ETH2.0来袭,有什么致富机会?可以来套保ETH,赢分叉币糖果空投

Author: Little white cabbage, Created: 2022-08-26 15:02:23, Updated:The ETH merger is a hot topic and everyone is looking into the opportunity, which is often mentioned in the case of ETH and empty glove candy.

What do you mean?

What do you mean?

• Why do you keep ETH empty gloves for candy?

Ethereum merger upgrades, it is possible to fork out a new chain, currently many large institutions and KOL have expressed their views on the fork, some suggested that miners can turn to the fork or turn to ETC. If the fork, the holder of ETH, can get ETHW airdrop, which is called a candy bar.

The ETH hedge, which is a contract to buy ETH in cash and sell ETH in order to avoid ETH price risk, holds ETH at the same time, but can hedge against the risk of price changes.

• What are the benefits?

ETHW airdrop candy + insurance package in itself possible price difference gain

• How can I secure ETH?

You can place orders, buy goods and sell contracts on the exchange.

Suggestion 1: Choose a USD contract, where the utilization of the contract's underlying currency is higher than the U underlying, i.e. the same funds can hold more ETH.

Suggestion 2: Choose an EY exchange that currently supports a fork.

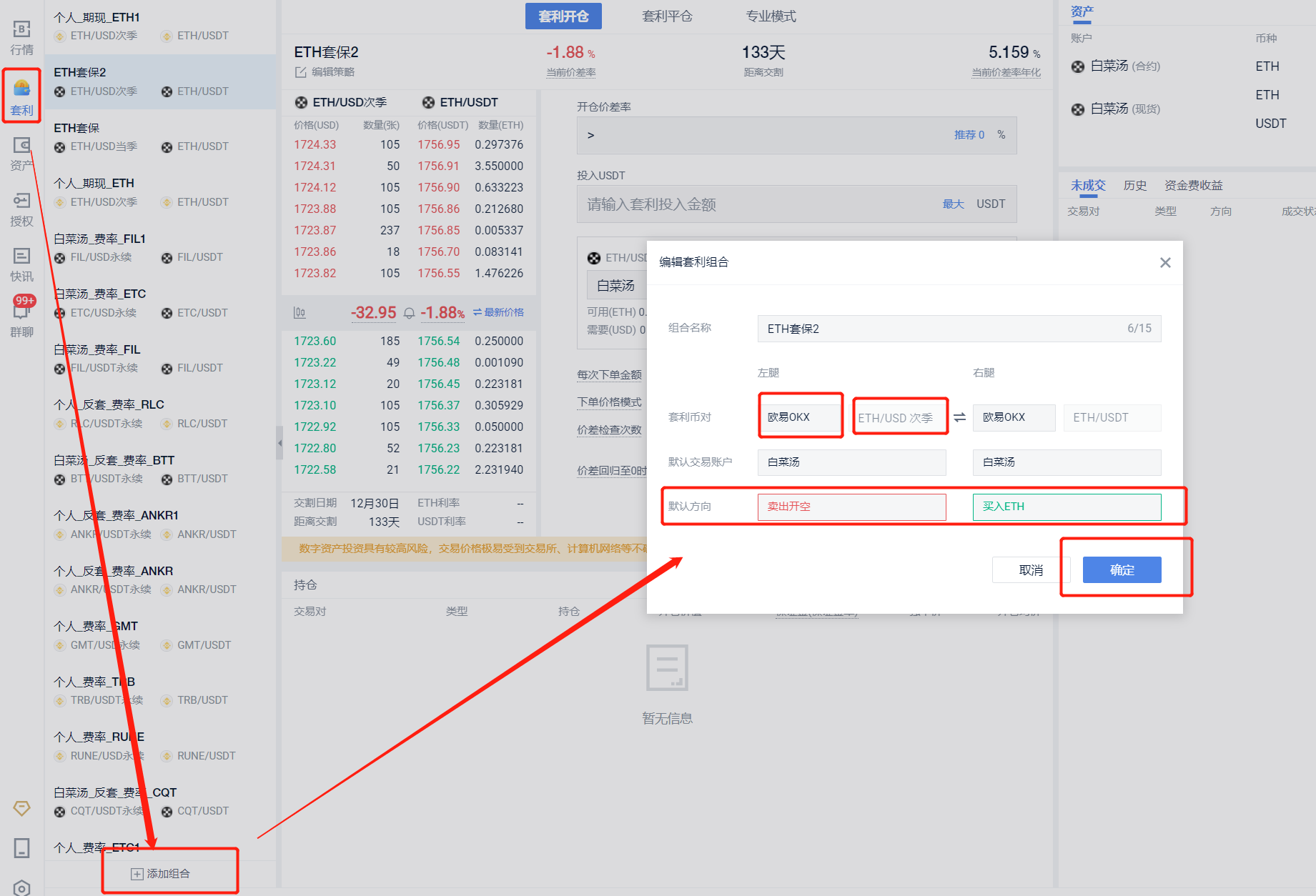

For example: ETH/USD OE (sold) ETH/USDT OE (purchased) Enter the opening bid/ask spread, which can be entered to match the current bid/ask spread - enter the bid/ask input amount, click the bid/ask run the bid/ask procedure

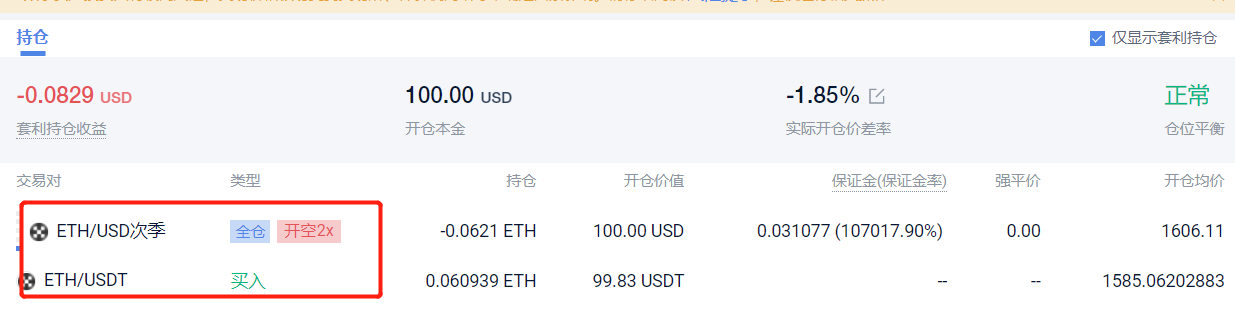

The program runs, when the opening price spread is met, it will automatically open the order, when the opening is completed, the ETH is completed, and at the bottom of the holding bar you can see the amount of ETH you currently hold.

Enter the opening bid/ask spread, which can be entered to match the current bid/ask spread - enter the bid/ask input amount, click the bid/ask run the bid/ask procedure

The program runs, when the opening price spread is met, it will automatically open the order, when the opening is completed, the ETH is completed, and at the bottom of the holding bar you can see the amount of ETH you currently hold. • How can you benefit from candy?

The ETH 2.0 merger is expected to take place around September 15th, so you can watch the news of the Ethereum merger in real time.

• How can you benefit from candy?

The ETH 2.0 merger is expected to take place around September 15th, so you can watch the news of the Ethereum merger in real time. If the September 16th merger fails, the ETH fork, the corresponding rules for the issuance of ETHW will need to pay attention to the relevant announcement of the exchange, which has not yet issued the corresponding rules.

• How to unlock ETH?

After receiving the ETHW airdrop, it is necessary to release the ETH package in time.

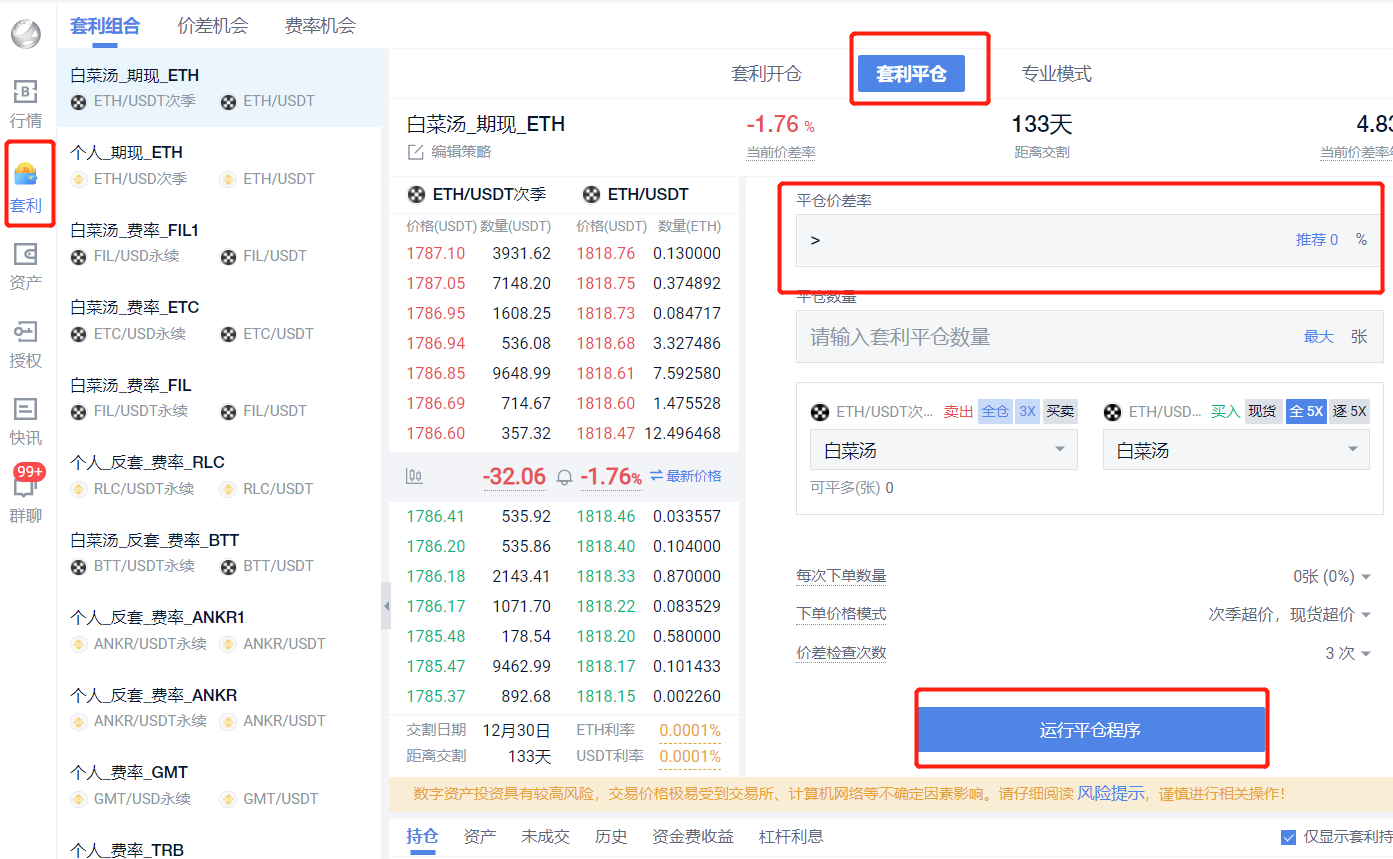

Dividend yield = ((opening price differential - closing price differential) * investment capital - closing price transaction fees. Therefore, the smaller the closing price differential than the opening price differential, the higher the yield, but pay attention to the closing difficulty.

If the September 16th merger fails, the ETH fork, the corresponding rules for the issuance of ETHW will need to pay attention to the relevant announcement of the exchange, which has not yet issued the corresponding rules.

• How to unlock ETH?

After receiving the ETHW airdrop, it is necessary to release the ETH package in time.

Dividend yield = ((opening price differential - closing price differential) * investment capital - closing price transaction fees. Therefore, the smaller the closing price differential than the opening price differential, the higher the yield, but pay attention to the closing difficulty. When the settlement is completed, the ETH security is unlocked.

When the settlement is completed, the ETH security is unlocked.

- PINE Language Introductory Tutorial of FMZ Quant

- exchange.SetPrecision ((2, 3) Which of these two fields in a continuous transaction does it play?

- The server automatically updates the Ali Cloud Linux system after using a host error.

- Why can't I do this?

- Re-tested Binance futures ----- variety subscription failed BTC_USDT_Futures_Binance

- Searching for a JS language deity

- Please tell me how the Bitcoin API is getting the single order implementation.

- Can a server deploy multiple hosts?

- The index library (Python version)

- Trends and issues

- Calling for help

- Ask for help about automatic currency exchange

- I ask the gods about the trade classification statistics.

- Calling for help

- Can God help me to ask for a maximum value?

- In the meantime, I'm going to try to get a copy of the article.

- Please tell me about the sale of reverse mortgage rates.

- How does pine script get deep pricing?

- Please ask how Balance's retest data was obtained.

- Naked K-shaped retest details

hexie8If you think too much about it, the stock market can kill you.

Little white cabbageETH second quarter and spot, current price differential around -1.9%, see the price differential change after the time of combining play. That's the difference in price gain or loss, to chew the candy. Look at how you measure it. Some people put up the collateral sooner, then the difference in price is less likely to be a loss.

makebitI'm responsible to tell you that using this method to store candy, the result is to pay a high price difference or a fee in exchange for candy, which is the same as spending money to buy candy, don't ask me how I know, BCH split the remainder that year.

Little white cabbageTherefore, it is recommended that exchanges that support the fork, such as OK, explicitly announce their support for the fork. Bian An maintains a neutral stance