Estrategia de banda de Bollinger de ruptura de media móvil

Fecha de creación:

2023-12-08 12:11:15

Última modificación:

2023-12-08 12:11:15

Copiar:

1

Número de Visitas:

864

1

Seguir

1630

Seguidores

Descripción general

Esta estrategia combina el indicador de las medias móviles, el indicador de las bandas de Brin y el indicador de Alertas de Bot de UT para lograr una estrategia de operación de ruptura simple. Cuando el precio rompa la banda de Brin, haga más; cuando el precio rompa la banda de Brin, haga un desvío.

Principio de estrategia

- Utiliza el EMA de 200 ciclos como eje central para determinar la tendencia. Los precios por encima de los EMA son positivos y los precios por debajo de los EMA son negativos.

- El indicador UT Bot Alerts se combina con el ATR para generar una señal de compra y venta. Se produce una señal de comprobación cuando el precio y el rápido cruce de EMA se encuentran en trayectoria; se produce una señal de comprobación cuando el precio y el rápido cruce de EMA se encuentran en trayectoria.

- El indicador de stop loss ATR se utiliza para establecer el punto de stop loss. La distancia de stop loss es 1.5 veces el valor de ATR.

- Después de entrar en el mercado, el precio de entrada se mueve a través de la tasa de retorno por riesgo, el establecimiento de un punto de parada, el punto de parada y el punto de parada.

Análisis de las ventajas

- El uso del indicador de la banda de Brin para determinar cuándo es el momento adecuado para hacer más ejercicio puede aumentar la probabilidad de obtener ganancias.

- El indicador UT Bot Alerts puede generar una señal más precisa.

- El uso de la proporción de riesgo-beneficio para el stop loss puede controlar el riesgo de manera efectiva.

Análisis de riesgos

- La banda de Bryn es propensa a generar señales erróneas en ciudades convulsionadas.

- El ATR es retrasado y puede tener una distancia de pérdida excesiva al comienzo de la tendencia.

- El error de ajuste de la relación de riesgo-beneficio también puede conducir a ser demasiado radical o demasiado conservador.

Dirección de optimización

- Puede intentar usar otros indicadores en lugar de los indicadores de Alertas de Bot de UT.

- Se puede optimizar el ciclo y el múltiplo de ATR para que la distancia de parada sea más adecuada.

- Se pueden probar diferentes ratios de riesgo-beneficio para encontrar el parámetro óptimo.

Resumir

La estrategia integra las ventajas de varios indicadores y tiene una gran utilidad. A través de la optimización de los parámetros, se puede convertir en un sistema de ruptura estable y confiable. Pero también se debe tener en cuenta los riesgos de prevención de fallas en los indicadores y parámetros incorrectos.

Código Fuente de la Estrategia

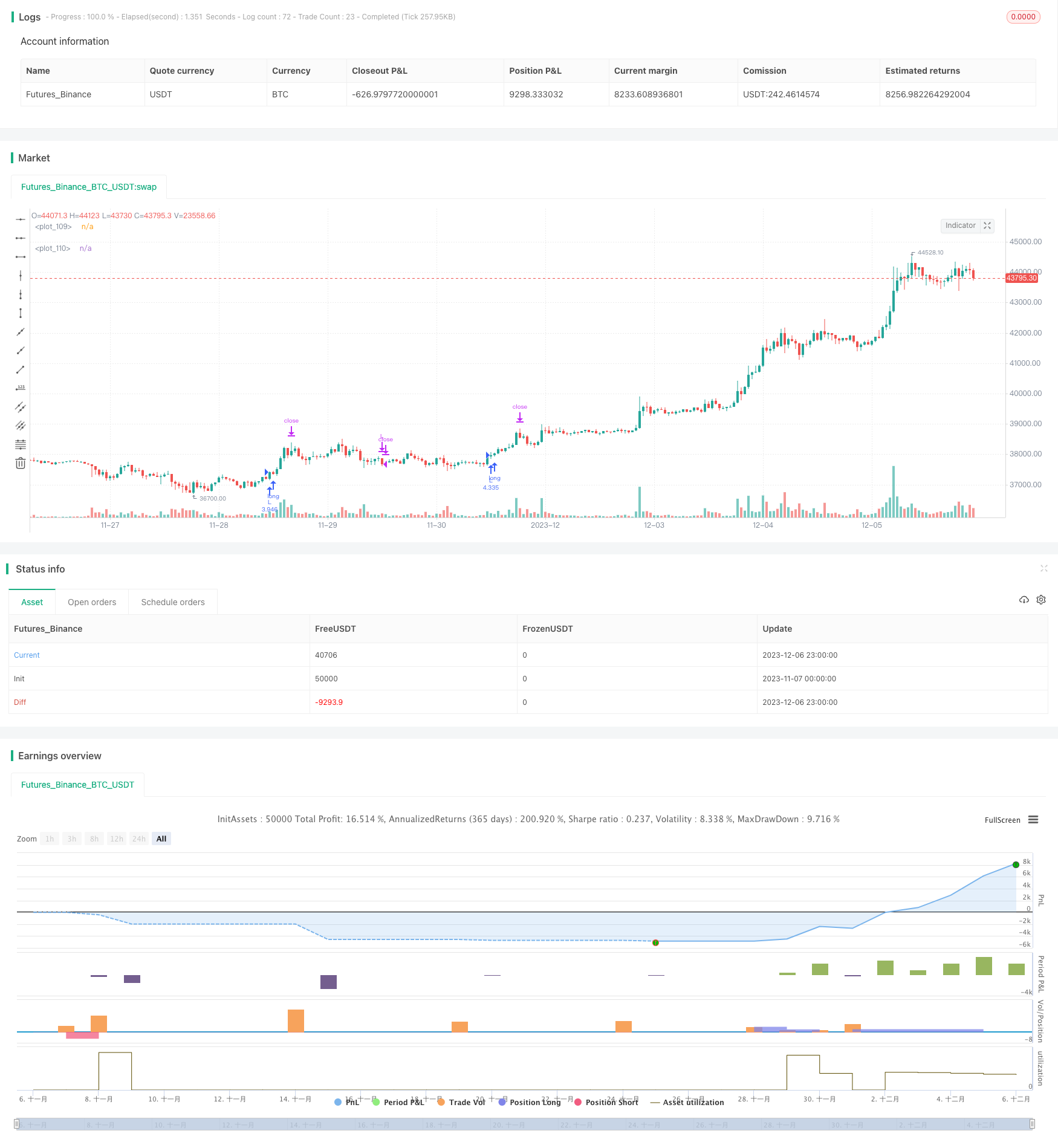

/*backtest

start: 2023-11-07 00:00:00

end: 2023-12-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//Developed by StrategiesForEveryone

strategy("UT Bot alerts strategy", overlay=true, process_orders_on_close = true, initial_capital = 1000000, default_qty_type=strategy.cash, precision = 2, calc_on_every_tick = true, commission_value = 0.03)

// ------ Inputs for calculating position --------

initial_actual_capital = input.float(defval=10000, title = "Enter initial/current capital", group = "Calculate position")

risk_c = input.float(2.5, '% account risk per trade', step=1, group = "Position amount calculator", tooltip = "Percentage of total account to risk per trade. The USD value that should be used to risk the inserted percentage of the account. Appears green in the upper left corner")

// ------ Date filter (obtained from ZenAndTheArtOfTrading) ---------

initial_date = input(title="Initial date", defval=timestamp("10 Feb 2014 13:30 +0000"), group="Time filter", tooltip="Enter the start date and time of the strategy")

final_date = input(title="Final date", defval=timestamp("01 Jan 2030 19:30 +0000"), group="Time filter", tooltip="Enter the end date and time of the strategy")

dateFilter(int st, int et) => time >= st and time <= et

colorDate = input.bool(defval=false, title="Date background", tooltip = "Add color to the period of time of the strategy tester")

bgcolor(colorDate and dateFilter(initial_date, final_date) ? color.new(color.blue, transp=90) : na)

// ------ Session limits (obtained from ZenAndTheArtOfTrading) -------

timeSession = input(title="Time session", defval="0000-2400", group="Time filter", tooltip="Session time to operate. It may be different depending on your time zone, you have to find the correct hours manually.")

colorBG = input.bool(title="Session background", defval=false, tooltip = "Add color to session time background")

inSession(sess) => na(time(timeframe.period, sess + ':1234567')) == false

bgcolor(inSession(timeSession) and colorBG ? color.rgb(0, 38, 255, 84) : na)

// ----------- Ema ----------------------

ema = input.int(200, title='Ema length', minval=1, maxval=500, group = "Trend")

ema200 = ta.ema(close, ema)

bullish = close > ema200

bearish = close < ema200

show_ema = input.bool(defval=false, title="Show ema ?", group = "Appearance")

// plot(show_ema ? ema200 : na, title = "Ema", color=color.white, linewidth=2, display = display.all - display.status_line - display.price_scale)

// -------------- UT BOT ALERTS INDICATOR by @QuantNomad -------------------------

// Inputs

a = input(3, title='Key Vaule', group = "UT BOT ALERTS", tooltip = "Higher amount, less trades. Changing this could be useful in some assets or time frames")

c = input(1, title='ATR Period', group = "UT BOT ALERTS", tooltip = "Higher amount, less trades. Changing this could be useful in some assets or time frames")

h = input(false, title='Signals from Heikin Ashi Candles', group = "UT BOT ALERTS")

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

show_atr_ut = input.bool(defval=false, title="Show atr from ut bot alerts ?", group = "Appearance")

// plot(show_atr_ut ? xATRTrailingStop : na, color = color.orange, linewidth = 2, display = display.all - display.price_scale - display.status_line)

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema_ut = ta.ema(src, 1)

show_ema_ut = input.bool(defval=false, title="Show ema from ut bot alerts ?", group = "Appearance")

// plot(show_ema_ut ? ema_ut : na, color = color.white, linewidth = 2, display = display.all - display.price_scale - display.status_line)

above = ta.crossover(ema_ut, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema_ut)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

close_buy = src < xATRTrailingStop and below

close_sell = src > xATRTrailingStop and above

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

show_signals = input.bool(true, title = "Show signals ?", group = "Appearance")

paint_candles = input.bool(false, title = "Paint candles ?", group = "Appearance")

// plotshape(bullish and show_signals ? buy : na, title='Buy', text='Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny , display = display.all - display.price_scale - display.status_line)

// plotshape(bearish and show_signals ? sell : na, title='Sell', text='Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny, display = display.all - display.price_scale - display.status_line)

// plotshape(bullish and show_signals ? close_buy : na, title='Close Buy', text='Cl Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 80), textcolor=color.new(color.white, 0), size=size.tiny, display = display.all - display.price_scale - display.status_line)

// plotshape(bearish and show_signals ? close_sell : na, title='Close Sell', text='Cl Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 80), textcolor=color.new(color.white, 0), size=size.tiny, display = display.all - display.price_scale - display.status_line)

barcolor(barbuy and paint_candles ? color.green : na)

barcolor(barsell and paint_candles ? color.red : na)

// -------------- Atr stop loss by garethyeo (modified) -----------------

long_condition_atr = src > xATRTrailingStop and above

short_condition_atr = src < xATRTrailingStop and below

source_atr = input(close, title='Source', group = "Atr stop loss", inline = "A")

length_atr = input.int(14, minval=1, title='Period', group = "Atr stop loss" , inline = "A")

multiplier = input.float(1.5, minval=0.1, step=0.1, title='Atr multiplier', group = "Atr stop loss", inline = "A", tooltip = "Defines the stop loss distance based on the Atr stop loss indicator")

show_atr = input.bool(defval = true, title = "Show Atr stop loss ?", group = "Appearance")

var float shortStopLoss = na

var float longStopLoss = na

var float atr_past_candle_long = na

var float atr_past_candle_short = na

//shortStopLoss = source_atr + ta.atr(length_atr) * multiplier

//longStopLoss = source_atr - ta.atr(length_atr) * multiplier

//atr_past_candle_short = close[1] + ta.atr(length_atr)[1] * multiplier[1]

//atr_past_candle_long = close[1] - ta.atr(length_atr)[1] * multiplier[1]

candle_of_stoploss = input.string(defval = "Current candle", title = "Source of stoploss", group = "Risk management for trades", options = ["Current candle","Past candle"])

if candle_of_stoploss == "Current candle"

shortStopLoss := source_atr + ta.atr(length_atr) * multiplier

longStopLoss := source_atr - ta.atr(length_atr) * multiplier

if candle_of_stoploss == "Past candle"

shortStopLoss := close[1] + ta.atr(length_atr)[1] * multiplier[1]

longStopLoss := close[1] - ta.atr(length_atr)[1] * multiplier[1]

plot(show_atr and long_condition_atr and bullish ? longStopLoss : na, color = color.white, style = plot.style_circles, linewidth = 2)

plot(show_atr and short_condition_atr and bearish ? shortStopLoss : na, color = color.white, style = plot.style_circles, linewidth = 2)

// ------------- Money management --------------

strategy_contracts = strategy.equity / close

distance_sl_atr_long = -1 * (longStopLoss - close) / close

distance_sl_atr_short = (shortStopLoss - close) / close

risk = input.float(2.5, '% Account risk per trade for backtesting', step=1, group = "Risk management for trades", tooltip = "Percentage of total account to risk per trade")

long_amount = strategy_contracts * (risk / 100) / distance_sl_atr_long

short_amount = strategy_contracts * (risk / 100) / distance_sl_atr_short

// ---- Fixed amounts ----

//fixed_amounts = input.bool(defval = false, title = "Fixed amounts ?", group = "Risk management for trades")

//fixed_amount_input = input.float(defval = 1000, title = "Fixed amount in usd", group = "Risk management for trades")

//if fixed_amounts

// long_amount := fixed_amount_input / close

//if fixed_amounts

// short_amount := fixed_amount_input / close

//

leverage=input.bool(defval=true, title="Use leverage for backtesting ?", group = "Risk management for trades", tooltip = "If it is activated, there will be no monetary units or amount of assets limit for each operation (That is, each operation will not be affected by the initial / current capital since it would be using leverage). If it is deactivated, the monetary units or the amount of assets to use for each operation will be limited by the initial/current capital.")

if not leverage and long_amount>strategy_contracts

long_amount:=strategy.equity/close

if not leverage and short_amount>strategy_contracts

short_amount:=strategy.equity/close

// ---------- Risk management ---------------

risk_reward_breakeven_long= input.float(title="Risk/reward for breakeven long", defval=0.75, step=0.1, group = "Risk management for trades")

risk_reward_take_profit_long= input.float(title="Risk/reward for take profit long", defval=3.0, step=0.1, group = "Risk management for trades")

risk_reward_breakeven_short= input.float(title="Risk/reward for break even short", defval=0.75, step=0.1, group = "Risk management for trades")

risk_reward_take_profit_short= input.float(title="Risk/reward for take profit short", defval=3.0, step=0.1, group = "Risk management for trades")

tp_percent=input.float(title="% of trade for first take profit", defval=50, step=5, group = "Risk management for trades", tooltip = "Closing percentage of the current position when the first take profit is reached.")

// ------------ Trade conditions ---------------

bullish := close > ema200

bearish := close < ema200

bought = strategy.position_size > 0

sold = strategy.position_size < 0

buy := src > xATRTrailingStop and above

sell := src < xATRTrailingStop and below

var float sl_long = na

var float sl_short = na

var float be_long = na

var float be_short = na

var float tp_long = na

var float tp_short = na

if not bought

be_long:=na

sl_long:=na

tp_long:=na

if not sold

be_short:=na

sl_short:=na

tp_short:=na

long_positions = input.bool(defval = true, title = "Long positions ?", group = "Positions management")

short_positions = input.bool(defval = true, title = "Short positions ?", group = "Positions management")

// ---------- Strategy -----------

// Long position

if not bought and buy and long_positions and bullish and inSession(timeSession)

sl_long:=longStopLoss

long_stoploss_distance = close - longStopLoss

be_long := close + long_stoploss_distance * risk_reward_breakeven_long

tp_long:=close+(long_stoploss_distance*risk_reward_take_profit_long)

strategy.entry('L', strategy.long, long_amount, alert_message = "Long")

strategy.exit("Tp", "L", stop=sl_long, limit=tp_long, qty_percent=tp_percent)

strategy.exit('Exit', 'L', stop=sl_long)

if bought and high > be_long

sl_long := strategy.position_avg_price

strategy.exit("Tp", "L", stop=sl_long, limit=tp_long, qty_percent=tp_percent)

strategy.exit('Exit', 'L', stop=sl_long)

if bought and sell and strategy.openprofit>0

strategy.close("L", comment="CL")

// Short position

if not sold and sell and short_positions and bearish and inSession(timeSession)

sl_short:=shortStopLoss

short_stoploss_distance=shortStopLoss - close

be_short:=((short_stoploss_distance*risk_reward_breakeven_short)-close)*-1

tp_short:=((short_stoploss_distance*risk_reward_take_profit_short)-close)*-1

strategy.entry("S", strategy.short, short_amount, alert_message = "Short")

strategy.exit("Tp", "S", stop=sl_short, limit=tp_short, qty_percent=tp_percent)

strategy.exit("Exit", "S", stop=sl_short)

if sold and low < be_short

sl_short:=strategy.position_avg_price

strategy.exit("Tp", "S", stop=sl_short, limit=tp_short, qty_percent=tp_percent)

strategy.exit("Exit", "S", stop=sl_short)

if sold and buy and strategy.openprofit>0

strategy.close("S", comment="CS")

// ---------- Draw positions and signals on chart (strategy as an indicator) -------------

if high>tp_long

tp_long:=na

if low<tp_short

tp_short:=na

if high>be_long

be_long:=na

if low<be_short

be_short:=na

show_position_on_chart = input.bool(defval=true, title="Draw position on chart ?", group = "Appearance", tooltip = "Activate to graphically display profit, stop loss and break even")

// position_price = plot(show_position_on_chart? strategy.position_avg_price : na, style=plot.style_linebr, color = color.new(#ffffff, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// sl_long_price = plot(show_position_on_chart and bought ? sl_long : na, style = plot.style_linebr, color = color.new(color.red, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// sl_short_price = plot(show_position_on_chart and sold ? sl_short : na, style = plot.style_linebr, color = color.new(color.red, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// tp_long_price = plot(strategy.position_size>0 and show_position_on_chart? tp_long : na, style = plot.style_linebr, color = color.new(#4cd350, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// tp_short_price = plot(strategy.position_size<0 and show_position_on_chart? tp_short : na, style = plot.style_linebr, color = color.new(#4cd350, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// breakeven_long = plot(strategy.position_size>0 and high<be_long and show_position_on_chart ? be_long : na , style = plot.style_linebr, color = color.new(#1fc9fd, 60), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// breakeven_short = plot(strategy.position_size<0 and low>be_short and show_position_on_chart ? be_short : na , style = plot.style_linebr, color = color.new(#1fc9fd, 60), linewidth = 1, display = display.all - display.status_line - display.price_scale)

show_break_even_on_chart = input.bool(defval=true, title="Draw first take profit/breakeven price on chart ?", group = "Appearance", tooltip = "Activate to display take profit and breakeven price. It appears as a green point in the chart")

long_stoploss_distance = close - longStopLoss

short_stoploss_distance=shortStopLoss - close

be_long_plot = close + long_stoploss_distance * risk_reward_breakeven_long

be_short_plot =((short_stoploss_distance*risk_reward_breakeven_short)-close)*-1

// plot(show_break_even_on_chart and buy and bullish? be_long_plot : na, color=color.new(#1fc9fd, 10), style = plot.style_circles, linewidth = 2, display = display.all - display.price_scale)

// plot(show_break_even_on_chart and sell and bearish? be_short_plot : na, color=color.new(#1fc9fd, 10), style = plot.style_circles, linewidth = 2, display = display.all - display.price_scale)

// position_profit_long = plot(bought and show_position_on_chart and strategy.openprofit>0 ? close : na, style = plot.style_linebr, color = color.new(#4cd350, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// position_profit_short = plot(sold and show_position_on_chart and strategy.openprofit>0 ? close : na, style = plot.style_linebr, color = color.new(#4cd350, 10), linewidth = 1, display = display.all - display.status_line - display.price_scale)

// fill(plot1 = position_price, plot2 = position_profit_long, color = color.new(#4cd350, 90))

// fill(plot1 = position_price, plot2 = position_profit_short, color = color.new(#4cd350, 90))

// fill(plot1 = position_price, plot2 = sl_long_price, color = color.new(color.red,90))

// fill(plot1 = position_price, plot2 = sl_short_price, color = color.new(color.red,90))

// fill(plot1 = position_price, plot2 = tp_long_price, color = color.new(color.green,90))

// fill(plot1 = position_price, plot2 = tp_short_price, color = color.new(color.green,90))

// --------------- Positions amount calculator -------------

contracts_amount_c = initial_actual_capital / close

distance_sl_long_c = -1 * (longStopLoss - close) / close

distance_sl_short_c = (shortStopLoss - close) / close

long_amount_c = close * (contracts_amount_c * (risk_c / 100) / distance_sl_long_c)

short_amount_c = close * (contracts_amount_c * (risk_c / 100) / distance_sl_short_c)

long_amount_lev = close * (contracts_amount_c * (risk_c / 100) / distance_sl_long_c)

short_amount_lev = close * (contracts_amount_c * (risk_c / 100) / distance_sl_short_c)

leverage_for_calculator=input.bool(defval=true, title="Use leverage ?", group = "Calculate position", tooltip = "If it is activated, there will be no monetary units or amount of assets limit for each operation (That is, each operation will not be affected by the initial / current capital since it would be using leverage). If it is deactivated, the monetary units or the amount of assets to use for each operation will be limited by the initial/current capital.")

if not leverage_for_calculator and long_amount_lev>initial_actual_capital

long_amount_lev:=initial_actual_capital

if not leverage_for_calculator and short_amount_lev>initial_actual_capital

short_amount_lev:=initial_actual_capital

// plot(buy and leverage_for_calculator ? long_amount_c : na, color = color.rgb(136, 255, 0), display = display.all - display.pane - display.price_scale)

// plot(sell and leverage_for_calculator ? short_amount_c : na, color = color.rgb(136, 255, 0), display = display.all - display.pane - display.price_scale)

// plot(buy and not leverage_for_calculator ? long_amount_lev : na, color = color.rgb(136, 255, 0), display = display.all - display.pane - display.price_scale)

// plot(sell and not leverage_for_calculator ? short_amount_lev : na, color = color.rgb(136, 255, 0), display = display.all - display.pane - display.price_scale)