Estrategia de trading de reversión de impulso TD

Descripción general

La estrategia de cambio de tendencia TD es una estrategia de comercio cuantitativa que utiliza el indicador TD Sequential para identificar señales de cambio de precio. La estrategia se basa en el análisis de la dinámica de los precios y establece posiciones de venta o venta libre después de la confirmación de la señal de cambio de precio.

Principio de estrategia

La estrategia utiliza el indicador TD Sequential para analizar la fluctuación de los precios y identificar la forma de reversión de los precios de 9 líneas K consecutivas. En concreto, cuando se identifica una línea K baja después de una subida de 9 líneas K consecutivas, la estrategia se considera una oportunidad de baja. Por el contrario, cuando se identifica una línea K alta después de una caída de 9 líneas K consecutivas, la estrategia se considera una oportunidad de alta.

Utilizando la ventaja del indicador TD Sequential, se puede capturar una señal de reversión de precios con anticipación. En combinación con un cierto número de mecanismos de seguimiento de caídas y caídas en la estrategia, se puede establecer una posición de plus o de short en el momento oportuno después de la confirmación de la señal de reversión, lo que brinda una mejor oportunidad de entrada en la etapa inicial de la reversión de precios.

Análisis de las ventajas

- Utilizando el indicador TD Sequential, se puede determinar la posibilidad de una reversión de precios con anticipación

- La creación de un mecanismo de seguimiento de la caída de los precios permite una confirmación más temprana de la reversión del precio

- Construir posiciones en la fase de formación inversa para obtener mejores puntos de entrada

Análisis de riesgos

- La probabilidad de un false breakout en el TD Sequential debe ser confirmada junto con otros factores

- La necesidad de controlar adecuadamente el tamaño y la duración de las posiciones para reducir el riesgo

Dirección de optimización

- Determinar la señal de reversión en combinación con otros indicadores para evitar el riesgo de falsa brecha

- Establecimiento de mecanismos de detención de pérdidas para controlar las pérdidas individuales

- Optimizar el tamaño y la duración de las posiciones, equilibrando el tamaño de las ganancias y el control del riesgo

Resumir

La estrategia de inversión de movimiento de TD es una estrategia muy adecuada para los operadores de movimiento de TD. Esta estrategia tiene la ventaja de identificar oportunidades de reversión, pero debe tener cuidado de controlar el riesgo y evitar grandes pérdidas por una falsa ruptura.

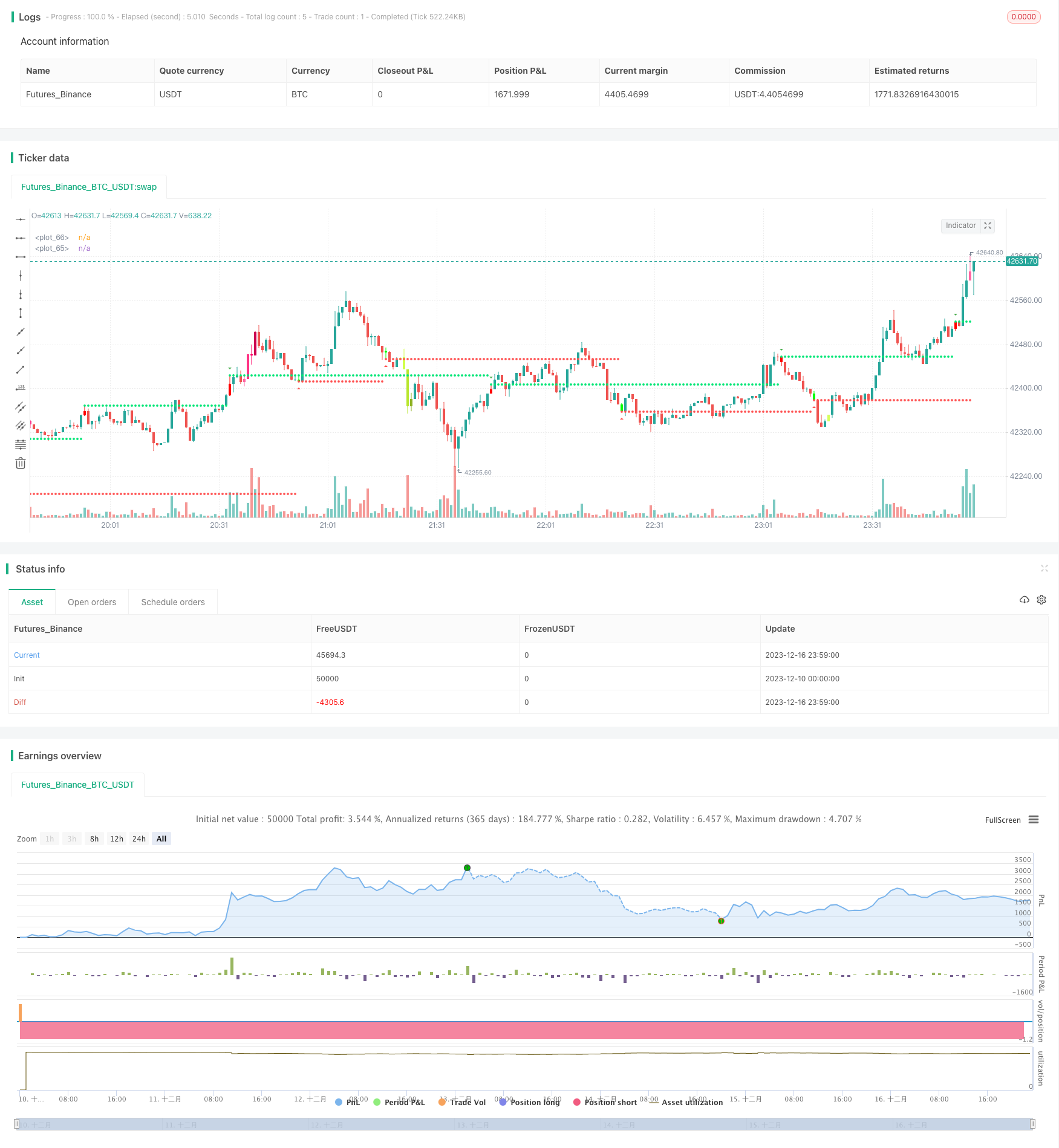

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-17 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//This strategy is based on TD sequential study from glaz.

//I made some improvement and modification to comply with pine script version 4.

//Basically, it is a strategy based on proce action, supports and resistance.

strategy("Sequential Up/Down", overlay=true )

source = input(close)

BarsCount = input(9, "Count of consecutive bars")

useLinearRegression = input(false)

LR_length = input(13,"Linear Regression length")

SR = input(true,"Shows Supports and Resistance lines")

Barcolor = input(true,"Color bars when there is a signal")

transp = input(0, "Transparency of triangle Up or Downs")

Numbers = input(true,"Plot triangle Up or Downs at signal")

//Calculation

src=useLinearRegression?linreg(source,LR_length,0):source

UP = 0

DW = 0

UP := src > src[4] ? nz(UP[1]) + 1 : 0

DW := src < src[4] ? nz(DW[1]) + 1 : 0

UPUp = UP - valuewhen(UP < UP[1], UP, 1)

DWDn = DW - valuewhen(DW < DW[1], DW, 1)

plotshape(Numbers ? UPUp == BarsCount ? true : na : na, style=shape.triangledown, text="", color=color.green, location=location.abovebar, transp=transp)

plotshape(Numbers ? DWDn == BarsCount ? true : na : na, style=shape.triangleup, text="", color=color.red, location=location.belowbar, transp=transp)

// S/R Code By johan.gradin

//------------//

// Sell Setup //

//------------//

priceflip = barssince(src < src[4])

sellsetup = src > src[4] and priceflip

sell = sellsetup and barssince(priceflip != BarsCount)

sellovershoot = sellsetup and barssince(priceflip != BarsCount+4)

sellovershoot1 = sellsetup and barssince(priceflip != BarsCount+5)

sellovershoot2 = sellsetup and barssince(priceflip != BarsCount+6)

sellovershoot3 = sellsetup and barssince(priceflip != BarsCount+7)

//----------//

// Buy setup//

//----------//

priceflip1 = barssince(src > src[4])

buysetup = src < src[4] and priceflip1

buy = buysetup and barssince(priceflip1 != BarsCount)

buyovershoot = barssince(priceflip1 != BarsCount+4) and buysetup

buyovershoot1 = barssince(priceflip1 != BarsCount+5) and buysetup

buyovershoot2 = barssince(priceflip1 != BarsCount+6) and buysetup

buyovershoot3 = barssince(priceflip1 != BarsCount+7) and buysetup

//----------//

// TD lines //

//----------//

TDbuyh = valuewhen(buy, high, 0)

TDbuyl = valuewhen(buy, low, 0)

TDsellh = valuewhen(sell, high, 0)

TDselll = valuewhen(sell, low, 0)

//----------//

// Plots //

//----------//

plot(SR ? TDbuyh ? TDbuyl : na : na, style=plot.style_circles, linewidth=1, color=color.red)

plot(SR ? TDselll ? TDsellh : na : na, style=plot.style_circles, linewidth=1, color=color.lime)

barcolor(Barcolor ? sell ? #FF0000 : buy ? #00FF00 : sellovershoot ? #FF66A3 : sellovershoot1 ? #FF3385 : sellovershoot2 ? #FF0066 : sellovershoot3 ? #CC0052 : buyovershoot ? #D6FF5C : buyovershoot1 ? #D1FF47 : buyovershoot2 ? #B8E62E : buyovershoot3 ? #8FB224 : na : na)

// Strategy: (Thanks to JayRogers)

// === STRATEGY RELATED INPUTS ===

//tradeInvert = input(defval = false, title = "Invert Trade Direction?")

// the risk management inputs

inpTakeProfit = input(defval = 0, title = "Take Profit Points", minval = 0)

inpStopLoss = input(defval = 0, title = "Stop Loss Points", minval = 0)

inpTrailStop = input(defval = 100, title = "Trailing Stop Loss Points", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset Points", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() => buy or buyovershoot or buyovershoot1 or buyovershoot2 or buyovershoot3// functions can be used to wrap up and work out complex conditions

//exitLong() => oscillator <= 0

strategy.entry(id = "Buy", long = true, when = enterLong() )// use function or simple condition to decide when to get in

//strategy.close(id = "Buy", when = exitLong() )// ...and when to get out

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() => sell or sellovershoot or sellovershoot2 or sellovershoot3

//exitShort() => oscillator >= 0

strategy.entry(id = "Sell", long = false, when = enterShort())

//strategy.close(id = "Sell", when = exitShort() )

// === STRATEGY RISK MANAGEMENT EXECUTION ===

// finally, make use of all the earlier values we got prepped

strategy.exit("Exit Buy", from_entry = "Buy", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Sell", from_entry = "Sell", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)