High frequency algorithmic trading strategies

Author: Zero, Created: 2015-08-21 20:18:32, Updated: 2015-08-21 20:19:04The BBO strategy

BBO - the best bid strategy is one of the most common strategies in high-frequency algorithmic trading. Foreign institutions such as Goldman Sachs and Merrill Lynch have adopted this strategy for high-frequency algorithmic trading. We have designed a fully automated high-frequency algorithmic trading process based on the successful experience of foreign countries to optimize for the Chinese market.

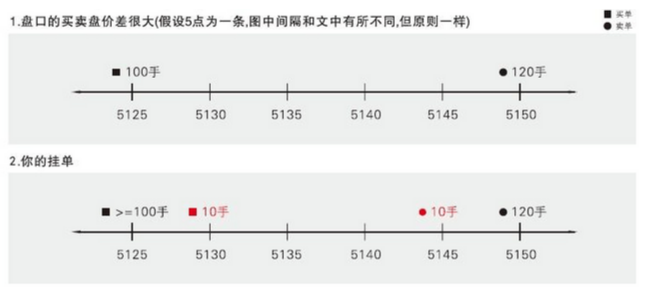

当盘口因流动性缺失而出现缺口并且两侧有大单时,我们分别在上图红色位置挂小单,利用盘中买卖的人不断获利,如果价格发生突破因为背后有大单依托我们可以立即转身止损,最多只亏损一跳。我们借助自动化交易对实盘状况进行了很多优化,这里涉及商业机密,不便说的太细

High-frequency statistical arbitrage strategy ((This strategy is currently suspended due to the number of withdrawals restricted by the Chinese currency.))

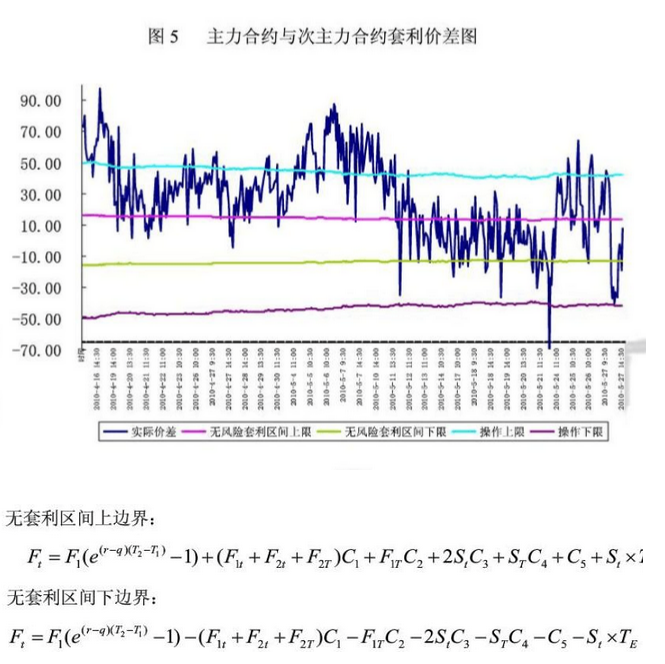

The high-frequency statistical arbitrage strategy is also one of the most widely used high-frequency algorithmic trading strategies in Europe and the United States, which uses statistical tools to calculate the price difference of high-relevant varieties and then draw a leverage channel for high-polluting and low-polluting of the difference. This requires the use of algorithmic trading strategies such as iceberg, one-legged BBO to reduce the shock cost, which involves trade secrets, without giving too much explanation.

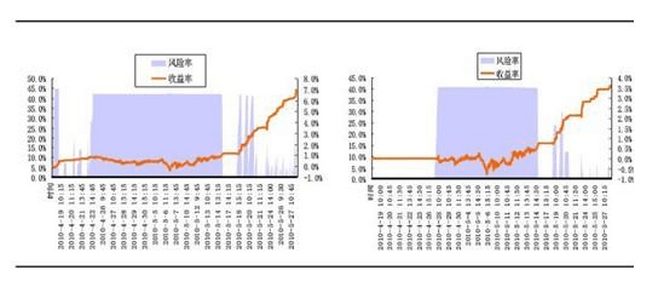

The following graph shows the capital curve for both strategies when small funds are in play.

Translated by:http://dwz.cn/1lbujw

- Judging the Effectiveness of Deep Data

- I ran down the robot, what is the reason for this?

- Antiquity: the life cycle of a programmatic transaction model

- The problem of a failed sub-order; if the funds are insufficient, it may return null; if the network is faulty, it may return undefined. Is this correct?

- Some easy misspellings for asynchronous concurrent calls

- Weight Watchers has added a push message feature to its receiving strategy!

- I've recently developed an entry point idea.

- In and out

- I found out this year that there are several websites that write automated trading strategies.

- Programmatic trading system in general

- Strategies and misconceptions for high-frequency trading and quantitative investing

- High-frequency trading strategies explored

- Several strategies for high-frequency trading

- Recent OKCoin futures or other dollar platforms cause robots to fail to boot solutions

- How do robots communicate with each other?

- Pyramid schemes are better

- Why is the onexit function not executed?

- 亚当理论里的一个小故事.

- One of the newcomers to the K-line collection on the hard disk

- Some tips for re-testing the wrong packaging