Recent Status and Recommended Operation of Funding Rate Strategy

0

0

789

789

Recent Status and Recommended Operation of Funding Rate Strategy

FMZ released a capital rate strategy in the last war of the Binance Championship: https://www.fmz.com/bbs-topic/9744 . This strategy is used by many users. In this bull market, the annualized rate was more than 100%, and there are several opportunities for large negative premium closing positions. As a prudent arbitrage strategy, the overall return is OK. However, with the increase of arbitrageurs and funds, the market has become more effective and the strategy has also changed:

- 1. First of all, the positive premium has become lower generally, the opening premium of 5‰ is common at the beginning, and 1‰ is common currently, the opportunity to open a position has become less.

- 2. The negative premium decreased. With the rapid decline of the market, the negative premium would be exaggerated, even a - 20% premium appeared. At this time, the profit from closing positions was very considerable. However, the current decline is often slow and the negative premium is small.

- 3. The slippage increases. At the beginning of the strategy release, the strategy can open a position at the premium of 3‰, and close a position the premium of -3 ‰. As long as the comission can be covered, a small profit can be obtained from each transaction, increasing the arbitrage profits. At present, even if we see the premium, the opportunity often disappears quickly, and we are likely to obtain loss when we get it. The way to yield the premium is basically not feasible.

- 4. The annualized rates are lower, there is no annualized rates more than 100% for a long time, and it will be lower and lower, even if the market continues to be the bull market in a long time, it should be difficult to view a very high annualized rate. Of course, the above changes are in expectation; after all, funding rate arbitrage is a public method that cannot sustain excess returns over a long time.

FTX Exchange also has perpetual contracts, which are charged once an hour. By crawling the historical data and converting it into 8h calculation, only a few currencies have higher rates. Compared with the recent rate of Binance perpetual contracts, the difference is not very much.

symbol rate symbol rate AMPL 0.001250 UNISWAP 0.001229 SRN 0.001069 DAWN 0.000573 MTA 0.000510 MCB 0.000497 FLOW 0.000386 PUNDIX 0.000330 TONCOIN 0.000327 CELO 0.000327

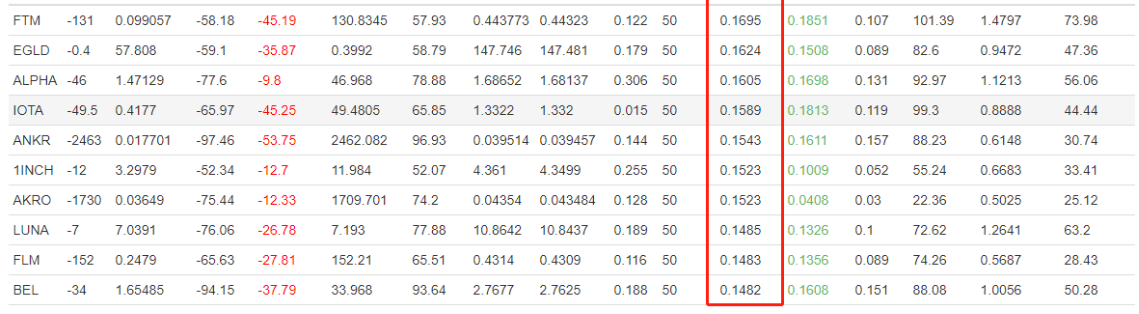

Recent rate of Binance (December 2):

However, FTX also has corresponding advantages. Spots can seamlessly borrow currencies to sell and going short directly, and repay automatically after buying, so it is convenient to carry out negative rate arbitrage.

If you continue to choose to do perpetual contract funding rate arbitrage, the following suggestions are available.

- 1. From decentralized positions to a few high rate positions, the original decentralized positions reduce the risk, but they also disperse the returns. Currently, the high rate positions are not common, so centralized positions are required.

- 2. Almost all multiple exchanges and mainstream exchanges have perpetual contracts, which will further increase trading opportunities.

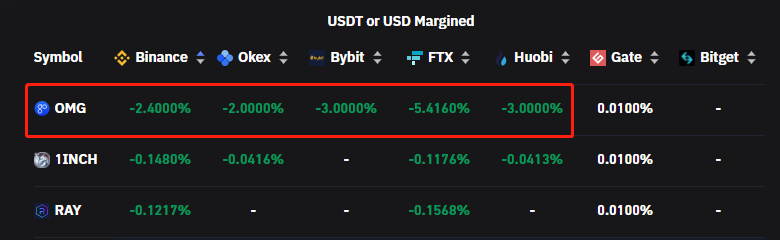

- 3. Seizing the opportunity of extreme rates, such as the recent OMG Airdrop, which leds to the emergence of an extreme rate of - 5.4%. Of course, there are often special reasons for this kind of situation, which requires careful operation.

Recently, a strategic gadget was published to calculate the funding rate of six mainstream exchanges, which can be further improved to assist billing.

Strategy public address: https://www.fmz.com/strategy/333315 Real bot address: https://www.fmz.com/robot/406857

- Digital currency futures multi-species ATR strategy (tutorial)

- Write a semi-automatic trading tool by using the Pine language

- Explore High-frequency Strategy Design from the Magic Change of LeeksReaper

- LeeksReaper Strategy Analysis (2)

- The "Magic Double EMA Strategy" from the YouTube Veterans

- JavaScript language implementation of Fisher indicators and drawing on FMZ

- Example of dYdX strategy design

- Design of Order Synchronization Management System Based on FMZ Quant (1)

- LeeksReaper Strategy Analysis(1)

- Deribit Options Delta Dynamic Hedging Strategy

- Review of Digital Currency Market in 2021 and the Simplest 10 times Strategy Missed

- Digital Currency Factor Model

- 来自YouTube大神的「神奇的双EMA均线策略」

- 使用Pine语言编写一个半自动的交易工具

- 数字货币因子模型

- 交易中做自己的救世主

- Hedging strategy of cryptocurrency manual futures and spots

- Cryptocurrency spot hedging strategy design(1)

- A perpetual balance strategy suitable for bear market bottoming

- Cryptocurrency Quantitative Trading for Beginners - Taking You Closer to Cryptocurrency Quantitative (8)