概述

该策略结合了布林带和移动平均线两个技术指标,通过布林带和价格的相对位置以及快慢移动平均线的交叉信号来判断市场趋势,从而实现择时买卖。当价格突破布林带下轨时开仓做多,突破上轨时开仓做空;同时,当快速移动平均线上穿慢速移动平均线时开仓做多,下穿时平仓。该策略能够帮助投资者把握市场趋势,实现稳健的投资收益。

策略原理

- 布林带由三条线组成:中轨、上轨和下轨。中轨为移动平均线,上下轨为中轨加减一定倍数的标准差。当价格突破上轨,表明市场处于超买状态,可能出现回调;突破下轨,表明市场处于超卖状态,可能出现反弹。

- 快慢移动平均线交叉也是一种常用的趋势判断方法。当快速移动平均线上穿慢速移动平均线,称为”金叉”,表明市场可能转强;快速移动平均线下穿慢速移动平均线,称为”死叉”,表明市场可能转弱。

- 该策略利用布林带判断超买超卖,利用均线交叉判断趋势,两者结合可形成较为可靠的交易信号。当价格突破布林带下轨且快速均线上穿慢速均线时做多,直到价格突破布林带上轨或快速均线下穿慢速均线时平仓。

优势分析

- 布林带能够根据价格波动的大小自适应调整,对于波动率的变化更加敏感。

- 均线系统能够有效跟踪市场趋势,帮助投资者把握主要趋势方向。

- 将布林带和均线结合,形成突破+趋势跟踪的交易系统,能够有效降低交易频率和成本,提高系统稳定性。

- 代码中设置了多个参数,如均线类型、周期等,可以灵活调整以适应不同市场状况。

风险分析

- 当市场波动率突然放大时,布林带通道会急剧扩张,可能发生较多止损。

- 均线系统判断趋势可能出现滞后,导致入场和离场时机不够准确。

- 趋势型策略在震荡市中表现一般,需要结合其他方法进行优化。

- 参数设置不当可能导致策略失效,需要不断调优和测试。

优化方向

- 可以在均线交叉的基础上,增加MACD等其他趋势类指标,进一步确认趋势信号。

- 布林带突破可以结合ATR等止损指标,控制回撤风险。

- 在趋势判断的基础上可以加入行情背离、形态识别等方法,提早判断趋势转折点。

- 针对不同的标的和周期,需要对参数进行优化,找到适合的参数组合。

总结

布林带交叉移动平均策略是一个经典的趋势跟踪策略,通过布林带判断超买超卖,利用均线交叉判断趋势,能够有效把握市场趋势,实现稳健收益。但在实际运用中需要注意控制回撤,优化参数,并结合其他方法不断改进,以适应多变的市场环境。

策略源码

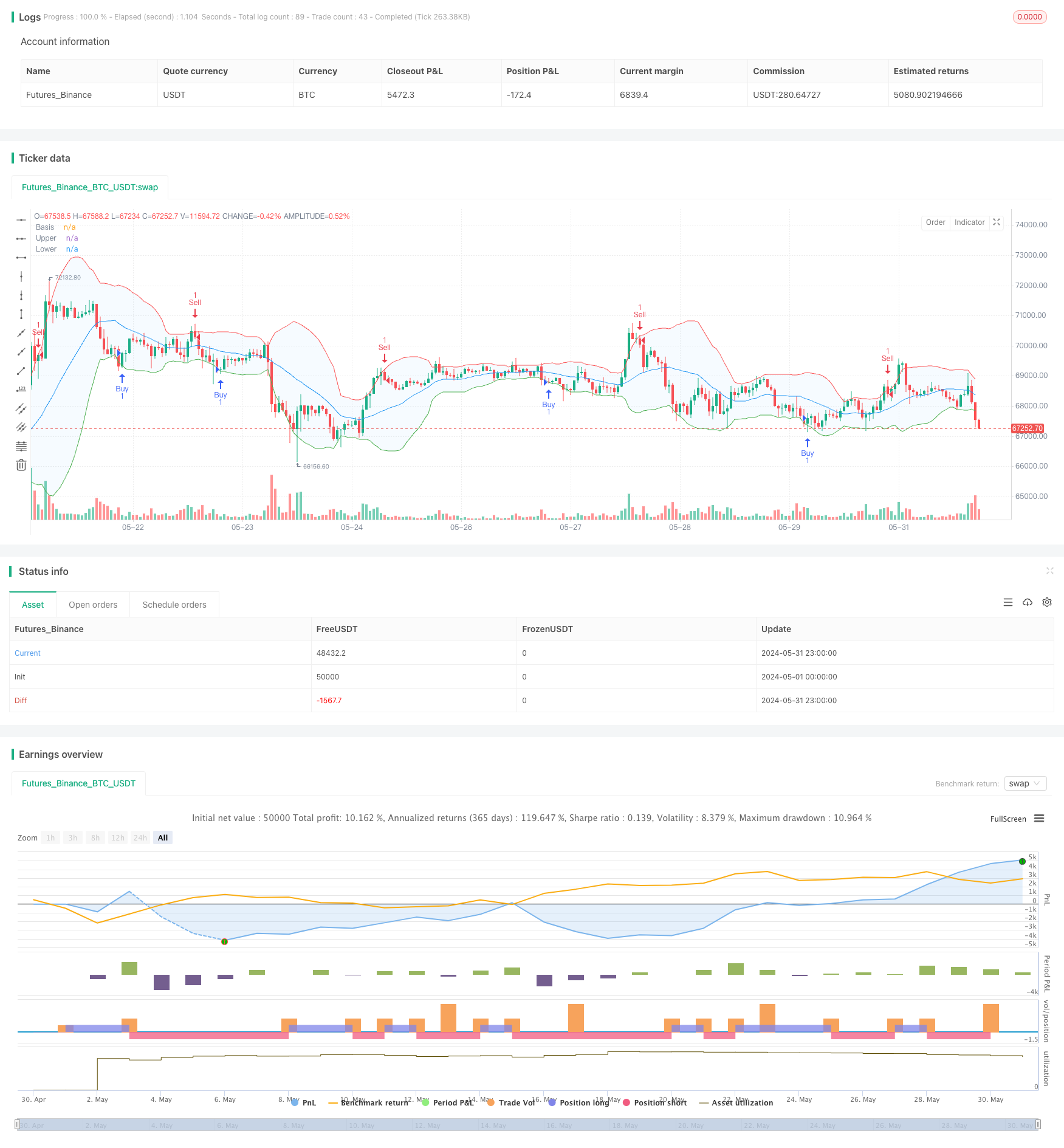

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(shorttitle="BB Strategy", title="Bollinger Bands Strategy", overlay=true)

// Input parameters

length = input.int(20, minval=1)

maType = input.string("SMA", "Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

offset = input.int(0, "Offset", minval=-500, maxval=500)

// Moving average function

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Calculate Bollinger Bands

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// Plot Bollinger Bands

plot(basis, "Basis", color=color.blue, offset=offset)

p1 = plot(upper, "Upper", color=color.red, offset=offset)

p2 = plot(lower, "Lower", color=color.green, offset=offset)

fill(p1, p2, title="Background", color=color.rgb(33, 150, 243, 95))

// Strategy entry and exit conditions

if (ta.crossover(close, lower))

strategy.entry("Buy", strategy.long)

if (ta.crossunder(close, upper))

strategy.entry("Sell", strategy.short)

相关推荐