概述

本策略是一种基于市场动态区间中点的高精度交易方法,通过捕捉价格在特定时间范围内的波动特征,实现精准的入场和出场时机。策略核心是利用可配置的回溯周期,动态计算价格区间的高点、低点和中点,并在纽约证券交易所交易时段内执行限价交易。

策略原理

策略原理基于以下关键机制: 1. 动态区间计算:通过设定可调整的回溯周期(默认30个K线),实时计算价格的最高点、最低点和中点。 2. 时间约束交易:严格限定在纽约证券交易所交易时段(上午9:30至下午3:00)内进行交易。 3. 中点突破信号:当收盘价格突破区间中点时,产生做多或做空信号。 4. 限价订单策略:在区间中点下单,并设置止盈和止损价格为区间高点和低点。

策略优势

- 高精度入场:通过动态计算区间中点,提供更加精准的入场时机。

- 风险可控:严格的止盈和止损机制,有效控制单笔交易风险。

- 时间选择性:仅在交易所活跃时段交易,避免低流动性periods。

- 参数灵活:回溯周期可调,适应不同市场环境。

- 避免隔夜风险:在交易日结束前自动平仓。

策略风险

- 区间计算局限性:在剧烈波动市场中,固定回溯周期可能无法准确反映实时市场状态。

- 交易频率风险:频繁交易可能增加交易成本和滑点风险。

- 参数敏感性:回溯周期和交易时段设置对策略表现影响显著。

- 市场适应性:策略可能不适用于所有品种和市场环境。

策略优化方向

- 动态回溯周期:引入自适应算法,根据市场波动性动态调整回溯周期。

- 多时间框架验证:结合不同时间框架的信号,提高信号准确性。

- volatility过滤:增加波动率指标,过滤低质量交易信号。

- 机器学习优化:使用机器学习算法动态调整入场和出场参数。

- 风险管理增强:引入更复杂的仓位管理和动态止损机制。

总结

本策略通过精确的区间中点突破和限价交易机制,为交易者提供了一种系统化、规则明确的交易方法。其核心优势在于高精度入场、风险可控和时间选择性。未来的优化方向将focus于提高策略的自适应性和稳定性。

关键技术指标

- 回溯周期(Lookback Period)

- 区间高点(Range High)

- 区间低点(Range Low)

- 区间中点(Range Midpoint)

- 交易时段(NYSE Trading Hours)

交易逻辑总结

通过动态计算价格区间并在中点附近进行限价交易,在严格的时间和风险管理框架下,捕捉短期价格趋势和反转机会。

风险提示

本策略仅供参考,实际交易中需要根据个人风险承受能力和市场环境进行调整。

推荐应用场景

适用于追求稳定、系统化交易策略的中短线投资者,特别是专注于期指和高流动性品种交易的交易者。

结语

量化交易的核心在于不断优化和适应,本策略为交易者提供了一个值得深入研究和改进的交易框架。

策略源码

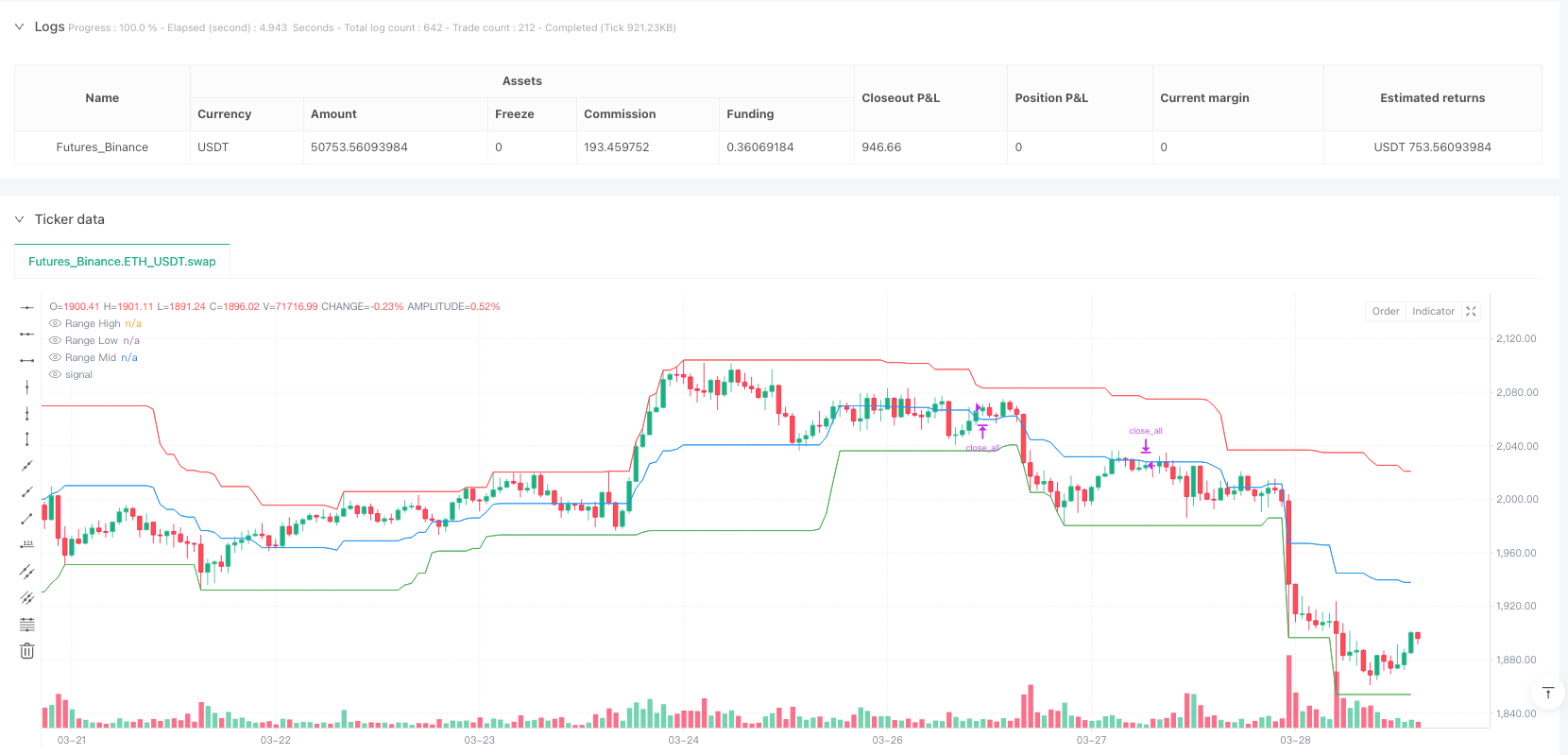

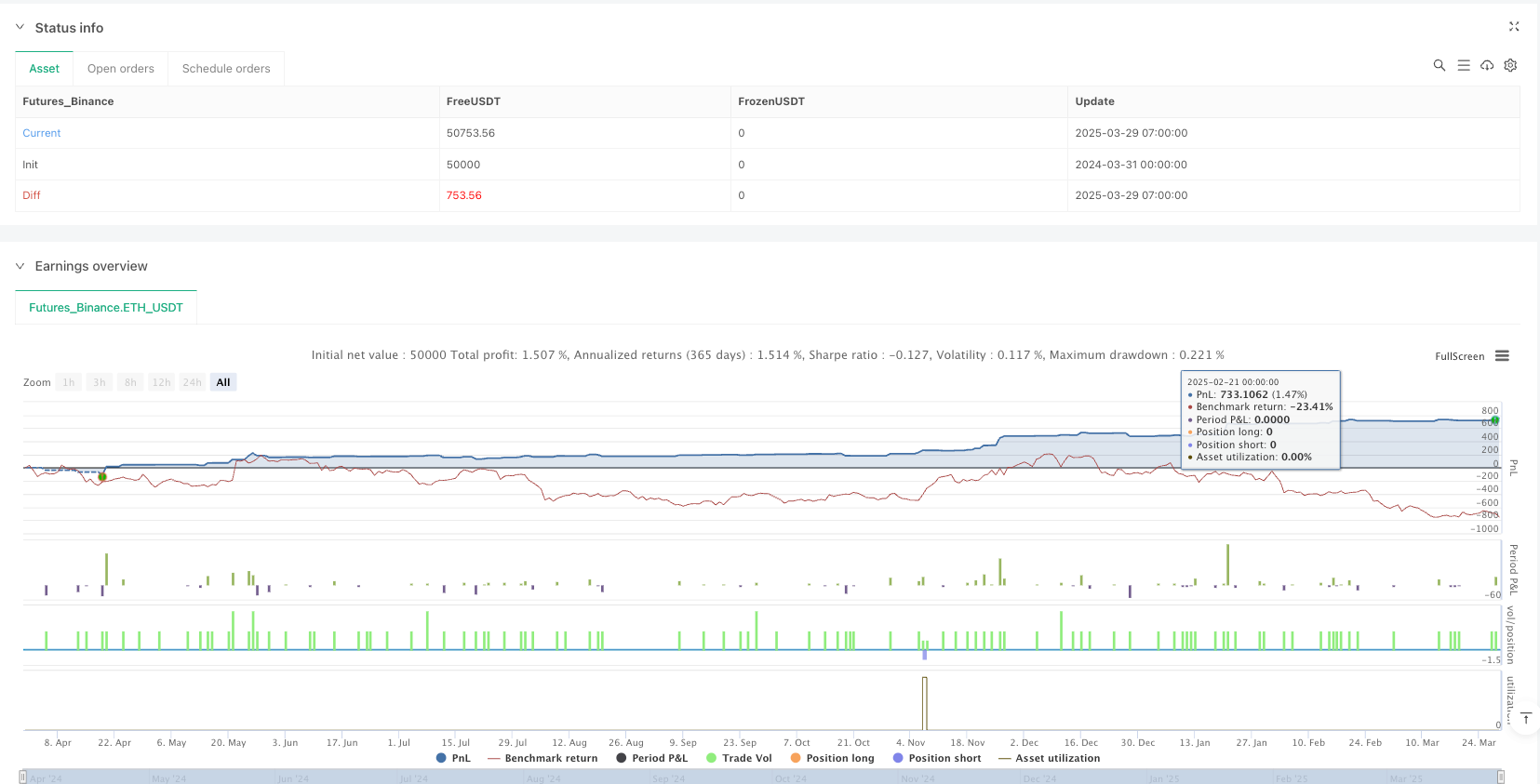

/*backtest

start: 2024-03-31 00:00:00

end: 2025-03-29 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy("Midpoint Crossing Strategy", overlay=true)

// Input for lookback period

lookback = input.int(30, title="Lookback Period", minval=1)

// Input for NYSE trading hours

startHour = 9

startMinute = 30

endHour = 15

endMinute = 0

// Variables to store high, low, and midpoint of the lookback period

var float rangeHigh = na

var float rangeLow = na

var float rangeMid = na

// Calculate high, low, and midpoint based on lookback period

if (bar_index >= lookback)

rangeHigh := ta.highest(high, lookback)

rangeLow := ta.lowest(low, lookback)

rangeMid := (rangeHigh + rangeLow) / 2

// Plot high, low, and midpoint for reference

plot(rangeHigh, color=color.red, title="Range High")

plot(rangeLow, color=color.green, title="Range Low")

plot(rangeMid, color=color.blue, title="Range Mid")

// Time condition for NYSE hours

currentTime = timestamp("GMT-5", year, month, dayofmonth, hour, minute)

startTime = timestamp("GMT-5", year, month, dayofmonth, startHour, startMinute)

endTime = timestamp("GMT-5", year, month, dayofmonth, endHour, endMinute)

// Check if the current time is within NYSE hours

isNYSEHours = currentTime >= startTime and currentTime <= endTime

// Entry conditions (only during NYSE hours)

longCondition = ta.crossover(close, rangeMid) and isNYSEHours

shortCondition = ta.crossunder(close, rangeMid) and isNYSEHours

// Define stop loss and take profit levels based on the range

longStopLoss = rangeLow

longTakeProfit = rangeHigh

shortStopLoss = rangeHigh

shortTakeProfit = rangeLow

// Place limit order at mid-price

if (longCondition and not strategy.opentrades)

strategy.order("Long Limit", strategy.long, limit=rangeMid)

strategy.exit("Take Profit", "Long Limit", limit=longTakeProfit, stop=longStopLoss)

if (shortCondition and not strategy.opentrades)

strategy.order("Short Limit", strategy.short, limit=rangeMid)

strategy.exit("Take Profit", "Short Limit", limit=shortTakeProfit, stop=shortStopLoss)

// Close open positions at 4:00 PM to avoid overnight risk

if (currentTime >= endTime)

strategy.close_all(comment="Close All at 4:00 PM")

// Add a check for open positions

if (strategy.opentrades > 0)

// Ensure no recalculation while a position is open

rangeHigh := na

rangeLow := na

rangeMid := na

相关推荐