概述

本策略是一个结合了多周期移动平均线带和MACD指标的交易系统。策略主要通过短期和长期移动平均线的交叉以及MACD指标的信号来确定市场趋势和交易时机。该策略集成了日内交易重置逻辑,可以有效防止隔夜风险。

策略原理

策略的核心逻辑包含三个主要部分:移动平均线带系统、MACD指标系统和日内交易重置机制。移动平均线带由两条不同周期(9和21)的均线构成,可以选择多种均线类型包括SMA、EMA、SMMA、WMA和VWMA。MACD系统采用标准的12/26/9参数设置,通过快线和慢线的差值以及信号线来判断趋势动量。买入信号需要同时满足短期均线上穿长期均线和MACD线上穿信号线两个条件,而卖出信号则在出现任一反向交叉时触发。每个交易日开始时会重置信号状态,确保交易的连续性和安全性。

策略优势

- 信号确认双重可靠:结合了趋势跟踪和动量指标,显著降低了假信号的风险

- 灵活的参数配置:支持多种类型的移动平均线,可以根据不同市场特征进行优化

- 风险控制完善:包含日内交易重置机制,有效规避了隔夜风险

- 可视化效果突出:集成了清晰的买卖信号标记和均线带显示,便于交易决策

策略风险

- 趋势转折滞后:由于使用均线系统,在市场快速转向时可能反应较慢

- 震荡市不适用:在横盘震荡市场中可能产生频繁的假信号

- 参数优化难度:不同市场环境下最优参数可能存在显著差异

- 执行延迟影响:在高波动市场中,信号确认到实际执行可能存在较大价格差异

策略优化方向

- 引入波动率过滤:建议添加ATR或波动率指标,在高波动环境下调整信号触发阈值

- 优化信号确认机制:可以考虑增加成交量确认或价格形态确认,提高信号可靠性

- 完善风险管理:建议加入动态止损和利润目标,提高策略的风险收益比

- 市场环境适应:可以根据不同的市场状态动态调整参数,提高策略适应性

总结

该策略通过结合均线带和MACD指标,构建了一个较为完善的交易系统。虽然存在一定的滞后性风险,但通过合理的参数优化和风险管理,策略可以在趋势市场中取得不错的效果。建议交易者在实盘使用前进行充分的回测,并根据具体市场特征调整参数设置。

策略源码

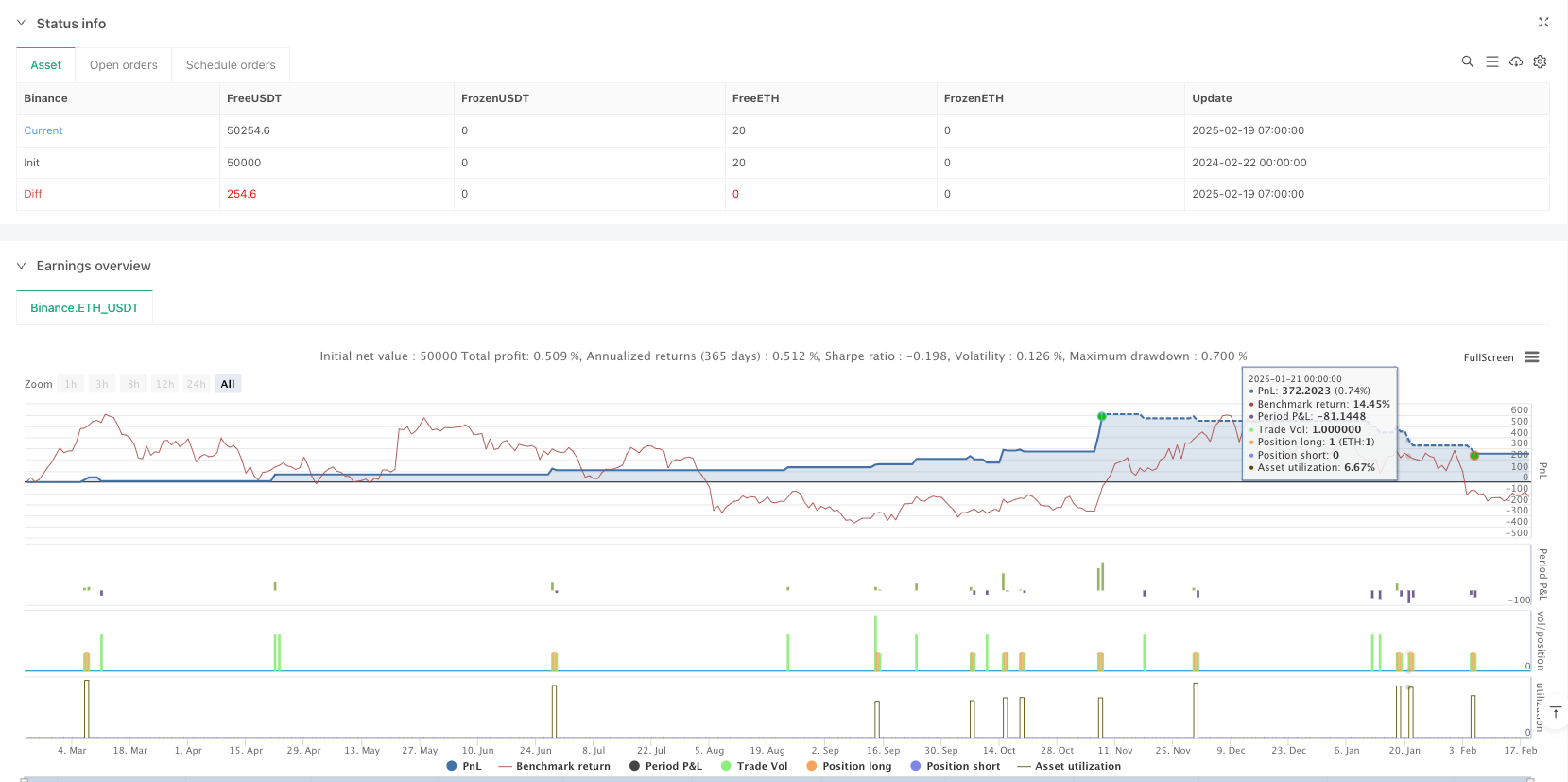

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Daily MA Ribbon + MACD Crossover with Buy/Sell Signals", overlay=true)

// === Daily Reset Logic ===

var bool newDay = false // Initialize newDay as a boolean variable

newDay := bool(ta.change(time("D"))) // Cast the result of ta.change to boolean

// === Moving Average Ribbon ===

ma(source, length, type) =>

type == "SMA" ? ta.sma(source, length) :

type == "EMA" ? ta.ema(source, length) :

type == "SMMA (RMA)" ? ta.rma(source, length) :

type == "WMA" ? ta.wma(source, length) :

type == "VWMA" ? ta.vwma(source, length) :

na

// MA1 (Short-term MA)

show_ma1 = input(true, "MA №1", inline="MA #1")

ma1_type = input.string("EMA", "", inline="MA #1", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

ma1_source = input(close, "", inline="MA #1")

ma1_length = input.int(9, "", inline="MA #1", minval=1) // Short-term MA (e.g., 9-period)

ma1_color = input(color.blue, "", inline="MA #1")

ma1 = ma(ma1_source, ma1_length, ma1_type)

plot(show_ma1 ? ma1 : na, color = ma1_color, title="MA №1")

// MA2 (Long-term MA)

show_ma2 = input(true, "MA №2", inline="MA #2")

ma2_type = input.string("EMA", "", inline="MA #2", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

ma2_source = input(close, "", inline="MA #2")

ma2_length = input.int(21, "", inline="MA #2", minval=1) // Long-term MA (e.g., 21-period)

ma2_color = input(color.red, "", inline="MA #2")

ma2 = ma(ma2_source, ma2_length, ma2_type)

plot(show_ma2 ? ma2 : na, color = ma2_color, title="MA №2")

// === MACD ===

fast_length = input(12, "Fast Length")

slow_length = input(26, "Slow Length")

signal_length = input.int(9, "Signal Smoothing", minval=1, maxval=50)

sma_source = input.string("EMA", "Oscillator MA Type", options=["SMA", "EMA"])

sma_signal = input.string("EMA", "Signal Line MA Type", options=["SMA", "EMA"])

// Calculate MACD

fast_ma = sma_source == "SMA" ? ta.sma(close, fast_length) : ta.ema(close, fast_length)

slow_ma = sma_source == "SMA" ? ta.sma(close, slow_length) : ta.ema(close, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, signal_length) : ta.ema(macd, signal_length)

hist = macd - signal

// Plot MACD

hline(0, "Zero Line", color = color.new(#787B86, 50))

plot(hist, title = "Histogram", style = plot.style_columns, color = (hist >= 0 ? (hist[1] < hist ? #26A69A : #B2DFDB) : (hist[1] < hist ? #FFCDD2 : #FF5252)))

plot(macd, title = "MACD", color = #2962FF)

plot(signal, title = "Signal", color = #FF6D00)

// === Buy/Sell Signal Logic ===

// Condition 1: MA1 (Short-term) crosses above MA2 (Long-term)

ma_crossover = ta.crossover(ma1, ma2)

// Condition 2: MACD line crosses above Signal line

macd_crossover = ta.crossover(macd, signal)

// Buy Signal: Both conditions must be true

buy_signal = ma_crossover and macd_crossover

// Sell Signal: MA1 crosses below MA2 or MACD crosses below Signal

sell_signal = ta.crossunder(ma1, ma2) or ta.crossunder(macd, signal)

// Reset signals at the start of each new day

if (newDay)

buy_signal := false

sell_signal := false

// Plot Buy/Sell Signals

plotshape(buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Strategy Entry/Exit

if (buy_signal)

strategy.entry("Buy", strategy.long)

if (sell_signal)

strategy.close("Buy", comment="Sell")

相关推荐