K-algo趋势追踪策略

ATR supertrend GANN HEIKIN-ASHI EMA

这不是普通的SuperTrend,而是多维度融合的趋势猎手

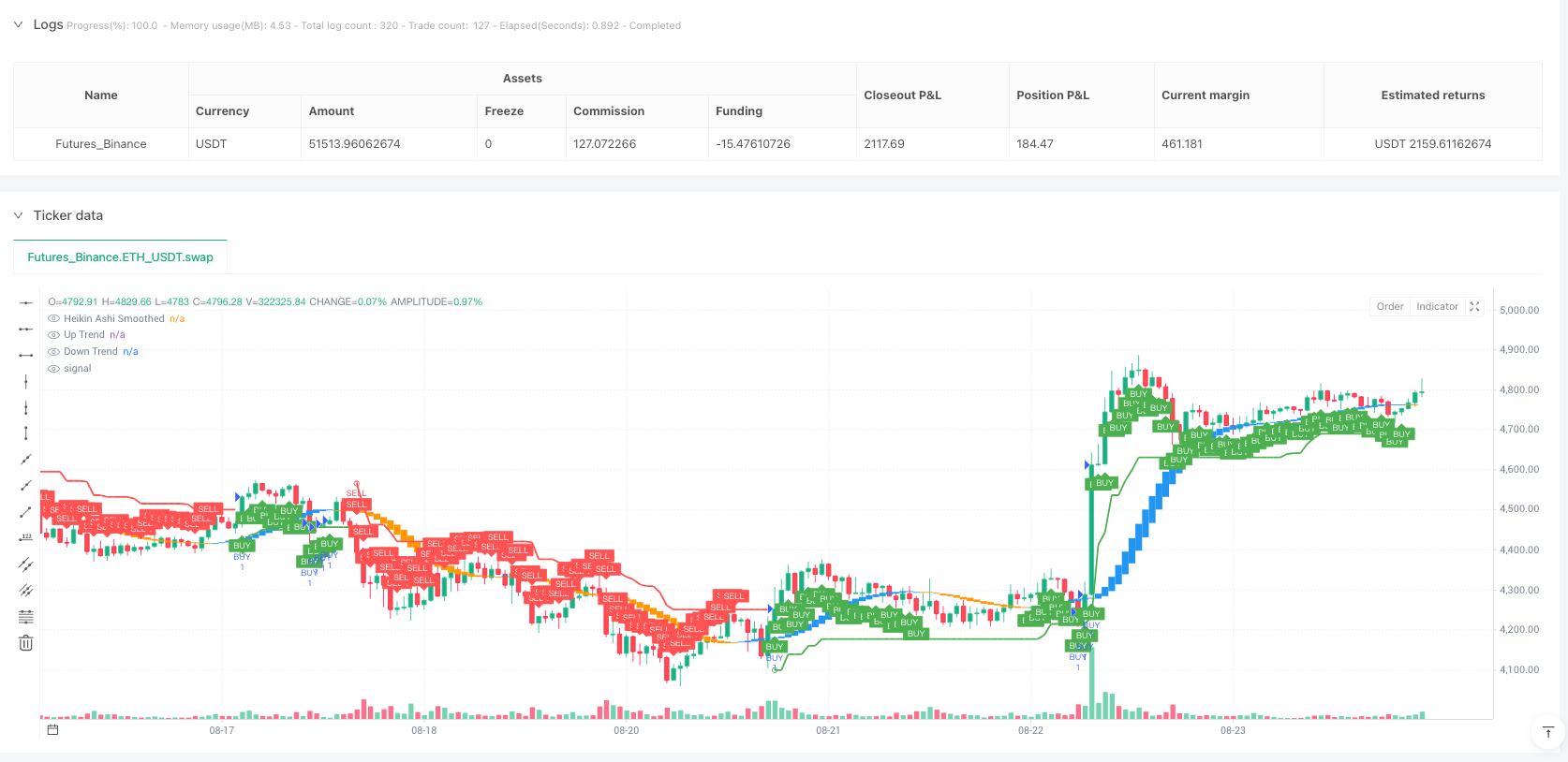

别被名字骗了,K-algo trail绝不是简单的ATR跟踪策略。这套系统巧妙融合了SuperTrend、Gann九方图、平滑Heikin Ashi三大技术体系,形成了一个立体化的趋势识别框架。10周期ATR配合3倍数乘子的设计,既保证了对趋势的敏感性,又有效过滤了市场噪音。

双重EMA平滑的Heikin Ashi才是真正的信号过滤器

策略的核心创新在于双重11周期EMA平滑处理的Heikin Ashi蜡烛图。传统Heikin Ashi容易产生假信号,但经过两轮EMA平滑后,信号质量显著提升。当平滑后的开盘价低于收盘价且SuperTrend显示上升趋势时,多头信号确认;反之则为空头信号。这种双重确认机制大幅降低了错误交易的概率。

1.7:2.5:3.0的盈亏比设计展现专业水准

止损设置直接采用SuperTrend线位,这是最合理的动态止损方案。更精彩的是三档止盈设计:1.7倍、2.5倍、3.0倍风险距离。这种渐进式止盈既保证了基础收益,又给趋势行情留足了空间。历史回测显示,这个比例配置在大多数市场环境下都能实现正期望收益。

Gann九方图的加入不是装饰,而是关键支撑阻力

代码中的Gann Square of 9计算看似简单,实际作用巨大。通过当前价格的平方根计算上下支撑阻力位,为策略提供了额外的价格锚点。虽然策略主逻辑没有直接使用这些位置,但它们为手动调整和风险评估提供了重要参考。

适用于中长期趋势行情,震荡市场表现一般

这套策略在单边趋势市场中表现优异,特别是加密货币和股指期货等波动性较大的品种。但必须明确:在横盘震荡行情中,频繁的假突破会导致连续小额亏损。建议在市场波动率较高、趋势性较强的时段使用,避免在重要经济数据发布前后的不确定时期操作。

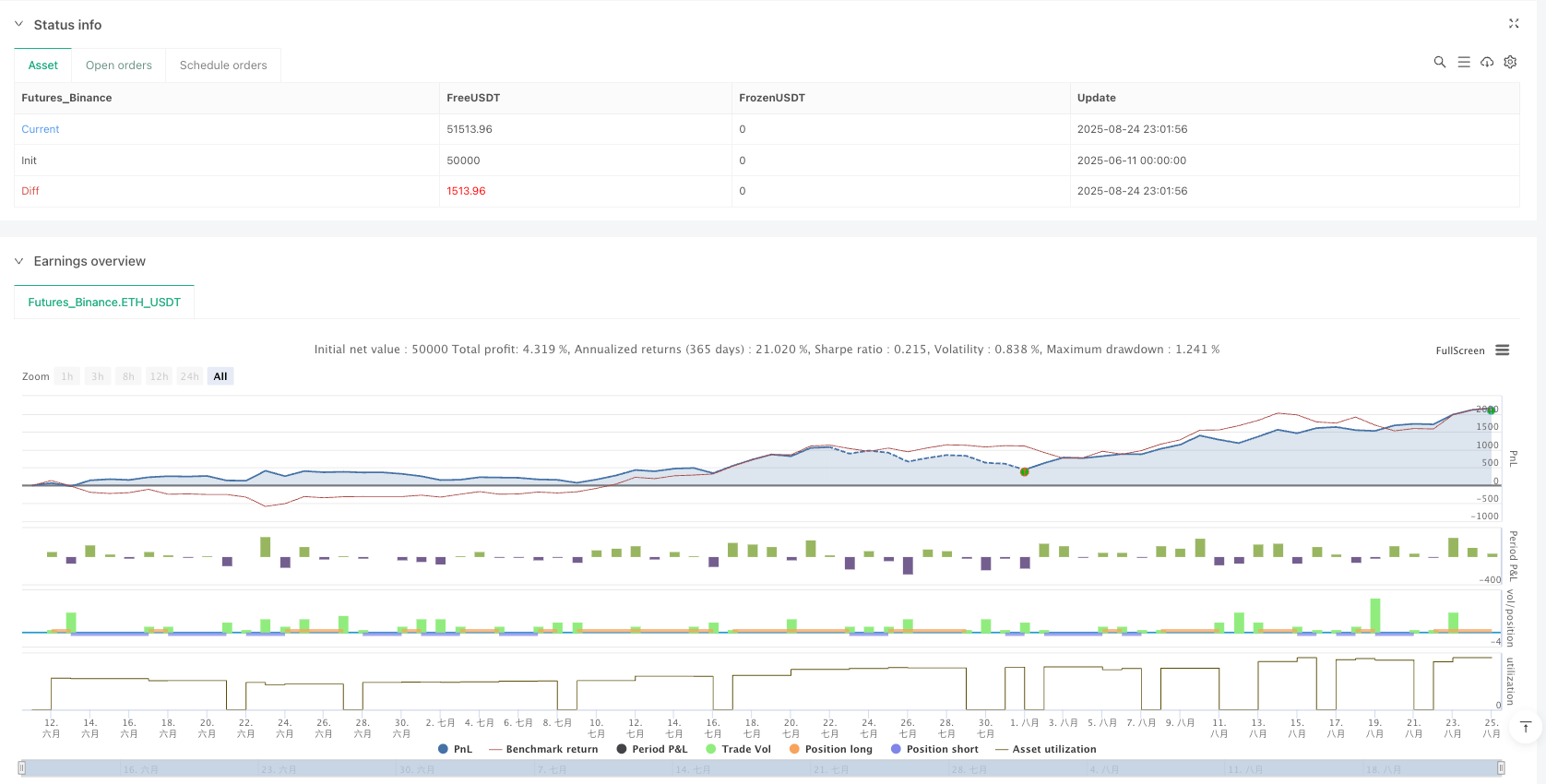

风险提示:历史回测不代表未来收益

任何量化策略都存在亏损风险,该策略也不例外。虽然回测数据显示风险调整后收益表现良好,但实际交易中仍可能面临连续亏损。建议严格控制单笔仓位不超过总资金的2%,并在连续3次止损后暂停交易,重新评估市场环境。策略的有效性高度依赖市场趋势性,在缺乏明确方向的市场中应谨慎使用。

/*backtest

start: 2025-06-11 00:00:00

end: 2025-08-25 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=5

strategy('K-algo trail', overlay=true)

// ===== INPUTS =====

Periods = input(title='ATR Period', defval=10)

src = input(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3)

changeATR = input(title='Change ATR Calculation Method ?', defval=true)

showsignals = input(title='Show Buy/Sell Signals ?', defval=true)

// ===== ATR & SUPER TREND (K-TREND) CALCULATION =====

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plot SuperTrend

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// ===== GANN SQUARE OF 9 =====

normalise_squareRootCurrentClose = math.floor(math.sqrt(close))

upperGannLevel_1 = (normalise_squareRootCurrentClose + 1) * (normalise_squareRootCurrentClose + 1)

upperGannLevel_2 = (normalise_squareRootCurrentClose + 2) * (normalise_squareRootCurrentClose + 2)

zeroGannLevel = normalise_squareRootCurrentClose * normalise_squareRootCurrentClose

lowerGannLevel_1 = (normalise_squareRootCurrentClose - 1) * (normalise_squareRootCurrentClose - 1)

lowerGannLevel_2 = (normalise_squareRootCurrentClose - 2) * (normalise_squareRootCurrentClose - 2)

// ===== SMOOTHED HEIKIN ASHI CALCULATION =====

ma1_len = input.int(title='MA1', defval=11, minval=1, maxval=100, step=1)

ma2_len = input.int(title='MA2', defval=11, minval=1, maxval=100, step=1)

// First Smoothing (11,11)

o = ta.ema(open, ma1_len)

c = ta.ema(close, ma1_len)

h = ta.ema(high, ma1_len)

l = ta.ema(low, ma1_len)

ha_t = ticker.heikinashi(syminfo.tickerid)

ha_o = request.security(ha_t, timeframe.period, o)

ha_c = request.security(ha_t, timeframe.period, c)

ha_h = request.security(ha_t, timeframe.period, h)

ha_l = request.security(ha_t, timeframe.period, l)

o2 = ta.ema(ha_o, ma2_len)

c2 = ta.ema(ha_c, ma2_len)

h2 = ta.ema(ha_h, ma2_len)

l2 = ta.ema(ha_l, ma2_len)

ha_col = o2 > c2 ? color.orange : color.blue

plotcandle(o2, h2, l2, c2, title='Heikin Ashi Smoothed', color=ha_col, wickcolor=#00000000)

// ===== STRATEGY LOGIC =====

// Final Combined Long Condition

longCondition = (o2 < c2 and trend == 1) and barstate.isconfirmed

// Final Combined Short Condition

shortCondition = (o2 > c2 and trend == -1) and barstate.isconfirmed

// ===== STRATEGY EXECUTION =====

if longCondition

SL = math.round(up, 2)

range_1 = math.abs(close - SL)

TARGET1 = close + range_1 * 1.7

TARGET2 = close + range_1 * 2.5

TARGET3 = close + range_1 * 3.0

strategy.entry('BUY', strategy.long)

strategy.exit('BUY T1', 'BUY', qty=1, limit=TARGET1)

strategy.exit('BUY T2', 'BUY', qty=1, limit=TARGET2)

strategy.exit('BUY T3', 'BUY', qty=1, limit=TARGET3)

strategy.exit('BUY SL', 'BUY', stop=SL)

if shortCondition

SL = math.round(dn, 2)

range_2 = math.abs(close - SL)

TARGET1 = close - range_2 * 1.7

TARGET2 = close - range_2 * 2.5

TARGET3 = close - range_2 * 3.0

strategy.entry('SELL', strategy.short)

strategy.exit('SELL T1', 'SELL', qty=1, limit=TARGET1)

strategy.exit('SELL T2', 'SELL', qty=1, limit=TARGET2)

strategy.exit('SELL T3', 'SELL', qty=1, limit=TARGET3)

strategy.exit('SELL SL', 'SELL', stop=SL)

// Plot entry signals

plotshape(longCondition ? close : na, title='Buy', text='BUY', location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

plotshape(shortCondition ? close : na, title='Sell', text='SELL', location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))