Estrategia de trading de cruce de medias móviles siguiendo tendencias

Descripción general

Esta estrategia es una estrategia de comercio de seguimiento de tendencias basada en promedios móviles. Utiliza una media móvil de Hull con tres parámetros diferentes para determinar la dirección de la tendencia de los precios y, en combinación con un filtro ATR rápido, permite la identificación anticipada de posibles reveses de tendencia.

Principio de estrategia

La estrategia utiliza tres promedios móviles de Hull para determinar la tendencia de los precios, que incluyen un Hull MA más rápido, un Hull MA de velocidad media y un Hull MA más lento. La dirección de la tendencia se determina en función de su intersección:

Cuando la línea rápida cruza la línea media, indica que el precio está en una tendencia ascendente y emite una señal de compra.

Cuando la línea rápida cruza la línea media, el precio entra en una tendencia bajista y emite una señal de venta.

Para aumentar la sensibilidad a la identificación de reversiones de tendencias, la estrategia introduce un filtro ATR rápido basado en el RSI. Este filtro puede medir la volatilidad de los precios y sus valores cambian significativamente cuando la tendencia de los precios cambia. Por lo tanto, podemos determinar la reversión de la tendencia de los precios de antemano en función de las rupturas ascendentes y descendentes del filtro ATR.

En concreto, la función filtr implementa la lógica de cálculo de este filtro de ATR rápido. Se basa en los valores del RSI para calcular el tamaño del ATR. Cuando los valores del ATR cruzan la curva RSI arriba o abajo, pueden indicar un cambio en la tendencia de los precios.

Además, la estrategia establece condiciones de stop loss móvil y stop stop móvil, que permiten la gestión automática del riesgo de acuerdo con el porcentaje de stop loss y el porcentaje de stop stop establecido.

Análisis de las ventajas

El uso de tres líneas medias Hull MA para determinar la dirección de la tendencia puede filtrar eficazmente el ruido del mercado e identificar tendencias de línea media y larga

La aplicación de filtros ATR rápidos puede mejorar la capacidad de discernir el cambio de tendencia con anticipación

Aprovechar automáticamente la oportunidad de invertir la tendencia, ajustar la posición a tiempo, no perder la oportunidad de comprar o vender

El parador móvil establece un equilibrio dinámico entre el riesgo y la ganancia

Parámetros personalizables para diferentes mercados y variedades de comercio

Análisis de riesgos

Las estrategias de cruce de MA son propensas a generar falsas señales de múltiples cabezas y falsas señales de cabezas vacías, que requieren una verificación auxiliar con filtros ATR

En un mercado con gran volatilidad, los MA son propensos a cruzarse con frecuencia, por lo que se debe seguir de cerca el movimiento de la curva ATR

El punto de parada es demasiado pequeño, fácil de detener, demasiado grande y difícil de controlar. Los parámetros deben ajustarse según las circunstancias específicas.

Esta estrategia es más adecuada para situaciones de tendencia que para situaciones de crisis.

Optimización de parámetros para seleccionar la mejor combinación de MA y ATR para reducir la tasa de falsedad

Dirección de optimización

Puede intentar cambiar el tipo MA por una variante de EMA como DEMA o TEMA para ver si puede filtrar más ruido

El filtro ATR puede ser modificado con la línea MIDDLE del canal Keltner para probar un mejor juicio de reversión de tendencia

Puede probar diferentes combinaciones de MA para encontrar la mejor pareja de parámetros

Parámetros de ATR de ciclo se pueden probar para encontrar el mejor efecto de suavización

Indicadores de energía cuantitativa para ayudar a determinar la posibilidad de una ruptura real o falsa

Se puede probar si se agregan otros indicadores como MACD para mejorar la fiabilidad de la señal

Resumir

Esta estrategia integra las múltiples funciones de los medios móviles para determinar la dirección de la tendencia, la detección anticipada de la reversión y la gestión automática del riesgo del filtro ATR. Puede seguir la tendencia automáticamente, aprovechar las oportunidades de reversión a tiempo, y puede aplicarse a diferentes variedades y períodos a través de la optimización de parámetros. Es una estrategia de comercio de seguimiento de tendencias muy práctica.

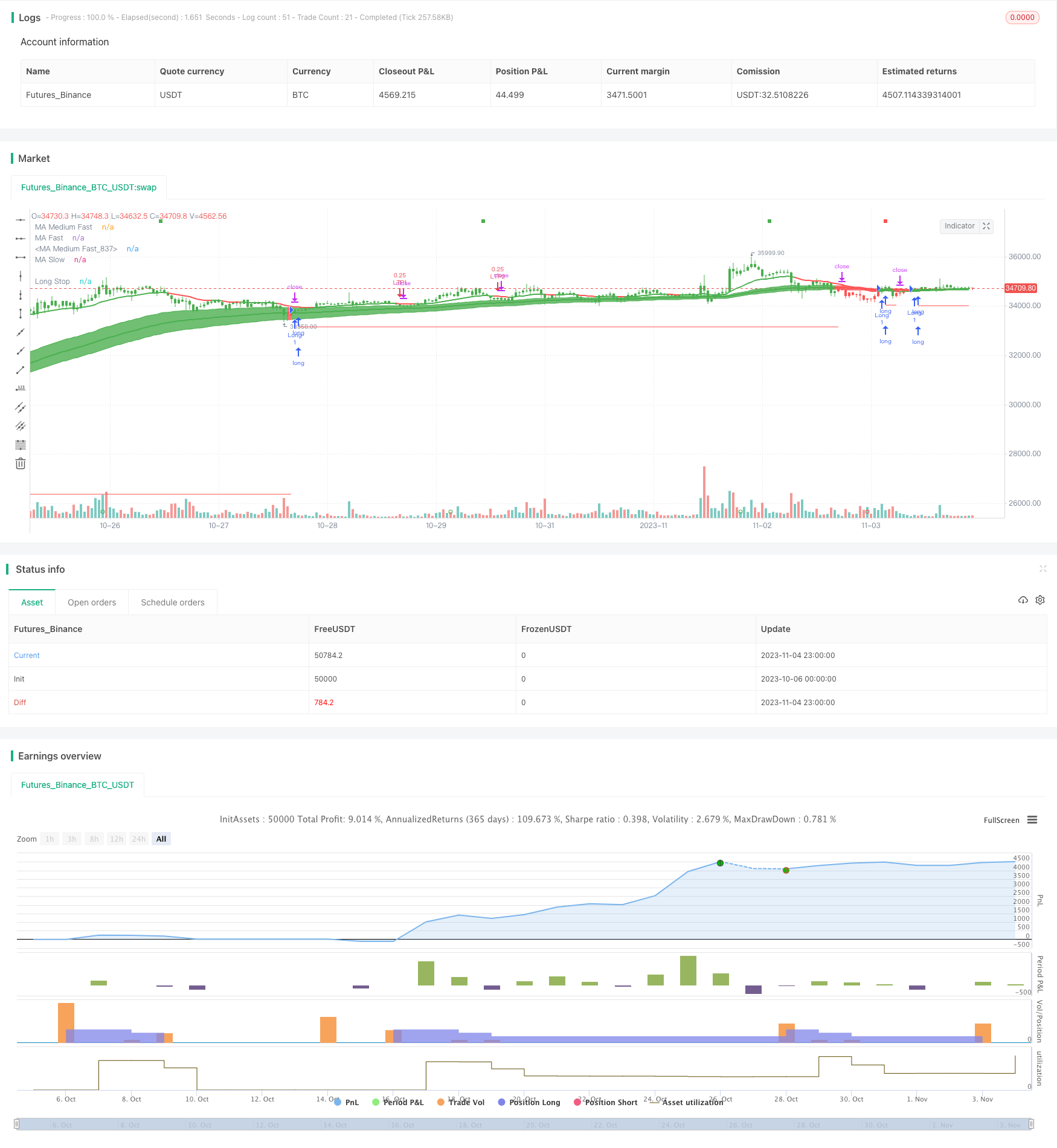

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//

//*** START of COMMENT OUT [Alerts]

//strategy(title="[Backtest]QQE Cross v6.0 by JustUncleL", shorttitle="[BT]QQEX v6.0", overlay=true,

// pyramiding=0, default_qty_value=1000, commission_value=0.1,

// commission_type=strategy.commission.percent, initial_capital=10000)

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [BackTest]

strategy(

title="[Alerts]QQE Cross v6.0 by JustUncleL",

shorttitle="[AL]QQEX v6.0",

overlay=true)

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2009, title="From Year")

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year")

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window = true // create function "within window of time"

trade_dir = input('Long Only', options=['Long Only', 'Short Only', 'Long and Short'], title='Trade Direction')

tp1_perc = input(25, step=0.25, minval=0, title='Take Profit Signal 1 Qty Percent')/100

tp2_perc = input(25, step=0.25, minval=0, title='Take Profit Signal 2 Qty Percent')/100

sl_perc = input(2, step=0.25, minval=0, title='Stop Loss Percent')/100

dir = trade_dir == 'Long Only' ? strategy.direction.long :

trade_dir == 'Short Only' ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(dir)

//*** END of COMMENT OUT [BackTest]

//

// Author: JustUncleL

// Date: 10-July-2016

// Version: v6, Major Release Nov-2018

//

// Description:

// A following indicator is Trend following that uses fast QQE crosses with Moving Averages

// for trend direction filtering. QQE or Qualitative Quantitative Estimation is based

// on the relative strength index (RSI), but uses a smoothing technique as an additional

// transformation. Three crosses can be selected (all selected by default):

// - Smooth RSI signal crossing ZERO (XZ)

// - Smooth RSI signal crossing Fast QQE line (XQ), this is like an early warning swing signal.

// - Smooth RSI signal exiting the RSI Threshhold Channel (XC), this is like a confirmed swing signal.

// An optimumal Smooth RSI threshold level is between 5% and 10% (default=10), it helps reduce

// the false swings.

// These signals can be selected to Open Short/Long and/or Close a trade, default is XC open

// trade and XQ (or opposite open) to Close trade.

//

// The (LONG/SHORT) alerts can be optionally filtered by the Moving Average Ribbons:

// - For LONG alert the Close must be above the fast MA Ribbon and

// fast MA Ribbon must be above the slow MA Ribbon.

// - For SHORT alert the Close must be below the fast MA Ribbon and

// fast MA Ribbon must be below the slow MA Ribbon.

// and/or directional filter:

// - For LONG alert the Close must be above the medium MA and the

// directional of both MA ribbons must be Bullish.

// - For SELL alert the Close must be below the medium MA and the

// directional of both MA ribbons must be Bearish.

//

// This indicator is designed to be used as a Signal to Signal trading BOT

// in automatic or semi-automatic way (start and stop when conditions are suitable).

// - For LONG and SHORT alerts I recommend you use "Once per Bar" alarm option

// - For CLOSE alerts I recommend you use "Once per Bar Close" alarm option

// (* The script has been designed so that long/short signals come at start of candles *)

// (* and close signals come at the end of candles *)

//

// Mofidifications:

// 6.0 - Major Release Version

// - Added second MA ribbon to help filter signals to the trend direction.

// - Modified Alert filtering to include second MA Ribbon

// - Change default settings to reflect Signal to Signal BOT parameters.

// - Removed older redunant alerts.

//

// 5.0 - Development series

//

// 4.1 - Fix bug with painting Buy/Sell arrows when non-repaint shunt mode selected.

// - Added option to alert just the first Buy/Sell alert after a trend swing

// - Added Long and Short Alarms. When combined with the "first Buy/Sell" in trend option,

// It is now possible to use this indicator to interface with AutoView

// or ProfitView. I suggest using the "QQEX XZ Alert" alarm to exit Long or Short

// trade. Use only "Once per bar Close" option for Alarms. This is not a full

// fledged trading BOT though with TP/SL settings.

//

// - Changed QQE defaults to be a bit smoother (14, 8, 5) instead of (6, 3, 2.618)

// which is more suited to Forex and Crypto trading.

//

// 4.0 - Added implied GPL copyright notice.

// - Changed defaults to use HullMAs instead of EMAs.

// 3.0 - No repaint on BUY/SELL alert, however, now trades should be taken when the BUY/SELL

// Alert is displayed. The alarm is still generated on the previous candle so you can

// still get a pre-warning, this enables you time to analyse the pending alert.

// - Added option to test success of alerted trades, highlight successful and failed trade bars

// and show simple stats: success rate and number of trades (out of 5000), this will help

// tune the settings for timeframe and currency PAIR.

// 2.0 - Added code to use the medium moving average (EMA20) rising/falling for additional

// trend direction filter.

// - Remove Moving Average cross over signals and other options not used in this indicator.

// - Added code to distinguish between the crosses, now only show Thresh Hold crosses as BUY/SELL

// alerts.

// - Modidied default settings to more well known MA's and slightly different QQE settings, these

// work well at lower timeframes.

// - Added circle plots at bottom of chart to show when actual BUY/SELL alerts occur.

// 1.0 - original

//

// References:

// Some Code borrowed from:

// - "Scalp Jockey - MTF MA Cross Visual Strategizer by JayRogers"

// - "QQE MT4 by glaz"

// Inspiration from:

// - http://www.forexstrategiesresources.com/binary-options-strategies-ii/189-aurora-binary-trading/

// - http://www.forexstrategiesresources.com/metatrader-4-trading-systems-v/652-qqe-smoothed-trading/

// - http://dewinforex.com/forex-indicators/qqe-indicator-not-quite-grail-but-accurately-defines-trend-and-flat.html

// - "Binary option trading by two previous bars" by radixvinni

//

//

// -----------------------------------------------------------------------------

// Copyright 2015 Glaz,JayRogers

//

// Copyright 2016,2017,2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

// Use Alternate Anchor TF for MAs

anchor = input(4,minval=0,maxval=100,title="Relative TimeFrame Multiplier for Second MA Ribbon (0=none, max=100)")

//

// - INPUTS START

// Fast MA - type, source, length

showAvgs = input(true,title="Show Moving Average Lines")

type1 = input(defval="EMA", title="Fast MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len1 = input(defval=16, title="Fast - Length", minval=1)

gamma1 = 0.33

// Medium Fast MA - type, source, length

type2 = input(defval="EMA", title="Medium MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len2 = input(defval=21, title="Medium - Length", minval=1)

gamma2 = 0.55

// Slow MA - type, source, length

type3 = input(defval="EMA", title="Slow MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len3 = input(defval=26, title="Slow Length", minval=1)

gamma3 = 0.77

//

// QQE rsi Length, Smoothing, fast ATR factor, source

RSILen = input(14,title='RSI Length')

SF = input(8,title='RSI Smoothing Factor')

QQEfactor = input(5.0,type=float,title='Fast QQE Factor')

threshhold = input(10, title="RSI Threshhold")

//

sQQEx = input(true,title="Show QQE Signal crosses")

sQQEz = input(false,title="Show QQE Zero crosses")

sQQEc = input(true,title="Show QQE Thresh Hold Channel Exits")

//

tradeSignal = input("XC", title="Select which QQE signal to Buy/Sell", options=["XC","XQ","XZ"])

closeSignal = input("XQ", title="Select which QQE signal to Close Order", options=["XC","XQ","XZ"])

//

xfilter = input(true, title="Filter XQ Buy/Sell Orders by Threshold" )

filter = input(false,title="Use Moving Average Filter")

dfilter = input(true, title="Use Trend Directional Filter" )

ufirst = input(false, title="Only Alert First Buy/Sell in a new Trend")

RSIsrc = input(close,title="Source")

src = RSIsrc // MA source

srcclose= RSIsrc

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [Alerts]

//testStartYear = input(2018, "Backtest Start Year",minval=1980)

//testStartMonth = input(6, "Backtest Start Month",minval=1,maxval=12)

//testStartDay = input(12, "Backtest Start Day",minval=1,maxval=31)

//testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

//testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

//testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

//testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

//testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

//testPeriod = time >= testPeriodStart and time <= testPeriodStop ? true : false

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

// - INPUTS END

gold = #FFD700

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier, base on time in mins

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := not isintraday? 1 : mult // Only available Daily or less

// Anchor is a relative multiplier based on current TF.

mult = anchor>0 ? anchor : 1

// - FUNCTIONS END

// - Fast ATR QQE

//

Wilders_Period = RSILen * 2 - 1

//

Rsi = rsi(RSIsrc,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex[1] - RSIndex)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

//

newshortband= RSIndex + DeltaFastAtrRsi

newlongband= RSIndex - DeltaFastAtrRsi

longband = 0.0

shortband=0.0

trend = 0

longband:=RSIndex[1] > longband[1] and RSIndex > longband[1] ? max(longband[1],newlongband) : newlongband

shortband:=RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? min(shortband[1],newshortband) : newshortband

trend:=cross(RSIndex, shortband[1])? 1 : cross(longband[1], RSIndex) ? -1 : nz(trend[1],1)

FastAtrRsiTL = trend==1 ? longband : shortband

// - SERIES VARIABLES

// MA's

ma_fast = variant(type1, srcclose, len1, gamma1)

ma_medium = variant(type2, srcclose, len2, gamma2)

ma_slow = variant(type3, srcclose, len3, gamma3)

// MA's

ma_fast_alt = variant(type1, srcclose, len1*mult, gamma1)

ma_medium_alt = variant(type2, srcclose, len2*mult, gamma2)

ma_slow_alt = variant(type3, srcclose, len3*mult, gamma3)

// Get Direction From Medium Moving Average

direction = rising(ma_medium,3) ? 1 : falling(ma_medium,3) ? -1 : 0

altDirection = rising(ma_medium_alt,3) ? 1 : falling(ma_medium_alt,3) ? -1 : 0

//

// Find all the QQE Crosses

QQExlong = 0, QQExlong := nz(QQExlong[1])

QQExshort = 0, QQExshort := nz(QQExshort[1])

QQExlong := FastAtrRsiTL< RSIndex ? QQExlong+1 : 0

QQExshort := FastAtrRsiTL> RSIndex ? QQExshort+1 : 0

// Zero cross

QQEzlong = 0, QQEzlong := nz(QQEzlong[1])

QQEzshort = 0, QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex>=50 ? QQEzlong+1 : 0

QQEzshort := RSIndex<50 ? QQEzshort+1 : 0

//

// Thresh Hold channel Crosses give the BUY/SELL alerts.

QQEclong = 0, QQEclong := nz(QQEclong[1])

QQEcshort = 0, QQEcshort := nz(QQEcshort[1])

QQEclong := RSIndex>(50+threshhold) ? QQEclong+1 : 0

QQEcshort := RSIndex<(50-threshhold) ? QQEcshort+1 : 0

//

// Check Filtering.

QQEflong = mult == 1 ? (not filter or (srcclose>ma_medium and ma_medium>ma_slow and ma_fast>ma_medium)) and (not dfilter or (direction>0 )) :

(not filter or (ma_medium>ma_medium_alt and srcclose>ma_fast and ma_fast>ma_medium)) and (not dfilter or (direction>0 and altDirection>0 and srcclose>ma_medium))

QQEfshort = mult == 1 ? (not filter or (srcclose<ma_medium and ma_medium<ma_slow and ma_fast<ma_medium)) and (not dfilter or (direction<0 )) :

(not filter or (ma_medium<ma_medium_alt and srcclose<ma_fast and ma_fast<ma_medium)) and (not dfilter or (direction<0 and altDirection<0 and srcclose<ma_medium))

QQExfilter = (not xfilter or RSIndex>(50+threshhold) or RSIndex<(50-threshhold))

//

// Get final BUY / SELL alert determination

buy_ = 0, buy_ := nz(buy_[1])

sell_ = 0, sell_ := nz(sell_[1])

// Make sure Buy/Sell are non-repaint and occur after close signal.

buy_ := tradeSignal=="XC"? (QQEclong[1]==1 and QQEflong[1] ? buy_+1 : 0) :

tradeSignal=="XQ"? (QQExlong[1]==1 and QQEflong[1] and QQExfilter[1]? buy_+1 : 0) :

tradeSignal=="XZ"? (QQEzlong[1]==1 and QQEflong[1] ? buy_+1 : 0) : 0

sell_ := tradeSignal=="XC"? (QQEcshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) :

tradeSignal=="XQ"? (QQExshort[1]==1 and QQEfshort[1] and QQExfilter[1]? sell_+1 : 0) :

tradeSignal=="XZ"? (QQEzshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) : 0

//

// Find the first Buy/Sell in trend swing.

Buy = 0, Buy := nz(Buy[1])

Sell = 0, Sell := nz(Sell[1])

Buy := sell_>0 ? 0 : buy_==1 or Buy>0 ? Buy+1 : Buy

Sell := buy_>0 ? 0 : sell_==1 or Sell>0 ? Sell+1 : Sell

// Select First or all buy/sell alerts.

buy = ufirst ? Buy : buy_

sell = ufirst ? Sell : sell_

closeLong = 0, closeLong := nz(closeLong[1])

closeShort = 0, closeShort := nz(closeShort[1])

closeLong := closeSignal=="XC" ? (QQEcshort==1 ? closeLong+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExshort==1 ? closeLong+1 : 0) : ((QQExshort==1 or QQEzshort or QQEcshort) ? closeLong+1 : 0) :

closeSignal=="XZ" ? (QQEzshort==1 ? closeLong+1 : 0) : 0

closeShort := closeSignal=="XC" ? (QQEclong==1 ? closeShort+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExlong==1 ? closeShort+1 : 0) : ((QQExlong==1 or QQEzlong or QQEclong==1) ? closeShort+1 : 0) :

closeSignal=="XZ" ? (QQEzlong==1 ? closeShort+1 : 0) : 0

tradestate = 0, tradestate := nz(tradestate[1])

tradestate := tradestate==0 ? (buy==1 ? 1 : sell==1 ? 2 : 0) : (tradestate==1 and closeLong==1) or (tradestate==2 and closeShort==1)? 0 : tradestate

isLong = change(tradestate) and tradestate==1

isShort = change(tradestate) and tradestate==2

isCloseLong = change(tradestate) and tradestate==0 and nz(tradestate[1])==1

isCloseShort = change(tradestate) and tradestate==0 and nz(tradestate[1])==2

// - SERIES VARIABLES END

// - PLOTTING

// Ma's

tcolor = direction<0?red:green

// ma1=plot(showAvgs?ma_fast:na, title="MA Fast", color=tcolor, linewidth=1, transp=0)

ma2=plot(showAvgs?ma_medium:na, title="MA Medium Fast", color=tcolor, linewidth=2, transp=0)

// ma3=plot(showAvgs?ma_slow:na, title="MA Slow", color=tcolor, linewidth=1, transp=0)

// fill(ma1,ma3,color=tcolor,transp=90)

// Ma's

altTcolor=altDirection<0?red:green

barcolor(altDirection<0? red:green)

ma4=plot(showAvgs and mult>1?ma_fast_alt:na, title="MA Fast", color=altTcolor, linewidth=1, transp=0)

ma5=plot(showAvgs and mult>1?ma_medium_alt:na, title="MA Medium Fast", color=altTcolor, linewidth=2, transp=0)

ma6=plot(showAvgs and mult>1?ma_slow_alt:na, title="MA Slow", color=altTcolor, linewidth=1, transp=0)

fill(ma4,ma6,color=altTcolor,transp=90)

// Color Changes

turned_aqua = altTcolor[1] == red and altTcolor == green

turned_blue = altTcolor[1] == green and altTcolor == red

take_profit_long = ma_slow > ma_fast_alt and ma_slow > ma_slow_alt and tcolor[1] == green and tcolor == red

take_profit_short = ma_slow < ma_fast_alt and ma_slow < ma_slow_alt and tcolor[1] == red and tcolor == green

// plotshape(turned_aqua, title="MA's Green Buy", style=shape.triangleup, location=location.belowbar, text="Long", color=green, transp=20, size=size.normal)

// plotshape(turned_blue, title="MA's Red Sell", style=shape.triangledown, location=location.abovebar, text="Short", color=red, transp=20, size=size.normal)

// plotshape(take_profit_long, title="Take Profit Long", style=shape.triangledown, location=location.abovebar, text="Take Profit Long", color=purple, transp=20, size=size.tiny)

// plotshape(take_profit_short, title="Take Profit Short", style=shape.triangleup, location=location.belowbar, text="Take Profit Short", color=purple, transp=20, size=size.tiny)

strategy.entry("Long", strategy.long, when=turned_aqua and window)

strategy.entry("short", strategy.short, when=turned_blue and window)

entered_long = strategy.position_size[1] <= 0 and strategy.position_size > 0

entered_short = strategy.position_size[1] >= 0 and strategy.position_size < 0

long_tp_count = 0

long_tp_count := entered_long ? 0 : take_profit_long ? long_tp_count[1] + 1 : long_tp_count[1]

short_tp_count = 0

short_tp_count := entered_short ? 0 : take_profit_short ? short_tp_count[1] + 1 : short_tp_count[1]

// take_off_long = long_tp_count == 0 ? tp1_perc : long_tp_count == 1 ? tp2_perc : na

// take_off_short = short_tp_count == 0 ? tp1_perc : short_tp_count == 1 ? tp2_perc : na

long_tp1_qty = na

long_tp2_qty = na

short_tp1_qty = na

short_tp2_qty = na

long_tp1_qty := entered_long ? strategy.position_size * tp1_perc : long_tp1_qty[1]

long_tp2_qty := entered_long ? strategy.position_size * tp2_perc : long_tp2_qty[1]

short_tp1_qty := entered_short ? -strategy.position_size * tp1_perc : short_tp1_qty[1]

short_tp2_qty := entered_short ? -strategy.position_size * tp2_perc : short_tp2_qty[1]

long_sl_level = sl_perc == 0 ? na : strategy.position_avg_price * (1 - sl_perc)

short_sl_level = sl_perc == 0 ? na : strategy.position_avg_price * (1 + sl_perc)

strategy.order("LTP1", strategy.short, qty=long_tp1_qty, when=strategy.position_size > 0 and take_profit_long and long_tp_count[1]==0 and not turned_blue)

strategy.order("LTP2", strategy.short, qty=long_tp2_qty, when=strategy.position_size > 0 and take_profit_long and long_tp_count[1]==1 and not turned_blue)

strategy.order("STP1", strategy.long, qty=short_tp1_qty, when=strategy.position_size < 0 and take_profit_short and short_tp_count[1]==0 and not turned_aqua)

strategy.order("STP2", strategy.long, qty=short_tp2_qty, when=strategy.position_size < 0 and take_profit_short and short_tp_count[1]==1 and not turned_aqua)

strategy.exit("L-SL", "Long", stop=long_sl_level)

strategy.exit("S-SL", "Short", stop=short_sl_level)

// SL PLOTS

// --------

plot(strategy.position_size > 0 ? long_sl_level : na, color=red, style=linebr, title="Long Stop")

plot(strategy.position_size < 0 ? short_sl_level : na, color=maroon, style=linebr, title="Short Stop")

// ALERTS (STUDY ONLY)

alertcondition(turned_aqua, title="Long", message="Ma's Turned Green")

alertcondition(turned_blue, title="Short", message="Ma's Turned Red")

alertcondition(take_profit_long, title="Take Profit Long", message="Take Profit Long")

alertcondition(take_profit_short, title="Take Profit Short", message="Take Profit Short")

alertcondition(isLong, title="QQEX Long", message="QQEX LONG") // use "Once per Bar" option

alertcondition(isShort, title="QQEX Short", message="QQEX SHORT") // use "Once per Bar" option

alertcondition(isCloseLong, title="QQEX Close Long", message="QQEX CLOSE LONG") // use "Once per Bar Close" option

alertcondition(isCloseShort, title="QQEX Close Short", message="QQEX CLOSE SHORT") // use "Once per Bar Close" option

// show only when alert condition is met and bar closed.

plotshape(isLong or isShort,title= "Cross Alert Completed", location=location.bottom, color=isShort?red:green, transp=0, style=shape.circle,size=size.auto,offset=0)

plotshape(isCloseShort[1] or isCloseLong[1],title= "Close Order", location=location.top, color=isCloseShort[1]?red:green, transp=0, style=shape.square,size=size.auto,offset=-1)

// Test Plots

// ---------

// plot(long_tp_count)

// plot(short_tp_count, color=red)

//EOF