概述

本策略是一种综合性的量化交易方法,通过整合多个技术指标(MACD、Supertrend和Parabolic SAR)来识别市场趋势和交易信号。该策略旨在提供一个灵活且严谨的交易决策框架,可以适应不同市场环境。

策略原理

策略原理基于三个关键技术指标的动态组合: 1. MACD指标:评估价格动量和趋势方向 2. Supertrend指标:判断市场主导趋势(多头或空头) 3. Parabolic SAR:提供精确的入场和出场信号

策略通过以下逻辑进行交易决策: - 长仓入场条件: - MACD线高于信号线 - Supertrend呈现绿色(多头) - 收盘价高于Parabolic SAR - 空仓入场条件: - MACD线低于信号线 - Supertrend呈现红色(空头) - 收盘价低于Parabolic SAR

策略优势

- 多指标综合验证:降低假信号风险

- 灵活的信号触发机制:不严格要求指标触发顺序

- 全仓交易策略:最大化每次交易的潜在收益

- 对称的交易逻辑:在多头和空头市场中表现一致

- 动态的出场机制:通过连续两根K线确认,避免过早退出

策略风险

- 指标滞后性风险:技术指标基于历史数据,可能存在延迟

- 全仓交易风险:未设置止损可能导致较大资金波动

- 市场剧烈波动风险:复杂市场环境可能影响策略表现

- 参数敏感性:指标参数选择直接影响策略效果

策略优化方向

- 引入动态仓位管理:根据市场波动性调整仓位大小

- 增加止损机制:降低单笔交易最大损失

- 优化指标参数:通过回测找到最佳参数组合

- 引入附加过滤条件:如交易量、波动率指标

- 增加多时间框架验证:提高信号的可靠性

总结

Vishal自适应多指标交易策略是一种创新的量化交易方法,通过MACD、Supertrend和Parabolic SAR的协同作用,提供了一个全面且灵活的交易决策框架。尽管存在一定风险,但其多指标验证和对称交易逻辑为投资者提供了一个值得深入研究的交易模型。

策略源码

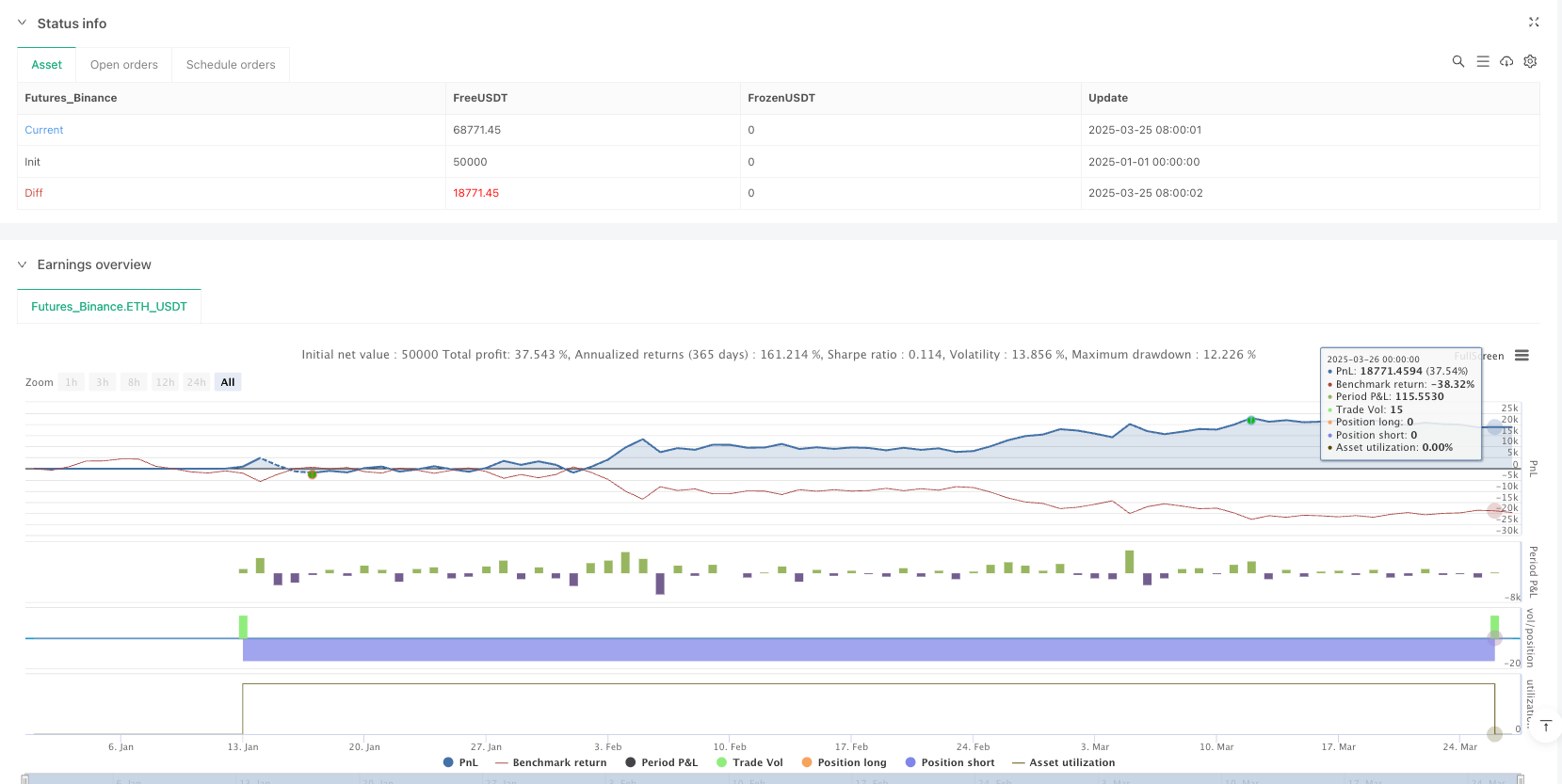

/*backtest

start: 2025-01-01 00:00:00

end: 2025-03-27 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy("Vishal Strategy", overlay=true, margin_long=100, margin_short=100, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// **MACD Inputs & Calculation**

fast_length = input.int(13, title="MACD Fast Length")

slow_length = input.int(27, title="MACD Slow Length")

signal_length = input.int(9, title="MACD Signal Smoothing")

fast_ma = ta.ema(close, fast_length)

slow_ma = ta.ema(close, slow_length)

macd = fast_ma - slow_ma

signal = ta.ema(macd, signal_length)

hist = macd - signal

// **Supertrend Inputs & Calculation**

atrPeriod = input.int(11, "ATR Length", minval = 1)

factor = input.float(3.0, "Factor", minval = 0.01, step = 0.01)

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

bullTrend = direction < 0 // Uptrend Condition

bearTrend = direction > 0 // Downtrend Condition

// **Parabolic SAR Inputs & Calculation**

sarStep = input.float(0.02, "Parabolic SAR Step")

sarMax = input.float(0.2, "Parabolic SAR Max")

sar = ta.sar(sarStep, sarStep, sarMax)

// **Trade Entry Conditions**

macdBullish = macd > signal // MACD in Bullish Mode

macdBearish = macd < signal // MACD in Bearish Mode

priceAboveSAR = close > sar // Price above SAR (Bullish)

priceBelowSAR = close < sar // Price below SAR (Bearish)

// **Boolean Flags to Track Conditions Being Met**

var bool macdConditionMet = false

var bool sarConditionMet = false

var bool trendConditionMet = false

// **Track if Each Condition is Met in Any Order**

if (macdBullish)

macdConditionMet := true

if (macdBearish)

macdConditionMet := false

if (priceAboveSAR)

sarConditionMet := true

if (priceBelowSAR)

sarConditionMet := false

if (bullTrend)

trendConditionMet := true

if (bearTrend)

trendConditionMet := false

// **Final Long Entry Signal (Triggers When All Three Flags Are True)**

longSignal = macdConditionMet and sarConditionMet and trendConditionMet

// **Final Short Entry Signal (Triggers When All Three Flags Are False)**

shortSignal = not macdConditionMet and not sarConditionMet and not trendConditionMet

// **Execute Full Equity Trades**

if (longSignal)

strategy.entry("Long", strategy.long)

if (shortSignal)

strategy.entry("Short", strategy.short)

// **Exit Logic - Requires 2 Consecutive Candle Closes Below/Above SAR**

var int belowSARCount = 0

var int aboveSARCount = 0

if (strategy.position_size > 0) // Long position is active

belowSARCount := close < sar ? belowSARCount + 1 : 0

if (belowSARCount >= 1)

strategy.close("Long")

if (strategy.position_size < 0) // Short position is active

aboveSARCount := close > sar ? aboveSARCount + 1 : 0

if (aboveSARCount >= 1)

strategy.close("Short")

// **Plot Indicators**

plot(supertrend, title="Supertrend", color=bullTrend ? color.green : color.red, linewidth=2, style=plot.style_linebr)

plot(sar, title="Parabolic SAR", color=color.blue, style=plot.style_cross, linewidth=2)

plot(macd, title="MACD Line", color=color.blue, linewidth=2)

plot(signal, title="MACD Signal", color=color.orange, linewidth=2)

plot(hist, title="MACD Histogram", style=plot.style_columns, color=hist >= 0 ? color.green : color.red)

相关推荐