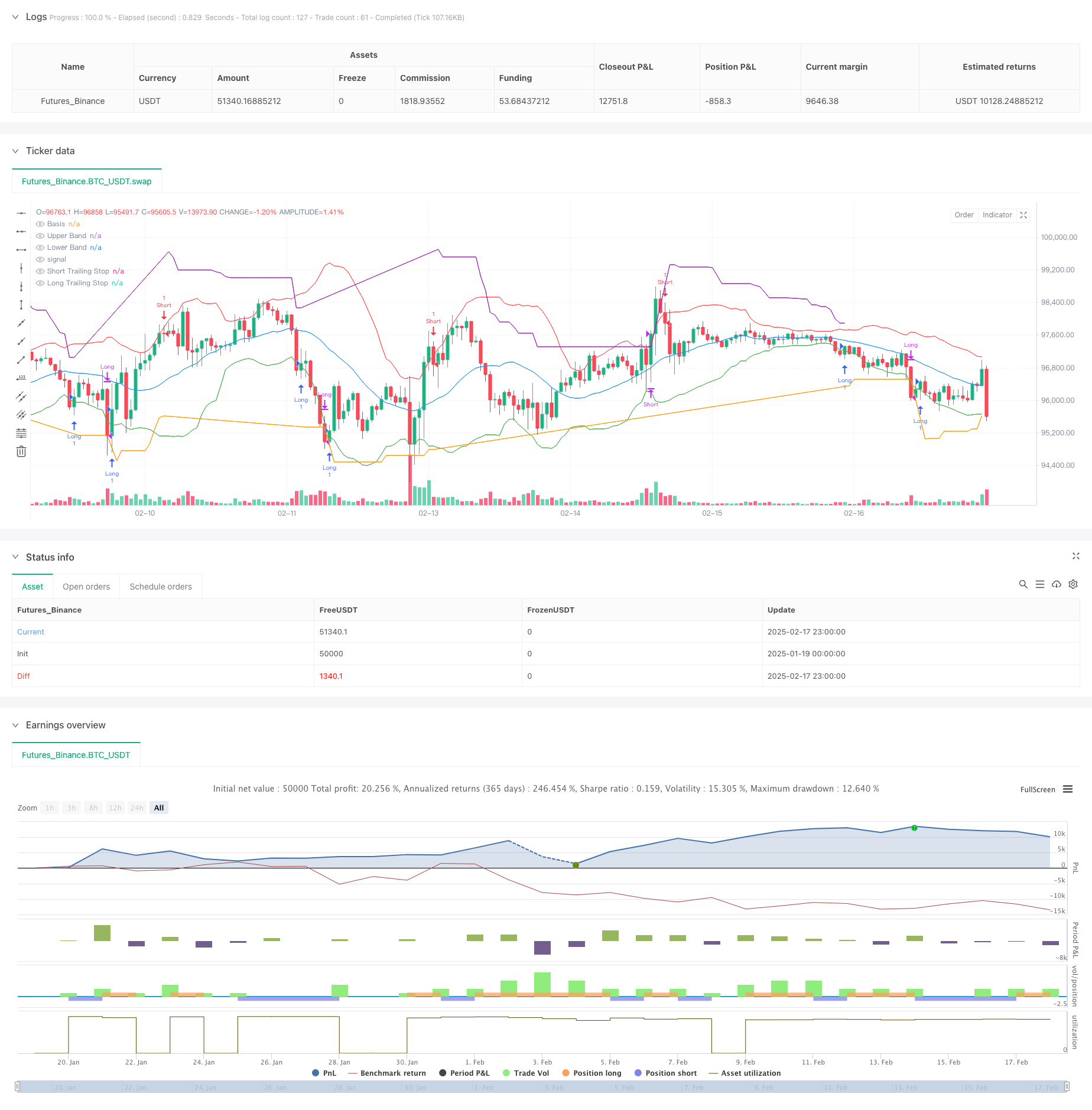

本策略是一个结合了布林带(Bollinger Bands)和ATR跟踪止损的自适应交易系统。策略通过布林带上下轨的突破来确定入场信号,同时使用基于ATR的动态跟踪止损来管理风险和确定出场时机。该策略能够在市场趋势明显时捕捉趋势性机会,同时在震荡市中提供防护。

策略原理

策略的核心逻辑包含两个主要部分: 1. 入场信号系统:使用布林带(BB)作为主要指标,当价格突破下轨时产生做多信号,突破上轨时产生做空信号。布林带参数设置为20周期移动平均线作为中轨,标准差倍数为2.0。 2. 止损管理系统:采用14周期ATR作为波动率参考,乘数为3.0。在持有多头仓位时,止损线会随着价格上涨而上移,反之亦然。这种动态止损机制能够让利润自然增长的同时,有效控制回撤。

策略优势

- 自适应性强:布林带和ATR都是基于市场实际波动计算的指标,能够自动适应不同市场环境。

- 风险控制完善:通过ATR动态止损,既能够及时止损,又不会过早退出强势趋势。

- 信号明确:入场和出场信号都基于明确的价格突破,不需要主观判断。

- 可视化程度高:策略在图表上清晰标示所有信号点,便于分析和优化。

策略风险

- 震荡市场风险:在没有明显趋势的市场中,可能会频繁产生假突破信号,导致连续止损。

- 滑点风险:在市场波动剧烈时,实际成交价格可能与理论信号价格有较大偏差。

- 参数敏感性:策略效果对布林带和ATR的参数设置较为敏感,需要针对不同市场环境进行优化。

策略优化方向

- 增加趋势过滤器:可以添加额外的趋势判断指标,只在趋势明确时开仓,减少震荡市假信号。

- 优化止损参数:可以根据不同市场条件动态调整ATR乘数,在波动率高时采用更宽松的止损。

- 引入仓位管理:可以基于ATR设计动态仓位系统,在不同波动环境下自动调整开仓规模。

- 加入时间过滤:可以避开重要经济数据公布等高波动时期的交易。

总结

该策略通过结合布林带和ATR跟踪止损,构建了一个兼具趋势捕捉和风险控制能力的交易系统。策略的自适应特性使其能够在不同市场环境下保持稳定性,而清晰的信号系统则提供了客观的交易依据。通过建议的优化方向,策略还有进一步提升的空间。在实际应用中,建议投资者根据自身风险偏好和交易品种特点,对参数进行针对性调整。

策略源码

/*backtest

start: 2025-01-19 00:00:00

end: 2025-02-18 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ATR Trailing Stop Loss with Bollinger Bands", overlay=true)

// Input parameters for Bollinger Bands

bb_length = input.int(20, title="Bollinger Bands Length")

bb_stddev = input.float(2.0, title="Bollinger Bands Std Dev")

// Input parameters for ATR Trailing Stop Loss

atr_length = input.int(14, title="ATR Length")

atr_multiplier = input.float(3.0, title="ATR Multiplier")

// Calculate Bollinger Bands

basis = ta.sma(close, bb_length)

upper_band = ta.sma(close, bb_length) + ta.stdev(close, bb_length) * bb_stddev

lower_band = ta.sma(close, bb_length) - ta.stdev(close, bb_length) * bb_stddev

// Calculate ATR

atr = ta.atr(atr_length)

// Trailing Stop Loss Calculation

var float long_stop = na // Explicitly define as float type

var float short_stop = na // Explicitly define as float type

if (strategy.position_size > 0)

long_stop := close - atr * atr_multiplier

long_stop := math.max(long_stop, nz(long_stop[1], long_stop))

else

long_stop := na

if (strategy.position_size < 0)

short_stop := close + atr * atr_multiplier

short_stop := math.min(short_stop, nz(short_stop[1], short_stop))

else

short_stop := na

// Entry and Exit Conditions

long_condition = ta.crossover(close, lower_band) // Enter long when price crosses above lower band

short_condition = ta.crossunder(close, upper_band) // Enter short when price crosses below upper band

exit_long_condition = ta.crossunder(close, long_stop) // Exit long when price crosses below trailing stop

exit_short_condition = ta.crossover(close, short_stop) // Exit short when price crosses above trailing stop

// Execute Trades

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

if (exit_long_condition)

strategy.close("Long")

if (exit_short_condition)

strategy.close("Short")

// Plot Bollinger Bands

plot(basis, color=color.blue, title="Basis")

plot(upper_band, color=color.red, title="Upper Band")

plot(lower_band, color=color.green, title="Lower Band")

// Plot Trailing Stop Loss

plot(strategy.position_size > 0 ? long_stop : na, color=color.orange, title="Long Trailing Stop")

plot(strategy.position_size < 0 ? short_stop : na, color=color.purple, title="Short Trailing Stop")

// Labels for Entry and Exit

if (long_condition)

label.new(bar_index, low, text="Entry Long", style=label.style_circle, color=color.green, textcolor=color.white, size=size.small)

if (short_condition)

label.new(bar_index, high, text="Entry Short", style=label.style_circle, color=color.red, textcolor=color.white, size=size.small)

if (exit_long_condition)

label.new(bar_index, low, text="Exit Long", style=label.style_circle, color=color.blue, textcolor=color.white, size=size.small)

if (exit_short_condition)

label.new(bar_index, high, text="Exit Short", style=label.style_circle, color=color.orange, textcolor=color.white, size=size.small)

相关推荐