This strategy works better on AUD/USD in the 15 min timeframe. It uses the Pivot Supertrend to enter trades based on different filters such as: - Simple EMA filter: that the 3 EMAs should be in order - DEMA angle: you can choose the DEMA Angle threshold and the look back to check the angle to just trade trades with DEMA at a certain angle - Simple DEMA filter: just check if close is above or below DEMA - Take Every Supertrend Signal: this means to take every normal supertrend signal to not just wait for a pivot supertrend signal to enter a trade (specially on long pivot supertrend periods) - Stop Loss at Supertrend: this means that the stop loss will be at the Normal Supertrend, if false the stop loss will be placed at the ATR level selected. - 2 Steps Take Profit: this means if you want to close a percentage of position as soon as the normal supertrend crosses the entry price, you can select the % on the “2 Steps TP qty” input - Stop Loss ATR Multiplier: if Stop Loss at Supertrend is off this will be the stoploss based on the atr - Take Profit ATR Multiplier: if Stop Loss at Supertrend is off this will be the takeprofit based on the atr (you have to keep in mind that the ratio between this two will make the Risk to reward ratio of the take profit when the Stop Loss at Supertrend) - Testing: to avoid overfitting, you can select date ranges for backtesting and forwardtesting and select which testing you wanna do

backtest

/*backtest

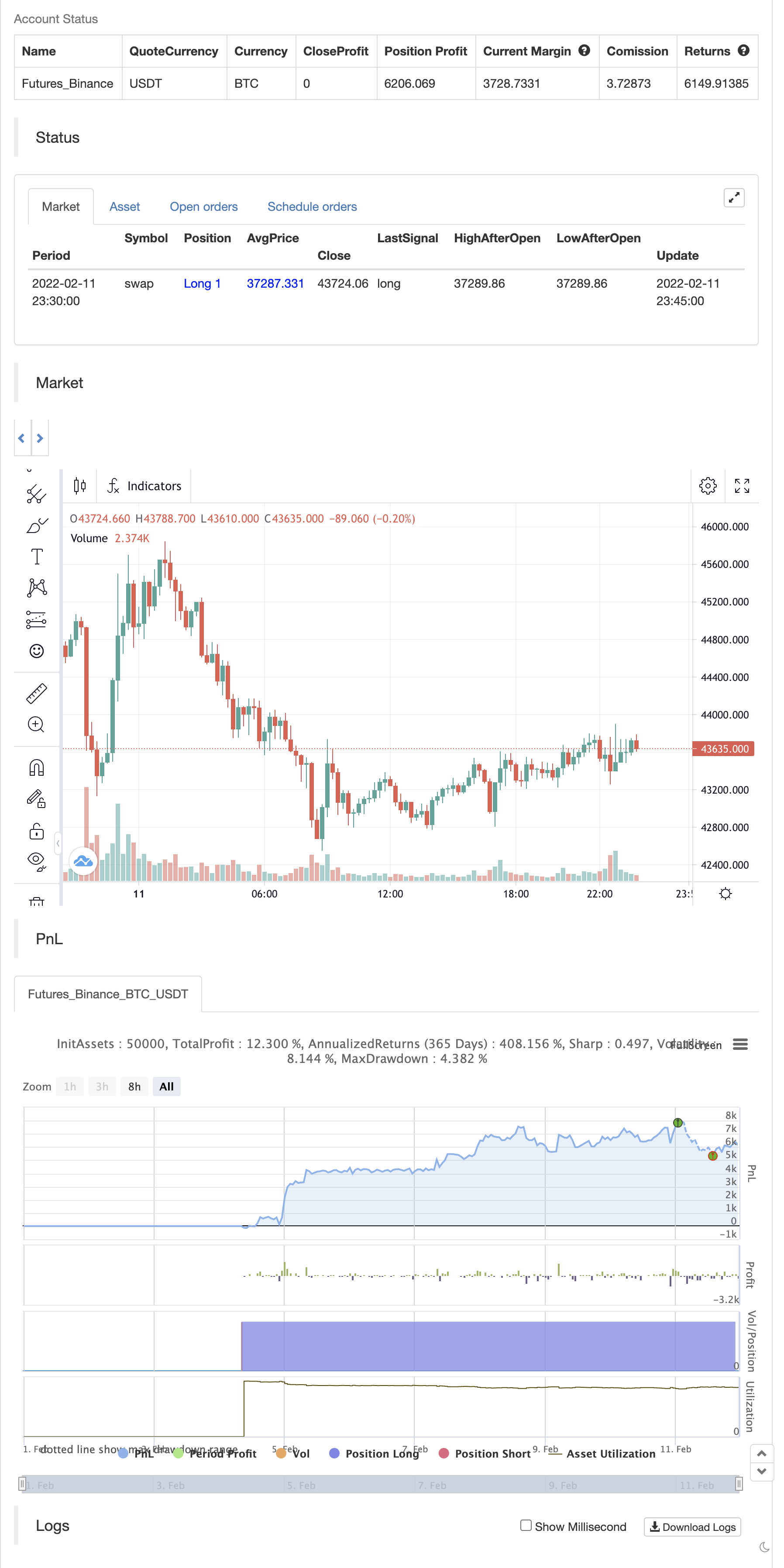

start: 2022-02-01 00:00:00

end: 2022-02-11 23:59:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © evillalobos1123

//@version=5

strategy("Villa Dinamic Pivot Supertrend Strategy", overlay=true, calc_on_every_tick = true)

//INPUTS

ema_b = input.bool(false, "Use Simple EMA Filter", group = "Strategy Inputs")

ema_b_ang = input.bool(true, "Use DEMA Angle Filter", group = "Strategy Inputs")

dema_b = input.bool(true, "Use DEMA Filter", group = "Strategy Inputs")

st_sig = input.bool(false, "Take Every Supertrend Signal" , group = "Strategy Inputs")

take_p = input.bool(true, "Stop Loss at Supertrend", group = "Strategy Inputs")

din_tp = input.bool(false, "2 Steps Take Profit", group = "Strategy Inputs")

move_sl = input.bool(true, "Move SL", group = "Strategy Inputs")

sl_atr = input.float(2.5, "Stop Loss ATR Multiplier", group = "Strategy Inputs")

tp_atr = input.float(4, "Take Profit ATR Multiplier", group = "Strategy Inputs")

din_tp_qty = input.int(50, "2 Steps TP qty%", group = "Strategy Inputs")

dema_a_filter = input.float(0, "DEMA Angle Threshold (+ & -)", group = "Strategy Inputs")

dema_a_look = input.int(1, "DEMA Angle Lookback", group = "Strategy Inputs")

dr_test = input.string("All", "Testing", options = ["Backtest", "Forwardtest", "All"], group = "Strategy Inputs")

test_act = input.string('Forex', 'Market', options = ['Forex', 'Stocks'], group = "Strategy Inputs")

not_in_trade = strategy.position_size == 0

//Backtesting date range

start_year = input.int(2021, "Backtesting start year", group = "BT Date Range")

start_month = input.int(1, "Backtesting start month", group = "BT Date Range")

start_date = input.int(1, "Backtesting start day", group = "BT Date Range")

end_year = input.int(2021, "Backtesting end year", group = "BT Date Range")

end_month = input.int(12, "Backtesting end month", group = "BT Date Range")

end_date = input.int(31, "Backtesting end day", group = "BT Date Range")

bt_date_range = (time >= timestamp(syminfo.timezone, start_year,

start_month, start_date, 0, 0)) and

(time < timestamp(syminfo.timezone, end_year, end_month, end_date, 0, 0))

//Forward testing date range

start_year_f = input.int(2022, "Forwardtesting start year", group = "FT Date Range")

start_month_f = input.int(1, "Forwardtesting start month", group = "FT Date Range")

start_date_f = input.int(1, "Forwardtesting start day", group = "FT Date Range")

end_year_f = input.int(2022, "Forwardtesting end year", group = "FT Date Range")

end_month_f = input.int(03, "Forwardtesting end month", group = "FT Date Range")

end_date_f = input.int(26, "Forwardtesting end day", group = "FT Date Range")

ft_date_range = (time >= timestamp(syminfo.timezone, start_year_f,

start_month_f, start_date_f, 0, 0)) and

(time < timestamp(syminfo.timezone, end_year_f, end_month_f, end_date_f, 0, 0))

//date condition

date_range_cond = if dr_test == "Backtest"

bt_date_range

else if dr_test == "Forwardtest"

ft_date_range

else

true

//INDICATORS

//PIVOT SUPERTREND

prd = input.int(2, "PVT ST Pivot Point Period", group = "Pivot Supertrend")

Factor=input.float(3, "PVT ST ATR Factor", group = "Pivot Supertrend")

Pd=input.int(9 , "PVT ST ATR Period", group = "Pivot Supertrend")

// get Pivot High/Low

float ph = ta.pivothigh(prd, prd)

float pl = ta.pivotlow(prd, prd)

// calculate the Center line using pivot points

var float center = na

float lastpp = ph ? ph : pl ? pl : na

if lastpp

if na(center)

center := lastpp

else

//weighted calculation

center := (center * 2 + lastpp) / 3

// upper/lower bands calculation

Up = center - (Factor * ta.atr(Pd))

Dn = center + (Factor * ta.atr(Pd))

// get the trend

float TUp = na

float TDown = na

Trend = 0

TUp := close[1] > TUp[1] ? math.max(Up, TUp[1]) : Up

TDown := close[1] < TDown[1] ? math.min(Dn, TDown[1]) : Dn

Trend := close > TDown[1] ? 1: close < TUp[1]? -1: nz(Trend[1], 1)

Trailingsl = Trend == 1 ? TUp : TDown

// check and plot the signals

bsignal = Trend == 1 and Trend[1] == -1

ssignal = Trend == -1 and Trend[1] == 1

//get S/R levels using Pivot Points

float resistance = na

float support = na

support := pl ? pl : support[1]

resistance := ph ? ph : resistance[1]

//DEMA

dema_ln = input.int(200, "DEMA Len", group = 'D-EMAs')

dema_src = input.source(close, "D-EMAs Source", group = 'D-EMAs')

ema_fd = ta.ema(dema_src, dema_ln)

dema = (2*ema_fd)-(ta.ema(ema_fd,dema_ln))

//EMA

ema1_l = input.int(21, "EMA 1 Len", group = 'D-EMAs')

ema2_l = input.int(50, "EMA 2 Len", group = 'D-EMAs')

ema3_l = input.int(200, "EMA 3 Len", group = 'D-EMAs')

ema1 = ta.ema(dema_src, ema1_l)

ema2 = ta.ema(dema_src, ema2_l)

ema3 = ta.ema(dema_src, ema3_l)

//Supertrend

Periods = input.int(21, "ST ATR Period", group = "Normal Supertrend")

src_st = input.source(hl2, "ST Supertrend Source", group = "Normal Supertrend")

Multiplier = input.float(2.0 , "ST ATR Multiplier", group = "Normal Supertrend")

changeATR= true

atr2 = ta.sma(ta.tr, Periods)

atr3= changeATR ? ta.atr(Periods) : atr2

up=src_st-(Multiplier*atr3)

up1 = nz(up[1],up)

up := close[1] > up1 ? math.max(up,up1) : up

dn=src_st+(Multiplier*atr3)

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

buySignal = trend == 1 and trend[1] == -1

sellSignal = trend == -1 and trend[1] == 1

//ATR

atr = ta.atr(14)

///CONDITIONS

//BUY

/// ema simple

ema_cond_b = if ema_b

ema1 > ema2 and ema2 > ema3

else

true

///ema angle

div_ang = if test_act == 'Forex'

0.0001

else

1

dema_angle_rad = math.atan((dema - dema[dema_a_look])/div_ang)

dema_angle = dema_angle_rad * (180/math.pi)

dema_ang_cond_b = if ema_b_ang

if dema_angle >= dema_a_filter

true

else

false

else

true

///ema distance

dema_cond_b = if dema_b

close > dema

else

true

//supertrends

///if pivot buy sig or (st buy sig and pivot. trend = 1)

pvt_cond_b = bsignal

st_cond_b = if st_sig

buySignal and Trend == 1

else

false

st_entry_cond = pvt_cond_b or st_cond_b

///stop loss tp

sl_b = if take_p

if trend == 1

up

else

close - (atr * sl_atr)

else

close - (atr * sl_atr)

tp_b = if take_p

if trend == 1

close + ((close - up) * (tp_atr / sl_atr))

else

close + (atr * tp_atr)

else

close + (atr * tp_atr)

//position size

init_cap = strategy.equity

pos_size_b = math.round((init_cap * .01) / (close - sl_b))

ent_price = strategy.opentrades.entry_price(strategy.opentrades - 1)

var sl_b_n = 0.0

var tp_b_n = 0.0

longCondition = (ema_cond_b and dema_cond_b and dema_ang_cond_b and st_entry_cond and date_range_cond and not_in_trade)

if (longCondition)

strategy.entry("Long", strategy.long, qty = pos_size_b)

sl_b_n := sl_b

tp_b_n := tp_b

ent_price := strategy.opentrades.entry_price(strategy.opentrades - 1)

if (up[1] < ent_price and up >= ent_price and trend[0] == 1)

if din_tp

strategy.close("Long", qty_percent = din_tp_qty)

if move_sl

sl_b_n := ent_price

strategy.exit("Exit", "Long", stop =sl_b_n, limit = tp_b_n)

//sell

///ema simple

ema_cond_s = if ema_b

ema1 < ema2 and ema2 < ema3

else

true

//ema distance

dema_cond_s = if dema_b

close < dema

else

true

//dema angle

dema_ang_cond_s = if ema_b_ang

if dema_angle <= -(dema_a_filter)

true

else

false

else

true

//supertrends

///if pivot buy sig or (st buy sig and pivot. trend = 1)

pvt_cond_s = ssignal

st_cond_s = if st_sig

sellSignal and Trend == -1

else

false

st_entry_cond_s = pvt_cond_s or st_cond_s

///stop loss tp

sl_s = if take_p

if trend == -1

dn

else

close + (atr * sl_atr)

else

close + (atr * sl_atr)

tp_s = if take_p

if trend == -1

close - ((dn - close) * (tp_atr / sl_atr))

else

close - (atr * tp_atr)

else

close - (atr * tp_atr)

shortCondition = (ema_cond_s and dema_cond_s and dema_ang_cond_s and date_range_cond and st_entry_cond_s and not_in_trade)

pos_size_s = math.round((init_cap * .01) / (sl_s - close))

var sl_s_n = 0.0

var tp_s_n = 0.0

if (shortCondition)

strategy.entry("Short", strategy.short, qty = pos_size_s)

sl_s_n := sl_s

tp_s_n := tp_s

if (dn[1] > ent_price and dn <= ent_price and trend[0] == -1)

if din_tp

strategy.close("Short", qty_percent = din_tp_qty)

if move_sl

sl_s_n := ent_price

strategy.exit("Exit", "Short", stop = sl_s_n, limit = tp_s_n)