RSI/MFI Momentum-Indikator-Strategie basierend auf der Dow-Theorie

Erstellungsdatum:

2023-12-12 17:54:58

zuletzt geändert:

2023-12-12 17:54:58

Kopie:

0

Klicks:

795

1

konzentrieren Sie sich auf

1629

Anhänger

Überblick

Diese Strategie verwendet die relativ starken und schwachen Indikatoren (RSI) oder die Geldflussindikatoren (MFI) für die Entscheidung, ob ein Markt bull oder bear ist, und kombiniert den Bull-Bear-Koeffizienten der Dow-Theorie mit der Berechnung der angepassten Wahrscheinlichkeitsverteilung. Je nach Markttyp werden unterschiedliche Ein- und Ausstiegslogiken verwendet.

Strategieprinzip

- Berechnen Sie den RSI oder MFI, um zu beurteilen, wie der Markt derzeit aussieht (bull oder bear)

- Die Berechnung des Dow-Bear-Koeffizienten, der die Korrelation zwischen aktuellen Preisen und Transaktionsmengen widerspiegelt

- Anpassung der RSI/MFI-Wahrscheinlichkeitsverteilung zur Bestimmung einer genauen Mehrraumverteilung

- Eintritt nach aktueller SessionId und Wahrscheinlichkeit

- Stopp-Loss, wenn die Gewinne zurückgenommen oder der Markt bereinigt wird

Analyse der Stärken

- Mit der Tao-Theorie kann man die Art des Marktes genauer bestimmen

- Einführung von Blindgängern unter Berücksichtigung von Schnittstellen

- Hohe Gewinn- und Verlustquote, niedrige Rücknahme

Risikoanalyse

- Die Parameter sind nicht aktuell und führen zu mehreren Fehleinschätzungen.

- Das ist eine Frage der historischen Daten.

- Die Stop-Loss-Logik ist einfach und kann nicht für spezifische Situationen optimiert werden.

Optimierungsrichtung

- Es gibt mehrere Indikatoren, die in Betracht gezogen werden können, um die Marktveranstaltung zu beurteilen.

- Erweiterte Stop-Loss-Logik basierend auf historischen Daten und Volatilität

- Es gibt viele Möglichkeiten, wie man mit maschinellem Lernen besser Parameter bestimmen kann.

Zusammenfassen

Diese Strategie hat im Allgemeinen gute Rückmeldungsergebnisse und einen gewissen Einsatzwert. Es sind jedoch noch weitere Tests und Anpassungen erforderlich, insbesondere die Stop-Loss-Logik. Die Verwendung von Indikatoren als Hilfsmittel zur Beurteilung ist besser und kann nicht blind gefolgt werden.

Strategiequellcode

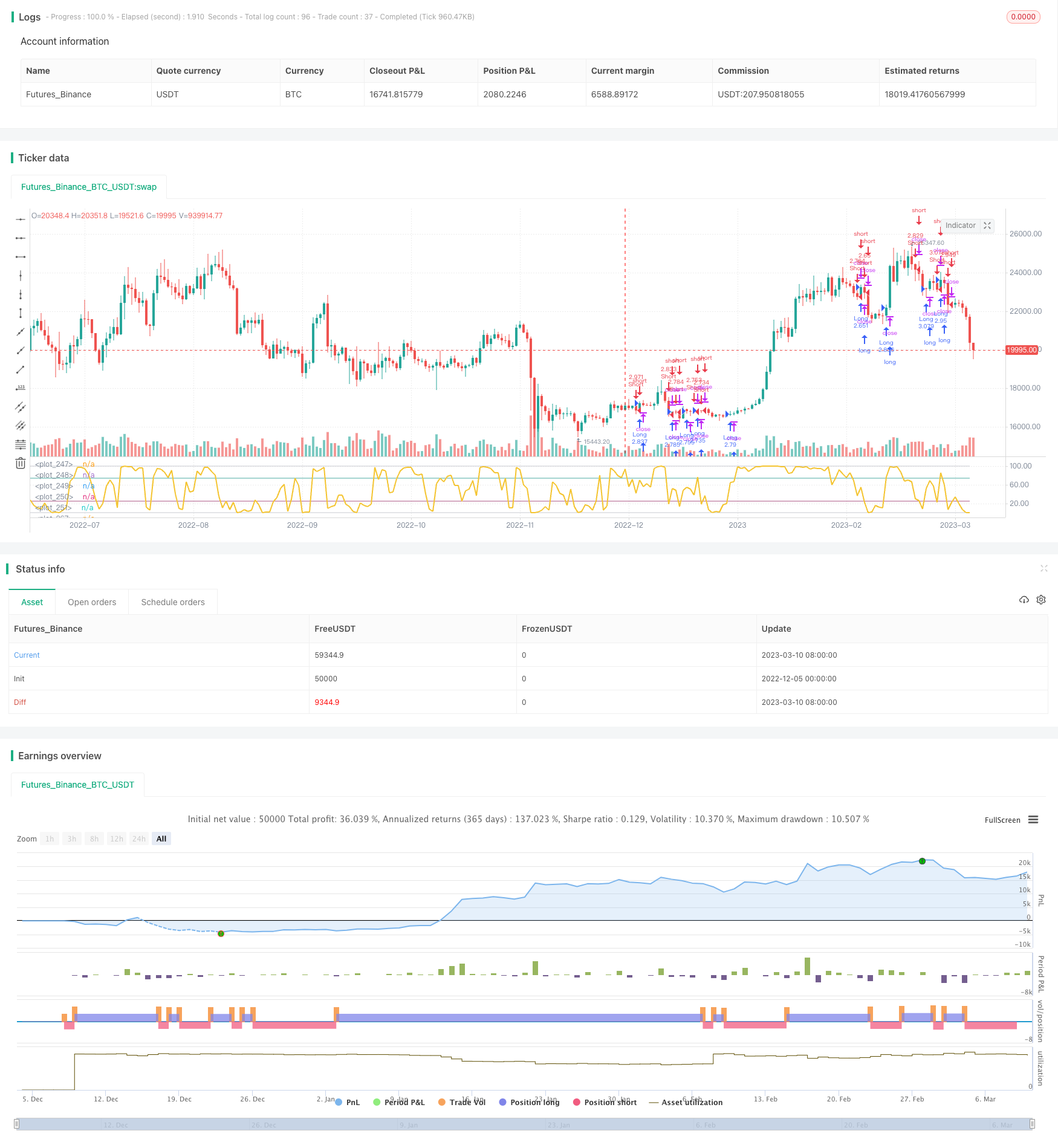

/*backtest

start: 2022-12-05 00:00:00

end: 2023-03-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//MIT License

//Copyright (c) 2019 user-Noldo

//Permission is hereby granted, free of charge, to any person obtaining a copy

//of this software and associated documentation files (the "Software"), to deal

//in the Software without restriction, including without limitation the rights

//to use, copy, modify, merge, publish, distribute, sublicense, and/or sell

//copies of the Software, and to permit persons to whom the Software is

//furnished to do so, subject to the following conditions:

//The above copyright notice and this permission notice shall be included in all

//copies or substantial portions of the Software.

//THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR

//IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY,

//FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE

//AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER

//LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM,

//OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE

//SOFTWARE.

strategy("Dow Factor RSI/MFI and Dependent Variable Odd Generator Strategy",shorttitle = "Dow_Factor RSI/MFI & DVOG Strategy", overlay = false, default_qty_type=strategy.percent_of_equity,commission_type=strategy.commission.percent, commission_value=0.125, default_qty_value=100 )

src = close

lights = input(title="Barcolor I / 0 ? ", options=["ON", "OFF"], defval="OFF")

method = input(title="METHOD", options=["MFI", "RSI"], defval="RSI")

length = input(5, minval=2,maxval = 14, title = "Strategy Period")

// Essential Functions

// Function Sum

f_sum(_src , _length) =>

_output = 0.00

_length_adjusted = _length < 1 ? 1 : _length

for i = 0 to _length_adjusted-1

_output := _output + _src[i]

f_sma(_src, _length)=>

_length_adjusted = _length < 1 ? 1 : _length

float _sum = 0

for _i = 0 to (_length_adjusted - 1)

_sum := _sum + _src[_i]

_return = _sum / _length_adjusted

// Unlocked Exponential Moving Average Function

f_ema(_src, _length)=>

_length_adjusted = _length < 1 ? 1 : _length

_multiplier = 2 / (_length_adjusted + 1)

_return = 0.00

_return := na(_return[1]) ? _src : ((_src - _return[1]) * _multiplier) + _return[1]

// Function Standard Deviation

f_stdev(_src,_length) =>

float _output = na

_length_adjusted = _length < 2 ? 2 : _length

_avg = f_ema(_src , _length_adjusted)

evar = (_src - _avg) * (_src - _avg)

evar2 = ((f_sum(evar,_length_adjusted))/_length_adjusted)

_output := sqrt(evar2)

// Linear Regression Channels :

f_pearson_corr(_src1, _src2, _length) =>

_length_adjusted = _length < 2 ? 2 : _length

_ema1 = f_ema(_src1, _length_adjusted)

_ema2 = f_ema(_src2, _length_adjusted)

isum = 0.0

for i = 0 to _length_adjusted - 1

isum := isum + (_src1[i] - _ema1) * (_src2[i] - _ema2)

isumsq1 = 0.0

for i = 0 to _length_adjusted - 1

isumsq1 := isumsq1 + pow(_src1[i] - _ema1, 2)

isumsq2 = 0.0

for i = 0 to _length_adjusted - 1

isumsq2 := isumsq2 + pow(_src2[i] - _ema2, 2)

pcc = isum/(sqrt(isumsq1*isumsq2))

pcc

// Dow Theory Cycles

dow_coeff = f_pearson_corr(src,volume,length)

dow_bull_factor = (1 + dow_coeff)

dow_bear_factor = (1 - dow_coeff)

// MONEY FLOW INDEX =====> FOR BULL OR BEAR MARKET (CLOSE)

upper_s = f_sum(volume * (change(src) <= 0 ? 0 : src), length)

lower_s = f_sum(volume * (change(src) >= 0 ? 0 : src), length)

_market_index = rsi(upper_s, lower_s)

// RSI (Close)

// Function RMA

f_rma(_src, _length) =>

_length_adjusted = _length < 1 ? 1 : _length

alpha = _length_adjusted

sum = 0.0

sum := (_src + (alpha - 1) * nz(sum[1])) / alpha

// Function Relative Strength Index (RSI)

f_rsi(_src, _length) =>

_output = 0.00

_length_adjusted = _length < 0 ? 0 : _length

u = _length_adjusted < 1 ? max(_src - _src[_length_adjusted], 0) : max(_src - _src[1] , 0) // upward change

d = _length_adjusted < 1 ? max(_src[_length_adjusted] - _src, 0) : max(_src[1] - _src , 0) // downward change

rs = f_rma(u, _length) / f_rma(d, _length)

res = 100 - 100 / (1 + rs)

res

_rsi = f_rsi(src, length)

// Switchable Method Codes

_method = 0.00

if (method=="MFI")

_method:= _market_index

if (method=="RSI")

_method:= _rsi

// Conditions

_bull_gross = (_method )

_bear_gross = (100 - _method )

_price_stagnant = ((_bull_gross * _bear_gross ) / 100)

_price_bull = (_bull_gross - _price_stagnant)

_price_bear = (_bear_gross - _price_stagnant)

_coeff_price = (_price_stagnant + _price_bull + _price_bear) / 100

_bull = _price_bull / _coeff_price

_bear = _price_bear / _coeff_price

_stagnant = _price_stagnant / _coeff_price

// Market Types with Dow Factor

_temp_bull_gross = _bull * dow_bull_factor

_temp_bear_gross = _bear * dow_bear_factor

// Addition : Odds with Stagnant Market

_coeff_normal = (_temp_bull_gross + _temp_bear_gross) / 100

// ********* OUR RSI / MFI VALUE ***********

_value = _temp_bull_gross / _coeff_normal

// Temporary Pure Odds

_temp_stagnant = ((_temp_bull_gross * _temp_bear_gross) / 100)

_temp_bull = _temp_bull_gross - _temp_stagnant

_temp_bear = _temp_bear_gross - _temp_stagnant

// Now we ll do venn scheme (Probability Cluster)

// Pure Bull + Pure Bear + Pure Stagnant = 100

// Markets will get their share in the Probability Cluster

_coeff = (_temp_stagnant + _temp_bull + _temp_bear) / 100

_odd_bull = _temp_bull / _coeff

_odd_bear = _temp_bear / _coeff

_odd_stagnant = _temp_stagnant / _coeff

_positive_condition = crossover (_value,50)

_negative_condition = crossunder(_value,50)

_stationary_condition = ((_odd_stagnant > _odd_bull ) and (_odd_stagnant > _odd_bear))

// Strategy

closePosition = _stationary_condition

if (_positive_condition)

strategy.entry("Long", strategy.long, comment="Long")

strategy.close(id = "Long", when = closePosition )

if (_negative_condition)

strategy.entry("Short", strategy.short, comment="Short")

strategy.close(id = "Short", when = closePosition )

// Plot Data

// Plotage

oversold = input(25 , type = input.integer , title = "Oversold")

overbought = input(75 , type = input.integer , title = "Overbought")

zero = 0

hundred = 100

limit = 50

// Plot Data

stagline = hline(limit , color=color.new(color.white,0) , linewidth=1, editable=false)

zeroline = hline(zero , color=color.new(color.silver,100), linewidth=0, editable=false)

hundredline = hline(hundred , color=color.new(color.silver,100), linewidth=0, editable=false)

oversoldline = hline(oversold , color=color.new(color.silver,100), linewidth=0, editable=false)

overboughtline = hline(overbought , color=color.new(color.silver,100), linewidth=0, editable=false)

// Filling Borders

fill(zeroline , oversoldline , color=color.maroon , transp=88 , title = "Oversold Area")

fill(oversoldline , stagline , color=color.red , transp=80 , title = "Bear Market")

fill(stagline , overboughtline , color=color.green , transp=80 , title = "Bull Market")

fill(overboughtline , hundredline , color=color.teal , transp=88 , title = "Overbought Market")

// Plot DOW Factor Methods

plot(_value, color = #F4C430 , linewidth = 2 , title = "DOW F-RSI" , transp = 0)

// Plot border lines

plot(oversold ,style = plot.style_line,color = color.new(color.maroon,30),linewidth = 1)

plot(overbought,style = plot.style_line,color = color.new(color.teal,30) ,linewidth = 1)

plot(zero ,style = plot.style_line , color = color.new(color.silver,30) , linewidth = 1 ,editable = false)

plot(hundred ,style = plot.style_line , color = color.new(color.silver,30) , linewidth = 1 ,editable = false)

// Switchable Barcolor ( On / Off)

_lights = 0.00

if (lights=="ON")

_lights:= 1.00

if (lights=="OFF")

_lights:= -1.00

bcolor_on = _lights == 1.00

bcolor_off = _lights == -1.00

barcolor((_positive_condition and bcolor_on) ? color.green : (_negative_condition and bcolor_on) ? color.red :

(_stationary_condition and bcolor_on) ? color.yellow : na)

// Alerts

alertcondition(_positive_condition , title='Strong Buy !', message='Strong Buy Signal ')

alertcondition(crossover(_value,overbought) , title='Gradual Buy', message='Gradual Buy Signal')

alertcondition(crossover(_value,oversold) , title='Gradual Buy', message='Gradual Buy Signal')

alertcondition(crossunder(_value,overbought) , title='Gradual Sell', message='Gradual Sell Signal')

alertcondition(crossunder(_value,oversold) , title='Gradual Sell', message='Gradual Sell Signal')

alertcondition(_negative_condition , title='Strong Sell !', message='Strong Sell Signal ')