Hello traders,

I hereby present to you the second stage of my journey to finding a reliable, profitable trading strategy. The “Millemachine” is based on the “Millebot”, my previous published strategy. This means the backbone of the strategy is still the same: a trend following system. Instead of using a fixed TP and SL, a trailing stoploss is now used. To limit the losses when the trend weakens, the trailing stoploss automatically gets smaller, as it is based on the ATR. A new utility is you can now easily switch between indicators on which the decision making is based. This allows the user to discover which indicators work best for entry, long/short switching and stoploss configuration.

The strategy has been proven to be very profitable in trending markets, but can suffer losses during ranging market. To make the system more robust, the strategy cannot solely rely on a trending system. Other systems must be added. I believe that a good trading bot must consist of more than 4 different strategies, based on different systems. This is what I am currently working on.

My goal for publishing this strategy is to help other traders build their own. In my journey I found it difficult to find a good strategy that employs a decent risk management, which is truly essential for having good, consistent results. Also, a realistic commission needs to be defined to have a realistic performance prediction. This weighs on the profitability and therefore is often set at 0 by authors of other strategies, which I find misleading.

If you have found this strategy informative or useful, please leave a comment.

Greetings Michael

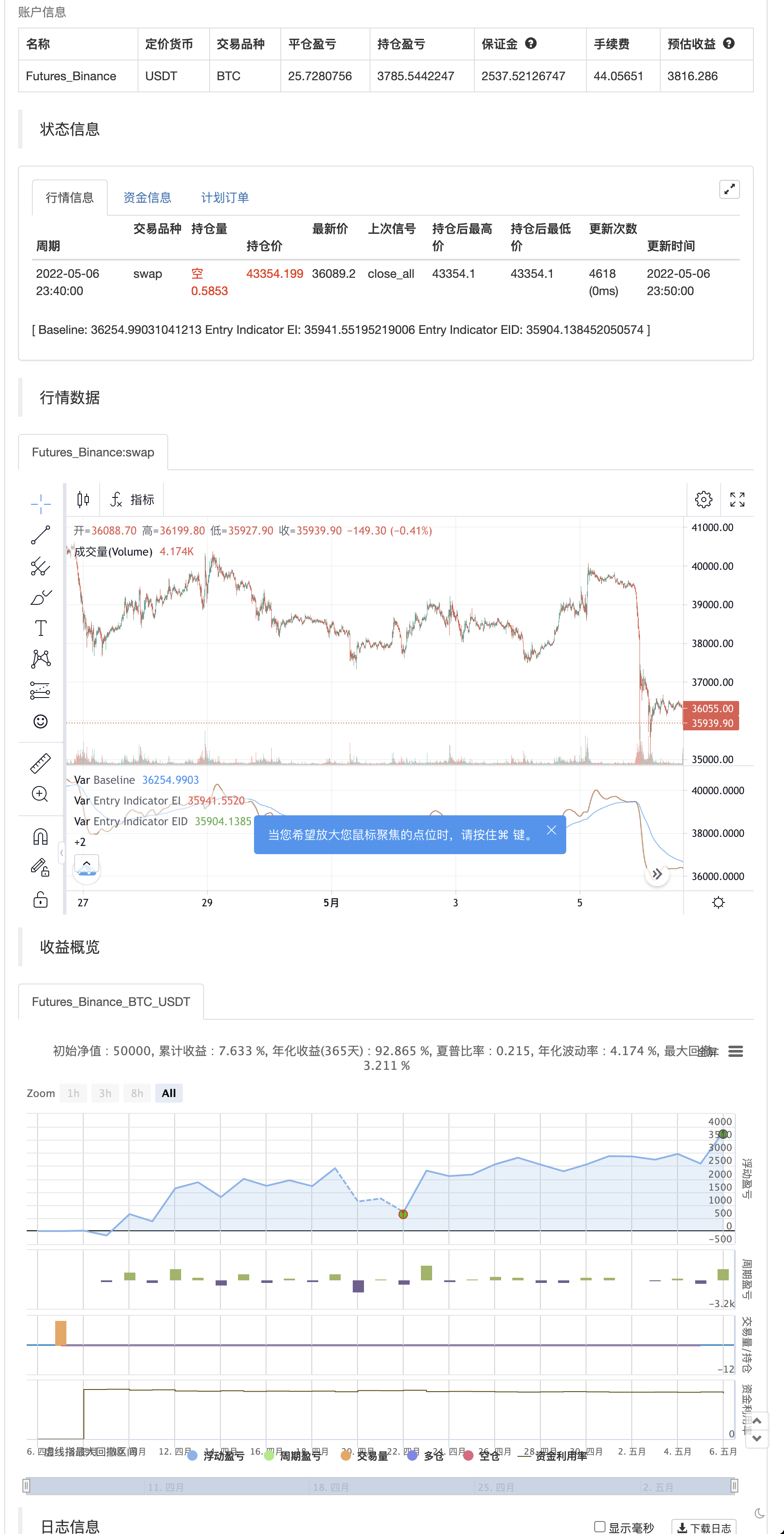

backtest

// © Milleman

//@version=4

//strategy("MilleMachine", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.06)

// Additional settings

Mode = input(title="Mode", defval="LongShort", options=["LongShort", "OnlyLong", "OnlyShort","Indicator Mode"])

UseTP = false //input(false, title="Use Take Profit?")

QuickSwitch = true //input(true, title="Quickswitch")

UseTC = true //input(true, title="Use Trendchange?")

// Risk management settings

//Spacer2 = input(false, title="======= Risk management settings =======")

Risk = input(1.0, title="% Risk",minval=0)/100

RRR = 2 //input(2,title="Risk Reward Ratio",step=0.1,minval=0,maxval=20)

SL_Mode = false // input(true, title="ON = Fixed SL / OFF = Dynamic SL (ATR)")

SL_Fix = 3 //input(3,title="StopLoss %",step=0.25, minval=0)/100

ATR = atr(14) //input(14,title="Periode ATR"))

Mul = input(2,title="ATR Multiplier",step=0.1)

xATR = ATR * Mul

SL = SL_Mode ? SL_Fix : (1 - close/(close+xATR))

// INDICATORS //////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////////

Ind(type, src, len) =>

float result = 0

if type=="McGinley"

result := na(result[1]) ? ema(src, len) : result[1] + (src - result[1]) / (len * pow(src/result[1], 4))

if type=="HMA"

result := wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len)))

if type=="EHMA"

result := ema(2*ema(src, len/2)-ema(src, len), round(sqrt(len)))

if type=="THMA"

lend = len/2

result := wma(wma(src, lend/3)*3-wma(src, lend/2)-wma(src,lend), lend)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VWMA" // Volume Weighted

result := vwma(src, len)

if type=="SMMA" // Smoothed

w = wma(src, len)

result := (w[1] * (len - 1) + src) / len

if type == "RMA"

result := rma(src, len)

if type=="LSMA" // Least Squares

result := linreg(src, len, 0)

if type=="ALMA" // Arnaud Legoux

result := alma(src, len, 0.85, 6)

if type=="Kijun" //Kijun-sen

kijun = avg(lowest(len), highest(len))

result :=kijun

if type=="WWSA" // Welles Wilder Smoothed Moving Average

result := nz(result[1]) + (close -nz(result[1]))/len

result

// Baseline : Switch from Long to Short and vice versa

BL_Act = input(true, title="====== Activate Baseline - Switch L/S ======")

BL_type = input(title="Baseline Type", defval="McGinley", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

BL_src = input(close, title="BL source")

BL_len = input(50, title="BL length", minval=1)

BL = Ind(BL_type,BL_src, BL_len)

// Confirmation indicator

C1_Act = input(false, title="===== Activate Confirmation indicator =====")

C1_type = input(title="C1 Entry indicator", defval="SMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

C1_src = input(close, title="Source")

C1_len = input(5,title="Length", minval=1)

C1 = Ind(C1_type,C1_src,C1_len)

// Entry indicator : Hull Moving Average

Spacer5 = input(true, title="====== ENTRY indicator =======")

EI_type = input(title="EI Entry indicator", defval="HMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

EI_src = input(close, title="Source")

EI_Len = input(46,title="Length", minval=1)

EI = Ind(EI_type,EI_src,EI_Len)

// Trail stop settings

TrailActivation = input(true, title="===== Activate Trailing Stop =====")

TS_type = input(title="TS Traling Stop Type", defval="EMA", options=["McGinley","HMA","EHMA","THMA","SMA","EMA","DEMA","TEMA","WMA","VWMA","SMMA","RMA","LSMA","ALMA","Kijun","WWSA"])

TrailSLScaling = 1 //input(100, title="SL Scaling", minval=0, step=5)/100

TrailingSourceLong = Ind(TS_type,low,input(5,"Smoothing Trail Long EMA", minval=1))

TrailingSourceShort = Ind(TS_type,high,input(2,"Smoothing Trail Short EMA", minval=1))

//VARIABLES MANAGEMENT

TriggerPrice = 0.0, TriggerPrice := TriggerPrice[1]

TriggerSL = 0.0, TriggerSL := TriggerSL[1]

SLPrice = 0.0, SLPrice := SLPrice[1], TPPrice = 0.0, TPPrice := TPPrice[1]

isLong = false, isLong := isLong[1], isShort = false, isShort := isShort[1]

//LOGIC

GoLong = crossover(EI,EI[1]) and (strategy.position_size == 0.0 and QuickSwitch) and (not BL_Act or BL/BL[1] > 1) and (not C1_Act or C1>C1[1]) and (Mode == "LongShort" or Mode == "OnlyLong")

GoShort = crossunder(EI,EI[1]) and (strategy.position_size == 0.0 and QuickSwitch) and (not BL_Act or BL/BL[1] < 1) and (not C1_Act or C1<C1[1]) and (Mode == "LongShort" or Mode == "OnlyShort")

ExitLong = isLong and crossunder(EI,EI[1]) and UseTC

ExitShort = isShort and crossover(EI,EI[1]) and UseTC

//FRAMEWORK

//Reset Long-Short memory

if isLong and strategy.position_size == 0.0

isLong := false

if isShort and strategy.position_size == 0.0

isShort := false

//Long

if GoLong

isLong := true, TriggerPrice := close, TriggerSL := SL

TPPrice := UseTP? TriggerPrice * (1 + (TriggerSL * RRR)) : na

SLPrice := TriggerPrice * (1-TriggerSL)

Entry_Contracts = strategy.equity * Risk / ((TriggerPrice-SLPrice)/TriggerPrice) / TriggerPrice

strategy.entry("Long", strategy.long, comment=str.tostring(math.round((TriggerSL/TriggerPrice)*1000)), qty=Entry_Contracts)

strategy.exit("TPSL","Long", limit=TPPrice, stop=SLPrice)

if isLong

NewValSL = TrailingSourceLong * (1 - (SL*TrailSLScaling))

if TrailActivation and NewValSL > SLPrice

SLPrice := NewValSL

strategy.exit("TPSL","Long", limit=TPPrice, stop=SLPrice)

if ExitLong

strategy.close_all(comment="TrendChange")

isLong := false

//Short

if GoShort

isShort := true, TriggerPrice := close, TriggerSL := SL

TPPrice := UseTP? TriggerPrice * (1 - (TriggerSL * RRR)) : na

SLPrice := TriggerPrice * (1 + TriggerSL)

Entry_Contracts = strategy.equity * Risk / ((SLPrice-TriggerPrice)/TriggerPrice) / TriggerPrice

strategy.entry("Short", strategy.short, comment=str.tostring(math.round((TriggerSL/TriggerPrice)*1000)), qty=Entry_Contracts)

strategy.exit("TPSL","Short", limit=TPPrice, stop=SLPrice)

if isShort

NewValSL = TrailingSourceShort * (1 + (SL*TrailSLScaling))

if TrailActivation and NewValSL < SLPrice

SLPrice := NewValSL

strategy.exit("TPSL","Short", limit=TPPrice, stop=SLPrice)

if ExitShort

strategy.close_all(comment="TrendChange")

isShort := false

//VISUALISATION

plot(BL_Act?BL:na, color=color.blue,title="Baseline")

plot(C1_Act?C1:na, color=color.yellow,title="confirmation Indicator")

EIColor = EI>EI[1] ? color.green : color.red

Fill_EI = plot(EI, color=EIColor, linewidth=1, transp=40, title="Entry Indicator EI")

Fill_EID = plot(EI[1], color=EIColor, linewidth=1, transp=40, title="Entry Indicator EID")

plot(strategy.position_size != 0.0 and (isLong or isShort) ? TriggerPrice : na, title="TriggerPrice", color=color.yellow, style=plot.style_linebr)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? TPPrice : na, title="TakeProfit", color=color.green, style=plot.style_linebr)

plot(strategy.position_size != 0.0 and (isLong or isShort) ? SLPrice : na, title="StopLoss", color=color.red, style=plot.style_linebr)