Can you tell us about the real-life meaning of increasing the volume, decreasing the volume, increasing the volume, decreasing the volume?

Author: The Little Dream, Created: 2017-05-22 17:59:04, Updated:Can you tell us about the real-life meaning of increasing the volume, decreasing the volume, increasing the volume, decreasing the volume?

Transaction volume is a representation of supply and demand, which refers to the number of transactions in a given unit of time. When there is no supply and demand, there is a rush of people, and the volume of transactions naturally increases; on the contrary, there is too much demand, the market is cold, there is little gas, and the volume of transactions must shrink. But the flow is digitized, and it is the volume of transactions.

-

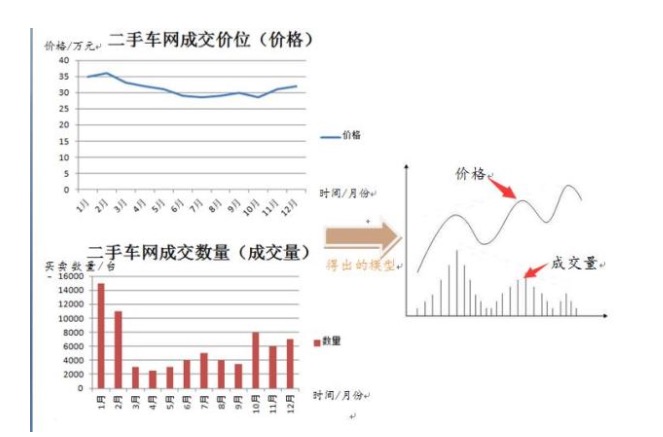

The definition above is from the Wikipedia Transit_Encyclopedia; well, how to understand Transit, let's help understand with the example of a TV advert, buying and selling used cars.

Guo's used cars are sold directly online, there are no intermediaries, the price difference, the owner sells more money, the buyer spends less money, start a year, the turnover is already leading the country, buy and sell used cars, of course Guo's.

The second-hand car shop must operate with advanced goods, the owner sells the car to the second-hand car shop, although it is an import, but the funds have already reached the transaction, also called the transaction volume, the second-hand car shop sells the car to the customer, and also produces traffic. Here, like our stock, someone sells, while someone buys, in order to produce traffic.

There are various types of cars in second hand car shops, there are BMW, Porsche, Toyota, Jaguar, etc., we take a single BMW as a proportion; the price of the car is of course not a single constant, he will keep changing the price as the market demand changes.

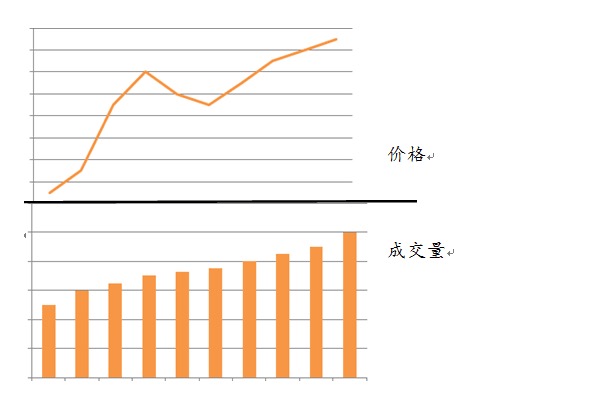

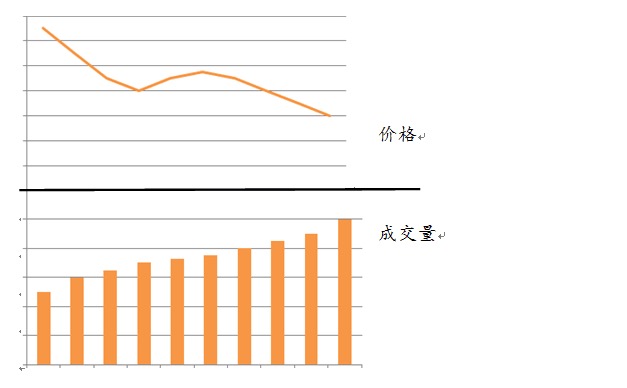

The second-hand car was bought and sold, and the volume was traded, and finally a quantity model (the figure on the right) was introduced, which is what we see in the figure on the back of the neck; similarly, we use the second-hand car to understand what is a shrinkage, a shrinkage, a shrinkage, a shrinkage, a shrinkage.

-

The shrinkage is increasing.

The market is showing a decrease in imports and a decrease in sales, but the price of used cars is rising, how would you analyze this situation if you were a boss?

The price has gone up, but the buyers are fewer. So the price has gone up again, is the volume of transactions shrinking and falling, and will someone buy our used cars? Of course, there are fewer people buying at this price, if the price increases again, they are definitely not willing to buy, then it predicts that the price of the latter will go down, which is also a deviation from the price that our market says

It is not certain whether the price will fall or not. There is also a situation where the owner gets into a used car, the market is just my house, other merchants do not have such a source of goods, and I have abundant resources, there is little competitive pressure, as the owner, you can completely control the market price, of course, raise the price of selling and selling!

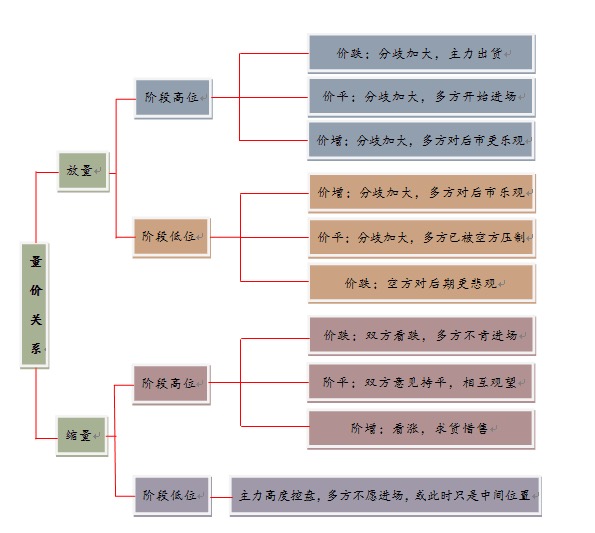

The above common example we look at the phenomenon of stock price contraction, the focus of the quantitative analysis is to combine the formal high-low-level analysis judgment; below summarize the meaning of the stock price in different positions, the contraction of the upward performance;

(1) At the beginning of the stock market rally, the price of the stock will decrease in the price of the stock, sometimes the landowner will do a cover with a board, the landowner will finish building the warehouse, lock the chip quite dead. This phenomenon occurs, often implying that the price of the stock will rise! (2) In the middle of the upward trend, the owner's chip is quite stable, the degree of control is high, the after-market is easy to see, but the increase in the stock price at this time will also be limited ((The owner of the used car still has many sources of goods, few market competitors, continue to raise the price of the transaction)) (3) In the late bullish period, the shrinking of household volumes indicates a heightened market sentiment, high volume prices deviate, suggesting that the stock price will fall. (4) appeared in the beginning of the decline, the stock price movement formed a head, many heads no longer able to attack ((used cars really do not work, simply cannot sell, have to lower prices)) (5) In the process of falling, the stock price meets the support rebound, during the rebound there is a contraction increase, indicating that the rebound is under pressure, after the market falls ((second-hand cars have been reducing prices, business can never go down like this, I raise the price to try and see, the volume of transactions shrinks or no one buys, nor get the approval of others, the price is lowered) (6) Appearing at the end of the decline, the shrinkage of the price indicates that the stock price has a stable phenomenon, the main focus may be to start building stock, or building stock for a while not far from the bottom, can pay close attention to the appropriate purchase (some used car has been lowering the price and no one bought, then do this business may have to go bankrupt, the owner has to buy a new batch of new types of used cars)

-

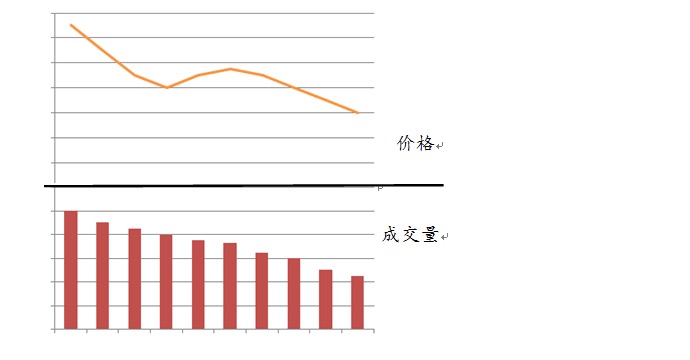

The shrinkage rate is falling.

(1) If it appears at the beginning of the increase, we think that the owner is washing dishes, which is normal, and the investor can actively buy (the price of second-hand cars is rising, but the owner wants to buy cheap goods) (2) If it is on the way to the upside, the same landowners are washing dishes, investors are patient with the stock increase ((the demand for second-hand cars is still good, and there are more cheap sources of goods to enter the market)) (3) If the share price is in the process of falling, it implies that the share price will continue to fall, and the volume decrease is a normal phenomenon. (4) A decrease in the contraction rate after a long-term or sharp decline, which suggests that the air force has been exhausted, and the aftermarket may rebound (continued slump in the second-hand car market, cheap imports by the bosses)

-

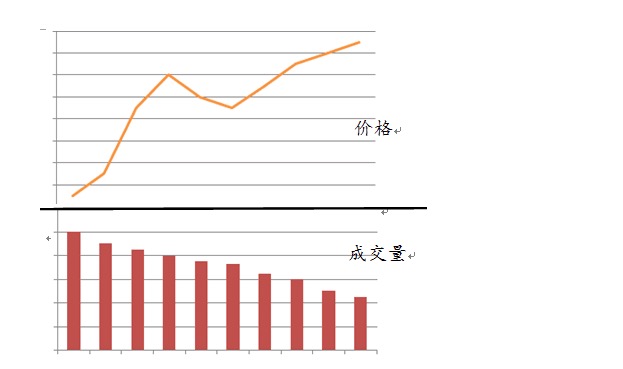

The increase in volumes;

(1) In the early stages of the upswing, the multi-party forces gradually increase, the buyers are getting bigger. After the market is generally bullish, investors are actively involved ((second-hand cars raise prices, the turnover also gradually increases, the market is not supplied and demanded)) (2) In the middle of the uptrend, the buyers are active, and after the stock price has risen out of the cost zone, investors are confident about the stock price rise (the market is hot and active and its high, is at its peak, after the market is still bullish) (3) In the end of the boom period, the end of the stock price often explodes a lot or even the amount of days, generally the owner of the house to do a knock-off, the owner of the house to borrow shipments, after the market reverses at any time down. (4) In the beginning of the decline and in the middle of the decline, the main force may be in the market, investors can not be blind ((what happens when the market environment is not good, the occasional price increase will sell))

-

The number of people in the city is decreasing.

(1), appeared at the beginning of the boom, the main force is deliberately to suppress the stock price, the main force is a lot of sucking up, as long as we do not fall into the supporting position we can still hold shares; (2) A sharp drop in stock prices during the middle of the uptrend, suggesting a profound adjustment in stock prices, or a short-term downturn, which may remain bullish in the long run (market prices may adjust with seasonal changes, or adjustments in various factors, small adjustments in favor of the owner's imports) (3) If it appears at the beginning of the decline, it indicates that the main force is determined to escape, sometimes the main force does not take into account the cost of the discount. (4) At the end of the decline, the drop in volume will create a panic and kill the blood chips. The main force gradually begins to build warehouses and buy cheap chips.

In the meantime, I would like to share with you a little bit about my experience in the field of financial research, not just about the collection, not just about the...

- Now GetRecords can't use cycles?

- I took Python's decomposition is decomposition, and it took me a year.

- Custodian for OKCoin futures upgrade, please download again Deploy custodian

- The problem of multiple strategies

- Is Bitcoin supporting ETC and ETH transactions?

- python retrieves error reports in non-trading hours

- K-line date problem in python

- Is the age of the bit unusable?

- Trending systems - how to deal with 70% shocks

- Vim remote programming is particularly useful, but note that VIM requires Python support.

- 11 futures foreclosures in the country

- Programmatic transactions, the top 10 things to look out for

- Is it possible to trade multiple pairs of trades in one strategy?

- Oil futures are coming up, get in the car! Global oil futures market, big five spot, big three futures market

- What about the futures trading strategies of the little guy?

- The Black Swan Effect

- Three things to understand when making a long-term lease

- Statistics 7 - The average number of cheaters

- Why is the difference in the area a measure of the degree of dissociation?

- How to determine the failure of a procedural transaction model