概述

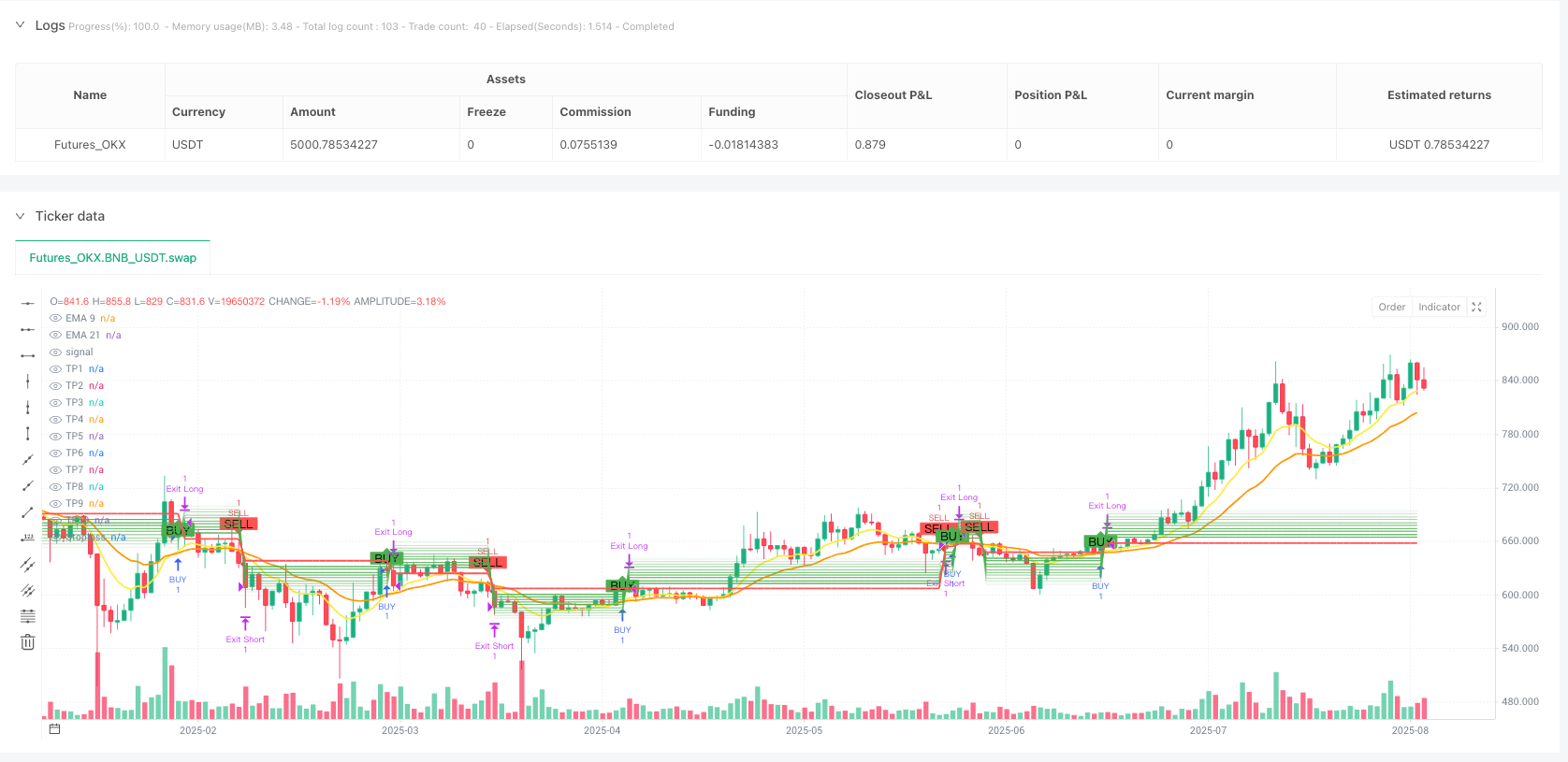

双指数移动平均线多目标交易策略是一种基于短期与长期指数移动平均线(EMA)交叉信号的量化交易系统。该策略利用9周期与21周期EMA的交叉作为入场信号,同时设置了多达10个利润目标和一个止损点,以实现风险管理和利润最大化。该策略同时支持多空双向交易,当短期EMA上穿长期EMA时开多,当短期EMA下穿长期EMA时开空,并在反向交叉时退出。

策略原理

该策略的核心原理基于指数移动平均线交叉系统,具体实现如下: 1. 计算两条EMA:快速EMA(9周期)和慢速EMA(21周期) 2. 当快速EMA上穿慢速EMA时,产生做多信号 3. 当快速EMA下穿慢速EMA时,产生做空信号 4. 入场后,策略会根据入场价格自动计算10个阶梯式目标价位(TP1-TP10)和止损价位 5. 策略对多头和空头头寸采用相同的百分比设置,但方向相反 6. 对于多头,止损设置在入场价格下方0.5%,利润目标从入场价格上方0.5%到5.0%不等 7. 对于空头,止损设置在入场价格上方0.5%,利润目标从入场价格下方0.5%到5.0%不等 8. 策略在出现反向交叉信号时也会平仓退出

策略采用了系统化的风险管理方法,每次交易默认使用10%的账户资金,初始资金设为100,000,并禁止了加仓操作。

策略优势

- 简单有效的入场信号:EMA交叉是一种被广泛使用和验证的交易信号,易于理解和实施。9/21周期的参数设置能够较好地捕捉中短期趋势。

- 多目标利润管理:设置10个阶梯式利润目标,允许交易者在不同价格水平分批获利,既能锁定部分利润,又能让利润尽可能延伸。

- 严格的风险控制:每个交易都设置明确的止损点,限制了单笔交易的最大损失比例,有效控制风险。

- 视觉化辅助:策略在图表上清晰标示出所有的入场信号、止损位和目标位,帮助交易者直观理解市场情况。

- 双向交易能力:策略同时支持多空交易,能够在各种市场环境中寻找机会。

- 参数可调整性:所有关键参数(包括EMA周期、止损比例、利润目标)都可以通过输入进行自定义,提高了策略的灵活性。

- 全自动化:策略执行完全自动化,从信号识别到入场、设置止损和获利目标,再到退出,无需人工干预。

策略风险

- 假突破风险:EMA交叉系统在震荡市场中容易产生假信号,可能导致频繁交易和亏损。策略没有设置过滤器来区分强弱信号。

- 止损偏紧:当前策略默认止损设置为0.5%,在波动较大的市场或品种中可能过于紧密,容易被市场噪音触发。

- 单一指标依赖:策略仅依靠EMA交叉作为入场信号,没有结合其他技术指标或市场条件进行确认,增加了误判风险。

- 资金管理固定:每次交易固定使用10%的账户资金,没有根据市场波动性或信号强度动态调整,可能不够优化。

- 缺乏市场环境识别:策略未区分趋势市和震荡市,在不适合EMA交叉系统的市场环境中依然会生成信号。

- 出场策略单一:虽然设置了多个获利目标,但实际上策略只会在第一个目标位(TP1)平仓,或在反向交叉时退出,没有实现真正的分批获利。

为减轻这些风险,建议引入额外的过滤条件,如趋势强度指标,并考虑根据市场波动性动态调整止损和目标位设置。

策略优化方向

- 增加过滤器:引入额外的技术指标作为过滤器,如ADX(平均趋向指数)来确认趋势强度,或相对强弱指标(RSI)来避免在超买超卖区域交易。

- 动态止损:将固定百分比止损改为基于市场波动性的动态止损,如使用ATR(真实波动幅度均值)乘以一个系数来设置止损距离。

- 实现真正的多目标获利:修改策略代码,实现在不同目标位部分平仓,而不是仅在第一个目标位全部平仓。这需要将每笔交易分解为多个较小的仓位。

- 增加趋势识别机制:添加趋势识别逻辑,只在趋势方向明确时开仓,避免在震荡市场中频繁交易。

- 优化资金管理:根据信号强度、市场波动性或回撤情况动态调整每次交易的资金比例,而不是固定使用10%。

- 添加时间过滤器:避免在市场开盘和收盘前后的高波动时段交易,或避开重要经济数据发布时段。

- 引入移动止损:当价格向有利方向移动一定距离后,将止损点移至盈亏平衡点或更有利位置,保护已有利润。

- 增加反趋势保护:在极端市场条件下,添加逆势指标作为警告信号,以避免在市场剧烈反转时继续持有头寸。

通过这些优化,可以显著提高策略的稳健性和盈利能力,减少回撤和亏损交易的频率。

总结

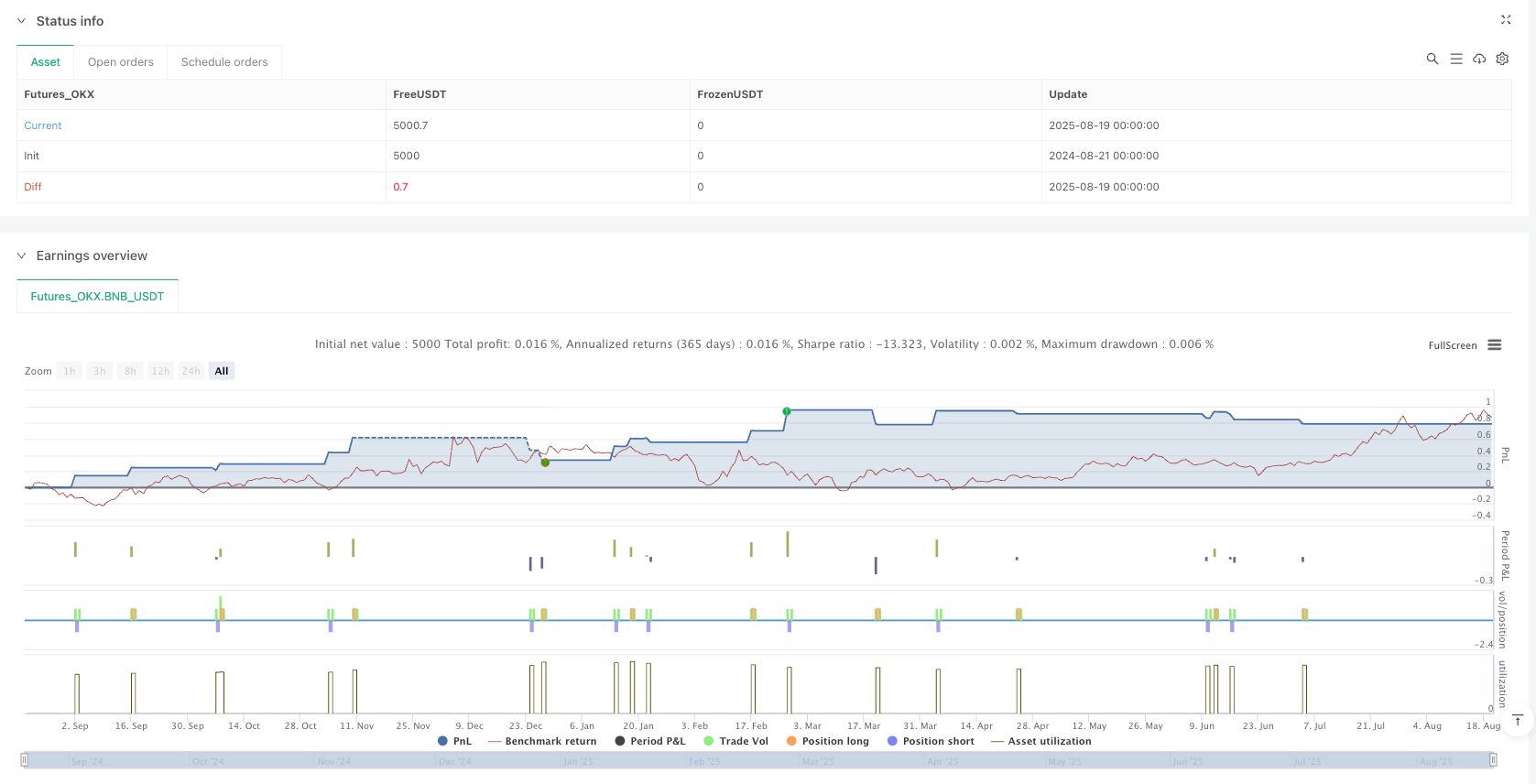

双指数移动平均线多目标交易策略是一个结构清晰、逻辑简单的量化交易系统,它基于经典的EMA交叉信号,并辅以多目标利润管理和止损设置。该策略适合中短期趋势交易,在明确趋势市场中表现较好。

虽然策略设计相对简单,但包含了交易策略的核心要素:入场信号、出场条件、止损管理和利润目标。策略的主要优势在于操作明确、易于理解和执行,同时提供了良好的视觉化支持。

然而,策略也存在依赖单一指标、缺乏市场环境识别和资金管理不够灵活等局限性。通过添加趋势过滤器、优化止损机制、实现真正的分批获利和改进资金管理方法,该策略有较大的优化空间。

对于交易者而言,该策略可以作为一个基础框架,根据个人风险偏好和交易品种特性进行个性化调整和优化,以达到更好的交易效果。

/*backtest

start: 2024-08-21 00:00:00

end: 2025-08-20 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_OKX","currency":"BNB_USDT","balance":5000}]

*/

//@version=5

strategy("9/21 EMA with 10 Targets + Stoploss",

overlay = true,

initial_capital = 100000,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 10,

pyramiding = 0)

// === Inputs ===

emaFastLen = input.int(9, "Fast EMA Length")

emaSlowLen = input.int(21, "Slow EMA Length")

slPercent = input.float(0.5, "Stoploss %", step=0.1)

// 10 Targets

tp1Percent = input.float(0.5, "Target 1 %", step=0.1)

tp2Percent = input.float(1.0, "Target 2 %", step=0.1)

tp3Percent = input.float(1.5, "Target 3 %", step=0.1)

tp4Percent = input.float(2.0, "Target 4 %", step=0.1)

tp5Percent = input.float(2.5, "Target 5 %", step=0.1)

tp6Percent = input.float(3.0, "Target 6 %", step=0.1)

tp7Percent = input.float(3.5, "Target 7 %", step=0.1)

tp8Percent = input.float(4.0, "Target 8 %", step=0.1)

tp9Percent = input.float(4.5, "Target 9 %", step=0.1)

tp10Percent = input.float(5.0, "Target 10 %", step=0.1)

// === EMA Calculation ===

emaFast = ta.ema(close, emaFastLen)

emaSlow = ta.ema(close, emaSlowLen)

// === Entry Conditions ===

longCond = ta.crossover(emaFast, emaSlow)

shortCond = ta.crossunder(emaFast, emaSlow)

// === Entry ===

if (longCond and strategy.position_size <= 0)

strategy.entry("BUY", strategy.long)

if (shortCond and strategy.position_size >= 0)

strategy.entry("SELL", strategy.short)

// === Series Variables for Targets ===

var float tp1 = na

var float tp2 = na

var float tp3 = na

var float tp4 = na

var float tp5 = na

var float tp6 = na

var float tp7 = na

var float tp8 = na

var float tp9 = na

var float tp10 = na

var float stopLevel = na

// === Long Positions ===

if strategy.position_size > 0

stopLevel := strategy.position_avg_price * (1 - slPercent/100)

tp1 := strategy.position_avg_price * (1 + tp1Percent/100)

tp2 := strategy.position_avg_price * (1 + tp2Percent/100)

tp3 := strategy.position_avg_price * (1 + tp3Percent/100)

tp4 := strategy.position_avg_price * (1 + tp4Percent/100)

tp5 := strategy.position_avg_price * (1 + tp5Percent/100)

tp6 := strategy.position_avg_price * (1 + tp6Percent/100)

tp7 := strategy.position_avg_price * (1 + tp7Percent/100)

tp8 := strategy.position_avg_price * (1 + tp8Percent/100)

tp9 := strategy.position_avg_price * (1 + tp9Percent/100)

tp10 := strategy.position_avg_price * (1 + tp10Percent/100)

strategy.exit("Exit Long", "BUY", stop=stopLevel, limit=tp1)

// === Short Positions ===

if strategy.position_size < 0

stopLevel := strategy.position_avg_price * (1 + slPercent/100)

tp1 := strategy.position_avg_price * (1 - tp1Percent/100)

tp2 := strategy.position_avg_price * (1 - tp2Percent/100)

tp3 := strategy.position_avg_price * (1 - tp3Percent/100)

tp4 := strategy.position_avg_price * (1 - tp4Percent/100)

tp5 := strategy.position_avg_price * (1 - tp5Percent/100)

tp6 := strategy.position_avg_price * (1 - tp6Percent/100)

tp7 := strategy.position_avg_price * (1 - tp7Percent/100)

tp8 := strategy.position_avg_price * (1 - tp8Percent/100)

tp9 := strategy.position_avg_price * (1 - tp9Percent/100)

tp10 := strategy.position_avg_price * (1 - tp10Percent/100)

strategy.exit("Exit Short", "SELL", stop=stopLevel, limit=tp1)

// === Plotting ===

plot(emaFast, "EMA 9", color=color.yellow, linewidth=2)

plot(emaSlow, "EMA 21", color=color.orange, linewidth=2)

// Global plots (avoid local scope error)

plot(tp1, "TP1", color=color.new(color.green, 0))

plot(tp2, "TP2", color=color.new(color.green, 10))

plot(tp3, "TP3", color=color.new(color.green, 20))

plot(tp4, "TP4", color=color.new(color.green, 30))

plot(tp5, "TP5", color=color.new(color.green, 40))

plot(tp6, "TP6", color=color.new(color.green, 50))

plot(tp7, "TP7", color=color.new(color.green, 60))

plot(tp8, "TP8", color=color.new(color.green, 70))

plot(tp9, "TP9", color=color.new(color.green, 80))

plot(tp10, "TP10", color=color.new(color.green, 90))

plot(stopLevel, "Stoploss", color=color.red, linewidth=2)

// Entry Signals

plotshape(longCond, title="BUY Signal", style=shape.labelup, color=color.green, text="BUY")

plotshape(shortCond, title="SELL Signal", style=shape.labeldown, color=color.red, text="SELL")