RSI动态背离量化策略

RSI ATR SL/TP risk management DIVERGENCE Pivot

创建日期:

2025-04-25 14:57:31

最后修改:

2025-04-25 14:57:31

复制:

2

点击次数:

542

概述

RSI双枢轴背离量化策略是一种通过检测价格行为与相对强弱指数(RSI)之间的常规看涨和看跌背离来识别潜在反转机会的高级交易策略。该策略采用自动化枢轴点检测算法,结合两种不同的止损/止盈管理方法,在确认背离信号时自动建立头寸。策略核心在于通过精确的数学计算验证价格与RSI指标之间的背离现象,并采用动态风险管理机制确保每笔交易都遵循预设的风险回报比。

策略原理

- RSI计算模块:采用Wilder平滑方法计算14周期(可调)RSI值,使用收盘价作为默认输入源(可配置)。

- 枢轴点检测:

- 使用左右各5周期(可调)的滑动窗口检测RSI指标的局部高点和低点

- 通过ta.barssince函数确保枢轴点之间间隔5-60根K线(可调范围)

- 使用左右各5周期(可调)的滑动窗口检测RSI指标的局部高点和低点

- 背离确认逻辑:

- 看涨背离:价格创新低而RSI形成更高的低点

- 看跌背离:价格创新高而RSI形成更低的高点

- 看涨背离:价格创新低而RSI形成更高的低点

- 交易执行系统:

- 采用双模式止损机制:基于最近20周期(可调)摆动点或ATR波动幅度

- 动态止盈计算:根据风险金额乘以预设的回报风险比(默认2:1)

- 采用双模式止损机制:基于最近20周期(可调)摆动点或ATR波动幅度

- 可视化系统:在图表上标记所有有效背离信号,并实时显示当前持仓的止损(红色)和止盈(绿色)水平线。

优势分析

- 多维度验证机制:要求价格和RSI必须同时满足特定形态,且时间间隔在预设范围内,大幅降低假信号概率。

- 自适应风险管理:

- 摆动点模式适合趋势市场,能有效抓住波段行情

- ATR模式适合震荡市场,根据波动率自动调整止损幅度

- 摆动点模式适合趋势市场,能有效抓住波段行情

- 参数高度可配置:所有关键参数(RSI周期、枢轴检测范围、风险回报比等)均可根据市场特性调整。

- 科学的资金管理:默认采用10%的仓位比例,防止单笔交易过度风险暴露。

- 实时视觉反馈:通过图表标记和动态止损/止盈线,提供直观的交易决策支持。

风险分析

- 滞后性风险:RSI作为滞后指标,在剧烈单边行情中可能产生延迟信号。缓解方案:结合趋势过滤器或缩短RSI周期。

- 震荡市场风险:在无明确趋势时可能产生连续假信号。缓解方案:启用ATR模式并增大乘数,或附加波动率过滤器。

- 参数过拟合风险:特定参数组合可能在历史数据表现良好但实盘失效。缓解方案:进行多周期多品种压力测试。

- 极端行情风险:跳空缺口可能导致止损失效。缓解方案:避免重大经济事件前后交易,或使用期权对冲。

- 时间框架依赖性:不同时间周期表现差异较大。缓解方案:在目标时间框架进行充分回测优化。

优化方向

- 复合指标验证:增加MACD或成交量指标作为二次确认,提升信号质量。

- 动态参数调整:根据市场波动率自动调整RSI周期和ATR乘数。

- 机器学习优化:使用遗传算法优化关键参数组合。

- 多时间框架分析:引入更高时间框架的趋势方向过滤。

- 仓位动态管理:根据波动率调整仓位大小,实现风险均衡。

- 事件过滤器:集成经济日历数据,避免重要数据发布前后的交易。

总结

RSI双枢轴背离量化策略通过系统化的背离识别和严格的风险管理,提供了一种结构化的反转交易方法。其核心价值在于将传统技术分析概念转化为可量化的交易规则,并通过双模式止损机制适应不同市场环境。策略表现出色需要三个关键要素:适当的参数优化、严格的风险控制和一致性的执行纪律。该策略特别适合有一定波动性但趋势不极端的市场环境,是中级交易者向量化交易过渡的优秀模板。

策略源码

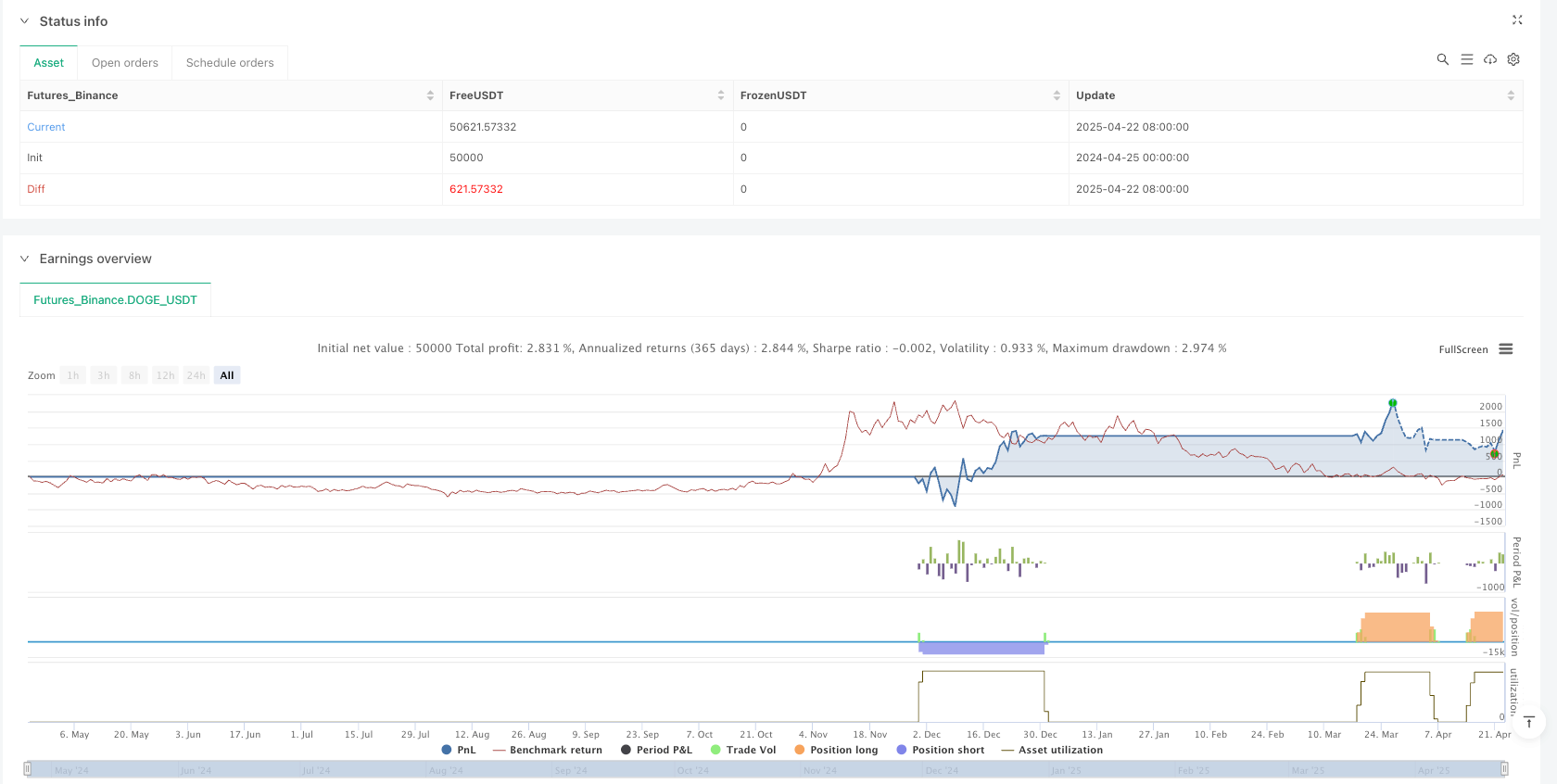

/*backtest

start: 2024-04-25 00:00:00

end: 2025-04-23 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"DOGE_USDT"}]

*/

//@version=6

strategy("RSI Divergence Strategy - AliferCrypto", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === RSI Settings ===

rsiLength = input.int(14, minval=1, title="RSI Length", group="RSI Settings", tooltip="Number of periods for RSI calculation")

rsiSource = input.source(close, title="RSI Source", group="RSI Settings", tooltip="Price source used for RSI calculation")

// === Divergence Settings ===

lookLeft = input.int(5, minval=1, title="Pivot Lookback Left", group="Divergence Settings", tooltip="Bars to the left for pivot detection")

lookRight = input.int(5, minval=1, title="Pivot Lookback Right", group="Divergence Settings", tooltip="Bars to the right for pivot detection")

rangeLower = input.int(5, minval=1, title="Min Bars Between Pivots", group="Divergence Settings", tooltip="Minimum bars between pivots to validate divergence")

rangeUpper = input.int(60, minval=1, title="Max Bars Between Pivots", group="Divergence Settings", tooltip="Maximum bars between pivots to validate divergence")

// === SL/TP Method ===

method = input.string("Swing", title="SL/TP Method", options=["Swing", "ATR"], group="SL/TP Settings", tooltip="Choose between swing-based or ATR-based stop and target")

// === Swing Settings ===

swingLook = input.int(20, minval=1, title="Swing Lookback (bars)", group="Swing Settings", tooltip="Bars to look back for swing high/low")

swingMarginPct = input.float(1.0, minval=0.0, title="Swing Margin (%)", group="Swing Settings", tooltip="Margin around swing levels as percentage of price")

rrSwing = input.float(2.0, title="R/R Ratio (Swing)", group="Swing Settings", tooltip="Risk/reward ratio when using swing-based method")

// === ATR Settings ===

atrLen = input.int(14, minval=1, title="ATR Length", group="ATR Settings", tooltip="Number of periods for ATR calculation")

atrMult = input.float(1.5, minval=0.1, title="ATR SL Multiplier", group="ATR Settings", tooltip="Multiplier for ATR-based stop loss calculation")

rrAtr = input.float(2.0, title="R/R Ratio (ATR)", group="ATR Settings", tooltip="Risk/reward ratio when using ATR-based method")

// === RSI Calculation ===

_d = ta.change(rsiSource)

up = ta.rma(math.max(_d, 0), rsiLength)

down = ta.rma(-math.min(_d, 0), rsiLength)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// === Divergence Detection ===

defPl = not na(ta.pivotlow(rsi, lookLeft, lookRight))

defPh = not na(ta.pivothigh(rsi, lookLeft, lookRight))

rsiAtRR = rsi[lookRight]

barsPl = ta.barssince(defPl)

barsPl1 = barsPl[1]

inRangePL = barsPl1 >= rangeLower and barsPl1 <= rangeUpper

barsPh = ta.barssince(defPh)

barsPh1 = barsPh[1]

inRangePH = barsPh1 >= rangeLower and barsPh1 <= rangeUpper

prevPlRsi = ta.valuewhen(defPl, rsiAtRR, 1)

prevPhRsi = ta.valuewhen(defPh, rsiAtRR, 1)

prevPlPrice = ta.valuewhen(defPl, low[lookRight], 1)

prevPhPrice = ta.valuewhen(defPh, high[lookRight], 1)

bullCond = defPl and low[lookRight] < prevPlPrice and rsiAtRR > prevPlRsi and inRangePL

bearCond = defPh and high[lookRight] > prevPhPrice and rsiAtRR < prevPhRsi and inRangePH

plotshape(bullCond, title="Bullish Divergence", style=shape.triangleup, location=location.belowbar, color=color.green, size=size.tiny)

plotshape(bearCond, title="Bearish Divergence", style=shape.triangledown, location=location.abovebar, color=color.red, size=size.tiny)

// === Entries ===

if bullCond

strategy.entry("Long", strategy.long)

if bearCond

strategy.entry("Short", strategy.short)

// === Pre-calculate SL/TP components ===

swingLow = ta.lowest(low, swingLook)

swingHigh = ta.highest(high, swingLook)

atrValue = ta.atr(atrLen)

// === SL/TP Calculation & Exits ===

var float slPrice = na

var float tpPrice = na

var float rr = na

// Long exits

if strategy.position_size > 0

entryPrice = strategy.position_avg_price

if method == "Swing"

slPrice := swingLow * (1 - swingMarginPct / 100)

rr := rrSwing

else

slPrice := entryPrice - atrValue * atrMult

rr := rrAtr

risk = entryPrice - slPrice

tpPrice := entryPrice + risk * rr

strategy.exit("Exit Long", from_entry="Long", stop=slPrice, limit=tpPrice)

// Short exits

if strategy.position_size < 0

entryPrice = strategy.position_avg_price

if method == "Swing"

slPrice := swingHigh * (1 + swingMarginPct / 100)

rr := rrSwing

else

slPrice := entryPrice + atrValue * atrMult

rr := rrAtr

risk = slPrice - entryPrice

tpPrice := entryPrice - risk * rr

strategy.exit("Exit Short", from_entry="Short", stop=slPrice, limit=tpPrice)

// === Plot SL/TP Levels ===

plot(strategy.position_size != 0 ? slPrice : na, title="Stop Loss", style=plot.style_linebr, color=color.red)

plot(strategy.position_size != 0 ? tpPrice : na, title="Take Profit", style=plot.style_linebr, color=color.green)

// === Alerts ===

alertcondition(bullCond, title="Bull RSI Divergence", message="Bullish RSI divergence detected")

alertcondition(bearCond, title="Bear RSI Divergence", message="Bearish RSI divergence detected")

相关推荐