概述

多时间框架交叉确认型随机相对强弱指标策略是一个综合性的交易系统,该系统巧妙地结合了随机相对强弱指标(Stochastic RSI)在不同时间框架下的信号交叉特性,并辅以平均真实波幅(ATR)过滤器来确保市场具有足够的波动性。该策略的核心思想是通过短时间框架(5分钟)捕捉初始信号,再利用长时间框架(15分钟)进行确认,从而提高交易信号的可靠性和准确性。此外,策略还设计了信号冷却机制,避免了短时间内频繁交易的问题,有效降低了过度交易的风险。

策略原理

该策略的运作基于四个核心机制:初始信号触发、多时间框架确认、波动率过滤和信号冷却系统。

初始信号触发机制:

- 在5分钟图表上,当Stochastic RSI的%K线上穿%D线且当时的%K值低于预设的超卖水平(默认30)时,系统进入做多信号等待状态。

- 当Stochastic RSI的%K线下穿%D线且当时的%K值高于预设的超买水平(默认70)时,系统进入做空信号等待状态。

多时间框架确认机制:

- 一旦系统处于信号等待状态,它会在预设的等待窗口(默认5根5分钟K线)内寻求15分钟时间框架的确认。

- 做多确认条件:15分钟图上的Stochastic RSI %K线值大于或等于%D线值,且%K值低于预设阈值(默认40)。

- 做空确认条件:15分钟图上的Stochastic RSI %K线值小于或等于%D线值,且%K值高于预设阈值(默认60)。

ATR波动率过滤机制:

- 系统计算当前的ATR值,并将其转换为最小跳动点数。

- 只有当当前ATR值超过用户预设的最小阈值(默认10个跳动点)时,交易信号才会被执行。

- 这一机制确保了只在市场具有足够波动性的情况下进行交易,避免了在低波动性市场中因微小价格波动产生的虚假信号。

信号冷却系统:

- 一旦产生一个交易信号,系统会强制等待预设的最小K线数量(默认18根K线),然后才允许在同一方向上产生新的信号。

- 这一机制有效防止了系统在短时间内产生过多同向信号,降低了过度交易的风险。

策略采用交叉反转的方式管理仓位,即当出现做多信号时会平掉任何已有的空仓并建立多仓,当出现做空信号时则平掉任何已有的多仓并建立空仓。

策略优势

多层次过滤系统:通过结合不同时间框架的信号确认和ATR波动率过滤,系统显著减少了假信号,提高了交易的质量。多层次的验证机制确保只在最有利的市场条件下入场,降低了不必要的交易频率。

自适应性强:策略参数高度可定制,包括RSI周期、随机指标平滑值、信号触发阈值等,使交易者能够根据不同市场环境和个人风险偏好进行优化调整。

波动率感知能力:通过ATR过滤器,策略能够智能地识别市场波动状态,只在波动性充分的条件下交易,避免了在盘整市场中因小幅波动产生的无效信号。

过度交易防护:信号冷却机制是一个创新设计,通过强制性的等待期限制同方向交易的频率,有效防止系统在短时间内产生过多交易,降低了佣金成本和滑点损失。

逻辑清晰透明:策略的每个组成部分都有明确的功能和目的,没有复杂难懂的黑盒算法,使交易者能够完全理解系统的运作方式,增强了操作的信心。

策略风险

信号滞后性:多层次的确认机制虽然提高了信号质量,但也不可避免地增加了信号的滞后性。特别是在快速变动的市场中,等待15分钟时间框架的确认可能导致错过最佳入场点或在不利位置入场。

参数敏感性:该策略的效果高度依赖于参数设置,如Stochastic RSI的周期、超买超卖阈值、确认等待窗口等。不恰当的参数设置可能导致错过有效信号或产生过多假信号。

缺乏明确止损机制:策略主要依靠反向信号来管理风险,没有明确的止损策略。在极端市场条件下,如大幅跳空或单向急速行情中,这可能导致较大的亏损。

周期互相影响:多时间框架策略中,各时间周期的指标相互影响,有时会形成复杂的关系。例如,在某些市场条件下,5分钟和15分钟的Stochastic RSI可能长时间保持一致的方向,导致系统错过反转信号。

ATR阈值设置挑战:ATR过滤器的阈值设置存在两难困境:设置过高会错过有效交易机会,设置过低则无法有效过滤低波动环境中的假信号。

策略优化方向

动态止损止盈机制:

- 基于ATR或其他波动指标设计动态止损水平,使风险控制能够自适应地随市场波动性调整。

- 实现方式:可添加

strategy.exit()命令,设置基于ATR倍数的止损,如strategy.exit("long_exit", "LE", stop=entry_price - current_atr_value * 2)。

增加趋势过滤器:

- 结合更长时间周期(如1小时或4小时)的趋势指标,如移动平均线或MACD,确保交易方向与主要趋势一致。

- 实现方式:添加代码获取更高时间级别的趋势指标,如

trend_direction = request.security(syminfo.tickerid, "240", ta.ema(close, 200) < ta.ema(close, 50) ? -1 : 1),并将其作为交易方向的过滤条件。

动态参数优化:

- 基于市场波动性或交易时段自动调整策略参数,使系统能够更好地适应不同市场状态。

- 实现方式:可以编写函数根据当前ATR值或市场波动状态动态调整超买超卖阈值,如

dynamic_overbought = 70 + math.min(15, current_atr_value / 2)。

增强信号确认机制:

- 除了Stochastic RSI外,引入其他指标如布林带、成交量或价格模式作为额外的确认条件。

- 实现方式:增加布林带偏离度检测代码,如

bb_condition = (close - ta.sma(close, 20)) / (ta.stdev(close, 20) * 2),用于评估价格与均值的偏离程度。

资金管理优化:

- 实现动态仓位管理,根据当前趋势强度、市场波动性和历史胜率动态调整每笔交易的风险敞口。

- 实现方式:添加代码计算基于最近N次交易胜率的动态仓位大小,如

position_size = strategy.initial_capital * 0.01 * (recent_win_rate * 2)。

总结

多时间框架交叉确认型随机相对强弱指标策略是一个设计精巧的交易系统,通过多层次的信号确认和过滤机制,有效提高了交易质量,降低了假信号风险。该策略特别适合波动较大的市场环境,通过ATR过滤器避免在低波动市场中产生过多无效信号,而信号冷却机制则有效控制了过度交易的问题。

这一策略的最大优势在于其逻辑清晰、参数可调、适应性强的特点,使其能够适应不同交易品种和市场环境。然而,由于缺乏明确的止损机制和可能存在的信号滞后性,交易者在实际应用中应当额外添加风险管理措施,并根据具体交易品种和个人风险偏好进行参数优化。

通过引入建议的优化措施,如动态止损机制、趋势过滤器和资金管理优化,该策略有望进一步提升其稳定性和盈利能力,成为一个更加全面和可靠的交易系统。

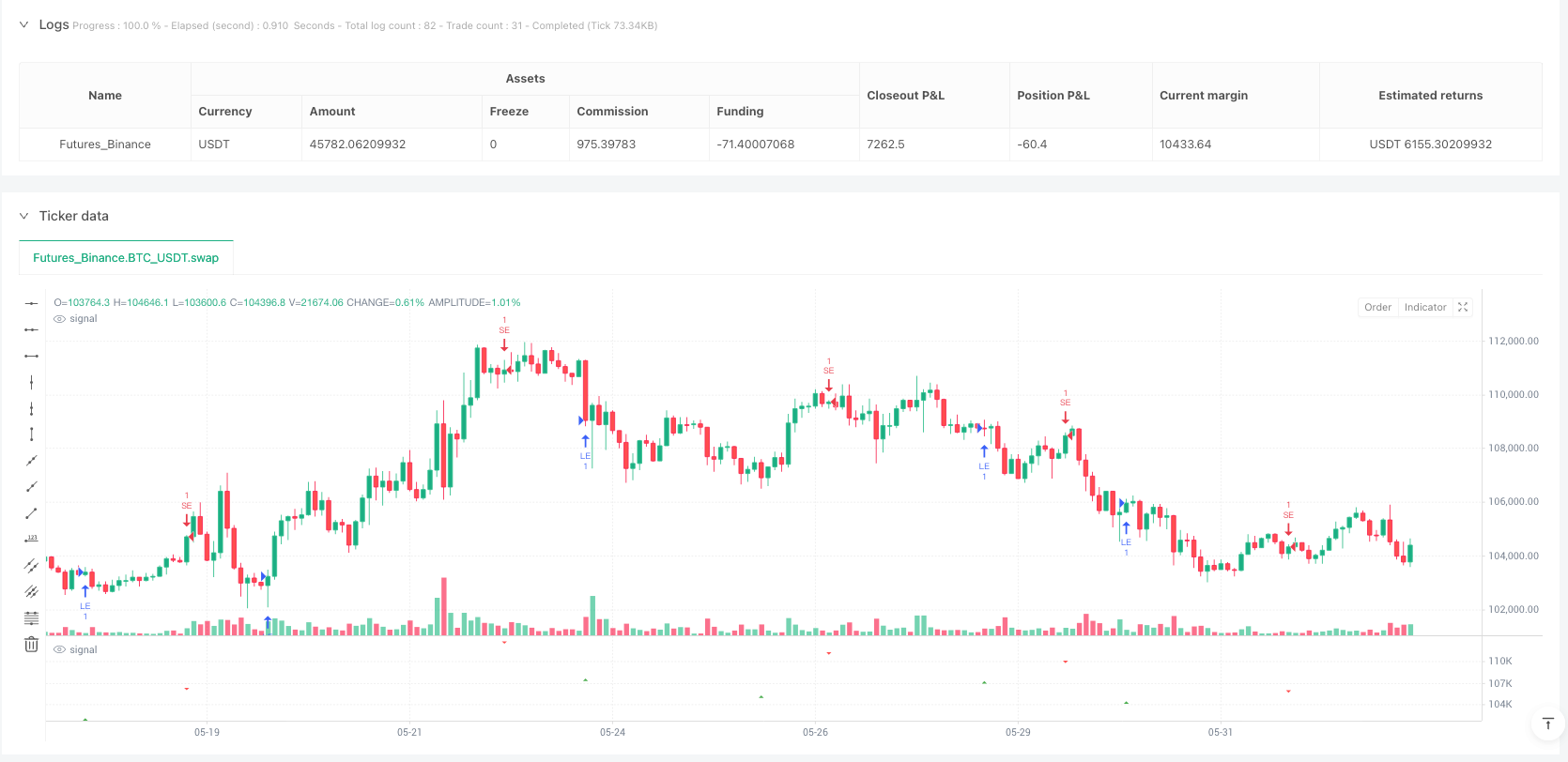

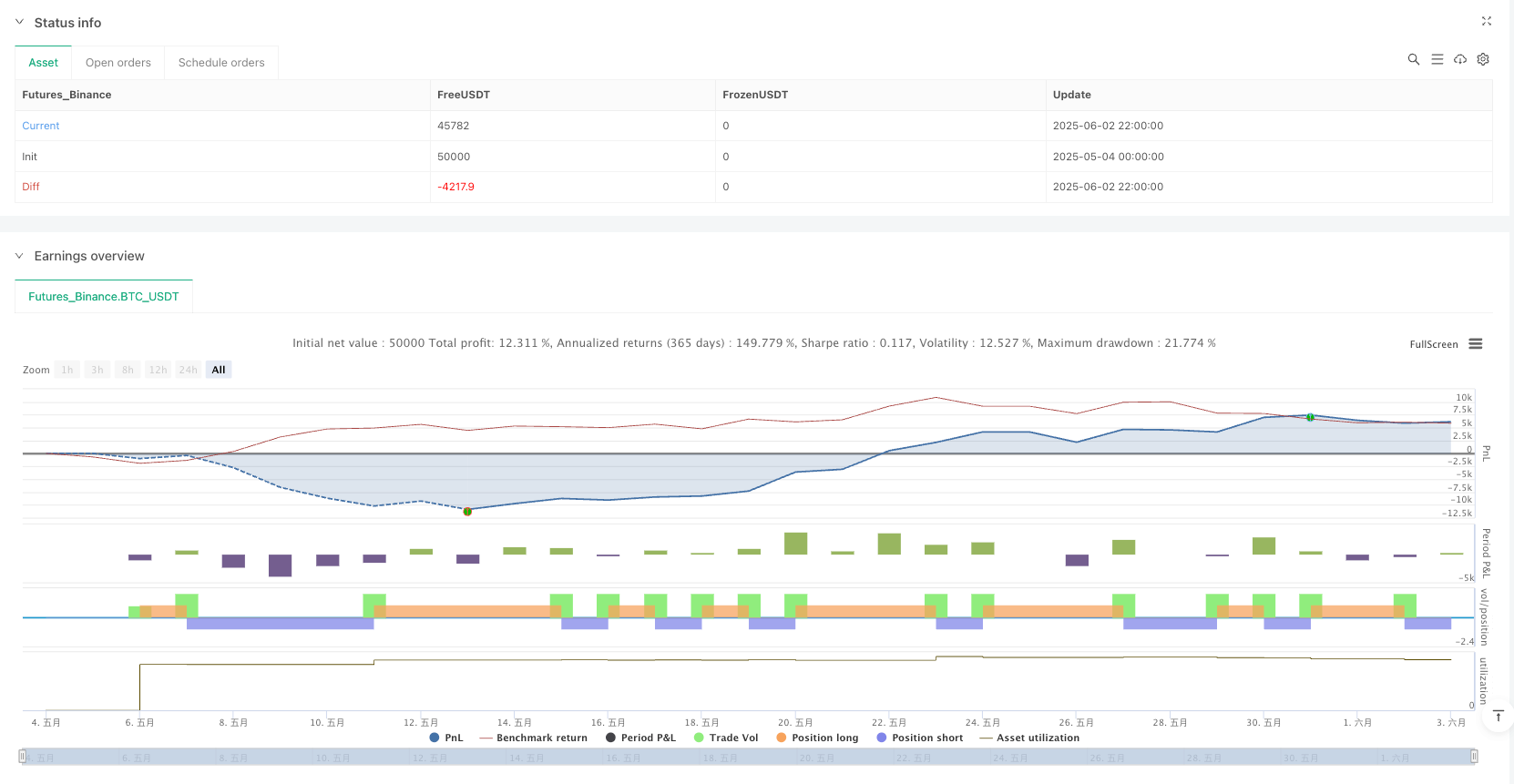

/*backtest

start: 2025-05-04 00:00:00

end: 2025-06-03 00:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script® code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Archertoria

//@version=6

strategy("System 0530 - Stoch RSI Strategy with ATR filter")

// --- 原始指标输入参数 ---

g_stoch = "Stochastic RSI 参数"

rsi_len = input.int(14, "RSI 周期", minval=1, group=g_stoch)

stoch_rsi_len = input.int(14, "Stochastic of RSI 周期 (K Period for Stoch)", minval=1, group=g_stoch)

stoch_k_smooth = input.int(3, "Stochastic %K 平滑 (D Period for Stoch)", minval=1, group=g_stoch)

stoch_d_smooth = input.int(3, "Stochastic %D 平滑 (Smoothing for final D)", minval=1, group=g_stoch)

g_signal = "信号触发与确认参数"

stoch_5min_k_long_trigger = input.float(30.0, "5分钟 Stoch K 做多触发水平 (K需 ≤ 此值)", minval=0, maxval=100, step=0.1, group=g_signal, tooltip="5分钟图上,K线向上交叉D线时,当时的K值必须小于或等于此设定值,才会启动做多信号等待。")

stoch_5min_k_short_trigger = input.float(70.0, "5分钟 Stoch K 做空触发水平 (K需 ≥ 此值)", minval=0, maxval=100, step=0.1, group=g_signal, tooltip="5分钟图上,K线向下交叉D线时,当时的K值必须大于或等于此设定值,才会启动做空信号等待。")

stoch_15min_long_entry_level = input.int(40, "15分钟 Stoch K 做多确认阈值 (K需低于此值)", minval=0, maxval=100, group=g_signal, tooltip="15分钟图上,最终确认做多时,15分钟K线值需低于此设定值。")

stoch_15min_short_entry_level = input.int(60, "15分钟 Stoch K 做空确认阈值 (K需高于此值)", minval=0, maxval=100, group=g_signal, tooltip="15分钟图上,最终确认做空时,15分钟K线值需高于此设定值。")

wait_window_5min_bars = input.int(5, "等待15分钟信号的K线数 (5分钟图)", minval=1, group=g_signal, tooltip="5分钟信号发出后,在接下来的N根5分钟K线内等待15分钟信号确认。")

g_repeat_filter = "重复信号过滤设置"

use_signal_cooldown_filter = input.bool(true, title="启用重复信号过滤器", group=g_repeat_filter, tooltip="过滤掉短时间内同向的重复信号。")

min_bars_between_signals = input.int(18, title="同向信号最小间隔K线数", minval=1, group=g_repeat_filter, tooltip="一个信号发出后,至少等待这么多根K线才会发出下一个同向信号。")

// --- 策略特定输入参数 ---

g_strategy = "策略参数"

leverage_multiplier = input.float(1.0, "杠杆倍数 (仅影响理论头寸大小)", minval=1.0, step=0.1, group=g_strategy, tooltip="注意:TradingView策略本身不直接模拟保证金账户的杠杆爆仓。此杠杆用于计算理论头寸大小。实际杠杆效果需在支持杠杆的经纪商处体现。")

// --- ATR波动率过滤器参数 --- (止盈止损参数组已删除)

g_volatility = "波动率过滤器参数 (ATR)"

use_atr_filter = input.bool(true, "启用ATR波动率过滤器", group=g_volatility, tooltip="勾选以启用ATR过滤器。")

atr_period = input.int(14, "ATR计算周期", minval=1, group=g_volatility)

min_atr_value_ticks = input.float(10, "ATR最小跳动点数阈值", minval=0, step=1, group=g_volatility, tooltip="ATR值(以合约最小跳动点数为单位)必须大于等于此阈值才允许开仓。例如,如果最小跳动点是0.1,这里填10,则要求ATR至少为1.0。0表示不基于此项过滤。")

// --- 函数: 计算 Stochastic RSI ---

getStochasticRSI(src, rsiLen, stochLen, kSmooth, dSmooth) =>

rsi_val = ta.rsi(src, rsiLen)

stoch_rsi_k_raw = ta.stoch(rsi_val, rsi_val, rsi_val, stochLen)

stoch_rsi_k = ta.sma(stoch_rsi_k_raw, kSmooth)

stoch_rsi_d = ta.sma(stoch_rsi_k, dSmooth)

[stoch_rsi_k, stoch_rsi_d]

// --- 时间序列数据获取与Stochastic RSI计算 ---

[stoch_k_15min_val, stoch_d_15min_val] = request.security(syminfo.tickerid, "15", getStochasticRSI(close, rsi_len, stoch_rsi_len, stoch_k_smooth, stoch_d_smooth), lookahead=barmerge.lookahead_off)

[stoch_k_5min_val, stoch_d_5min_val] = getStochasticRSI(close, rsi_len, stoch_rsi_len, stoch_k_smooth, stoch_d_smooth)

// --- ATR 计算 ---

current_atr_value = ta.atr(atr_period)

atr_condition_met = not use_atr_filter or (min_atr_value_ticks == 0) or (current_atr_value / syminfo.mintick >= min_atr_value_ticks)

// --- 信号逻辑状态变量 ---

var bool waiting_for_15m_long_confirm = false

var bool waiting_for_15m_short_confirm = false

var int bars_elapsed_in_wait_state = 0

var int last_long_signal_bar_idx = -min_bars_between_signals

var int last_short_signal_bar_idx = -min_bars_between_signals

// --- 检测5分钟Stochastic RSI交叉事件 ---

bool stoch_5min_crossed_up_prev_bar = ta.crossover(stoch_k_5min_val[1], stoch_d_5min_val[1])

bool stoch_5min_crossed_down_prev_bar = ta.crossunder(stoch_k_5min_val[1], stoch_d_5min_val[1])

bool condition_5min_k_level_for_long_trigger = stoch_k_5min_val[1] <= stoch_5min_k_long_trigger

bool condition_5min_k_level_for_short_trigger = stoch_k_5min_val[1] >= stoch_5min_k_short_trigger

// --- 管理等待状态和容错期 ---

if (stoch_5min_crossed_up_prev_bar and condition_5min_k_level_for_long_trigger)

can_trigger_new_long = not use_signal_cooldown_filter or (bar_index - last_long_signal_bar_idx >= min_bars_between_signals)

if (can_trigger_new_long)

waiting_for_15m_long_confirm := true

waiting_for_15m_short_confirm := false

bars_elapsed_in_wait_state := 1

else

if (waiting_for_15m_long_confirm or waiting_for_15m_short_confirm)

bars_elapsed_in_wait_state := 1

else if (stoch_5min_crossed_down_prev_bar and condition_5min_k_level_for_short_trigger)

can_trigger_new_short = not use_signal_cooldown_filter or (bar_index - last_short_signal_bar_idx >= min_bars_between_signals)

if (can_trigger_new_short)

waiting_for_15m_short_confirm := true

waiting_for_15m_long_confirm := false

bars_elapsed_in_wait_state := 1

else

if (waiting_for_15m_long_confirm or waiting_for_15m_short_confirm)

bars_elapsed_in_wait_state := 1

else if (waiting_for_15m_long_confirm or waiting_for_15m_short_confirm)

bars_elapsed_in_wait_state += 1

if (bars_elapsed_in_wait_state > wait_window_5min_bars)

waiting_for_15m_long_confirm := false

waiting_for_15m_short_confirm := false

// bars_elapsed_in_wait_state := 0 // Optional reset

// --- 15分钟Stochastic RSI确认条件 ---

bool confirm_15min_long_stoch_kd_cond = stoch_k_15min_val >= stoch_d_15min_val

bool confirm_15min_short_stoch_kd_cond = stoch_k_15min_val <= stoch_d_15min_val

bool filter_15min_stoch_level_long = stoch_k_15min_val < stoch_15min_long_entry_level

bool filter_15min_stoch_level_short = stoch_k_15min_val > stoch_15min_short_entry_level

// --- 主要信号判断 (用于策略逻辑) ---

entry_long_signal = false

entry_short_signal = false

if (waiting_for_15m_long_confirm and bars_elapsed_in_wait_state <= wait_window_5min_bars)

if (confirm_15min_long_stoch_kd_cond and filter_15min_stoch_level_long)

can_confirm_new_long = not use_signal_cooldown_filter or (bar_index - last_long_signal_bar_idx >= min_bars_between_signals)

if (can_confirm_new_long)

if (atr_condition_met) // ATR 过滤器检查

entry_long_signal := true

last_long_signal_bar_idx := bar_index

waiting_for_15m_long_confirm := false

bars_elapsed_in_wait_state := 0

else

waiting_for_15m_long_confirm := false

bars_elapsed_in_wait_state := 0

if (waiting_for_15m_short_confirm and bars_elapsed_in_wait_state <= wait_window_5min_bars)

if (confirm_15min_short_stoch_kd_cond and filter_15min_stoch_level_short)

can_confirm_new_short = not use_signal_cooldown_filter or (bar_index - last_short_signal_bar_idx >= min_bars_between_signals)

if (can_confirm_new_short)

if (atr_condition_met) // ATR 过滤器检查

entry_short_signal := true

last_short_signal_bar_idx := bar_index

waiting_for_15m_short_confirm := false

bars_elapsed_in_wait_state := 0

else

waiting_for_15m_short_confirm := false

bars_elapsed_in_wait_state := 0

// --- 策略执行逻辑 ---

if (entry_long_signal)

strategy.entry("LE", strategy.long, comment="long entry")

if (entry_short_signal)

strategy.entry("SE", strategy.short, comment="short entry")

// --- 绘图 ---

plotshape(entry_long_signal, title="做多信号点", location=location.belowbar, color=color.new(color.green,0), style=shape.triangleup, size=size.small)

plotshape(entry_short_signal, title="做空信号点", location=location.abovebar, color=color.new(color.red,0), style=shape.triangledown, size=size.small)