概述

这是一个专为纳斯达克100微型期货设计的日内交易策略。策略核心采用双均线系统结合成交量加权平均价格(VWAP)作为趋势确认,并通过真实波动幅度(ATR)动态调整止损位置。该策略在保持资金安全的同时,通过严格的风险控制和动态的仓位管理来捕捉市场趋势。

策略原理

策略主要基于以下几个核心组件: 1. 信号系统采用9周期与21周期指数移动平均线(EMA)的交叉来识别趋势方向。当短期均线向上穿越长期均线时产生做多信号,反之产生做空信号。 2. 使用VWAP作为趋势确认指标,价格需要位于VWAP之上才能开多仓,位于VWAP之下才能开空仓。 3. 风险管理系统使用基于ATR的动态止损,多仓止损设置为2倍ATR,空仓为1.5倍ATR。 4. 获利目标采用不对称设计,多仓使用3:1的收益风险比,空仓使用2:1的收益风险比。 5. 设置了移动止损和保本止损机制,当价格达到目标利润的50%时,止损点上移至成本位。

策略优势

- 动态适应性强 - 通过ATR来调整止损和移动止损参数,策略能够自动适应不同的市场波动环境。

- 风险控制完善 - 每笔交易风险限制在1500美元以内,并设置了7500美元的每周最大亏损限制。

- 不对称收益设计 - 考虑到市场特性,多空策略采用不同的收益风险比和仓位大小,更符合市场实际情况。

- 多重确认机制 - 结合EMA交叉和VWAP确认,有效减少假突破信号。

- 完整的止损体系 - 包含固定止损、移动止损和保本止损三重保护。

策略风险

- 震荡市场风险 - 在横盘震荡市场中,均线交叉信号可能产生较多假信号。

- 滑点风险 - 在快速行情中,实际成交价格可能与信号价格存在较大偏差。

- 系统性风险 - 当市场出现重大事件时,止损可能失效。

- 过度交易风险 - 频繁的信号可能导致交易成本增加。

- 资金管理风险 - 如果初始资金较小,可能无法有效执行完整的仓位管理计划。

策略优化方向

- 引入成交量过滤器 - 可以添加成交量确认机制,只在成交量满足条件时执行交易。

- 优化时间过滤 - 考虑加入具体的交易时间窗口,避开波动较大的开盘和收盘时段。

- 动态调整参数 - 可以根据不同的市场环境自动调整均线周期和ATR倍数。

- 增加市场情绪指标 - 引入VIX等波动率指标来调整交易频率和仓位大小。

- 完善移动止损 - 可以设计更灵活的移动止损算法,提高对趋势的把握能力。

总结

该策略通过均线系统和VWAP的配合建立了稳健的趋势跟踪系统,并通过多层次的风险控制机制保护资金安全。策略的最大特点是其适应性和风险管理能力,通过ATR动态调整各项参数,使其能够在不同市场环境下保持稳定性能。该策略特别适合日内交易纳斯达克100微型期货,但需要交易者严格执行风险控制规则,并根据市场变化适时调整参数。

策略源码

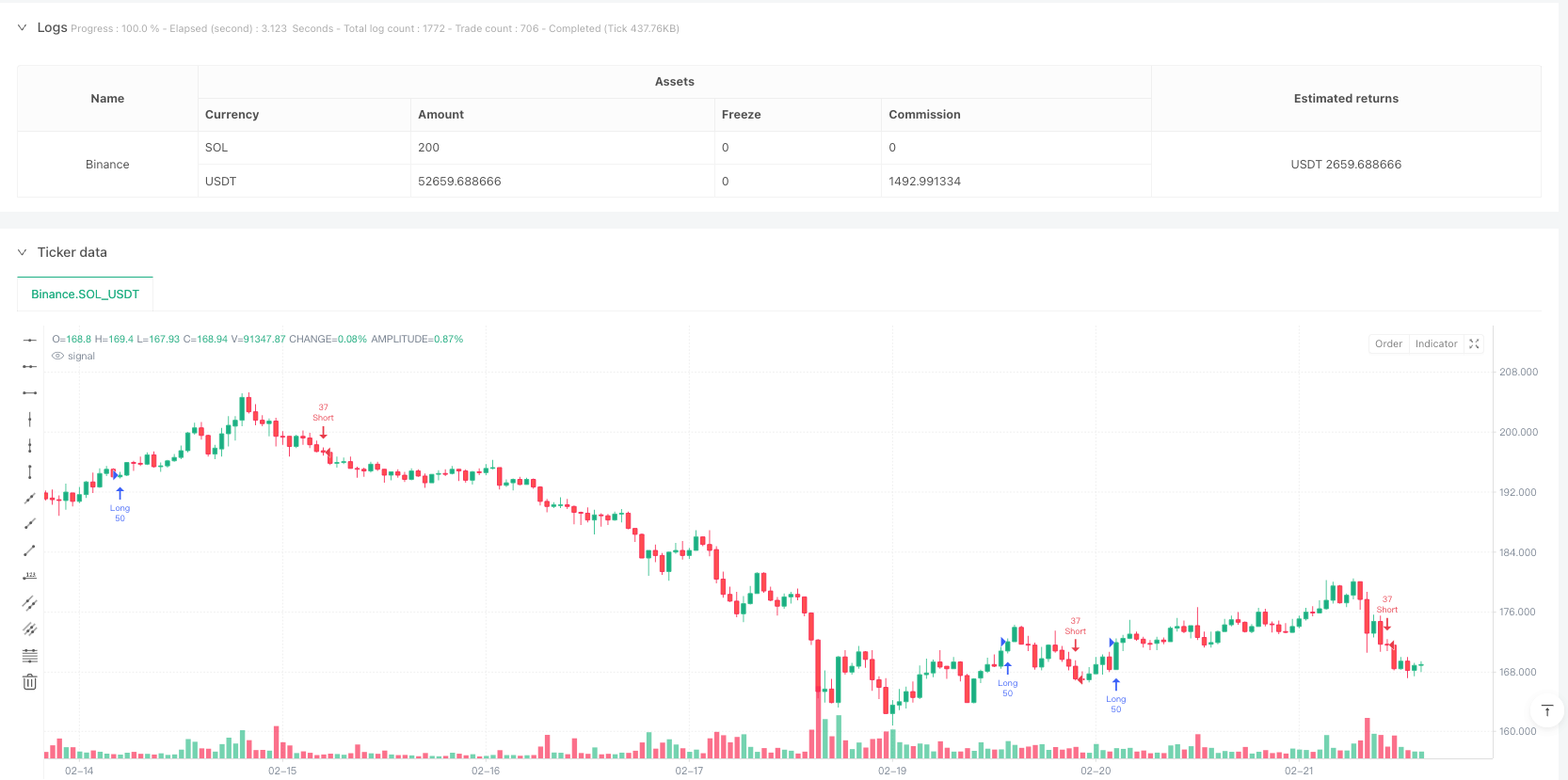

/*backtest

start: 2024-02-25 00:00:00

end: 2025-02-22 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Binance","currency":"SOL_USDT"}]

*/

//@version=5

strategy("Nasdaq 100 Micro - Optimized Risk Management", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// === INPUTS ===

riskPerTrade = input(1500, title="Max Risk Per Trade ($)")

profitTarget = input(3000, title="Target Profit Per Trade ($)")

maxWeeklyLoss = input(7500, title="Max Weekly Loss ($)")

emaShort = input(9, title="Short EMA Period")

emaLong = input(21, title="Long EMA Period")

vwapEnabled = input(true, title="Use VWAP?")

contractSizeMax = input(50, title="Max Micro Contracts per Trade")

atrLength = input(14, title="ATR Length")

// === INDICATORS ===

emaFast = ta.ema(close, emaShort)

emaSlow = ta.ema(close, emaLong)

vwapLine = ta.vwap(close)

atrValue = ta.atr(atrLength)

// === CONDITIONS ===

// Long Entry: EMA Crossover + Above VWAP

longCondition = ta.crossover(emaFast, emaSlow) and (not vwapEnabled or close > vwapLine)

// Short Entry: EMA Crossunder + Below VWAP

shortCondition = ta.crossunder(emaFast, emaSlow) and (not vwapEnabled or close < vwapLine)

// Position Size Calculation (Adjusted for Shorts)

riskPerPoint = 5 // MNQ Micro Futures = $5 per point per contract

stopLossPointsLong = atrValue * 2 // More room for longs

stopLossPointsShort = atrValue * 1.5 // Tighter for shorts

contractsLong = math.min(contractSizeMax, math.floor(riskPerTrade / (stopLossPointsLong * riskPerPoint)))

contractsShort = math.min(math.floor(contractsLong * 0.75), contractSizeMax) // Shorts use 75% of long size

// Stop Loss & Take Profit

longSL = close - stopLossPointsLong

longTP = close + (stopLossPointsLong * 3) // 1:3 Risk-Reward for longs

shortSL = close + stopLossPointsShort

shortTP = close - (stopLossPointsShort * 2) // 1:2 Risk-Reward for shorts

// === BREAK-EVEN STOP MECHANISM ===

longBE = close + (stopLossPointsLong * 1.5) // If price moves 50% to TP, move SL to entry

shortBE = close - (stopLossPointsShort * 1) // More aggressive on shorts

// === TRAILING STOP LOGIC ===

trailStopLong = close - (atrValue * 1.5)

trailStopShort = close + (atrValue * 1)

// === EXECUTION ===

// Check for weekly loss limit

weeklyLoss = strategy.netprofit < -maxWeeklyLoss

if (longCondition and not weeklyLoss)

strategy.entry("Long", strategy.long, contractsLong)

strategy.exit("TakeProfitLong", from_entry="Long", limit=longTP, stop=longSL, trail_points=atrValue * 1.5, trail_offset=atrValue * 0.5)

strategy.exit("BreakEvenLong", from_entry="Long", stop=longBE, when=close >= longBE)

if (shortCondition and not weeklyLoss)

strategy.entry("Short", strategy.short, contractsShort)

strategy.exit("TakeProfitShort", from_entry="Short", limit=shortTP, stop=shortSL, trail_points=atrValue * 1, trail_offset=atrValue * 0.5)

strategy.exit("BreakEvenShort", from_entry="Short", stop=shortBE, when=close <= shortBE)

// === STOP TRADING IF WEEKLY LOSS EXCEEDED ===

if (weeklyLoss)

strategy.close_all()

相关推荐