重要内容!!

- 一定要先看这篇研究 https://www.fmz.com/digest-topic/5294 。了解策略原理、风险、交易对如何筛选、如何设置参数、开仓和总资金的比例等等一系列问题。

- 上一篇研究报告需要下载并上传到自己的研究环境中。实际修改运行一遍。如果你已经看过这篇报告,最近又更新了最新一周的数据。

- 策略不能直接回测,需要在研究环境中回测。

- 策略代码以及默认参数仅供研究,实盘运行需要谨慎,根据自己的研究决定参数,自担风险。

- 策略不可能每天盈利,可看回测历史,1-2周的横盘和回撤都是正常的,并且有可能回测很大,需要正确对待

- 代码是公开的,可以自行修改,如果有任何问题,欢迎评论反馈,最好加入发明者币安交流群(研究报告中有加入方法),可获得更新通知

- 策略需要在全仓模式运行,不要设置双向持仓,策略只支持币安期货,创建机器人时用默认交易对和K线周期即可,策略没有用到K线

- 策略和其他策略以及手动操作是冲突的,需要注意

- 实盘运行需要海外托管者,测试阶段可在平台一键租用阿里云香港服务器,自己按月整租更便宜(配置最低的即可,部署教程: https://www.fmz.com/bbs-topic/2848 )

- 币安的期货和现货需要单独添加,币安期货为

Futures_Binance

策略原理

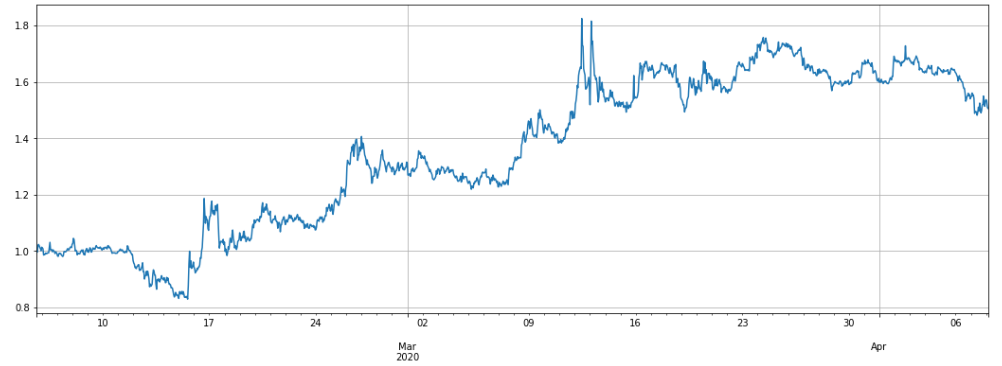

策略将分散等值做空选定的一篮子山寨币,同时等仓位做多比特币对冲,降低风险和波动率。随着价格的波动,不断调整仓位保持空头价值恒定和多头仓位对等。本质上时做空山寨币-比特币价格指数。最近两个月的表现(3倍左右杠杆,数据更新到4.8),最近一周山寨币相对于比特币是上涨的,因此亏损,如果你看多山寨币,可以在参数中设置做空比特币做多山寨币:

策略默认是做多比特币做空山寨币,你也可以反过来(假如你认为山寨币处于底部),决定权在自己

策略逻辑

1.更新行情和账户持仓 2.更新各个山寨币空头持仓价值,判断空头是否需要调整持仓 3.更新总空头的仓位,确定多头持仓,判断多头仓位是否要调整 4.下单,下单量由冰山委托决定,按照对手价成交(买入用卖一价)。下单后立即撤销(所以会看到很多撤销失败的单子400: {“code”:-2011,“msg”:“Unknown order sent.”},正常现象) 5.再次循环

会判断Short_symbols,Long_symbols那个交易对多,多的每个币种开仓价值为Trade_value,少的每个币种合约价值为需要对冲价值的平均。

如果只空BTC,多TRX,DASH,ONT,QTUM,Trade_value为50,则TRX,DASH,ONT,QTUM均有多仓50,BTC持有空仓50*4。

如果只多BTC,空TRX,DASH,ONT,QTUM,Trade_value为50,则TRX,DASH,ONT,QTUM均有空仓50,BTC持有多仓50*4。

状态栏中的leverage代表保证金已用占比,不宜过高。

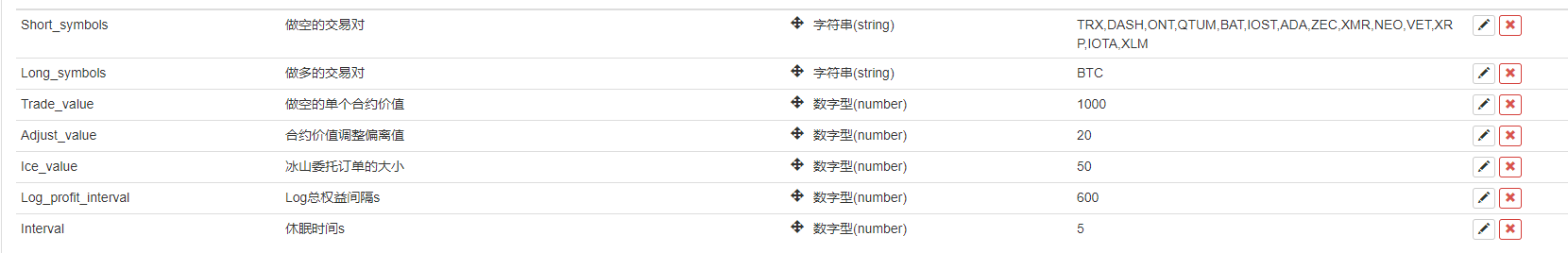

策略参数

- Short_symbols:做空的币种,用“ , ”隔开

- Long_symbols:做多的币种,也可以留空,不对冲,直接裸空。

- Trade_value:单个币种做空持有价值。还要做多对冲,总价值=2*Trade_value*做空币种数。一般使用3-5倍杠杆,即总价值=3*账户余额。需要根据自己投入的总资金决定,可通过研究环境的回测看杠杆的大小

- Adjust_value: 合约价值(USDT计价)调整偏离值,过大调整较慢,太小手续费过高,根据Trade_value自行决定。不能低于20,否则会达不到最小成交

- Ice_value:冰山委托价值,同样不能低于20,实际下单选Adjust_value与Ice_value 中较小的那一个

策略风险

当做空的币价上涨,合约价值增加,此时是减仓的,反之盈利是加仓。这使得总的合约价值维持恒定。山寨币是很有可能走出独立的行情的,目前从一年的周期看,山寨币可能处于底部,并且有可能从底部抬升不少。这取决与如何使用,如果你看好山寨币并认为已经到底部,可以方向操作,做多指数。或者你看好某几个币种(不一定是比特币),可以和它们对冲。

if(IsVirtual()){

throw '不能回测,回测参考 https://www.fmz.com/digest-topic/5294 '

}

if(exchange.GetName() != 'Futures_Binance'){

throw '只支持币安期货交易所,和现货交易所不同,需要单独添加,名称为Futures_Binance'

}

var short_symbols = Short_symbols.split(',')

var long_symbols = Long_symbols.split(',')

if(short_symbols.length == 1 && short_symbols[0] == ''){

short_symbols = []

}

if(long_symbols.length == 1 && long_symbols[0] == ''){

long_symbols = []

}

var symbols = []

for(var i=0; i<short_symbols.length; i++){

if(short_symbols[i]){

symbols.push(short_symbols[i])

}

}

for(var i=0; i<long_symbols.length; i++){

if(long_symbols[i]){

symbols.push(long_symbols[i])

}

}

var update_profit_time = 0

var assets = {}

var trade_info = {}

var exchange_info = HttpQuery('https://fapi.binance.com/fapi/v1/exchangeInfo')

if(!exchange_info){

throw '无法连接币安网络,需要海外托管者'

}

exchange_info = JSON.parse(exchange_info)

for (var i=0; i<exchange_info.symbols.length; i++){

if(symbols.indexOf(exchange_info.symbols[i].baseAsset) > -1){

assets[exchange_info.symbols[i].baseAsset] = {amount:0, hold_price:0, value:0, bid_price:0, ask_price:0, realised_profit:0, margin:0, unrealised_profit:0}

trade_info[exchange_info.symbols[i].baseAsset] = {minQty:parseFloat(exchange_info.symbols[i].filters[1].minQty),

priceSize:parseInt((Math.log10(1.1/parseFloat(exchange_info.symbols[i].filters[0].tickSize)))),

amountSize:parseInt((Math.log10(1.1/parseFloat(exchange_info.symbols[i].filters[1].stepSize))))

}

}

}

assets.USDT = {unrealised_profit:0, margin:0, margin_balance:0, total_balance:0, leverage:0}

function updateAccount(){

var account = exchange.GetAccount()

var pos = exchange.GetPosition()

if (account == null || pos == null ){

Log('update account time out')

return

}

assets.USDT.update_time = Date.now()

for(var i=0; i<symbols.length; i++){

assets[symbols[i]].margin = 0

assets[symbols[i]].unrealised_profit = 0

assets[symbols[i]].hold_price = 0

assets[symbols[i]].amount = 0

assets[symbols[i]].unrealised_profit = 0

}

for(var j=0; j<account.Info.positions.length; j++){

if(account.Info.positions[j].positionSide == 'BOTH'){

var pair = account.Info.positions[j].symbol

var coin = pair.slice(0,pair.length-4)

if(symbols.indexOf(coin) < 0){continue}

assets[coin].margin = parseFloat(account.Info.positions[j].initialMargin) + parseFloat(account.Info.positions[j].maintMargin)

assets[coin].unrealised_profit = parseFloat(account.Info.positions[j].unrealizedProfit)

}

}

assets.USDT.margin = _N(parseFloat(account.Info.totalInitialMargin) + parseFloat(account.Info.totalMaintMargin),2)

assets.USDT.margin_balance = _N(parseFloat(account.Info.totalMarginBalance),2)

assets.USDT.total_balance = _N(parseFloat(account.Info.totalWalletBalance),2)

assets.USDT.unrealised_profit = _N(parseFloat(account.Info.totalUnrealizedProfit),2)

assets.USDT.leverage = _N(assets.USDT.margin/assets.USDT.total_balance,2)

pos = JSON.parse(exchange.GetRawJSON())

if(pos.length > 0){

for(var k=0; k<pos.length; k++){

var pair = pos[k].symbol

var coin = pair.slice(0,pair.length-4)

if(symbols.indexOf(coin) < 0){continue}

assets[coin].hold_price = parseFloat(pos[k].entryPrice)

assets[coin].amount = parseFloat(pos[k].positionAmt)

assets[coin].unrealised_profit = parseFloat(pos[k].unRealizedProfit)

}

}

}

function updateTick(){

var ticker = HttpQuery('https://fapi.binance.com/fapi/v1/ticker/bookTicker')

if(ticker == null){

Log('get ticker time out')

return

}

ticker = JSON.parse(ticker)

for(var i=0; i<ticker.length; i++){

var pair = ticker[i].symbol

var coin = pair.slice(0,pair.length-4)

if(symbols.indexOf(coin) < 0){continue}

assets[coin].ask_price = parseFloat(ticker[i].askPrice)

assets[coin].bid_price = parseFloat(ticker[i].bidPrice)

assets[coin].ask_value = _N(assets[coin].amount*assets[coin].ask_price, 2)

assets[coin].bid_value = _N(assets[coin].amount*assets[coin].bid_price, 2)

}

}

function trade(symbol, dirction, value){

if(Date.now()-assets.USDT.update_time > 10*1000){

Log('更新账户延时,不交易')

return

}

var price = dirction == 'sell' ? assets[symbol].bid_price : assets[symbol].ask_price

var amount = _N(Math.min(value,Ice_value)/price, trade_info[symbol].amountSize)

if(amount < trade_info[symbol].minQty){

Log(symbol, '合约调整偏离价值或冰山委托订单设置过小,达不到最小成交, 至少需要: ', _N(trade_info[symbol].minQty*price,0))

return

}

exchange.IO("currency", symbol+'_'+'USDT')

exchange.SetContractType('swap')

exchange.SetDirection(dirction)

var f = dirction == 'buy' ? 'Buy' : 'Sell'

var id = exchange[f](price, amount, symbol)

if(id){

exchange.CancelOrder(id) //订单会立即撤销

}

}

function updateStatus(){

var table = {type: 'table', title: '交易对信息',

cols: ['币种', '数量', '持仓价格', '当前价格', '持仓价值', '保证金', '未实现盈亏'],

rows: []}

for (var i=0; i<symbols.length; i++){

var price = _N((assets[symbols[i]].ask_price + assets[symbols[i]].bid_price)/2, trade_info[symbols[i]].priceSize)

var value = _N((assets[symbols[i]].ask_value + assets[symbols[i]].bid_value)/2, 2)

var infoList = [symbols[i], assets[symbols[i]].amount, assets[symbols[i]].hold_price, price, value,_N(assets[symbols[i]].margin,3), _N(assets[symbols[i]].unrealised_profit,3)]

table.rows.push(infoList)

}

var logString = _D() + ' ' + JSON.stringify(assets.USDT) + '\n'

LogStatus(logString + '`' + JSON.stringify(table) + '`')

if(Date.now()-update_profit_time > Log_profit_interval*1000){

LogProfit(_N(assets.USDT.margin_balance,3))

update_profit_time = Date.now()

}

}

function onTick(){

var short_value = Trade_value

if(short_symbols.length<long_symbols.length){

short_value = _N(long_symbols.length*Trade_value/short_symbols.length,0)

}

var long_value = Trade_value

if(short_symbols.length>long_symbols.length){

long_value = _N(short_symbols.length*Trade_value/long_symbols.length,0)

}

var symbol = ''

for(var i=0; i<short_symbols.length; i++){

symbol = short_symbols[i]

if(assets[symbol].ask_price == 0){ continue }

if(assets[symbol].bid_value + short_value > Adjust_value){

trade(symbol, 'sell', assets[symbol].bid_value + short_value)

}

if(assets[symbol].ask_value + short_value < -Adjust_value){

trade(symbol, 'buy', -(assets[symbol].ask_value + short_value))

}

}

for(var i=0; i<long_symbols.length; i++){

symbol = long_symbols[i]

if(assets[symbol].ask_price == 0){ continue }

if(assets[symbol].bid_value - long_value > Adjust_value){

trade(symbol, 'sell', assets[symbol].bid_value-long_value)

}

if(assets[symbol].ask_value - long_value < -Adjust_value){

trade(symbol, 'buy', long_value-assets[symbol].ask_value)

}

}

}

function main() {

while(true){

updateAccount()

updateTick()

onTick()

updateStatus()

Sleep(Interval*1000)

}

}- Python版追涨杀跌策略(教学)@币安USDT永续合约

- 币安合约websocket接口查询持仓账户范例

- 币安合约BNB手续费抵扣/ 自动购买自动划转

- 币安合约蝶式套利(千团大战策略3)

- 币安永续多币种对冲策略(做多超跌做空超涨) (张总python版)

- 币安策略二去掉高低分

- 币安永续多币种对冲策略原版(做多超跌做空超涨)4月13日最新止损模块

- 币安 提币范例代码

- 实时推送币安成交到微信(wss协议练习)

- 币安买卖统计