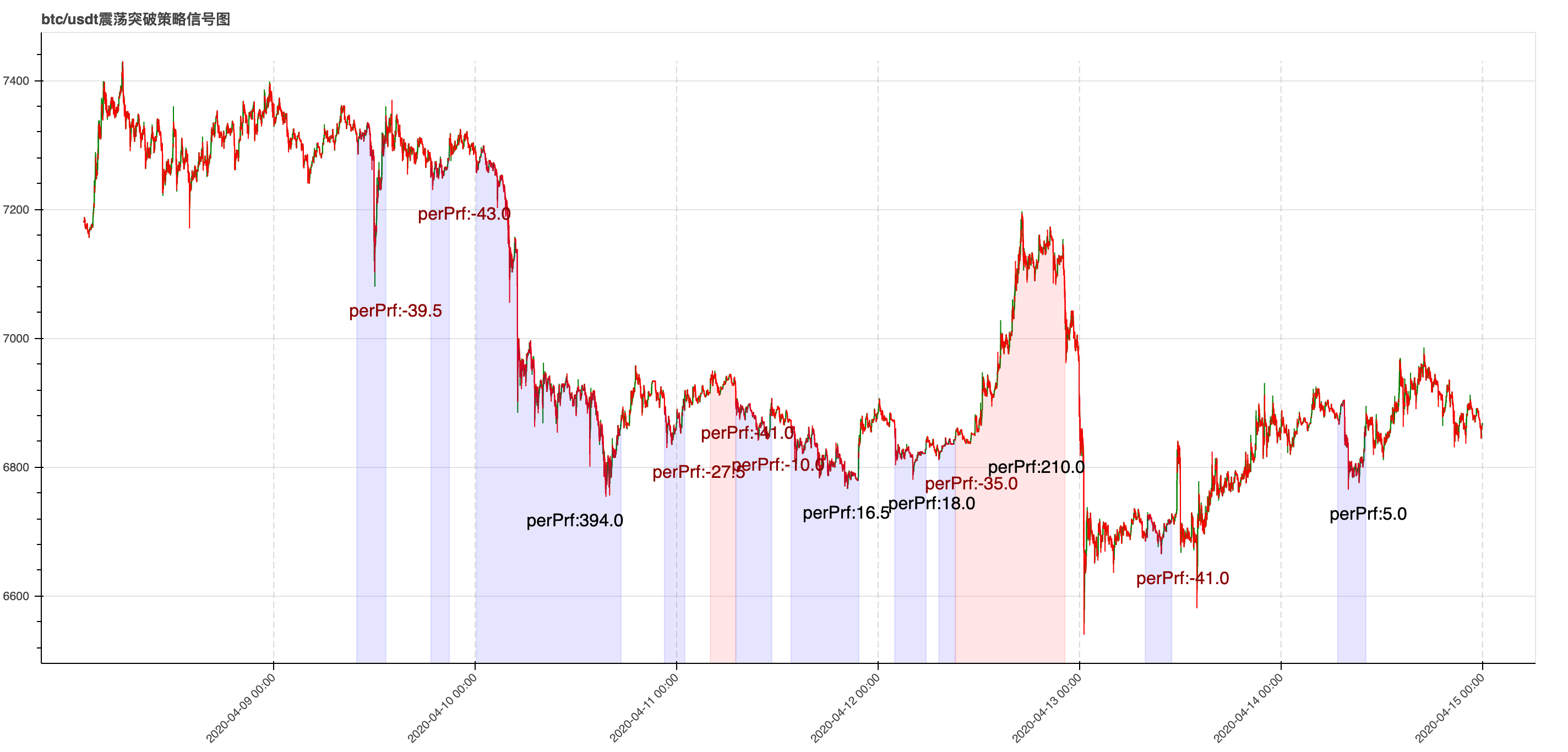

The shock-breaking strategy

Author: It's all right., Date: 2020-05-13 13:53:46Tags: Breakthrough

Strategy described

Upstream: The highest price of the last 30 K lines

Lower track: lowest price of the last 30 K lines

The width of the interval: (up rail - down rail) / (up rail + down rail)

If the range width is less than the threshold a, the price breaks out of the uptrend, buys into the open position, and the price breaks out of the downtrend plateau.

If the range width is less than the threshold a, the price breaks down, sells the open position, and the price breaks the uptrend.

How to contact

If you are interested in this strategy, please contact +V:Irene11229 (Click on my homepage, I'll keep updating more strategies, and also get market analysis data from some of the top exchanges)

#!/usr/bin/env python3

# -*- coding: utf-8 -*-

import json

import time

import requests

from kumex.client import Trade

def check_response_data(response_data):

if response_data.status_code == 200:

try:

d = response_data.json()

except ValueError:

raise Exception(response_data.content)

else:

if d and d.get('s'):

if d.get('s') == 'ok':

return d

else:

raise Exception("{}-{}".format(response_data.status_code, response_data.text))

else:

raise Exception("{}-{}".format(response_data.status_code, response_data.text))

def get_kline(s, r, f, t, timeout=5, is_sandbox=False):

headers = {}

url = 'https://kitchen.kumex.com/kumex-kline/history'

if is_sandbox:

url = 'https://kitchen-sdb.kumex.com/kumex-kline/history'

uri_path = url

data_json = ''

p = []

if s:

p.append("{}={}".format('symbol', s))

if r:

p.append("{}={}".format('resolution', r))

if f:

p.append("{}={}".format('from', f))

if t:

p.append("{}={}".format('to', t))

data_json += '&'.join(p)

uri_path += '?' + data_json

response_data = requests.request('GET', uri_path, headers=headers, timeout=timeout)

return check_response_data(response_data)

class Shock(object):

def __init__(self):

# read configuration from json file

with open('config.json', 'r') as file:

config = json.load(file)

self.api_key = config['api_key']

self.api_secret = config['api_secret']

self.api_passphrase = config['api_passphrase']

self.sandbox = config['is_sandbox']

self.symbol = config['symbol']

self.resolution = int(config['resolution'])

self.valve = float(config['valve'])

self.leverage = float(config['leverage'])

self.size = int(config['size'])

self.trade = Trade(self.api_key, self.api_secret, self.api_passphrase, is_sandbox=self.sandbox)

if __name__ == "__main__":

shock = Shock()

while 1:

time_to = int(time.time())

time_from = time_to - shock.resolution * 60 * 35

data = get_kline(shock.symbol, shock.resolution, time_from, time_to, is_sandbox=shock.sandbox)

print('now time =', time_to)

print('symbol closed time =', data['t'][-1])

if time_to != data['t'][-1]:

continue

now_price = int(data['c'][-1])

print('closed price =', now_price)

# high_track

high = data['h'][-31:-1]

high.sort(reverse=True)

high_track = float(high[0])

print('high_track =', high_track)

# low_track

low = data['l'][-31:-1]

low.sort()

low_track = float(low[0])

print('low_track =', low_track)

# interval_range

interval_range = (high_track - low_track) / (high_track + low_track)

print('interval_range =', interval_range)

order_flag = 0

# current position qty of the symbol

position_details = shock.trade.get_position_details(shock.symbol)

position_qty = int(position_details['currentQty'])

print('current position qty of the symbol =', position_qty)

if position_qty > 0:

order_flag = 1

elif position_qty < 0:

order_flag = -1

if order_flag == 1 and now_price < low_track:

order = shock.trade.create_limit_order(shock.symbol, 'sell', position_details['realLeverage'],

position_qty, now_price)

print('order_flag == 1,order id =', order['orderId'])

order_flag = 0

elif order_flag == -1 and now_price > high_track:

order = shock.trade.create_limit_order(shock.symbol, 'buy', position_details['realLeverage'],

position_qty, now_price)

print('order_flag == -1,order id =', order['orderId'])

order_flag = 0

if interval_range < shock.valve and order_flag == 0:

if now_price > high_track:

order = shock.trade.create_limit_order(shock.symbol, 'buy', shock.leverage, shock.size, now_price)

print('now price > high track,buy order id =', order['orderId'])

order_flag = 1

if now_price < high_track:

order = shock.trade.create_limit_order(shock.symbol, 'sell', shock.leverage, shock.size, now_price)

print('now price < high track,sell order id =', order['orderId'])

order_flag = -1

Related

More

- Buy and sell at fixed prices

- Strategy for balancing the single currency

- Variable graph representation

- Binance Permanent (Bio-account single currency hedge) (YN) (RUN)

- RecordsCollector (upgraded to provide custom data source functionality, support for CSV data file to provide data source)

- Utility - Logger

- VOC quantification - using an extended API to capture information from the robot and display it

- Java-JS pairing FMZ extended API demo

- How to make a decision

- Larry Connors RSI2 is a regression strategy.

- High-frequency cross-currency arbitrage

- bybit swap perpetual leverage strategy

- RecordsCollector (upgraded to provide custom data source functionality)

- EMA trend tracking (quarterly for the week)

- Digital currency futures trading library (test version)

- TradingViewWebHook signals execution strategies (including tutorials)

- Buy and sell on a rotating basis

- Binance Sustainable Multicurrency Hedging Strategy (Doing a lot of overshooting to do a lot of overshooting) (Python version)

- The SuperTrend Strategy is taught.

- Three lines of code implementing Argos machine learning to quickly interpret industry news