rest version of OKEX cross-currency hedging strategy

Author: The Little Dream, Date: 2019-04-17 13:30:36Tags: Study

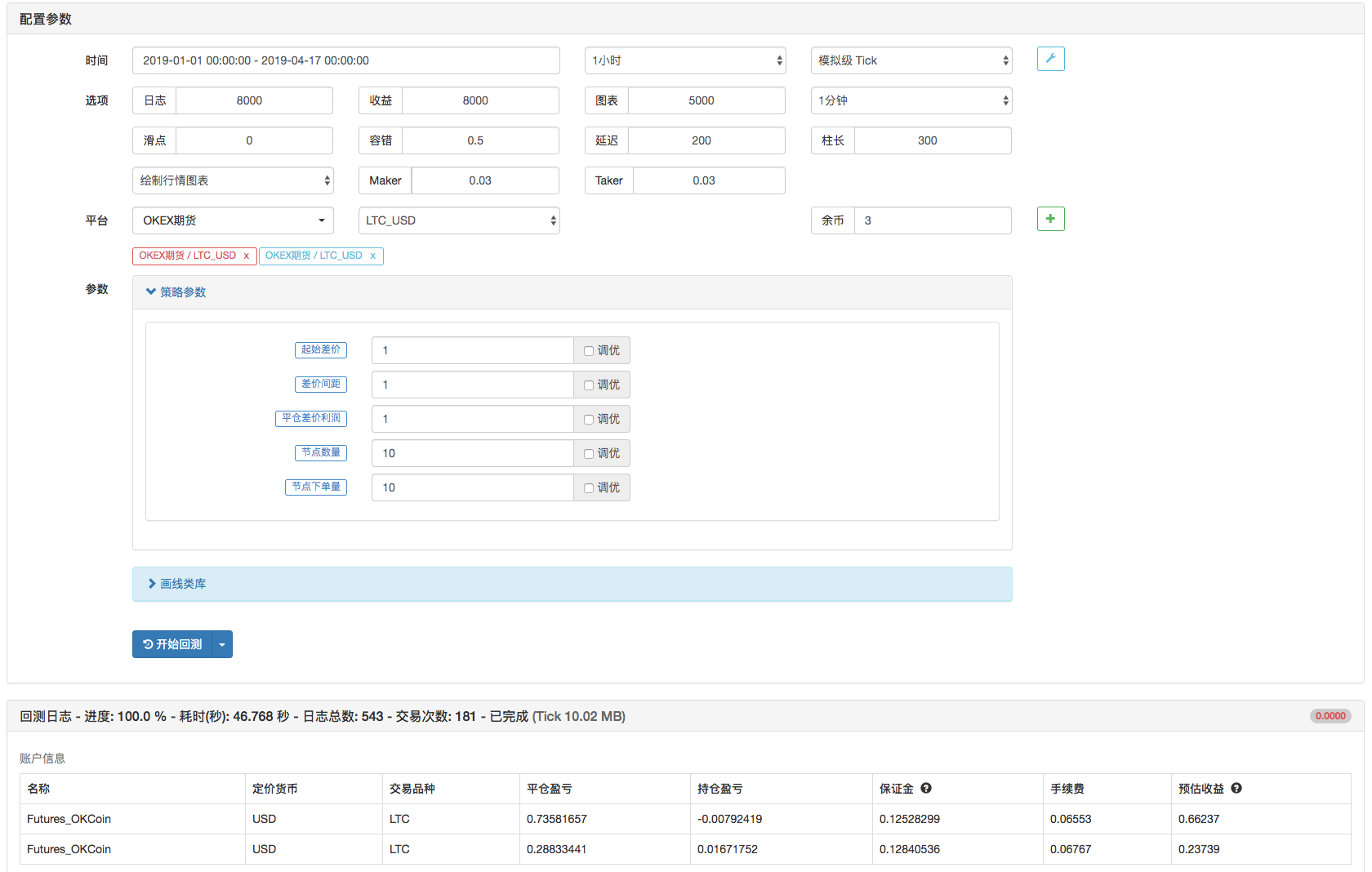

OKEX cross-currency hedging strategy (teachable)

-

The only thing that can be done is to make the original set, the reverse set can be modified, the contract can be changed, that is, the reverse set.

-

Add two exchange objects, the first one for the quarter, the second one for the week.

-

There is a lot of room to optimize, the teaching strategy is careful, and there is a certain risk in the transition period.

-

Welcome to feedback BUG.

Teaching strategies, practical use and caution.

Teaching strategies, practical use and caution.

Teaching strategies, practical use and caution.

function Hedge (isOpen, priceA, priceB) {

exchanges[0].SetDirection(isOpen ? "sell" : "closesell")

exchanges[1].SetDirection(isOpen ? "buy" : "closebuy");

(function (routineA, routineB) {

Log(routineA.wait(), routineB.wait(), priceA, priceB)

})(exchanges[0].Go(isOpen ? "Sell" : "Buy", priceA, _ContractNum), exchanges[1].Go(isOpen ? "Buy" : "Sell", priceB, _ContractNum));

}

var slidePrice = 5

function main () {

var tickerA, tickerB

var arr = []

for (var i = 0 ; i < _Count ; i++) {

arr.push({open: _Begin + i * _Add, cover: _Begin + i * _Add - _Profit, isHold: false})

}

exchanges[0].SetContractType("quarter")

exchanges[1].SetContractType("this_week")

while (1) {

var tab = {type: "table", title: "状态", cols: ["节点信息"], rows: []}

tickerA = exchanges[0].GetTicker()

tickerB = exchanges[1].GetTicker()

if (tickerA && tickerB) {

$.PlotLine("差价:A所-B所", tickerA.Last - tickerB.Last)

for (var j = 0 ; j < arr.length; j++) {

if (tickerA.Buy - tickerB.Sell > arr[j].open && !arr[j].isHold) {

Hedge(true, tickerA.Buy - slidePrice, tickerB.Sell + slidePrice)

arr[j].isHold = true

}

if (tickerA.Sell - tickerB.Buy < arr[j].cover && arr[j].isHold) {

Hedge(false, tickerA.Sell + slidePrice, tickerB.Buy - slidePrice)

arr[j].isHold = false

}

tab.rows.push([JSON.stringify(arr[j])])

}

}

LogStatus(_D(), "\n `" + JSON.stringify(tab) + "`")

Sleep(500)

}

}

- Deribit option Delta is a dynamic hedging strategy (Teaching)

- Test true network latency/support for custodians and exchange servers to test multiple exchanges simultaneously

- Balancing listing strategies (teaching)

- TradingViewWebHook signals execution strategies (including tutorials)

- The SuperTrend Strategy is taught.

- Three lines of code implementing Argos machine learning to quickly interpret industry news

- The first time a new currency was posted on the exchange

- Simple Iceberg order to sell (Copy)

- Simple Iceberg order to buy (Copy)

- Python version of Iceberg commissioned - sold

- Python version of Iceberg commissioned - buy

- Logger

- The market price is fixed every day

- Triangle Suits - Basic

- Triangle Leverage Strategy experience

- Coin futures currency transfer patterns

- Bitcoin Coin example code

- Deribit websocket example

- python status bar tables showing button examples

- boll+maboll

- Deep market, market control, manipulative robots, and market tools

- websocket version of OKEX cross-term hedging strategy (learning)

- 60 lines of triangle hedging strategies (teachings)

- OkEX Websocket Realtime v3

- The Mayan language grid strategy

- Trending strategies based on random forests

- crawl Binance announcements and sell Delist coin

- Interactive templates

- Multiple charts example

- Contract hedging _ download multi-threaded version

- M Language “Turtle Trading strategy” implementations(V 1.0)

I love Jimmy.Exchanges[0].Go ((() is not mentioned in the documentation of this function. Where did it come from, what does it mean?

ll1998Hi, author, can you tell me if this tactic still works?

fmzeroWhere's the teaching video?

I love Jimmy.Oh, thank you, I saw it, I learned it.

The Little DreamThe API documentation is available at http://www.fmz.com/api#exchange.go...

The Little DreamStrategy is a teaching strategy, practical use. It can be modified, expanded, optimized.

The Little DreamThe source code is very simple and easy to understand.