JavaScript版本SuperTrend策略

创建于: 2020-04-17 16:36:24,

更新于:

2023-10-09 22:46:56

16

16

4057

4057

JavaScript版本SuperTrend策略

TV上的SuperTrend指标有多种版本,找了一个比较容易看懂的算法移植的,对比在发明者量化交易平台回测系统TV图表上加载的SuperTrend指标,发现略有差异,暂时没弄明白原因,期盼各位读者大神指导,我先抛砖引玉。

SuperTrend 指标JavaScript版本算法

// VIA: https://github.com/freqtrade/freqtrade-strategies/issues/30

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

// 测试指标用的main函数,并非交易策略

function main() {

while (1) {

var r = _C(exchange.GetRecords)

var st = SuperTrend(r, 10, 3)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

Sleep(2000)

}

}

测试代码回测对比:

一个使用SuperTrend指标的简单策略

交易逻辑部分,比较简单,就是当空头趋势转为多头趋势时,开多仓。 多头趋势转为空头趋势时开空仓。

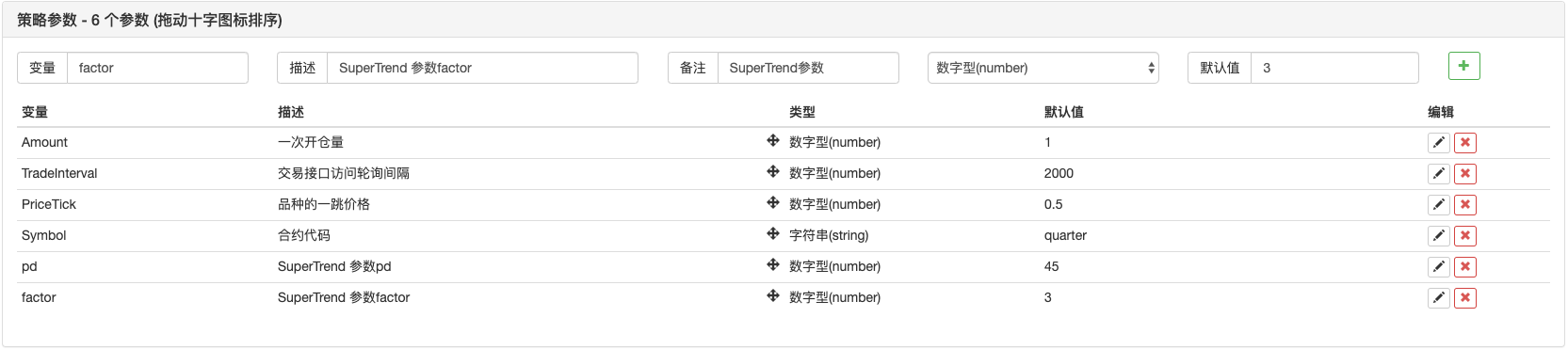

策略参数:

SuperTrend交易策略

/*backtest

start: 2019-08-01 00:00:00

end: 2020-03-11 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

// 全局变量

var OpenAmount = 0 // 开仓后持仓的数量

var KeepAmount = 0 // 保留仓位

var IDLE = 0

var LONG = 1

var SHORT = 2

var COVERLONG = 3

var COVERSHORT = 4

var COVERLONG_PART = 5

var COVERSHORT_PART = 6

var OPENLONG = 7

var OPENSHORT = 8

var State = IDLE

// 交易逻辑部分

function GetPosition(posType) {

var positions = _C(exchange.GetPosition)

/*

if(positions.length > 1){

throw "positions error:" + JSON.stringify(positions)

}

*/

var count = 0

for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw "positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0]

}

function CancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

function Trade(Type, Price, Amount, CurrPos, OnePriceTick){ // 处理交易

if(Type == OPENLONG || Type == OPENSHORT){ // 处理开仓

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sell

var idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} else if(Type == COVERLONG || Type == COVERSHORT){ // 处理平仓

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buy

var idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw "Type error:" + Type

}

}

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

var preTime = 0

function main() {

exchange.SetContractType(Symbol)

while (1) {

var r = _C(exchange.GetRecords)

var currBar = r[r.length - 1]

if (r.length < pd) {

Sleep(5000)

continue

}

var st = SuperTrend(r, pd, factor)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

if(!isNaN(st[0][st[0].length - 2]) && isNaN(st[0][st[0].length - 3])){

if (State == SHORT) {

State = COVERSHORT

} else if(State == IDLE) {

State = OPENLONG

}

}

if(!isNaN(st[1][st[1].length - 2]) && isNaN(st[1][st[1].length - 3])){

if (State == LONG) {

State = COVERLONG

} else if (State == IDLE) {

State = OPENSHORT

}

}

// 执行信号

var pos = null

var price = null

if(State == OPENLONG){ // 开多仓

pos = GetPosition(PD_LONG) // 检查持仓

// 判断是不是 满足状态,如果满足 修改状态

if(pos[1] >= Amount){ // 持仓超过或者等于参数设置的 开仓量

Sleep(1000)

$.PlotFlag(currBar.Time, "开多仓", 'OL') // 标记

OpenAmount = pos[1] // 记录开仓数

State = LONG // 标记为 做多状态

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2 // 计算价格

Trade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // 下单函数 (Type, Price, Amount, CurrPos, PriceTick)

}

if(State == OPENSHORT){ // 开空仓

pos = GetPosition(PD_SHORT) // 检查持仓

if(pos[1] >= Amount){

Sleep(1000)

$.PlotFlag(currBar.Time, "开空仓", 'OS')

OpenAmount = pos[1]

State = SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(State == COVERLONG){ // 处理平多仓

pos = GetPosition(PD_LONG) // 获取持仓信息

if(pos[1] == 0){ // 判断持仓是否为 0

$.PlotFlag(currBar.Time, "平多仓", '----CL') // 标记

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(State == COVERSHORT){ // 处理做多仓

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

$.PlotFlag(currBar.Time, "平空仓", '----CS')

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

if(State == COVERLONG_PART) { // 部分平多仓

pos = GetPosition(PD_LONG) // 获取持仓

if(pos[1] <= KeepAmount){ // 持仓小于等于 保持量,本次平仓完成

$.PlotFlag(currBar.Time, "平多仓,保留:" + KeepAmount, '----CL') // 标记

State = pos[1] == 0 ? IDLE : LONG // 更新状态

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1] - KeepAmount, pos, PriceTick)

}

if(State == COVERSHORT_PART){

pos = GetPosition(PD_SHORT)

if(pos[1] <= KeepAmount){

$.PlotFlag(currBar.Time, "平空仓,保留:" + KeepAmount, '----CS')

State = pos[1] == 0 ? IDLE : SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1] - KeepAmount, pos, PriceTick)

}

LogStatus(_D())

Sleep(1000)

}

}

策略地址:https://www.fmz.com/strategy/201837

回测绩效

参数设置,K线周期,参考: homily 大神的SuperTrend V.1–超级趋势线系统 K线周期设置15分钟,SuperTrend参数设置45,3。回测OKEX期货quarter合约最近一年的时间,设置每次交易一张合约,由于设置每次只交易一张合约,所以资金利用率很低,不用在意夏普值。

策略仅供学习,实盘慎用。

相关推荐

- Research on Binance Futures Multi-currency Hedging Strategy Part 4

- Larry Connors拉里·康纳斯 RSI2均值回归策略

- Research on Binance Futures Multi-currency Hedging Strategy Part 3

- Research on Binance Futures Multi-currency Hedging Strategy Part 2

- Research on Binance Futures Multi-currency Hedging Strategy Part 1

- 手把手教你给行情收集器升级回测自定义数据源功能

- Crocodile line trading system Python version

- 使用发明者量化交易平台扩展API实现TradingView报警信号交易(推荐)

- JavaScript version SuperTrend strategy

- SuperTrend V.1--超级趋势线系统

- [千团大战]币安期货多币种对冲策略最近的复盘和分钟级K线回测的结果(第4篇)

- 手把手教你实现一个行情收集器

- [千团大战]币安期货做空超涨做多超跌策略风险分析(第3篇)

- [千团大战]币安期货做空超涨做多超跌策略重要优化(第2篇)

- [千团大战]币安期货多币种对冲策略研究(第1篇)

- 98年本科生的炒币和量化之路

- Python版冰山委托策略

- 基于数字货币的动态平衡策略

- 使用交易终端插件方便手工交易

- Python版MACD画图范例

全部留言

lijingxfdj

梦总,这个策略的原问题解决了吗?

我看现在TV有了TA.superstend策略,但写javascript更自由点,期待在能够Javascipt的TA中也封装一个正确的superstrend版本

2024-06-09 22:16:31

发明者量化-小小梦

暂时还没有办法直接调用PINE脚本的函数,可能后期会增加兼容支持。

2024-06-10 09:50:23

[email protected]

算法return(up,down)是什么意思,返回的内容是什么样子的,超级趋势不也是一个数字么,,想用一下这个函数,不会啊。。求教f

2022-01-08 13:15:13

发明者量化-小小梦

$.PlotLine 是画线类库的接口函数,具体可以到策略广场复制画线类库这个模版,代码公开的。看下源码即可明白。

2022-01-09 17:40:25

[email protected]

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

请问下,L后边的代码代表什么意思,如果是低线的话,后边的r需要跟它配合使用么,用来表征L出现的时间?

2022-01-09 13:30:17

[email protected]

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

请问下,L后边的代码代表什么意思,如果是低线的话,后边的r需要跟它配合使用么

2022-01-09 13:29:03

发明者量化-小小梦

什么sp?

2022-01-09 11:20:09

发明者量化-小小梦

up[up.length - 1],指标的倒数第一个数据,对应K线倒数第一个BAR。

2022-01-09 11:17:44

发明者量化-小小梦

返回的是一个二维数组,up就是上面的那条线,down就是下线。返回的是整个指标数据。

2022-01-08 16:00:21

skyfffire

梦总牛逼

2020-05-07 22:58:48

violain

与TV上有差异应该是fmz封装的ATR计算的问题,比如传入的周期是7,计算出来ATR前6个值应该是null,但实际上并不是

2020-05-04 23:59:37

发明者量化-小小梦

嗯,再详细研究下tradingview上的算法。

2020-05-06 14:50:28

violain

是的,大佬确认一下问题所在,有点纠结了,不知道用哪个了

2020-05-06 14:41:51

发明者量化-小小梦

好的,感谢感谢,但是我使用的是talib库的ATR,算出的好像也不对,按照算法直接实现ATR得出的数据也是有点差异。

2020-05-06 09:28:51