Oil futures are coming up, get in the car! Global oil futures market, big five spot, big three futures market

Author: The Little Dream, Created: 2017-05-13 10:31:27, Updated:Oil futures are coming up, get in the car! Global oil futures market, big five spot, big three futures market

On 11 May, the Shanghai International Energy Exchange (hereinafter referred to as the Energy Center), a subsidiary of the Shanghai Futures Exchange, officially published the Shanghai International Energy Exchange's Articles of Association, the Shanghai International Energy Exchange's Trading Rules and 11 related business rules.

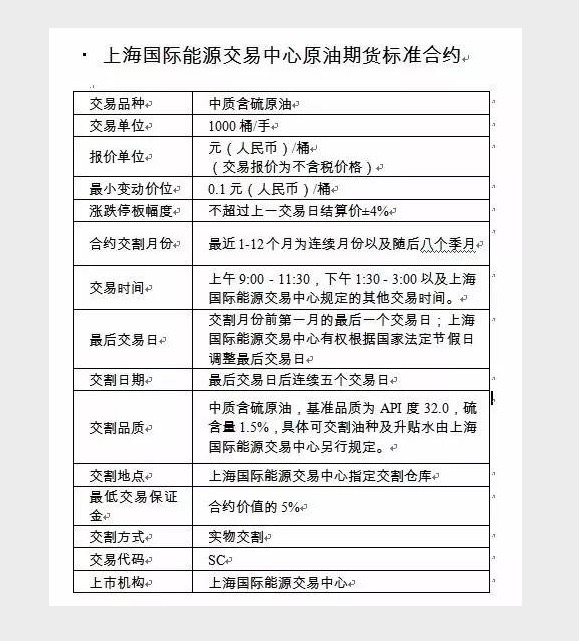

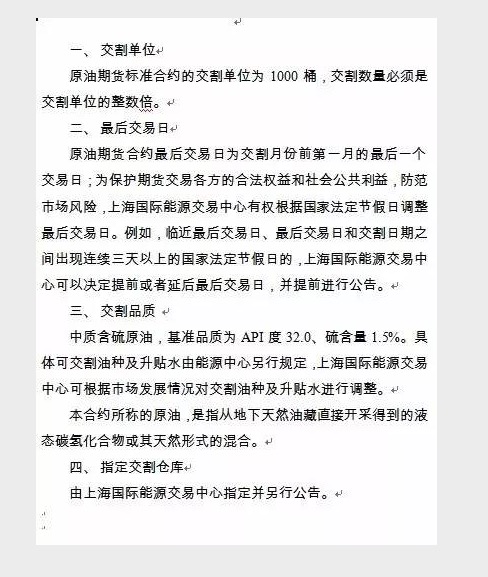

According to the regulations, the unit of trade is 1000 barrels/hand, and the unit of change of the bid is 0.1 yuan/barrel. This is also good, that is, the volatility rate is at least 100 yuan/hand, and there is no bullishness.

According to the opinion of the global market makers, due to the rule of the downside of + 4%, when the off-shore crude oil price falls above + 4%, the possibility of domestic crude oil futures being leveraged, that is, the risk arises; but also note that three consecutive trading days of cumulative downside of + 12%, the regulators will go out of their way.

The delivery varieties are neutral sulphur-containing crude oil, in addition, the trading time is only four hours a day.

The contract minimum collateral amount is 5%, i.e. at least 17500 yuan in collateral. However, this is only one of the minimum requirements, and there is also a Shanghai International Energy Trading Center settlement details, Chapter III of the daily settlement, Article 24, settlement reserve refers to the funds prepared in advance by the member in the special settlement account of the energy center for the purpose of settlement of transactions, which are collateral not occupied by the contract.

The minimum balance of the settlement reserves of the members of the futures company is RMB 2 million; the minimum balance of the settlement reserves of the members of the non-future company is RMB 500,000. And, for each addition of an institution or financial commissioner, the corresponding reserve must be increased by RMB 2 million. For example, a large company, with three institutions commissioning transactions, has a settlement reserve of RMB 6 million, if a Fortune company wants to join, the settlement reserve becomes RMB 8 million, the same applies to the members of the non-future company.

In other words, even if a private investor enters the trading floor, they need at least 51.75 million yuan to start trading or trading.

The minimum quantity of crude oil in the warehouse is 200,000 barrels. The minimum quantity of crude oil in the warehouse is 200,000 barrels, less than 200,000 barrels, can be filled by cash and other means, and more than 200,000 barrels can be arranged for the warehouse operation, unless the shipowner and the designated delivery warehouse have otherwise agreed. However, at least 200,000 barrels of VLCC shipments can be, before and after involving at least 100 billion, so, only a few large institutions and state-owned enterprises are actually handed over.

At the same time, this is not surprising if strictly in accordance with API, sulfur content, in accordance with delivery criteria, and the larger production is Russia's Ural crude oil, in accordance with domestic energy security, crude oil transportation convenience. Many refined ESPO crude oil can reach the port of Zhoushan or Shandong in a few days, according to this analysis, so Zhoushan is likely to set up a warehouse.

Crude oil futures are the first domestically specific variety approved by the Securities and Exchange Commission, domestic brokers and foreign brokers can participate in crude oil futures trading in accordance with the law, the basic framework of its overall scheme is the international platform, net price trading, guaranteed tax transfer, yuan pricing. According to the actual operation of China's futures market and the exploratory steps to expand the opening up to the outside, crude oil futures aim to establish a set of rules that both meet the requirements of China's futures market regulatory system, but also absorb the practice of international markets, form and establish a gradual marketization, a multi-level rules system, service the petroleum industry marketization reform, and provide risk management tools for domestic and foreign petroleum industry enterprises, all types of investors.

Currently, there are five major oil spot markets in the world: Northwest Europe, Mediterranean, Caribbean, Singapore and the United States.

The Northwest European market is located in Amsterdam, Rotterdam, Danzig and Antwerp, mainly serving Germany, France, the United Kingdom and the Netherlands, and is centered in Rotterdam. The emergence of the Singapore market, although only more than a decade old, has been extremely rapid due to its superior geographical location, and has now become the center of oil trading in South and Southeast Asia. The United States consumes about 900 million tons of oil annually, accounting for about a quarter of the global total, of which about 600 million tons are needed for imports, forming a huge market in the United States' ports of Houston and New York, which face the Gulf of Mexico.

The major global oil futures markets are the New York Commodity Exchange, the London International Oil Exchange and the Tokyo Industrial Exchange. In 2003, the New York Commodity Exchange traded more than 100 million energy futures and options, accounting for 60% of the total of the three major energy exchanges. Its publicly traded West Texas Intermediate Crude Oil (WTI) is the world's largest commodity futures and one of the most important benchmarks for pricing in the global oil market.

The pattern of the world oil market determines its pricing mechanism. Currently, international crude oil trading is mostly based on the benchmark oil of the major regions, the spot or futures trading price of the benchmark oil at a certain time before delivery or after the pick-up date plus a raise in the bidding water as the final settlement price of the crude oil trade.

By geographical division, all crude oil produced in North America or sold to North America is priced on the basis of wti crude oil; crude oil from the former Soviet Union, Africa and the Middle East to Europe is priced on the basis of Brent crude oil; Middle Eastern oil producing countries or crude oil from the Middle East sold to Asia are priced on the basis of UAE Dubai crude oil; and the Far Eastern market is primarily priced on the basis of Malaysia's tapioca light crude oil and Indonesia's tapis minas; and Chinese exports are priced on the basis of Indonesia's Minas crude oil.

This pricing system determines the difference in the cost of importing oil from different regions. According to experts, from 1993 to 2001, Saudi light crude oil sold to Northeast Asia was on average $1.01 per barrel higher than sold to Europe, with a larger gap compared to the US market, sometimes reaching more than $3 per barrel.

Finished oils are mainly comprised of gasoline, gasoline, diesel and fuel oil. In general, the lighter components are always separated first during the processing of crude oil. Fuel oil is a type of finished oil, a heavier residual product that is separated from crude oil during the processing of petroleum after steam, coal and diesel.

-

First, the market pricing mechanism for international domestic crude oil

Crude oil is the main source of energy in the world today and is a strategically important commodity for all countries. The world crude oil trading market has developed over decades and the rules of the market have been quite perfected. Currently, crude oil in the international crude oil market is priced on the standard oil of all major regions of the world as a benchmark.

1st, West Texas Intermediate Oil (WTI) is a US-based oil company that produces crude oil in West Texas.

All crude oil produced in the United States or sold to the United States is priced on it as a benchmark oil. Its primary trading method is the NYMEX exchange, where prices are constantly changing and trading is very active. In addition, there is a trading floor. NYMEX's lightweight low-sulfur crude oil futures are currently the most traded commodity futures in the world. Due to the contract's good liquidity and high price transparency, NYMEX's lightweight low-sulfur crude oil futures price is considered one of the benchmarks in the world oil market.

BRENT, light crude oil in the UK North Sea

About 80% of the world's crude oil trade is priced on it as a benchmark oil, mainly in Northwest Europe, the North Sea, the Mediterranean, Africa and parts of the Middle East, such as Yemen.

3rd, the UAE has sulfur-containing crude oil DUBAI

Crude oil produced in Middle Eastern oil producing countries or sold from the Middle East to Asia is priced on it as a benchmark oil. Its main method of trading is a spot bid or a price difference with other standard oil.

Fourth, the Far East market is divided into two ways: Malaysian light crude oil TAPIS

It is the typical crude oil that represents the price of light crude oil in Southeast Asia, where light crude oil is priced largely on it as a benchmark oil. Its main mode of trading is price differential trading with other standard oils.

The official price of Indonesia is the ICP. This is the way the majority of Indonesian crude oil is priced, as well as some crude oil from some countries in the Far East, such as Vietnam's White Tiger and China's Daqing.

Compared to the crude oil market, the history of the international market is relatively short and the degree of internationalization of pricing is relatively low. Currently, there are three main international markets for finished oil, namely the Dutch Rotterdam market in Europe, the New York market in the United States and the Singapore market in Asia, and the international trade of finished oil in each region is mainly based on the market price of the region. Fuel oil is a downstream product of crude oil, so the price movement of fuel oil is strongly correlated with crude oil.

In our country's case, since 1998, the pricing mechanism of crude oil began to be aligned with the international market, currently the vast majority of crude oil prices are linked to some crude oil in Indonesia, a small part of crude oil is linked to TAPIS in Malaysia, adjusted once a month in the form of an equivalent to the official price, it should be said that our crude oil pricing method has basically been very close to the international practice; in terms of finished products, from June this year, every month the country will adjust the selling price of finished oil based on the average price of the Singaporean finished oil market in the previous month, in relation to the daily changes in the international market, which, although it does not fully reflect the actual price of the international market, but has made great progress in relation to the previously purely domestic supply and demand situation.

In general, the tax rate for the import price of finished oil is as follows: import to shore price = [offshore price + levy) * barrel ratio * exchange rate * 1+ tariff rate + fuel consumption tax) * 1+ VAT rate) + port charges; of which: exchange rate: 8.28 yuan/USD; barrel ratio: varies depending on the density of the gasoline; import duty: oil 5%, diesel 6%, fuel oil 6%; fuel consumption tax: gasoline 277.6 yuan/ton, diesel 117.6 yuan/ton, value added tax 17%, port charges 50 yuan/ton.

The production methods of petroleum products are often reduced pressure distillation, catalytic cracking, additive cracking, catalytic reforming, etc. In general, regardless of the processing process, the light component in crude oil is first separated, such as first petroleum gas, gasoline, then intermediate base components, such as gasoline, diesel, then heavy components, such as fuel oil, aluminum asphalt, etc.;

Nature and classification of oil products

1, gasoline

Generally, gasoline is divided into two brands according to the value of the Mattafash spark plug 70 and 85, and according to the research method spark plug 90, 93, 95 and 97. The most common gasoline brand in everyday life is classified according to the research method spark plug. Gasoline is usually used as a fuel for gasoline cars and gasoline engines.

2, oil

Kerosene was formerly known as lamp oil, because kerosene was initially mainly used for lighting. Kerosene is divided into three grades of quality, first-class and qualified products by quality, mainly used for lighting, various light bulbs, gas lamps, steam boilers and kerosene boilers; It can also be used as a washing agent for mechanical parts, aluminum and pharmaceutical industrial solvents, ink diluents, organic cracking raw materials; Process oil for processes such as glass ceramics, aluminum plate plating, metal surface heat treatment.

3 light diesel and heavy diesel

Light diesel is divided by quality into three grades of premium, first-class and qualified products, and by concentration into six brands: 10, 0, 10, 20, 35, and 50. The number 10 indicates that the concentration is not higher than 10 ° C, and the rest is recommended. Light diesel is used as a fuel for diesel cars, tractors and various high-speed ((1000 r/min) diesel engines. Depending on the temperature, region and season, light diesel of different brands are selected.

4 Fuel oil

Fuel oil is mainly classified according to kinetic viscosity, the commonly used unit of kinetic viscosity is in centimeters, such as the kinetic viscosity of fuel oil is 180 centimeters, we call it 180 fuel oil; depending on the sulfur content, fuel oil can be divided into high-sulfur fuel oil and low-sulfur fuel oil.

Fuel oil consumption in China is mainly concentrated in power generation, transportation, metallurgy, chemicals, light industry and other industries. According to the National Bureau of Statistics, the electricity industry is the largest, accounting for 32% of total consumption; followed by the petrochemical industry, mainly for fertilizer raw materials and fuels for petrochemical enterprises, accounting for 25% of total consumption; again, the transportation industry, mainly for marine fuel, accounting for 22% of total consumption; the largest increase in demand in recent years is in the building materials and light industries (including flat glass, glassware, building and ceramic manufacturing enterprises), accounting for 14% of total consumption).

-

A brief introduction to the world oil price system

The meaning of several prices in international oil trade

1 The official price of the Opec

In the 1960s, in order to combat the behavior of Western multinationals to lower the target price, OPEC published standard crude oil prices at successive ministerial conferences in the late 1960s and especially in the early 1970s. The standard crude oil price was based on the Saudi API of 34 for light crude oil, which was the official price at the time.

By the 1980s, as non-OPEC oil production grew, the Organization of Petroleum Exporting Countries (OPEC) saw that official prices had become less important in late 1986 and switched to the average price of seven crude oils in the world (the price of seven crude oils in a package) to determine the price of crude oil for each member of the organization. The average price of seven crude oils is the reference price, which is adjusted according to the quality of the crude oil and the price of shipping.

2 The official price of the OPCW

It is a system of oil prices set by non-OPEC oil producers themselves, which generally floats up and down in relation to their actual situation.

3 Price on the spot market

The world's largest oil spot markets are New York in the United States, London in the United Kingdom, Rotterdam in the Netherlands, and Singapore in Asia. Prior to the 1970s, these markets were merely a means of adjusting oil surpluses and exchanging oil products by the major oil companies, with oil spot transactions accounting for less than 5% of the world's total oil trade, and spot prices generally only reflecting the selling price of long-term contract excess production.

Thus, the oil spot market at this stage is called the residual market. After the 1973 oil crisis, as the volume of spot trade and its share in the world oil market gradually increased, the oil spot market evolved from a pure residual market to a marginal market that reflected the production, refining costs and profits of crude oil.

This practice of long-term contracts being pegged to spot market prices generally involves two types of pegging: one is in the form of negotiated prices on a weekly, monthly or quarterly basis, and the other is in the form of calculating the average spot price (monthly, fortnightly, weekly).

There are two types of prices in the oil spot market, one is the actual spot trading price and the other is the estimate of some market price levels made by some institutions through market research and tracking.

4, futures trading price

The price of the oil is the price of the oil futures, which is negotiated by the buyers and sellers through open bidding in the oil futures market, the standard oil contracts for the future time, the price, the quantity and the place of delivery, and the priority of identification. The futures market facilitates the traders or expand the flow, sometimes by the rules of the settlement price of the oil futures, generally the weighted average price over a period of time.

In view of the fluctuations in crude oil prices in recent years, the futures market has replaced the price discovery function of the spot market to some extent, and futures prices have become a leading indicator of changes in national crude oil prices. The open bidding pattern of oil futures exchanges signals the market's future supply-demand relationship, exchanges publish real-time trading patterns to the world at large, and oil traders can access price information at any time.

5th, at affordable prices

OPEC members must comply with the official prices agreed upon between the members when exporting their crude oil, but due to different national circumstances, some urgently in need of funds need to extract more oil to replenish the resources, but also to comply with OPEC's production quotas. To resolve this contradiction, some countries use the bargain method to exchange the materials they want. This method, although the price of crude oil used is calculated according to the official price of OPEC, because the price of the exchange is higher than the general market price, in fact the price of bargain oil is often lower than the official price, so this is a more hidden discount method and means of trading in a weak market.

The most basic form of barter is the exchange of specially specified goods or services in exchange for oil, but there are also various forms such as oil collateral, oil swaps, buybacks, etc. Buybacks are transactions in which the seller uses a portion of the proceeds of the sale of oil to purchase goods from the country that imports its oil. This transaction is more flexible, and the oil-exporting country can choose from a variety of goods and services offered by the oil-importing country, choosing the goods or services it is willing to accept as all or part of the proceeds of the sale of oil.

6, net return on investment

The net return price, also known as net back pricing, is generally calculated as the spot price of finished oil on the consumer market multiplied by its respective yield as a basis, minus shipping costs, refinery processing costs and refiner profits. The essence of this pricing system is to transfer all the risk of price decline to the sale of crude oil, thus ensuring the interests of refiners, and therefore suitable for the situation of a relative surplus in the crude oil market.

7 The price index

Information has become a strategic resource, and many well-known news organizations use their information advantage to instantly collect oil transaction prices around the world to form authoritative quotes for a particular oil product. The most widely used quotation systems and price indices are: Pfizer quotes Platinum, Argus quotes Petroleum Argus, Reuters quotes Reuters Energy, Associated Press Telerate, Asian Oil Price Index APPI, Indonesian Crude Oil Price Index ICP Far East Oil Price Index FEOP, Sukhoi RIM.

International market pricing mechanisms for crude and refined oil

1st, the international oil price system

With the development and evolution of the world oil market, many long-term trading contracts for crude oil now use a formula calculation, which is to choose one or more reference crude oil prices based on, plus a premium, the basic formula is: P = A + D

In this case, P is the settlement price of crude oil, A is the benchmark price, and D is the water levy.

The reference price is not the specific transaction price of a certain crude oil at a specific time, but a price calculated in connection with the spot price, futures price or quotation of a quotation agency for a period of time before and after the transaction. Some crude oils use quotations for this type of crude oil in a quotation system, which are processed by formula as a reference price; some crude oils depend on quotations for other crude oils for reasons such as no quotation.

The reference oil is called the benchmark oil. The benchmark oil used varies from one trading region to another. Exports to Europe or from Europe are generally Brent oil; North America primarily chooses West Texas Intermediate Oil (WTI); the Middle East exports Europe based on Brent oil, North America based on West Texas Intermediate Oil, and the Far East based on Oman and Dubai based on crude oil; the Middle East and Asia often price the benchmark oil in combination with the Brent index, and they all place a lot of emphasis on water tariffs.

(1) European crude

In Europe, the North Sea Brent crude oil market has developed relatively early and well, with both spot and futures markets. The market is more mature in the region, and the UK's North Sea Brent has become the benchmark oil for trading crude oil in the region and exporting crude oil to the region, i.e. trading crude oil is basically based on Brent crude oil pricing. The main regions include: Northwest Europe, the North Sea, the Mediterranean, Africa and some Middle Eastern countries such as Yemen.

Brent spot prices can be divided into two types: the short-term Brent spot price (DatedBrent) and the long-term Brent spot price (15-daygrent). The former is the price of specified cargo within a specified time frame; the latter is the price of shipment for a specified delivery month, but the specific delivery time is not determined, the specific delivery time of which requires the seller to notify the buyer at least 15 days in advance.

Algeria's Sahara mixed oil.

2 Libya's Annah oil, Buttiful oil, Brega oil, Cedar oil, Cyril oil, Sirteca oil and Zuwetna oil.

It is also the largest oil producer in the world, with a market share of about $1.8 billion.

Saudi Arabia exports to Europe Arabian light oil, Arabian medium oil, Arabian heavy oil and Berry ultra-light oil.

5, Syrian light oil and Swedish crude oil.

6, Yemen Marijuana oil and Maquiladora crude oil.

The price of Brent crude oil in the long term is mainly based on six exports to Egypt.

(2) North American crude

Like the European crude oil market, the U.S. and Canadian crude oil markets are also relatively mature. Its main trading method is the NYMEX exchange, where prices are constantly changing and transactions are very active. In addition, there are bargaining opportunities. Some crude oil traded in or exported to the region is priced primarily by reference to the U.S. West Texas Intermediate (WTI), such as crude oil exported from the eastern United States and the Gulf of Mexico by Ecuador, Arab crude oil exported from Saudi Arabia to the United States, Arab super crude oil, Arab heavy oil and Bayer crude oil.

(3) Middle East oil

Crude oil in the Middle East is mainly exported to North America, Western Europe and the Far East. The benchmark crude oil referred to in its pricing generally depends on the export market of its crude oil. The Middle East oil exporting countries are priced in two categories: one is linked to its benchmark oil. The other is the exporting country's own published price index, known in the oil industry as the Official Sales Price Index (OSP).

The MPM price index is calculated as follows:

1, calculate the average price of a certain type of crude oil in the previous month;

2, calculate the average price of the five largest user transactions;

3) Calculate the average price of a particular oil;

4. calculate the average price of the three above average prices;

5. submit the results of 4 to the Ministry of Petroleum and Minerals of Oman as a decision reference price for the MPM index;

The Ministry of Petroleum and Minerals of Oman has released the MPM Index.

The QGPC and ADNOC price indices basically refer to the MPM index for determination. The official price index emerged after OPEC abandoned fixed prices in 1986, and many oil spot transactions in the Asian market are currently linked to the OSP price. It can be seen from the pricing mechanism of the OSP that the above three price indices are heavily influenced by the government of the country, including the government's judgment of market trends and the corresponding countermeasures taken.

In general, for crude oil exported to North America, the price is based on West Texas in the United States, for crude oil exported to Europe, the price is based on Brent crude oil in the North Sea, and for crude oil exported to the Far East, the price is based on Oman and Dubai. In addition, there are some countries in which all markets use only one reference crude oil, but for different markets, different quotas are selected. Kuwait exports crude oil to the above three markets, whose reference price is Arabian crude oil, but its quotas are different for Arabian crude oil.

(4) Asia and the Pacific

In addition to the PPP, AGS oil quotations, the APPI, ICP, OSP, and FEOP, which have only been developed in the last two years, have important effects on the price of crude oil in Asia. The pricing methods used in long-term oil sales contracts are mainly divided into two categories: one based on the Indonesian crude oil price index or the Asian crude oil price index in Indonesia, and the other based on the Asian crude oil price index in Malaysia, plus or minus the price adjustment.

For example, Vietnamese tiger oil is priced on the basis of the Asian crude oil price index plus or minus the Indonesian crude oil price index. Australia and Papua New Guinea export crude oil is priced on the basis of the Asian crude oil price index of Malaysian Tapis crude oil.

A. The Asian Oil Price Index (APPI) is the highest price index in the world.

The Asian Petroleum Price Index began reporting on oil prices in April 1985 and on crude oil prices in January 1986. The price index is published weekly, based in Hong Kong, and the quotation system is managed and maintained by trading company Seapac Services, with the accounting firm KPMG Peat Marwick in Hong Kong. The index is published every Thursday at 12 noon.

Members are required to submit their estimates of the crude oil price level for the week to the index data processing company by Thursday of each week. At this stage, there are 21 crude oils in the index. The various crude oil price calculation methods are as follows:

1. Each member submits an estimate of the size of its price range at a difference of 10 cents, e.g. 15.30 tonnes to 15.40 USD/barrel;

2. To calculate the standard deviation of the sample by using a simple average of the lower limits in the price level ranges of the Members;

3, eliminate the absolute value of the difference between the lower limit and the sample mean value for price estimates with more than one standard deviation of the sample;

The average value of the estimated residual price, i.e. the Asian oil price index for this type of crude oil, is calculated.

B. The Indonesian crude oil price index (ICP)

Assuming that the name of an oil is X, the method of calculating the monthly Indonesian crude oil price index for that oil is as follows:

1, calculate the simple average of the Asian Oil Price Index values for five crude oils (UAE Dubai Crude, Australian Gippsland Crude, Indian Mines Crude, Oman Crude and Malaysian Tapis Crude);

2, calculate the price difference between the Asian oil price index of X crude oil and the 52-week average of (i); if X crude oil does not have an Asian oil price index, the price difference is agreed;

3. add the monthly average of the five Asian oil price indices above to ((2));

4, calculate the average price of X for Platts and Rim;

5, calculate the last two averages above, i.e. the Indonesian crude oil price index for X.

Some crude oil settlement price pricing formulas also include prices reported by both the APPI and the ICP indices, such as the formula for Petronas Tapis crude oil in Malaysia:

(APPI × 30% + Platts × 30% + Reuters × 20% + Telerate × 20%) + Lift with water

The adjusted pricing formula is:

(APPI × 50% of ten Platts × 50%) 10 liters of water

C. Far Eastern oil price index (FEOP)

The Far East Oil Price Index is quoted from 5:45-8:00 a.m., during which time the index's Citrus Oil Price Group processes the relevant crude oil and petroleum products prices via a computer network to Reuters Singapore, the index price being a simple average of the quotes. The price is coordinated and managed by a consultancy in Singapore, Citrus Oil Trading Co. Ltd. ("Oil Trade Associate"). If the quotes of the group members exceed the quoted time, their price data is processed as follows:

It should be noted that the composition and level of the price of crude oil is related to the delivery method. According to international practice, such as FOB delivery, the buyer bears the cost of shipping and other related costs after the delivery point. Delivery at C+F or CIF price, the seller pays the cost of shipping and other related costs before reaching the designated delivery point.

2 The international system of finished oil prices

In comparison, the international market for refined oil has a shorter history of development than the crude oil market, and the degree of internationalization of pricing is relatively low. Currently, there are three main international markets for refined oil, namely the European market in Rotterdam, the Netherlands, New York, the United States, and the Asian market in Singapore, and international trade in refined oil in various regions is mainly based on the market price of the region.

The following is a brief description mainly using Singapore as an example. There is a special authoritative quoting agency in the Singaporean refined oil market, Platts, which is published daily, except on holidays. With the increasingly active trading of the Singaporean refined oil spot and futures market, the prices of refined oil in virtually all countries in the Far East are mainly based on the prices of the Singaporean refined oil market.

(1) Gasoline prices are mainly based on the benchmark of kerosene oil or 92# gasoline, and there are also individual transactions with 95# or 97# gasoline prices.

(2) Diesel prices are mainly based on diesel containing 0.5% sulphur. Other diesel of different grade specifications can be used as a reference price or can be quoted separately, such as 0.25% and 1.0% sulphur diesel.

(3) The prices of shipping coal, dual-use gasoline and light fuel oil are mainly based on gasoline.

(4) Fuel oil prices are mainly based on fuel oil prices of 180 or 380 viscosity. In addition, there are also individual trades based on Dubai crude oil.

The above pricing method is known as live price quotation, where a certain standard crude oil or finished oil is used as a benchmark; in addition, the buyer and seller can also use a fixed price as a contract settlement price, which is known as dead price quotation.

How to Price Our Crude and Finished Oil

1.我国原油作价方法

Since 1998, the price mechanism for crude oil in our country began to align with the international market, and currently the vast majority of crude oil prices are linked to some crude oil in Indonesia, a small amount of crude oil is linked to Tapis in Malaysia, and adjusted once a month in the form of the equivalent of official prices. It should be said that our crude oil pricing method is basically very close to the international practice method.

Currently, domestic crude oil is mainly the national accounting commission in accordance with the offshore average price of international crude oil of the same quality in the first stage to adjust the domestic crude oil price accordingly, including: benchmark price = monthly offshore average price * barrel per barrel * exchange rate, crude oil tariffs are 0; to shore price = benchmark price + water levy; the actual price to the selling company = to shore price * 1.17, need additional value added tax.

2.我国成品油作价方法

In the case of crude oil, domestic oil prices began to be linked to the three-way market prices of Singapore, New York and Rotterdam in 2000, and when international oil prices fluctuated between 5% and 8%, oil prices remained unchanged, adjusted by the National Development and Reform Commission (NDRC) to retail prices above this range.

In general, the tax on the price of imported crude oil is as follows:

Import to shore price = [shore price + water levy] * barrel ratio * exchange rate * 1 + tariff rate) + fuel consumption tax cap * 1 + VAT rate) + port charges; of which: exchange rate: 8.28 yuan / USD; barrel ratio: varies according to the density of oil; import duty: gasoline 5%, diesel 6%, fuel oil 6%; fuel consumption tax: gasoline 277.6 yuan / ton, diesel 117.6 / ton, value added tax 17%, port fee 50 / ton.

-

The world's largest spot oil market

Currently, the major oil markets in Europe, the United States, and Asia have been formed in terms of physical commodity trading (including spot and long-term trading). Here are some brief descriptions of the three major markets:

The European market

The European market is dominated by the Northwest European market, which covers three of the four major European consumer countries - Germany, the United Kingdom and France. The European spot market emerged in the 1950s, when trading volumes were small and did not attract the attention of the big oil companies, but ultimately oil sales in the region were based on spot trading prices. The region now has many refiners, some owned by big oil companies, some independent.

In terms of quotation, many quotation systems guarantee the completion of daily transactions and display the transaction via a screen, or by fax or telegraph. These quotation systems allow the service staff to communicate with the trader by telephone to obtain information on the completion and price of the transaction. At the same time, the quotation service is also seen as one of the foundations of IPE's crude oil contracts and is one of the problems that IPE and other exchanges have to face in terms of physical delivery when developing new contracts.

The Northwest European market consists of both barges and tankers. The barge market trades 1000 tonnes and 2000 tonnes of bulk oil, mainly via the Rhine to Germany and Switzerland. There is also a small amount of oil that flows this way to the UK and France. The barge market is mainly supplied by refiners on the Northwest European coast.

Another form of the spot market is the tanker trade. Although it is also centered in the Amsterdam/Rotterdam/Antwerp area, it is a more international market, with tankers frequently moving from one market to another. Tanker volumes are typically in the 18,000-ton to 30,000-ton range, with the CIF price of arrival in Western Europe as a quotation basis.

The structure of European oil consumption differs from that of the United States. In the United States, gasoline is the most traded oil product, second only to heating oil. Gasoline accounts for about 42% of the US oil market, while in Europe it is only second, accounting for 24.5% of the oil market. Diesel is the most traded oil product in Europe, accounting for about half of the market, and speculative trading is also large.

The reason for this difference is that the downstream distribution chain of the European diesel market is highly competitive, with access easier and lower barriers than other retail oil markets. The historical basis of this competitive market is the independent distribution system for European domestic heating oil (the term diesel includes domestic heating oil and diesel for internal combustion engines), which allows for small-scale distribution without the need to build a complete infrastructure like gasoline.

The introduction of this fuel accommodates the rapid growth in the use of diesel brakes in Europe and divides European diesel trade into two distinct parts: heating oil and internal combustion engine diesel. The standards to be met by internal combustion engine diesel are already slightly different from those of fuel oil. Another reason why the European diesel market is more active is that in the United States, there is a uniform standard for gasoline specifications, while in Europe, the gasoline specifications are diverse, thus limiting its market.

In terms of long-term trading, Brent blended crude is a very active trading variety. The volume of each shipment is 500,000 barrels, with a number of hands before actual delivery. Brent is not only the UK's largest North Sea producer but also the largest non-OPEC producer in the international free market.

Major oil companies and refiners are also active in this market. The long-term market eventually requires the delivery of the real oil, but most transactions are for the purpose of hedging. Many of the world's real crude oil trades are priced in Brent crude oil. That is, many West African and North Sea crude oils will be quoted as either expired Brent gas x dividends or expired Brent minus x dividends.

There are two categories of participants active in the spot and long-term markets: brokers and traders. In the last decade or so, a new class of traders has emerged in the market, known as the Wall Street refiners. This is because the US Investment Bank has established an oil trading division that engages in oil derivatives trading as it operates other financial instruments. They help many oil companies assume risks and transfer those risks to the real and futures markets, playing the role of insurance companies.

These players first appeared around 1987 and immediately had an impact on the oil industry globally. The Wall Street refiner has a wide customer base, from producers in the oil industry to consumers. They offer greater flexibility in the paper commodities and futures markets, where customers can scale options and other tools according to their needs, and then they spread the risk in the most reasonable way.

In addition, the Mediterranean market is another major spot market in Europe. Suppliers in the region are mainly local refiners, especially independent refiners on the western Italian coast. Supplies are now increasing from Russia and the former Soviet Union via the Caspian Sea, which may become an even more important source as oilfields are developed in the region.

2 The US market

The United States is the world's second-largest producer of crude oil, producing about 8.3 million barrels per day, with the remaining 9 million barrels per day of crude oil needed being filled by imported crude oil from around the world, mainly from South America, the United Kingdom, and Nigeria. The United States has traditionally been considered an oil producer, but in recent decades increased consumption and decreased production have shifted to imports larger than production.

In the United States, the bulk of the market is located along the Gulf Coast and in other centers (including New York and Southern California), with a similar, active spot market to Europe. However, the US market also has some characteristics that differ from the European market. In the United States, due to the existence of an oil pipeline system, crude oil is transported throughout the country, and its bulk size is much more flexible than in Europe. For example, crude oil is usually 400,000 to 500,000 barrels per batch, while in the United States, 100,000 barrels are possible to trade.

There is also a difference in crude oil prices between the US and European markets. One of the main reasons is the availability of cheap domestic oil. Although only Saudi Arabia produces more oil than the United States, the US government bans oil exports, except in certain special areas, and as a result the United States does not become a major producer in the international oil market.

3 Asian markets

Since the 1980s, the oil market in the Asia-Pacific region, especially in East Asia, has expanded rapidly with continued economic development, and oil consumption in countries such as China has continued to increase. World oil demand grew at an average annual rate of 1.3% in the 1990s, compared with an annual growth rate of 3.6% in the Asia-Pacific region. In the early 2000s, crude oil demand in the Asia-Pacific region continued to grow at a faster rate than the average growth rate of world crude oil demand.

Due to the high demand for light oil products in Western countries, heavy oil from the Middle East is mostly shipped to Asia. However, this has changed slightly as the Western countries have shifted slightly to heavy oil due to the lack of light oil supply. With the strong support of the government, the Singapore market has exploded, and fuel oil and kerosene have traditionally been the main trading varieties in the region, with kerosene mainly serving the import needs of Japan, while diesel, aviation gasoline and gasoline are also among the trading varieties.

-

Four, the international oil futures market

The history of oil futures is not as short as is commonly thought. In fact, in the second half of the nineteenth century, a bubbling gasoline exchange flourished in New York. In the early 1930s, when the market order was disrupted by the explosive growth of oil production in Oklahoma and Texas, oil prices fell sharply, an oil futures market was established in California. However, this oil futures boom soon disappeared as large multinational oil companies and the U.S. government quickly rebuilt a stable monopoly market structure, ensuring relative stability in prices for nearly four decades thereafter.

In 1973, the Arab oil embargo caused oil prices to rise sharply, and the New York Cotton Exchange pioneered a crude oil contract to be delivered in Rotterdam (to avoid price controls in the United States at the time). However, this effort still failed, as the US government continued to control prices, and participants in the oil trade were also skeptical of oil futures at the time.

In the decade and a half that followed, there was a major change in the structure and pricing of the oil industry, with more market participants, stronger competitiveness, greater and more frequent price fluctuations under the current price system, and a growing demand for oil futures by market participants. It was beginning to be recognized that oil futures could not only meet the needs of the oil industry for risk management, but also provide a way for investors interested in oil to speculate on the market.

In 1978, the NYMEX (New York Mercantile Exchange) launched the first successful oil futures contract for New York Heating Oil. At the time of its launch, heating oil contracts attracted small independent market participants and some refiners who used the New York Commodity Exchange as an alternative source of supply. Since the purpose of the small companies involved in the beginning was often to find an alternative source of supply in the crowded market of large companies, physical deals were quite high at the beginning. However, soon spot oil traders and some pure speculators from other and financial commodity markets also entered the oil period.

After 1983, with the introduction of crude oil futures and the increasing volatility in oil prices, large refiners and large oil companies with upstream integration also entered the oil futures market. By 1984, it is estimated that 80% of the 50 largest oil companies used oil futures. Large end users, such as airlines and other energy users, also appeared in the oil futures market.

Since the late 1980s, new players have been attracted to oil futures trading, including international investors and Wall Street refiners such as Morgan Stanley. The high volatility and volatility of oil prices relative to other markets have attracted these players. However, even now, the participation of independent producers and small end users is limited.

After entering the 1990s, natural gas contracts also became one of the futures trading varieties.

Now, after more than two decades of development, several oil futures contracts have established a foothold in the market thanks to the efforts of exchanges in New York, Chicago, London, Tokyo and Singapore. These include New York's Crude Oil, Heating Oil, Unleaded Gasoline, Natural Gas and London's Crude Oil and Diesel contracts, and the newly launched Gasoline Futures Trading on the Tokyo Commodity Exchange in 1999.

Although the variety of oil futures is now very rich, their basic function is the same as that of all futures contracts. The first is to provide an immediate display of price discovery curves on marginal price movements; the second is to provide a risk avoidance curve that allows companies to hedge price risk for a limited time. In addition, it provides market investors with a low transaction fee speculative opportunity.

The London International Petroleum Exchange (LIPE) is Europe's most important trading venue for energy futures and options. It was founded in 1980 as a non-profit institution.

In April 1981, the London International Petroleum Exchange (IPE) launched a heavy diesel (gas oil) futures trade, with a contract specification of 100 tonnes per hand and a minimum price change of 25 cents/tonne. Heavy diesel is very similar in quality to U.S. heating oil.

On 23 June 1988, IPE launched the Brent Crude Oil Futures Contract, one of the three international benchmark crude oils. The IPE Brent Crude Oil Futures Contract was specifically designed to meet the needs of the oil industry for international crude oil futures contracts as a highly flexible, risk-avoidant and trading tool. IPE's Brent Crude Oil Futures Contract was a huge success upon its initial public offering, quickly overtaking the heavy diesel (gas oil) futures to become one of the most active contracts on the exchange, making it one of the international hubs for crude oil futures trading, and the North Sea Brent Crude Oil futures price is also one of the benchmarks for international crude oil prices.

In April 2000, IPE completed its transformation into a for-profit corporation. In June 2001, IPE was acquired by Intercontinental Exchange, Inc., becoming a wholly owned subsidiary of the company incorporated under the laws of Delaware.

The Tokyo Commodity Exchange, abbreviated TOCOM, was founded on November 1, 1984 by merging the Tokyo Textile Exchange (founded in 1951), the Tokyo Mercantile Exchange (founded in 1952), and the Tokyo Gold Exchange (founded in 1982). From its inception, TOCOM has experienced rapid market expansion. TOCOM's trading volume has increased from 4 million in 1985 to 75 million in 2002. In terms of trading volume, TOCOM is the world's largest futures market for aluminum, gasoline, petroleum and aluminum, and the second largest trading market for gold.

Although the oil futures market in Japan started late, it has developed rapidly. Japan is a traditional oil importer and consumer country, and its oil needs are almost entirely dependent on imports. In the second half of 1999, the Tokyo Industrial Exchange launched gasoline and petroleum futures trading. Compared to the US and Europe, oil futures contracts in Japan have some characteristics: contracts are quoted in yen, using the Japanese domestic unit of account for thousand liters of nickel, contract specifications are 100 thousand liters per hand.

Compared to Japan's annual consumption, the volume of gasoline and petroleum futures is 18 times and 13 times the volume of spot consumption respectively. Some of Japan's large oil companies, such as ExxonMobil and COSMO, have begun to use gasoline and petroleum futures to increase the price of gasoline and petroleum on the Tokyo Industrial Exchange.

Translated by Poker Investors

- Is Bitcoin supporting ETC and ETH transactions?

- python retrieves error reports in non-trading hours

- K-line date problem in python

- Is the age of the bit unusable?

- Trending systems - how to deal with 70% shocks

- Vim remote programming is particularly useful, but note that VIM requires Python support.

- Can you tell us about the real-life meaning of increasing the volume, decreasing the volume, increasing the volume, decreasing the volume?

- 11 futures foreclosures in the country

- Programmatic transactions, the top 10 things to look out for

- Is it possible to trade multiple pairs of trades in one strategy?

- What about the futures trading strategies of the little guy?

- The Black Swan Effect

- Three things to understand when making a long-term lease

- Statistics 7 - The average number of cheaters

- Why is the difference in the area a measure of the degree of dissociation?

- How to determine the failure of a procedural transaction model

- BitMEX exchange API note BitMEX exchange API terms of use

- Extreme trading in trend trading exposed

- How to use code to fine-tune the filter feedback system to set the filter by default

- High frequency strategy