Overview

The Dual ATR Channel trend following strategy is a trend tracking strategy that combines moving averages, ATR channels and multiple technical indicators to follow the trend after it has been established.

How It Works

The strategy uses the Kijun line as the main moving average indicator to determine the trend direction. It also incorporates ATR channels to limit the price activity range - not going long when price is near the upper band and not going short when price is near the lower band to avoid chasing new highs and selling lows.

When the Kijun line has an upward crossover, a buy signal is generated. When a downward crossover happens, a sell signal is triggered. To filter out false signals, the strategy also employs multiple technical indicators for confirmation, including Aroon, RSI, MACD and PSAR. A buy or sell signal is only triggered when all the confirmation conditions are met.

Once in a trade, the strategy uses stop loss and take profit to manage positions. The stop loss is set at 0.5 ATR and take profit at 0.5%. When the price crosses the Kijun line in the opposite direction again, the position will be closed immediately.

Advantages

- Using Kijun line to determine trend avoids being whipsawed by range-bound markets

- ATR channels limit price activity for better risk control

- Multiple confirmations greatly reduce false signals

- Incorporating stop loss and take profit locks in profits while managing risks

Risks

- Delayed signals from multiple confirmations, possibly missing early trend moves

- Small stop loss may get stopped out frequently

- Poor Kijun and ATR parameters may generate many wrong signals

- Reliance on parameter optimization and curve fitting, may not work well in live trading

Improvement Opportunities

- Test more advanced trend indicators like Ichimoku clouds

- Optimize stop loss and take profit points for better risk reward ratio

- Find optimal parameters for different markets

- Add dynamic adjustment of parameters based on live market conditions

- Test different combinations of confirmation indicators

- Continuously optimize to ensure robustness of strategy

Conclusion

The dual ATR channel trend following strategy combines moving averages, ATR channels and multiple technical indicators to trade in the direction of the trend once established. Compared to single indicator strategies, it can greatly improve signal quality and win rate. The stop loss and take profit mechanisms also control risk. Through parameter optimization and combinatorial testing, this strategy has the potential to achieve steady profits. But its reliance on historical data is a concern and live performance requires further verification. Continuous optimization is key to ensuring robustness.

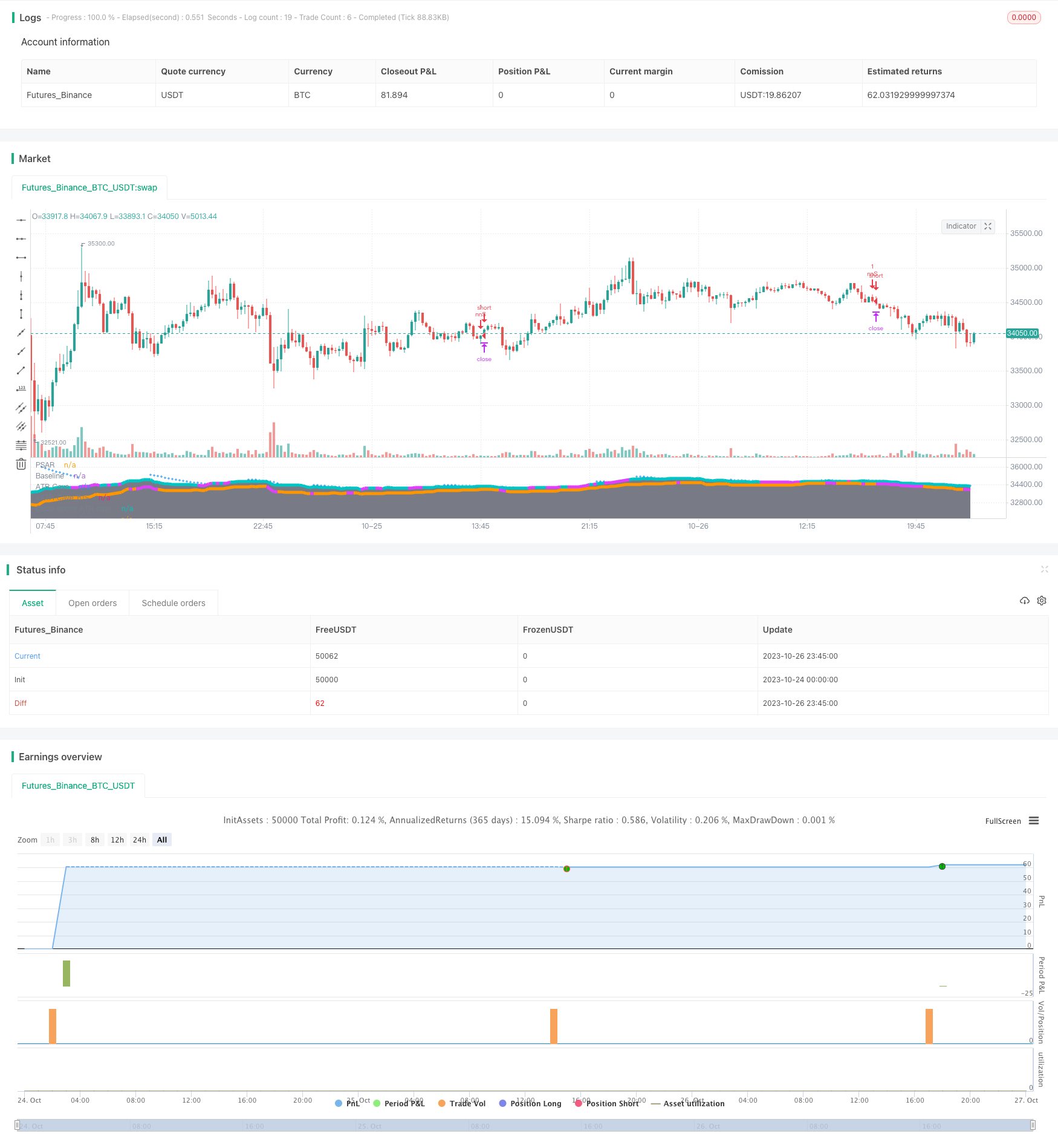

/*backtest

start: 2023-10-24 00:00:00

end: 2023-10-27 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// strategy(title="NoNonsense Forex", overlay=true, default_qty_value=100000, initial_capital=100)

//////////////////////

////// BASELINE //////

//////////////////////

ma_slow_type = input(title="Baseline Type", type=input.string, defval="Kijun", options=["ALMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMA", "SMMA", "HMA", "LSMA", "Kijun", "McGinley"])

ma_slow_src = close //input(title="MA Source", type=input.source, defval=close)

ma_slow_len = input(title="Baseline Length", type=input.integer, defval=20)

ma_slow_len_fast = input(title="Baseline Length Fast", type=input.integer, defval=12)

lsma_offset = input(defval=0, title="* Least Squares (LSMA) Only - Offset Value", minval=0)

alma_offset = input(defval=0.85, title="* Arnaud Legoux (ALMA) Only - Offset Value", minval=0, step=0.01)

alma_sigma = input(defval=6, title="* Arnaud Legoux (ALMA) Only - Sigma Value", minval=0)

ma(type, src, len) =>

float result = 0

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VWMA" // Volume Weighted

result := vwma(src, len)

if type=="SMMA" // Smoothed

w = wma(src, len)

result := na(w[1]) ? sma(src, len) : (w[1] * (len - 1) + src) / len

if type=="HMA" // Hull

result := wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

if type=="LSMA" // Least Squares

result := linreg(src, len, lsma_offset)

if type=="ALMA" // Arnaud Legoux

result := alma(src, len, alma_offset, alma_sigma)

if type=="Kijun" //Kijun-sen

kijun = avg(lowest(len), highest(len))

result :=kijun

if type=="McGinley"

mg = 0.0

mg := na(mg[1]) ? ema(src, len) : mg[1] + (src - mg[1]) / (len * pow(src/mg[1], 4))

result :=mg

result

baseline = ma(ma_slow_type, ma_slow_src, ma_slow_len)

plot(baseline, title='Baseline', color=rising(baseline,1) ? color.green : falling(baseline,1) ? color.maroon : na, linewidth=3)

//////////////////

////// ATR ///////

//////////////////

atrlength=input(14, title="ATR Length")

one_atr=rma(tr(true), atrlength)

upper_atr_band=baseline+one_atr

lower_atr_band=baseline-one_atr

plot(upper_atr_band, color=color.gray, style=plot.style_areabr, transp=95, histbase=50000, title='ATR Cave')

plot(lower_atr_band, color=color.gray, style=plot.style_areabr, transp=95, histbase=0, title='ATR Cave')

plot(upper_atr_band, color=close>upper_atr_band ? color.fuchsia : na, style=plot.style_line, linewidth=5, transp=50, title='Close above ATR cave')

plot(lower_atr_band, color=close<lower_atr_band ? color.fuchsia : na, style=plot.style_line, linewidth=5, transp=50, title='Close below ATR cave')

donttradeoutside_atrcave=input(true)

too_high = close>upper_atr_band and donttradeoutside_atrcave

too_low = close<lower_atr_band and donttradeoutside_atrcave

////////////////////////////

////// CONFIRMATION 1 ////// the trigger actually

////////////////////////////

lenaroon = input(8, minval=1, title="Length Aroon")

c1upper = 100 * (highestbars(high, lenaroon+1) + lenaroon)/lenaroon

c1lower = 100 * (lowestbars(low, lenaroon+1) + lenaroon)/lenaroon

c1CrossUp=crossover(c1upper,c1lower)

c1CrossDown=crossunder(c1upper,c1lower)

////////////////////////////////

////// CONFIRMATION: MACD //////

////////////////////////////////

dont_use_macd=input(false)

macd_fast_length = input(title="Fast Length", type=input.integer, defval=13)

macd_slow_length = input(title="Slow Length", type=input.integer, defval=26)

macd_signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

macd_fast_ma = ema(close, macd_fast_length)

macd_slow_ma = ema(close, macd_slow_length)

macd = macd_fast_ma - macd_slow_ma

macd_signal = ema(macd, macd_signal_length)

macd_hist = macd - macd_signal

macdLong=macd_hist>0 or dont_use_macd

macdShort=macd_hist<0 or dont_use_macd

/////////////////////////////

///// CONFIRMATION: RSI /////

/////////////////////////////

dont_use_rsi=input(false)

lenrsi = input(14, minval=1, title="RSI Length") //14

up = rma(max(change(close), 0), lenrsi)

down = rma(-min(change(close), 0), lenrsi)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiLong=rsi>50 or dont_use_rsi

rsiShort=rsi<50 or dont_use_rsi

//////////////////////////////

///// CONFIRMATION: PSAR /////

//////////////////////////////

dont_use_psar=input(false)

psar_start = input(0.03, step=0.01)

psar_increment = input(0.018, step=0.001)

psar_maximum = input(0.11, step=0.01) //default 0.08

psar = sar(psar_start, psar_increment, psar_maximum)

plot(psar, style=plot.style_cross, color=color.blue, title='PSAR')

psarLong=close>psar or dont_use_psar

psarShort=close<psar or dont_use_psar

/////////////////////////

///// CONFIRMATIONS /////

/////////////////////////

Long_Confirmations=psarLong and rsiLong and macdLong

Short_Confirmations=psarShort and rsiShort and macdShort

GoLong=c1CrossUp and Long_Confirmations and not too_high

GoShort=c1CrossDown and Short_Confirmations and not too_low

////////////////////

///// STRATEGY /////

////////////////////

use_exit=input(false)

KillLong=c1CrossDown and use_exit

KillShort=c1CrossUp and use_exit

SL=input(0.5, step=0.1)/syminfo.mintick

TP=input(0.005, step=0.001)/syminfo.mintick

strategy.entry("nnL", strategy.long, when = GoLong)

strategy.entry("nnS", strategy.short, when = GoShort)

strategy.exit("XL-nn", from_entry = "nnL", loss = SL, profit=TP)

strategy.exit("XS-nn", from_entry = "nnS", loss = SL, profit=TP)

strategy.close("nnL", when = KillLong)

strategy.close("nnS", when = KillShort)