🎯 这个策略到底在干什么?

你知道吗?这个策略就像是市场的”情绪识别器”!📊 它专门捕捉那些让散户措手不及的关键转折点。想象一下,如果你能提前知道股价什么时候要”变脸”,是不是就像拥有了交易的超能力?

这个策略的核心思路超级简单:当价格突破重要的高点或低点时,市场结构就发生了转变。就像你在爬山时突然发现前面是下坡路一样,趋势的改变往往就在这一瞬间!

🔍 划重点!三大核心机制

1. 摆动点识别系统 🎢 策略会自动找出过去一段周期内的重要高点和低点,就像给市场画出”山峰”和”山谷”。当价格突破这些关键位置时,就是趋势可能转变的信号!

2. ATR过滤器 📏 这里有个超聪明的设计!策略不会被小幅波动忽悠,必须要突破幅度达到ATR的一定倍数才算有效。这就像设置了一个”最低门槛”,过滤掉那些假突破。

3. 溢价/折价区间框架 💎 最有趣的来了!策略会在价格区间内划分出”便宜区”和”昂贵区”。在便宜区买入,在昂贵区卖出,这不就是投资的黄金法则吗?

🚀 实战优势在哪里?

避坑指南一:告别追涨杀跌!这个策略专门在趋势转折的第一时间入场,让你成为”聪明钱”而不是”接盘侠”。

避坑指南二:风险控制超贴心!可以根据账户比例自动计算仓位大小,还能设置基于区间的止损位,让你睡得安稳。

避坑指南三:视觉化超棒!图表上会自动标记转折点,背景还会变色提示当前是便宜区还是昂贵区,一目了然!

💡 适合什么样的交易者?

如果你是那种喜欢”低买高卖”但总是把握不好时机的交易者,这个策略简直就是为你量身定制的!它特别适合中长期交易者,因为它关注的是市场结构的根本性变化,而不是短期噪音。

记住,最好的策略不是让你每天都交易,而是让你在对的时间做对的事情!🎯

策略源码

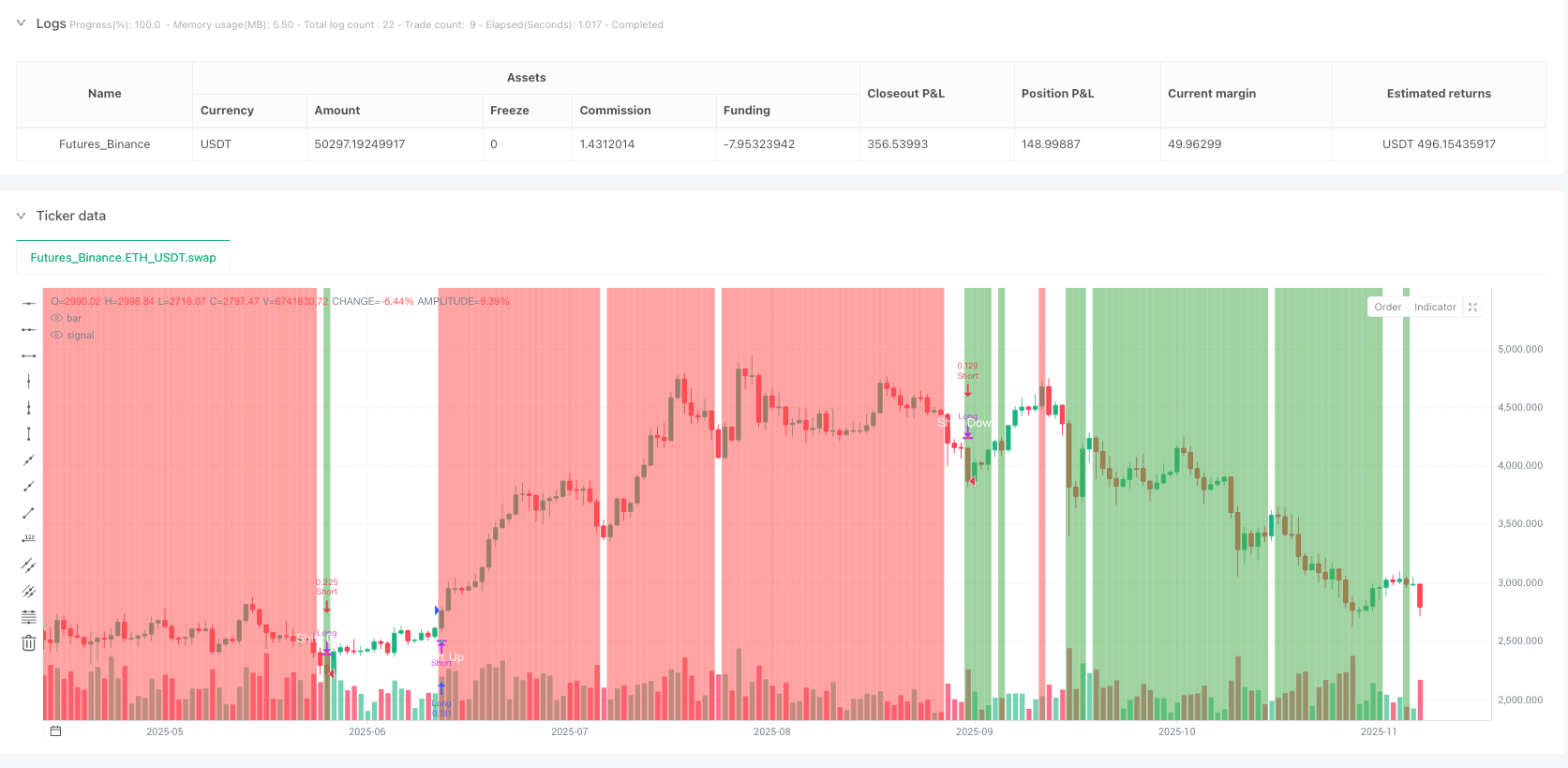

/*backtest

start: 2024-12-04 00:00:00

end: 2025-12-02 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

//@version=6

strategy(title="Trendshift [CHE] Strategy", shorttitle="TrShStr", overlay=true)

// ——— SECTION: Constants & Enums

string GROUP_MARKET_STRUCTURE = "Market Structure"

string GROUP_FRAMEWORK = "Premium/Discount Framework"

string GROUP_VISUAL = "Visuals"

string GROUP_RISK = "Execution and Risk"

// ——— SECTION: Inputs (grouped; tooltips; one-row via inline)

swing_len_input = input.int(5, "Swing length", minval=1, group=GROUP_MARKET_STRUCTURE, inline="msw", tooltip="Bars left and right for major swing highs and lows.")

is_use_atr_filter_input = input.bool(true, "Use ATR filter", group=GROUP_MARKET_STRUCTURE, inline="msw", tooltip="Require breakout to exceed swing level by an ATR multiple.")

atr_len_input = input.int(14, "ATR length", minval=1, group=GROUP_MARKET_STRUCTURE, inline="atr", tooltip="ATR length for conviction and band checks.")

atr_mult_break_input = input.float(1.0, "Break ATR mult", minval=0.0, step=0.1, group=GROUP_MARKET_STRUCTURE, inline="atr", tooltip="Distance beyond swing, in ATR units, to confirm a structure shift.")

is_enable_framework_input = input.bool(true, "Enable framework", group=GROUP_FRAMEWORK, inline="fw", tooltip="Enable premium and discount band logic.")

is_persist_last_band_input = input.bool(true, "Persist band on timeout", group=GROUP_FRAMEWORK, inline="fw", tooltip="Keep last band after regime timeout.")

min_band_atr_mult_input = input.float(0.5, "Min band ATR mult", minval=0.0, step=0.1, group=GROUP_FRAMEWORK, inline="band", tooltip="Minimum band height relative to ATR.")

regime_timeout_bars_input = input.int(200, "Regime timeout bars", minval=0, group=GROUP_FRAMEWORK, inline="band", tooltip="Bars since last shift before regime reset. Zero disables timeout.")

is_invert_colors_input = input.bool(false, "Invert colors", group=GROUP_FRAMEWORK, inline="col", tooltip="Swap premium and discount colors.")

show_zone_tint_input = input.bool(true, "Show zone tint", group=GROUP_VISUAL, inline="vis", tooltip="Tint background in discount or premium bands.")

show_structure_marks_input = input.bool(true, "Show shift markers", group=GROUP_VISUAL, inline="vis", tooltip="Show first bullish and first bearish structure shift markers.")

risk_percent_input = input.float(1.0, "Risk per trade percent", minval=0.0, maxval=100.0, step=0.1, group=GROUP_RISK, inline="risk", tooltip="Account percent used to size position.")

is_use_band_for_size_input = input.bool(false, "Use band for size", group=GROUP_RISK, inline="risk", tooltip="If enabled, band height is used to scale position size.")

is_close_on_opposite_input = input.bool(true, "Flat on opposite shift", group=GROUP_RISK, inline="exit", tooltip="Close and reverse on opposite first shift.")

is_use_stop_band_input = input.bool(false, "Use stop at band", group=GROUP_RISK, inline="exit", tooltip="If enabled, band edge is used as stop distance.")

stop_band_side_input = input.string("Opposite band edge", "Stop band side", options=["Opposite band edge", "Same band edge"], group=GROUP_RISK, inline="exit", tooltip="Defines which band edge is used as stop reference.")

// ——— SECTION: Types

// (no custom types)

// ——— SECTION: Persistent Vars → Runtime Vars

var float last_swing_high = na

var float last_swing_low = na

var int last_swing_high_bar = na

var int last_swing_low_bar = na

var int regime = 0

var float band_low = na

var float band_high = na

var float struct_level = na

var int last_shift_bar = na

var bool is_last_shift_bullish = false

// ——— SECTION: Helpers (pure, no side effects)

stop_from_band(is_long, band_low_value, band_high_value, stop_side) =>

float stop_price = na

if is_long

stop_price := stop_side == "Opposite band edge" ? band_low_value : band_high_value

else

stop_price := stop_side == "Opposite band edge" ? band_high_value : band_low_value

stop_price

// ——— SECTION: Core Calculations

// Swings and ATR

pivot_high_value = ta.pivothigh(high, swing_len_input, swing_len_input)

pivot_low_value = ta.pivotlow(low, swing_len_input, swing_len_input)

if not na(pivot_high_value)

last_swing_high := pivot_high_value

last_swing_high_bar := bar_index - swing_len_input

if not na(pivot_low_value)

last_swing_low := pivot_low_value

last_swing_low_bar := bar_index - swing_len_input

atr_value = ta.atr(atr_len_input)

// Structure shifts

has_major_high = not na(last_swing_high)

has_major_low = not na(last_swing_low)

is_bullish_break_base = has_major_high and close > last_swing_high

is_bearish_break_base = has_major_low and close < last_swing_low

is_bullish_break = is_bullish_break_base

is_bearish_break = is_bearish_break_base

if is_use_atr_filter_input and atr_value > 0.0

is_bullish_break := is_bullish_break_base and (close - last_swing_high) >= atr_mult_break_input * atr_value

is_bearish_break := is_bearish_break_base and (last_swing_low - close) >= atr_mult_break_input * atr_value

is_bullish_shift = is_bullish_break and has_major_low

is_bearish_shift = is_bearish_break and has_major_high

if is_bullish_shift and is_bearish_shift

is_bullish_shift := close >= open

is_bearish_shift := not is_bullish_shift

is_bullish_shift_first = is_bullish_shift and (na(last_shift_bar) or not is_last_shift_bullish)

is_bearish_shift_first = is_bearish_shift and (na(last_shift_bar) or is_last_shift_bullish)

// Regime and band update

if is_bullish_shift

regime := 1

band_low := last_swing_low

band_high := high

struct_level := last_swing_high

last_shift_bar := bar_index

is_last_shift_bullish := true

if is_bearish_shift

regime := -1

band_low := low

band_high := last_swing_high

struct_level := last_swing_low

last_shift_bar := bar_index

is_last_shift_bullish := false

// Regime timeout and band clear

if regime_timeout_bars_input > 0 and regime != 0 and not is_bullish_shift and not is_bearish_shift and not na(last_shift_bar) and bar_index - last_shift_bar > regime_timeout_bars_input

regime := 0

if not is_persist_last_band_input

band_low := na

band_high := na

struct_level := na

// Premium and discount band

is_base_valid_band = is_enable_framework_input and not na(band_low) and not na(band_high) and band_high > band_low

price_span = is_base_valid_band ? band_high - band_low : na

is_band_not_tiny = is_base_valid_band and atr_value > 0.0 and min_band_atr_mult_input > 0.0 and price_span >= min_band_atr_mult_input * atr_value or is_base_valid_band and (min_band_atr_mult_input == 0.0 or atr_value <= 0.0)

is_valid_band = is_base_valid_band and is_band_not_tiny

discount_threshold = is_valid_band ? band_low + 0.25 * price_span : na

premium_threshold = is_valid_band ? band_low + 0.75 * price_span : na

is_in_discount = is_valid_band and close <= discount_threshold

is_in_premium = is_valid_band and close >= premium_threshold

// Execution sizing and stops

acc_value = strategy.equity

base_qty = risk_percent_input > 0.0 ? acc_value * risk_percent_input * 0.01 / nz(close, 1.0) : 0.0

band_qty_factor = is_use_band_for_size_input and is_valid_band and atr_value > 0.0 ? math.min(2.0, math.max(0.25, price_span / atr_value)) : 1.0

trade_qty = base_qty * band_qty_factor

is_long_entry = is_bullish_shift_first

is_short_entry = is_bearish_shift_first

float long_stop = na

float short_stop = na

if is_use_stop_band_input and is_valid_band

long_stop := stop_from_band(true, band_low, band_high, stop_band_side_input)

short_stop := stop_from_band(false, band_low, band_high, stop_band_side_input)

// Strategy entries and exits

if is_long_entry and trade_qty > 0.0

if is_close_on_opposite_input and strategy.position_size < 0

strategy.close("Short")

if is_use_stop_band_input and not na(long_stop)

strategy.entry("Long", strategy.long, qty=trade_qty)

strategy.exit("Long SL", "Long", stop=long_stop)

else

strategy.entry("Long", strategy.long, qty=trade_qty)

if is_short_entry and trade_qty > 0.0

if is_close_on_opposite_input and strategy.position_size > 0

strategy.close("Long")

if is_use_stop_band_input and not na(short_stop)

strategy.entry("Short", strategy.short, qty=trade_qty)

strategy.exit("Short SL", "Short", stop=short_stop)

else

strategy.entry("Short", strategy.short, qty=trade_qty)

// ——— SECTION: Rendering/UI (GLOBAL ONLY; single-line calls)

discount_zone_color = is_invert_colors_input ? color.new(color.red, 30) : color.new(color.green, 30)

premium_zone_color = is_invert_colors_input ? color.new(color.green, 30) : color.new(color.red, 30)

discount_bg_color = show_zone_tint_input and is_in_discount ? color.new(discount_zone_color, 85) : na

premium_bg_color = show_zone_tint_input and is_in_premium ? color.new(premium_zone_color, 85) : na

bgcolor(discount_bg_color, title="Discount zone tint")

bgcolor(premium_bg_color, title="Premium zone tint")

plotshape(show_structure_marks_input and is_bullish_shift_first ? low : na, title="Bullish structure shift first", style=shape.triangleup, location=location.belowbar, size=size.small, color=color.new(color.lime, 0), text="Shift Up", textcolor=color.white)

plotshape(show_structure_marks_input and is_bearish_shift_first ? high : na, title="Bearish structure shift first", style=shape.triangledown, location=location.abovebar, size=size.small, color=color.new(color.red, 0), text="Shift Down", textcolor=color.white)

相关推荐