概述

动态风险管理ATR倍数交叉策略是一种基于移动平均线交叉和平均真实波幅(ATR)的量化交易系统。该策略通过短期和长期简单移动平均线(SMA)的交叉来确定入场信号,同时利用ATR动态计算止损、止盈和追踪止损水平,以实现风险管理的自动化和精确化。策略设计针对\(25,000初始资金的账户,具有每日\)4,167的目标利润,并通过动态仓位大小控制来平衡收益与风险。

策略原理

该策略的核心原理是结合技术指标交叉信号与动态风险管理体系:

入场信号生成:

- 当14周期SMA上穿28周期SMA时,产生做多信号

- 当14周期SMA下穿28周期SMA时,产生做空信号

动态风险参数计算:

- 使用14周期ATR计算市场波动性

- 止损水平 = 当前价格 ± (ATR × 1.5倍)

- 止盈水平 = 当前价格 ± (ATR × 3.0倍)

- 追踪止损距离 = ATR × 1.0倍

退出机制:

- 主要退出通过止损、止盈或追踪止损自动执行

- 辅助退出信号:价格与10周期SMA交叉时可选择性平仓

交易执行和通知:

- 通过JSON格式的警报消息传递交易信号及参数

- 包含操作类型、交易品种、数量、订单类型和风险管理参数

此策略特别注重风险与收益的比例,采用了3:1.5的获利与风险比(TP:SL比),遵循了良好的风险管理原则。

策略优势

动态风险适应性:

- 通过ATR动态调整止损和止盈水平,使策略能够适应市场波动性的变化

- 在高波动环境中自动扩大止损距离,在低波动环境中收窄止损范围

清晰的入场和出场规则:

- 基于移动平均线交叉的明确入场信号,减少主观判断

- 多重退出机制确保利润保护和风险控制

完整的风险管理框架:

- 止损、止盈和追踪止损的组合应用,全面保护交易资金

- 风险参数可通过输入变量进行个性化调整,满足不同风险偏好

高度自动化:

- JSON格式的警报系统,可与其他交易平台和工具无缝集成

- 策略参数封装在警报中,便于自动化执行或API连接

可视化辅助:

- 在图表上绘制移动平均线,提供直观的交易信号参考

- 有助于交易者理解策略逻辑和市场状况

策略风险

震荡市场假信号:

- 在横盘或震荡市场中,移动平均线交叉可能产生频繁的假信号

- 缓解方法:考虑增加过滤条件,如趋势确认指标或波动率过滤器

ATR参数敏感性:

- ATR计算周期(14)和乘数(1.5⁄3.0/1.0)的选择对策略表现有显著影响

- 缓解方法:通过回测不同参数组合找到最优配置,或根据特定市场特性调整

趋势反转风险:

- 在强趋势突然反转时,简单移动平均线系统可能反应滞后

- 缓解方法:考虑整合震荡指标或动量指标作为辅助信号

资金管理挑战:

- 固定的账户资金百分比(10%)可能在不同市场条件下过于激进或保守

- 缓解方法:基于波动率和胜率动态调整仓位大小百分比

执行滑点风险:

- 市场订单执行可能面临滑点,影响实际止损和止盈水平

- 缓解方法:在高流动性时段交易,考虑在计算中预留滑点缓冲

策略优化方向

入场信号优化:

- 整合额外的确认指标,如相对强弱指数(RSI)或移动平均线收敛散度指标(MACD)

- 实现:可添加条件过滤器,要求主要趋势方向确认后才执行交易

自适应参数调整:

- 使ATR乘数基于历史波动性或市场状态动态变化

- 实现:可通过计算波动率比率(当前ATR与历史ATR的比较)来动态调整乘数

优化仓位管理:

- 基于胜率和风险回报比动态调整仓位大小

- 实现:编写函数计算最优凯利比例(Kelly Criterion)或考虑最近交易表现

分时段策略调整:

- 根据不同交易时段的波动特性调整策略参数

- 实现:添加时间过滤器,在不同时段应用不同的ATR乘数或信号过滤规则

整合市场结构分析:

- 加入支撑阻力、市场结构高低点分析

- 实现:识别关键价格水平,仅在价格接近支撑或阻力时执行相应方向的交易

总结

动态风险管理ATR倍数交叉策略是一个结合经典技术分析与现代风险管理的量化交易系统。其核心优势在于通过ATR动态调整风险参数,使策略能够适应不同市场环境。该策略特别适合波动性相对稳定且趋势明显的市场,通过简单移动平均线交叉生成交易信号,同时确保每笔交易都有预定义的风险控制参数。

虽然存在震荡市场假信号和参数敏感性等风险,但通过前文提出的优化方向,如整合额外确认指标、自适应参数调整和优化仓位管理等措施,可以显著提升策略的稳健性和适应性。最终,该策略提供了一个平衡简洁性与有效性的交易框架,适合作为系统化交易的基础模型,并可根据个人需求和市场特性进行进一步定制和优化。

策略源码

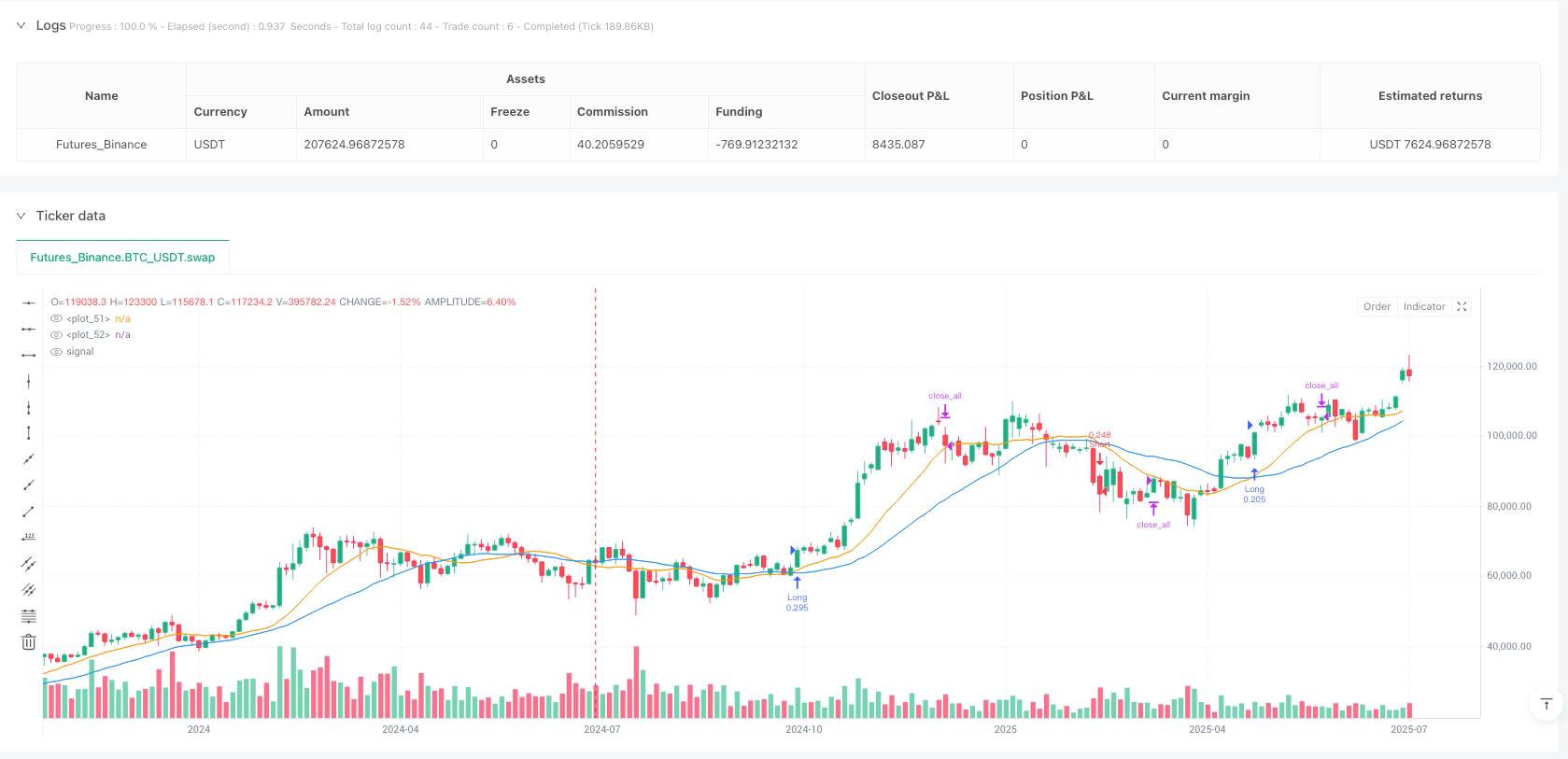

/*backtest

start: 2024-07-17 00:00:00

end: 2025-07-15 08:00:00

period: 3d

basePeriod: 3d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":200000}]

*/

//@version=5

strategy("MYM Strategy for TradersPost", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// === Inputs ===

atrLength = input.int(14, "ATR Length")

slMultiplier = input.float(1.5, "Stop Loss Multiplier")

tpMultiplier = input.float(3.0, "Take Profit Multiplier")

tsMultiplier = input.float(1.0, "Trailing Stop Multiplier")

// === ATR Calculation ===

atr = ta.atr(atrLength)

stopPts = atr * slMultiplier

takePts = atr * tpMultiplier

trailPts = atr * tsMultiplier

// === Example Entry Logic (crossover example) ===

shortSMA = ta.sma(close, 14)

longSMA = ta.sma(close, 28)

longCondition = ta.crossover(shortSMA, longSMA)

shortCondition = ta.crossunder(shortSMA, longSMA)

// === Example Exit Condition (optional close signal) ===

exitCondition = ta.cross(close, ta.sma(close, 10))

// === Entry & Alerts ===

if (longCondition)

// Build JSON message

stopVal = str.tostring(close - stopPts)

tpVal = str.tostring(close + takePts)

trailVal = str.tostring(trailPts)

longMessage = '{"action":"buy","symbol":"MYM","quantity":1,"order_type":"market","stop_loss":' + stopVal + ',"take_profit":' + tpVal + ',"trailing_stop":' + trailVal + ',"comment":"MYM Long Entry"}'

alert(longMessage, alert.freq_once_per_bar_close)

strategy.entry("Long", strategy.long)

if (shortCondition)

stopVal = str.tostring(close + stopPts)

tpVal = str.tostring(close - takePts)

trailVal = str.tostring(trailPts)

shortMessage = '{"action":"sell","symbol":"MYM","quantity":1,"order_type":"market","stop_loss":' + stopVal + ',"take_profit":' + tpVal + ',"trailing_stop":' + trailVal + ',"comment":"MYM Short Entry"}'

alert(shortMessage, alert.freq_once_per_bar_close)

strategy.entry("Short", strategy.short)

// === Optional Close Alert ===

if (exitCondition)

closeMessage = '{"action":"close_position","ticker":"MYM","comment":"MYM Close Position"}'

alert(closeMessage, alert.freq_once_per_bar_close)

strategy.close_all(comment="Exit Signal")

// === Visual aids ===

plot(shortSMA, color=color.orange)

plot(longSMA, color=color.blue)

相关推荐