概述

该策略是一个基于多重技术指标和动态风险管理的量化交易策略。它结合了EMA趋势跟踪、ATR波动率、RSI超买超卖以及K线形态识别等多个维度,通过自适应调仓和动态止损来实现收益风险的平衡。策略采用了分批止盈和移动止损的方式来保护盈利。

策略原理

策略主要通过以下几个方面来实现交易: 1. 使用5周期和10周期的EMA均线交叉来确定趋势方向 2. 通过RSI指标判断超买超卖区域,避免追涨杀跌 3. 利用ATR指标动态调整止损位置和仓位大小 4. 结合K线形态(吞没、锤子、流星)作为辅助入场信号 5. 采用基于ATR的动态滑点补偿机制 6. 通过交易量确认来过滤虚假信号

策略优势

- 多重信号交叉验证,提高交易可靠性

- 动态风险管理,根据市场波动自适应调整

- 分批止盈策略,合理锁定部分利润

- 采用移动止损,保护既有盈利

- 设置每日止损限制,控制风险暴露

- 滑点动态补偿,提高订单成交率

策略风险

- 多重指标可能导致信号滞后

- 频繁交易可能产生较高成本

- 在震荡市场中可能频繁止损

- K线形态识别存在主观因素

- 参数优化可能导致过度拟合

策略优化方向

- 引入市场波动周期判断,动态调整参数

- 增加趋势强度过滤器,减少假信号

- 优化仓位管理算法,提高资金利用效率

- 加入更多的市场情绪指标

- 开发自适应参数优化系统

总结

这是一个综合了多个技术指标的成熟策略系统,通过动态风险管理和多重信号验证来提高交易的稳定性。策略的核心优势在于其自适应性和完善的风险控制体系,但仍需要在实盘中进行充分验证和持续优化。

策略源码

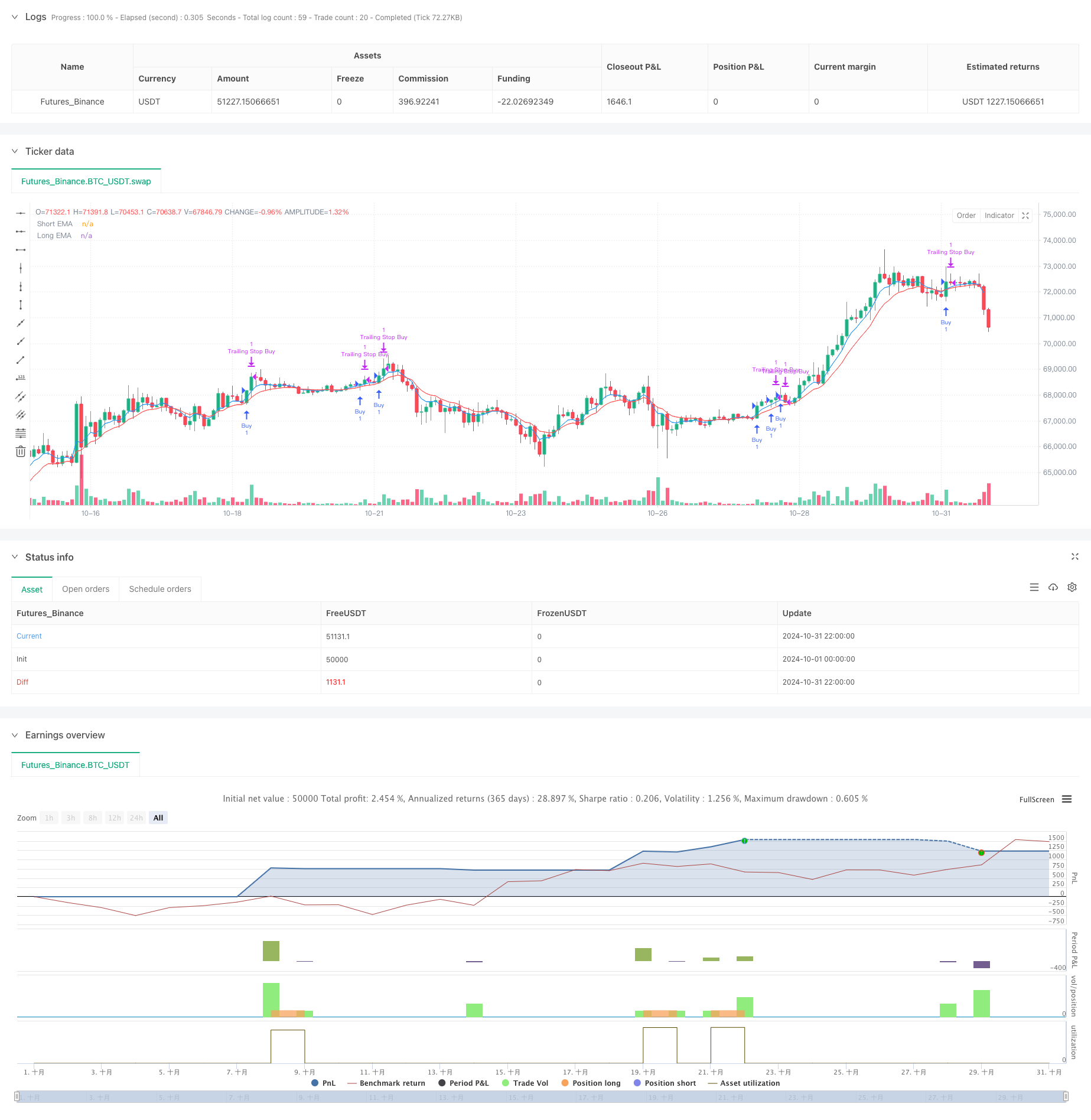

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Optimized Scalping with High Risk-Reward", overlay=true)

// Input for EMA periods

shortEMA_length = input(5, title="Short EMA Length")

longEMA_length = input(10, title="Long EMA Length")

// ATR for dynamic stop-loss

atrPeriod = input(14, title="ATR Period")

atrMultiplier = input(1.5, title="ATR Multiplier for Stop Loss")

// Calculate EMAs

shortEMA = ta.ema(close, shortEMA_length)

longEMA = ta.ema(close, longEMA_length)

// ATR calculation for dynamic stop loss

atr = ta.atr(atrPeriod)

// RSI for overbought/oversold conditions

rsi = ta.rsi(close, 14)

// Plot EMAs

plot(shortEMA, color=color.blue, title="Short EMA")

plot(longEMA, color=color.red, title="Long EMA")

// Dynamic Slippage based on ATR

dynamic_slippage = math.max(5, atr * 0.5)

// Candlestick pattern recognition

bullish_engulfing = close[1] < open[1] and close > open and close > open[1] and close > close[1]

hammer = close > open and (high - close) / (high - low) > 0.6 and (open - low) / (high - low) < 0.2

bearish_engulfing = open[1] > close[1] and open > close and open > open[1] and close < close[1]

shooting_star = close < open and (high - open) / (high - low) > 0.6 and (close - low) / (high - low) < 0.2

// Enhanced conditions with volume and RSI check

buy_condition = (bullish_engulfing or hammer) and close > shortEMA and shortEMA > longEMA and volume > ta.sma(volume, 20) and rsi < 70

sell_condition = (bearish_engulfing or shooting_star) and close < shortEMA and shortEMA < longEMA and volume > ta.sma(volume, 20) and rsi > 30

// Dynamic ATR multiplier based on recent volatility

volatility = atr

adaptiveMultiplier = atrMultiplier + (volatility - ta.sma(volatility, 50)) / ta.sma(volatility, 50) * 0.5

// Execute buy trades with slippage consideration

if (buy_condition)

strategy.entry("Buy", strategy.long)

stop_loss_buy = strategy.position_avg_price - atr * adaptiveMultiplier - dynamic_slippage

take_profit_buy = strategy.position_avg_price + atr * adaptiveMultiplier * 3 + dynamic_slippage

strategy.exit("Exit Buy", "Buy", stop=stop_loss_buy, limit=take_profit_buy)

// Execute sell trades with slippage consideration

if (sell_condition)

strategy.entry("Sell", strategy.short)

stop_loss_sell = strategy.position_avg_price + atr * adaptiveMultiplier + dynamic_slippage

take_profit_sell = strategy.position_avg_price - atr * adaptiveMultiplier * 3 - dynamic_slippage

strategy.exit("Exit Sell", "Sell", stop=stop_loss_sell, limit=take_profit_sell)

// Risk Management

maxLossPerTrade = input.float(0.01, title="Max Loss Per Trade (%)", minval=0.01, maxval=1, step=0.01) // 1% max loss per trade

dailyLossLimit = input.float(0.03, title="Daily Loss Limit (%)", minval=0.01, maxval=1, step=0.01) // 3% daily loss limit

maxLossAmount_buy = strategy.position_avg_price * maxLossPerTrade

maxLossAmount_sell = strategy.position_avg_price * maxLossPerTrade

if (strategy.position_size > 0)

strategy.exit("Max Loss Buy", "Buy", stop=strategy.position_avg_price - maxLossAmount_buy - dynamic_slippage)

if (strategy.position_size < 0)

strategy.exit("Max Loss Sell", "Sell", stop=strategy.position_avg_price + maxLossAmount_sell + dynamic_slippage)

// Daily loss limit logic

var float dailyLoss = 0.0

if (dayofweek != dayofweek[1])

dailyLoss := 0.0 // Reset daily loss tracker at the start of a new day

if (strategy.closedtrades > 0)

dailyLoss := dailyLoss + strategy.closedtrades.profit(strategy.closedtrades - 1)

if (dailyLoss < -strategy.initial_capital * dailyLossLimit)

strategy.close_all("Daily Loss Limit Hit")

// Breakeven stop after a certain profit with a delay

if (strategy.position_size > 0 and close > strategy.position_avg_price + atr * 1.5 and bar_index > strategy.opentrades.entry_bar_index(0) + 5)

strategy.exit("Breakeven Buy", from_entry="Buy", stop=strategy.position_avg_price)

if (strategy.position_size < 0 and close < strategy.position_avg_price - atr * 1.5 and bar_index > strategy.opentrades.entry_bar_index(0) + 5)

strategy.exit("Breakeven Sell", from_entry="Sell", stop=strategy.position_avg_price)

// Partial Profit Taking

if (strategy.position_size > 0 and close > strategy.position_avg_price + atr * 1.5)

strategy.close("Partial Close Buy", qty_percent=50) // Use strategy.close for partial closure at market price

if (strategy.position_size < 0 and close < strategy.position_avg_price - atr * 1.5)

strategy.close("Partial Close Sell", qty_percent=50) // Use strategy.close for partial closure at market price

// Trailing Stop with ATR type

if (strategy.position_size > 0)

strategy.exit("Trailing Stop Buy", from_entry="Buy", trail_offset=atr * 1.5, trail_price=strategy.position_avg_price)

if (strategy.position_size < 0)

strategy.exit("Trailing Stop Sell", from_entry="Sell", trail_offset=atr * 1.5, trail_price=strategy.position_avg_price)

相关推荐