概述

这是一个基于多重技术指标交叉信号的智能型趋势跟踪策略。该策略整合了移动平均线(EMA)、相对强弱指标(RSI)和移动平均线趋同散度(MACD)三大技术指标,通过多维度信号确认来识别市场趋势,并配合动态止损止盈进行风险管理。策略设计采用全自动化交易方式,特别适合日内交易。

策略原理

策略的核心逻辑基于三层技术指标过滤: 1. 使用9周期和21周期的指数移动平均线(EMA)交叉来确认趋势方向 2. 利用相对强弱指标(RSI)过滤超买超卖区域,避免在极端市场条件下入场 3. 通过MACD指标进一步确认趋势强度和方向

入场信号的产生需同时满足以下条件: - 做多条件:短期EMA上穿长期EMA,RSI低于70,且MACD线在信号线上方 - 做空条件:短期EMA下穿长期EMA,RSI高于30,且MACD线在信号线下方

策略采用资金百分比持仓模式,每次交易使用10%的账户权益,并配合2%的止盈和1%的止损进行风险控制。

策略优势

- 多重指标交叉验证,大幅降低虚假信号风险

- 动态止损止盈设置,根据入场价格自动调整风险管理水平

- 百分比仓位管理,实现资金利用的最优化配置

- 全自动化执行,无需人工干预,降低情绪影响

- 完整的风险管理体系,包括位置控制和止损止盈机制

策略风险

- 多重指标可能导致信号滞后,在快速行情中错过机会

- 固定百分比的止损止盈可能在波动性较大的市场中过早触发

- 依赖技术指标可能在横盘市场产生过多虚假信号

- 佣金成本对策略收益有显著影响

风险控制建议: - 根据市场波动情况动态调整止损止盈比例 - 增加趋势强度过滤器,减少横盘市场的交易频率 - 优化持仓时间管理,避免隔夜风险

策略优化方向

- 指标参数优化

- 对EMA周期进行优化,寻找最佳的短期和长期周期组合

- 调整RSI的超买超卖阈值,适应不同市场环境

- 优化MACD参数,提高趋势识别的准确性

- 风险管理优化

- 实现动态止损止盈比例,根据市场波动性自动调整

- 增加最大回撤控制机制

- 引入时间退出机制,避免长期套牢

- 交易执行优化

- 增加交易量过滤器,避免在低流动性环境下交易

- 实现分批建仓和平仓机制,优化成本均价

- 加入市场波动性指标,动态调整持仓比例

总结

该策略通过多重技术指标的协同作用,构建了一个相对完善的趋势跟踪系统。策略的优势在于信号可靠性高、风险管理完善,但也存在一定的滞后性和对市场环境的依赖性。通过建议的优化方向,策略可以进一步提升其适应性和稳定性。在实盘应用中,建议进行充分的回测和参数优化,并结合市场实际情况进行适当调整。

策略源码

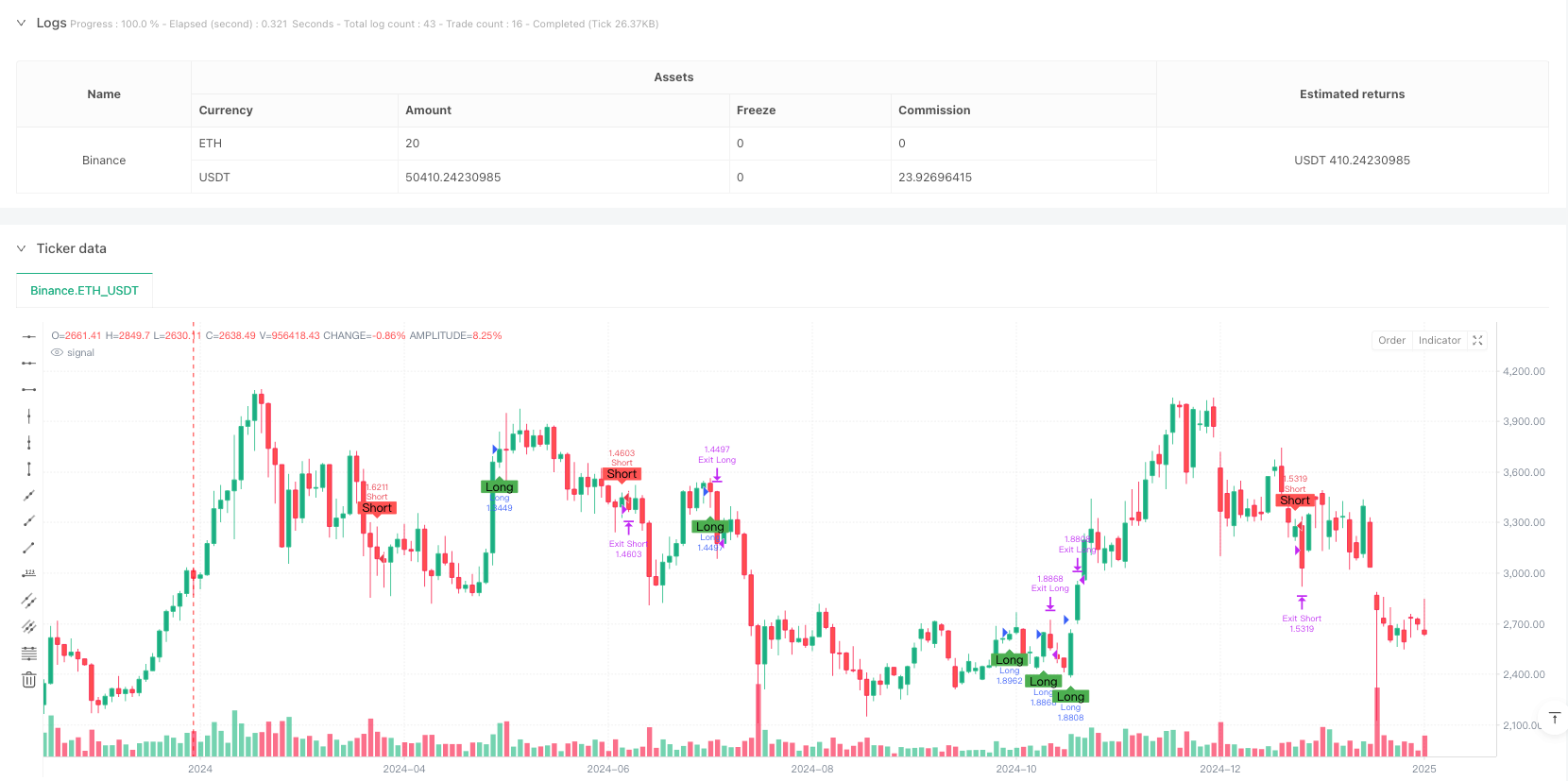

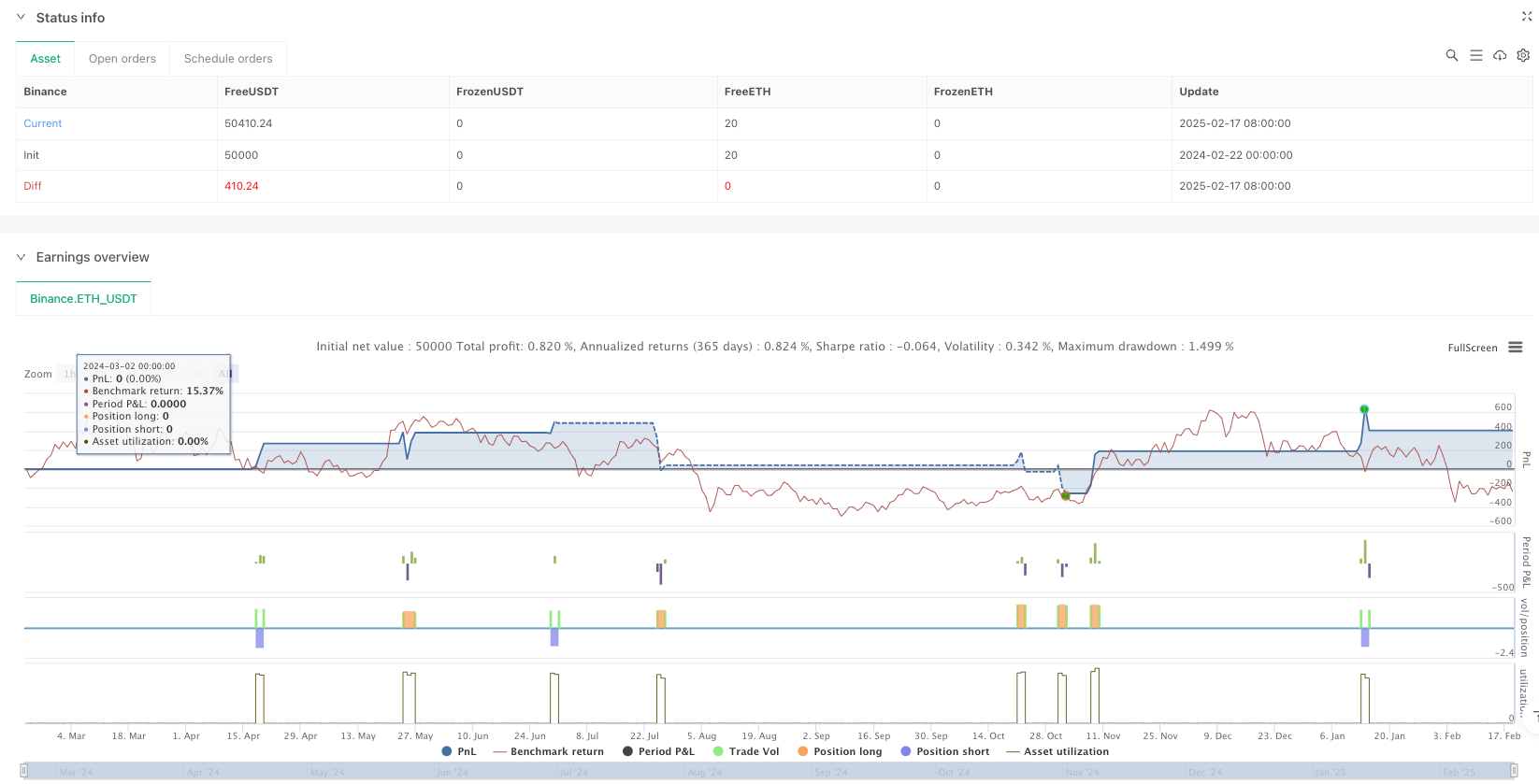

/*backtest

start: 2024-02-22 00:00:00

end: 2025-02-19 08:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Binance","currency":"ETH_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © egidiopalmieri

//@version=5

strategy("BTCUSD Intraday - AI-like Strategy", overlay=true, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=10, commission_type=strategy.commission.percent, commission_value=0.1)

// ==========================

// Risk and Strategy Parameters

// ==========================

takeProfitPerc = input.float(2.0, "Take Profit (%)", step=0.1) / 100.0 // Target profit: 2%

stopLossPerc = input.float(1.0, "Stop Loss (%)", step=0.1) / 100.0 // Stop loss: 1%

// ==========================

// Technical Indicators

// ==========================

emaShortPeriod = input.int(9, "Short EMA (period)", minval=1)

emaLongPeriod = input.int(21, "Long EMA (period)", minval=1)

emaShort = ta.ema(close, emaShortPeriod)

emaLong = ta.ema(close, emaLongPeriod)

// RSI Indicator

rsiPeriod = input.int(14, "RSI (period)", minval=1)

rsiValue = ta.rsi(close, rsiPeriod)

// MACD Indicator

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// ==========================

// Entry Conditions

// ==========================

// LONG entry: short EMA crosses above long EMA, RSI not in overbought zone, MACD in bullish trend

longCondition = ta.crossover(emaShort, emaLong) and (rsiValue < 70) and (macdLine > signalLine)

// SHORT entry: short EMA crosses below long EMA, RSI not in oversold zone, MACD in bearish trend

shortCondition = ta.crossunder(emaShort, emaLong) and (rsiValue > 30) and (macdLine < signalLine)

// ==========================

// Signal Visualization

// ==========================

plotshape(longCondition, title="Long Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="Long")

plotshape(shortCondition, title="Short Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Short")

// ==========================

// Entry Logic

// ==========================

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// ==========================

// Stop Loss and Take Profit Management

// The levels are calculated dynamically based on the average entry price

// ==========================

if strategy.position_size > 0

// For long positions

longSL = strategy.position_avg_price * (1 - stopLossPerc)

longTP = strategy.position_avg_price * (1 + takeProfitPerc)

strategy.exit("Exit Long", from_entry="Long", stop=longSL, limit=longTP)

if strategy.position_size < 0

// For short positions

shortSL = strategy.position_avg_price * (1 + stopLossPerc)

shortTP = strategy.position_avg_price * (1 - takeProfitPerc)

strategy.exit("Exit Short", from_entry="Short", stop=shortSL, limit=shortTP)

// ==========================

// Final Notes

// ==========================

// This script uses rules based on technical indicators to generate signals

// "AI-like". The integration of actual AI algorithms is not natively supported in PineScript.

// It is recommended to customize, test, and validate the strategy before using it in live trading.

相关推荐