概述

本策略是一个基于布林带和ATR指标的智能交易系统,结合了多层次的止盈止损机制。策略主要通过识别布林带下轨附近的反转信号进行多头入场,并采用动态跟踪止损方法管理风险。系统设计了20%获利目标和12%止损位,同时结合ATR指标实现动态跟踪止损,能够在保护利润的同时给予趋势足够的发展空间。

策略原理

策略的核心逻辑包括以下几个关键部分: 1. 入场条件:要求红色蜡烛触及布林带下轨后出现绿色蜡烛,这种形态通常预示着可能的反转信号。 2. 移动平均线选择:支持多种移动平均线类型(SMA、EMA、SMMA、WMA、VWMA),默认使用20周期SMA。 3. 布林带参数:使用1.5倍标准差作为带宽,这个设置比传统的2倍标准差更为保守。 4. 止盈机制:设定20%的初始获利目标。 5. 止损机制:设置12%的固定止损位保护资金。 6. 动态跟踪止损: - 价格达到目标获利水平后激活ATR跟踪止损 - 触及布林带上轨后启动ATR动态跟踪止损 - 使用ATR乘数动态调整跟踪止损距离

策略优势

- 多层次风险控制:

- 固定止损位保护本金

- 动态跟踪止损锁定利润

- 布林带上轨触发的动态止损提供额外保护

- 灵活的移动平均线选择让策略可以适应不同市场环境

- 结合ATR指标的动态跟踪止损可以根据市场波动性自动调整,避免过早离场

- 入场信号结合价格形态和技术指标,提高了信号的可靠性

- 支持仓位管理和交易成本设置,更贴近实际交易环境

策略风险

- 快速震荡市场可能导致频繁交易,增加交易成本

- 12%的固定止损位在某些高波动性市场可能过小

- 布林带信号在趋势市场中可能产生虚假信号

- ATR跟踪止损在剧烈波动时可能导致较大回撤 缓解措施:

- 建议在较大时间周期使用(30分钟-1小时)

- 可以根据具体品种特性调整止损比例

- 考虑增加趋势过滤器减少虚假信号

- 动态调整ATR乘数以适应不同市场环境

策略优化方向

- 入场优化:

- 增加成交量确认机制

- 添加趋势强度指标过滤信号

- 考虑加入动量指标辅助判断

- 止损优化:

- 将固定止损改为基于ATR的动态止损

- 开发自适应止损算法

- 根据波动率动态调整止损距离

- 移动平均线优化:

- 测试不同周期组合

- 研究自适应周期方法

- 考虑使用价格行为替代移动平均线

- 仓位管理优化:

- 开发基于波动率的仓位管理系统

- 实现分批建仓和减仓机制

- 加入风险敞口控制

总结

该策略通过布林带和ATR指标构建了一个多层次的交易系统,在入场、止损和获利了结等方面都采用了动态管理方法。策略的优势在于其完善的风险控制体系和对市场波动的自适应能力。通过建议的优化方向,策略还有很大的提升空间。特别适合在较大时间周期上使用,对于持有优质资产的投资者来说,可以帮助优化建仓和减仓时机。

策略源码

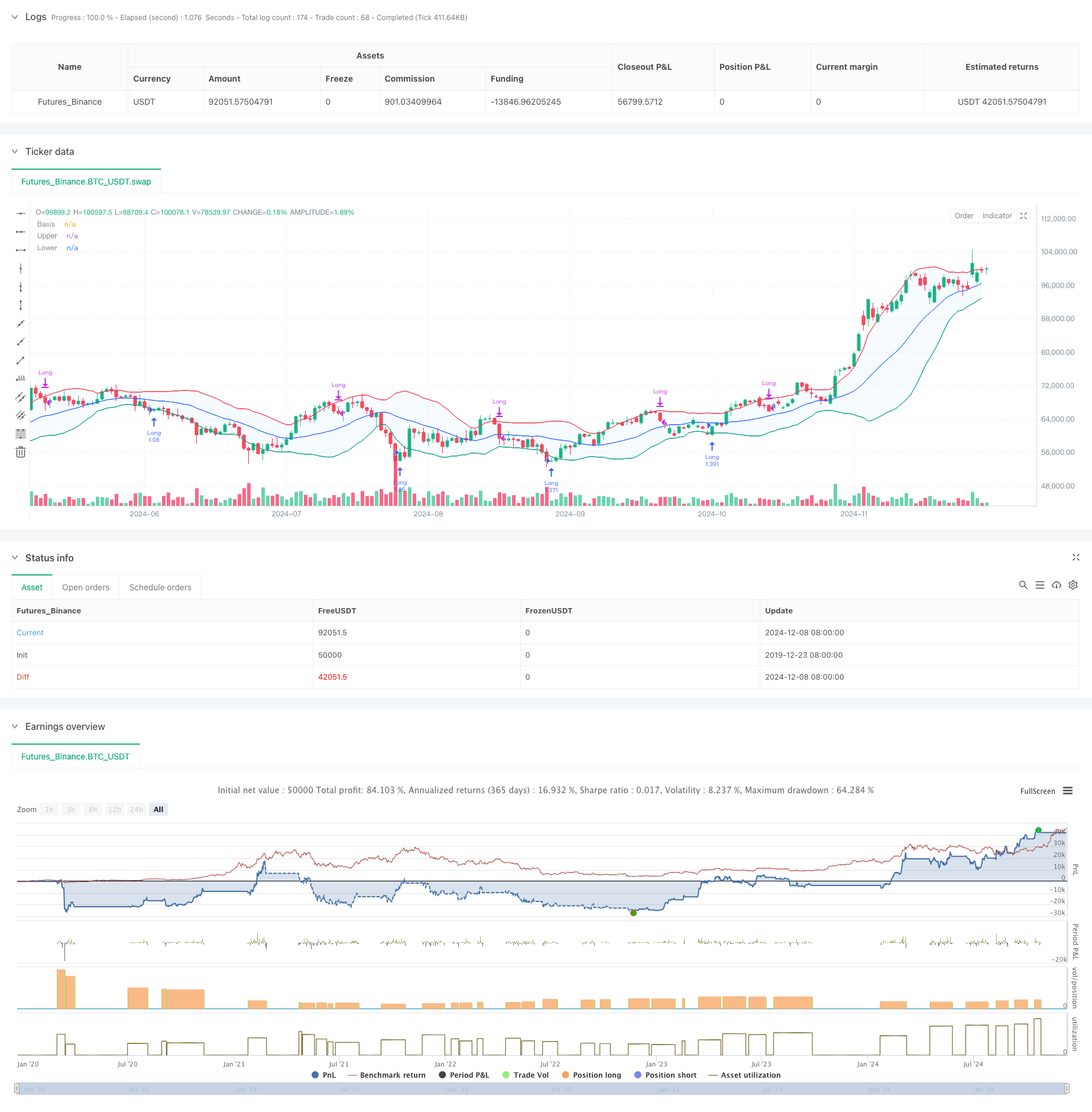

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-09 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Demo GPT - Bollinger Bands Strategy with Tightened Trailing Stops", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_value=0.1, slippage=3)

// Input settings

length = input.int(20, minval=1)

maType = input.string("SMA", "Basis MA Type", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = 1.5 // Standard deviation multiplier set to 1.5

offset = input.int(0, "Offset", minval=-500, maxval=500)

atrMultiplier = input.float(1.0, title="ATR Multiplier for Trailing Stop", minval=0.1) // ATR multiplier for trailing stop

// Time range filters

start_date = input(timestamp("2018-01-01 00:00"), title="Start Date")

end_date = input(timestamp("2069-12-31 23:59"), title="End Date")

in_date_range = true

// Moving average function

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

// Calculate Bollinger Bands

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

// ATR Calculation

atr = ta.atr(length) // Use ATR for trailing stop adjustments

// Plotting

plot(basis, "Basis", color=#2962FF, offset=offset)

p1 = plot(upper, "Upper", color=#F23645, offset=offset)

p2 = plot(lower, "Lower", color=#089981, offset=offset)

fill(p1, p2, title="Background", color=color.rgb(33, 150, 243, 95))

// Candle color detection

isGreen = close > open

isRed = close < open

// Flags for entry and exit conditions

var bool redTouchedLower = false

var float targetPrice = na

var float stopLossPrice = na

var float trailingStopPrice = na

if in_date_range

// Entry Logic: First green candle after a red candle touches the lower band

if close < lower and isRed

redTouchedLower := true

if redTouchedLower and isGreen

strategy.entry("Long", strategy.long)

targetPrice := close * 1.2 // Set the target price to 20% above the entry price

stopLossPrice := close * 0.88 // Set the stop loss to 12% below the entry price

trailingStopPrice := na // Reset trailing stop on entry

redTouchedLower := false

// Exit Logic: Trailing stop after 20% price increase

if strategy.position_size > 0 and not na(targetPrice) and close >= targetPrice

if na(trailingStopPrice)

trailingStopPrice := close - atr * atrMultiplier // Initialize trailing stop using ATR

trailingStopPrice := math.max(trailingStopPrice, close - atr * atrMultiplier) // Tighten dynamically based on ATR

// Exit if the price falls below the trailing stop after 20% increase

if strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice

strategy.close("Long", comment="Trailing Stop After 20% Increase")

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

trailingStopPrice := na // Reset trailing stop

// Stop Loss: Exit if the price drops 12% below the entry price

if strategy.position_size > 0 and not na(stopLossPrice) and close <= stopLossPrice

strategy.close("Long", comment="Stop Loss Triggered")

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

trailingStopPrice := na // Reset trailing stop

// Trailing Stop: Activate after touching the upper band

if strategy.position_size > 0 and close >= upper and isGreen

if na(trailingStopPrice)

trailingStopPrice := close - atr * atrMultiplier // Initialize trailing stop using ATR

trailingStopPrice := math.max(trailingStopPrice, close - atr * atrMultiplier) // Tighten dynamically based on ATR

// Exit if the price falls below the trailing stop

if strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice

strategy.close("Long", comment="Trailing Stop Triggered")

trailingStopPrice := na // Reset trailing stop

targetPrice := na // Reset the target price

stopLossPrice := na // Reset the stop loss price

相关推荐