Optimization of grid trading strategies - how to use position management to quickly unlock

Author: iyth888, Created: 2021-07-16 19:47:28, Updated: 2021-07-18 00:32:28This is the fifth column in the Universe of Grid Trading, the previous articles discussed the principles, advantages and disadvantages of grid trading, investment variety selection, and segmental grid optimization.

This article mainly discusses the problem of position management in grid trading and how to use position management to quickly unlock the grid trading system.

A common grid trading rule is that the underlying position is fixed, such as first investing 50% of the underlying position, and then the remaining 50% of the funds are distributed on average to each grid. This advantage is simple and easy to execute. The disadvantage is that the highest position is held until the price returns above the benchmark line before unlocking.

Is there a way to fully unlock prices without having to cross the benchmark?

There is.

By adjusting the level of the underlying position and the size of the upside position, as well as the range of the exit grid, it is possible to pull down the trade price quickly.

I'm not sure what you mean.

For example, the underlying position from 50% to 50% and the underlying position from 50% to 50% is the same size, which is equivalent to no underlying position, the first order of the grid is the single amount of the underlying position, assuming 1 ; then each time the price drops one degree, you add 1 position.

Assuming the price continues to fall, after falling 10 times and adding 10 base positions, start increasing the investment, 2 base positions for each falling grid. If the price is still falling, after 10 times and adding 2 base positions, the next grid continues to fall 3 base positions to add to the stock.

That is, the first 1-10 grid 1 base, 10-20 grid 2 base, 30 - unlimited grid 3 base. This method is not the same as Martin, Martin is an infinite card, we can play up to 3, which is equivalent to the big number base, everyone can bear.

Because the heavier positions are below the average price of all the units, a fixed base position will be much lower than the average price of all the units, and the price can float if the price rises by about a third.

I'm not going to talk about how we've improved our presentation.

Normally, the grid is up and down, which is the most traditional and most efficient method. But it is also the most abrasive method, the reason for the abrasive is that it can be worn for a long time, showing a loss. If you want to eliminate the loss as soon as possible, you can try to change the way you play.

For example, if we set the top grid 3 to sell all the orders below this grid. If we sell the bottom 1 2 3 orders at 4, then the distance between grid 3 and grid 4 is 3 grids, then the profit is 33 = 9.

If you extend it, for quick unwrapping, the 14 profits can be taken out to offset the ones that are wrapped above grid number 4.

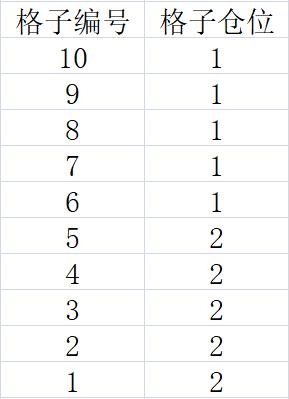

Take the example above. 10 is the first order to be opened on the benchmark line, followed by 1 base position under 10-6 and 2 base positions under 5-1. When the price jumps from 1 to 4, it is as follows:

Grid number one floats 2 times 3 is 6.

So let's say that the number 2 grid floats.

Grid 3 floats 2 times 1 is 2 coins.

Grid number 4 floats 2*0 = 0 coins.

The money floated up to twelve bucks.

This allows you to make a profit on the position on grid 4 that is flat with the position on grid 123, and continue to trade according to the traditional grid method when the price falls.

It is also possible to tie a total of 13 positions from 1-8 without losing money, so that only the positions of the 9th and 10th grids are left in the hand, quickly releasing the positions that are in the hole, without risking the risk of being in the hole.

The latter method is a modification of the traditional grid trading method, and has advantages and disadvantages compared to the traditional one. Although the traditional grid will show losses, but the rules are simple and the growth rate of the account funds is constant and stable.

The cost is the rules are more complicated, how many grids can be deleted, how many grids, to be calculated, because much cheaper, the capital growth rate will be operated, more suitable for high-frequency trading.

In general, since the grid trading method is a method of controlling the movement of positions up and down, there are two ways to quickly unlock, one is to accelerate the cost decline by weighing positions, and one is to increase the stop-loss distance to form a floating position.

Both methods can be used separately or together to speed up the unwinding process. Interested friends can demonstrate in person, which is very interesting.

Finally, to summarize, there are methods to quickly unlock, but to make a stable profit, you can not rely on one or two methods, you need to systematize, it is strongly recommended that you read the entire article in the column of the universe of hedge fund trading, all the secrets of hedge fund trading are here.

Written by V: wgjyfyz

Some of the ideas from the network trading law:https://www.fmz.cn/bbs-topic/7567The rules of trading are detailed in the scientific principles of stable profitabilityhttps://www.fmz.cn/bbs-topic/7568Advantages and disadvantages of grid trading and strategies for optimizinghttps://www.fmz.cn/bbs-topic/7569Optimizing your trading strategy - how to choose the right investment varietieshttps://www.fmz.cn/bbs-topic/7570Optimized grid trading strategies - solving the problem of one-sided decline, reducing the network breakdown ratehttps://www.fmz.cn/bbs-topic/7571Optimization of grid trading strategies - how to use position management to quickly unlockhttps://www.fmz.cn/bbs-topic/7572Net trading is ultimately optimized - net trading yields five times higherhttps://www.fmz.cn/bbs-topic/7524The idea of a grid strategy for high-frequency brushing

- How do I randomly select more or empty in Python?

- OKx can only be used for USD pairs? How to set USDT pairs

- number of decimal units that the okex perpetual contract cannot open

- Please, God, look at this.

- The k-line seems to have a problem.

- Please tell me how to save the data for daily voting.

- It's not fair.

- How do I get the current account, the number of coins and the current value of the coins?

- Why is the balance negative?

- Net trading is ultimately optimized - net trading yields five times higher

- Optimized grid trading strategies - solving the problem of one-sided decline, reducing the network breakdown rate

- Optimizing your trading strategy - how to choose the right investment varieties

- Advantages and disadvantages of grid trading and strategies for optimizing

- The rules of trading are detailed in the scientific principles of stable profitability

- A bug in the digital accuracy of the currency's disks

- How many times do you open a position for ten?

- If you want to see if there's a bull market in the review, the cycle gains and losses on the yield curve should not be visible.

- Upstream testing

- Traceback (most recent call last): File "<stdin>", line 13, in <module> File "<string>", line 23, in <module> ValueError: bad marshal data (unknown type code)

- Ask for a brushed script/code