La stratégie de rupture de choc

Auteur:C'est pas vrai., Date: 2020-05-13 13:53:46 Le président du conseil d'administrationLes étiquettes:Une percée

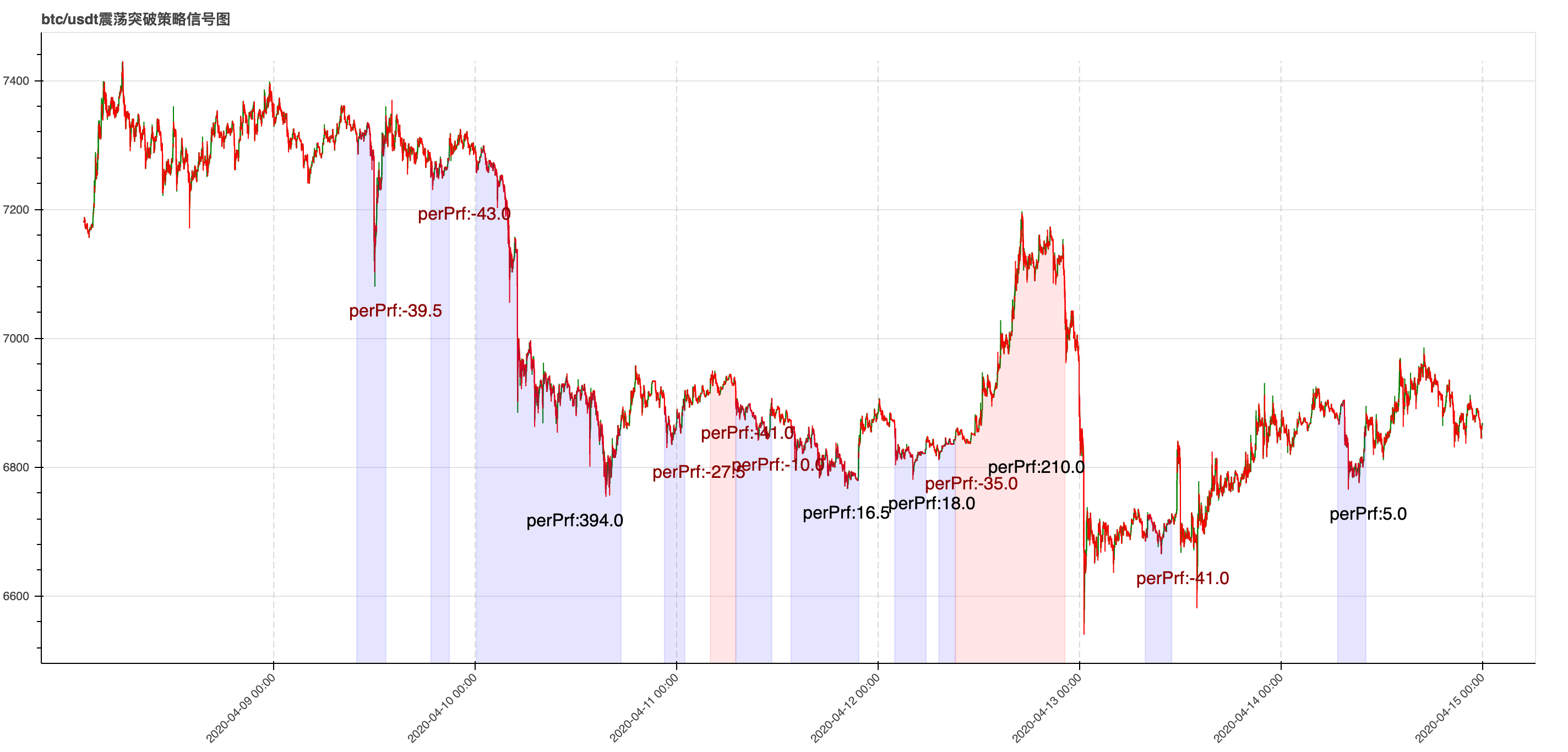

Décrire la stratégie

En haut: le prix le plus élevé des 30 dernières lignes K

En bas: le prix le plus bas des 30 dernières lignes K

Largeur de l'intervalle: (train supérieur - train inférieur) / (train supérieur + train inférieur)

Si la largeur de la fourchette est inférieure au seuil a, le prix dépasse la trajectoire ascendante, achète une position ouverte, et le prix dépasse la trajectoire descendante.

Si la largeur de la fourchette est inférieure au seuil a, le prix se déplace vers le bas, vend une position ouverte, et le prix se déplace vers le haut.

Les coordonnées

Si vous êtes intéressé par cette stratégie, veuillez contacter +V:Irene11229 (Cliquez sur ma page, je vais continuer à mettre à jour plus de stratégies, ainsi que des données d'analyse de marché de plusieurs des principaux échanges)

#!/usr/bin/env python3

# -*- coding: utf-8 -*-

import json

import time

import requests

from kumex.client import Trade

def check_response_data(response_data):

if response_data.status_code == 200:

try:

d = response_data.json()

except ValueError:

raise Exception(response_data.content)

else:

if d and d.get('s'):

if d.get('s') == 'ok':

return d

else:

raise Exception("{}-{}".format(response_data.status_code, response_data.text))

else:

raise Exception("{}-{}".format(response_data.status_code, response_data.text))

def get_kline(s, r, f, t, timeout=5, is_sandbox=False):

headers = {}

url = 'https://kitchen.kumex.com/kumex-kline/history'

if is_sandbox:

url = 'https://kitchen-sdb.kumex.com/kumex-kline/history'

uri_path = url

data_json = ''

p = []

if s:

p.append("{}={}".format('symbol', s))

if r:

p.append("{}={}".format('resolution', r))

if f:

p.append("{}={}".format('from', f))

if t:

p.append("{}={}".format('to', t))

data_json += '&'.join(p)

uri_path += '?' + data_json

response_data = requests.request('GET', uri_path, headers=headers, timeout=timeout)

return check_response_data(response_data)

class Shock(object):

def __init__(self):

# read configuration from json file

with open('config.json', 'r') as file:

config = json.load(file)

self.api_key = config['api_key']

self.api_secret = config['api_secret']

self.api_passphrase = config['api_passphrase']

self.sandbox = config['is_sandbox']

self.symbol = config['symbol']

self.resolution = int(config['resolution'])

self.valve = float(config['valve'])

self.leverage = float(config['leverage'])

self.size = int(config['size'])

self.trade = Trade(self.api_key, self.api_secret, self.api_passphrase, is_sandbox=self.sandbox)

if __name__ == "__main__":

shock = Shock()

while 1:

time_to = int(time.time())

time_from = time_to - shock.resolution * 60 * 35

data = get_kline(shock.symbol, shock.resolution, time_from, time_to, is_sandbox=shock.sandbox)

print('now time =', time_to)

print('symbol closed time =', data['t'][-1])

if time_to != data['t'][-1]:

continue

now_price = int(data['c'][-1])

print('closed price =', now_price)

# high_track

high = data['h'][-31:-1]

high.sort(reverse=True)

high_track = float(high[0])

print('high_track =', high_track)

# low_track

low = data['l'][-31:-1]

low.sort()

low_track = float(low[0])

print('low_track =', low_track)

# interval_range

interval_range = (high_track - low_track) / (high_track + low_track)

print('interval_range =', interval_range)

order_flag = 0

# current position qty of the symbol

position_details = shock.trade.get_position_details(shock.symbol)

position_qty = int(position_details['currentQty'])

print('current position qty of the symbol =', position_qty)

if position_qty > 0:

order_flag = 1

elif position_qty < 0:

order_flag = -1

if order_flag == 1 and now_price < low_track:

order = shock.trade.create_limit_order(shock.symbol, 'sell', position_details['realLeverage'],

position_qty, now_price)

print('order_flag == 1,order id =', order['orderId'])

order_flag = 0

elif order_flag == -1 and now_price > high_track:

order = shock.trade.create_limit_order(shock.symbol, 'buy', position_details['realLeverage'],

position_qty, now_price)

print('order_flag == -1,order id =', order['orderId'])

order_flag = 0

if interval_range < shock.valve and order_flag == 0:

if now_price > high_track:

order = shock.trade.create_limit_order(shock.symbol, 'buy', shock.leverage, shock.size, now_price)

print('now price > high track,buy order id =', order['orderId'])

order_flag = 1

if now_price < high_track:

order = shock.trade.create_limit_order(shock.symbol, 'sell', shock.leverage, shock.size, now_price)

print('now price < high track,sell order id =', order['orderId'])

order_flag = -1

- Ventes et achats en cycles à prix fixe

- Stratégie de mise en équilibre de la monnaie unique

- Exemple de représentation graphique variable

- Binance pérenne (hypothèque monétaire à deux comptes) (YN) (RUN)

- RecordsCollector (mise à niveau pour fournir une fonctionnalité de source de données personnalisée, prise en charge des sources de données de fichiers de données CSV)

- Utilisation - Enregistreur

- Quantification de l'aluminium de Vaucluse - utilise une API étendue pour obtenir des informations du robot et les afficher

- Démo de l'API étendue FMZ de couplage quantifié de JS-JS

- Une stratégie de choix

- Larry Connors RSI2 stratégie de régression moyenne

- Stratégie de négociation à haute fréquence

- Stratégie d'accumulation permanente de bybit swap

- RecordsCollector (mise à niveau pour une fonctionnalité de source de données personnalisée)

- Suivi de tendance de l'EMA (quatrième semaine de la semaine en cours)

- Bibliothèque de négociation de contrats à terme de devises numériques (version expérimentale)

- TradingViewWebHook stratégie d'exécution du signal (enseignement)

- Les prix des achats et des ventes

- La stratégie de couverture des monnaies multi-monnaies pérennes de Binance (pour faire plus de dépassements et de dépassements) (version Python)

- Les stratégies de SuperTrend (enseignement)

- Trois lignes de code mettent en œuvre des stratégies de contre-indication pour l'apprentissage automatique d'Argos pour interpréter rapidement les nouvelles de l'industrie