波动引擎协议

ATR volatility ACCUMULATION DCA

这不是普通的DCA,这是带大脑的波动引擎

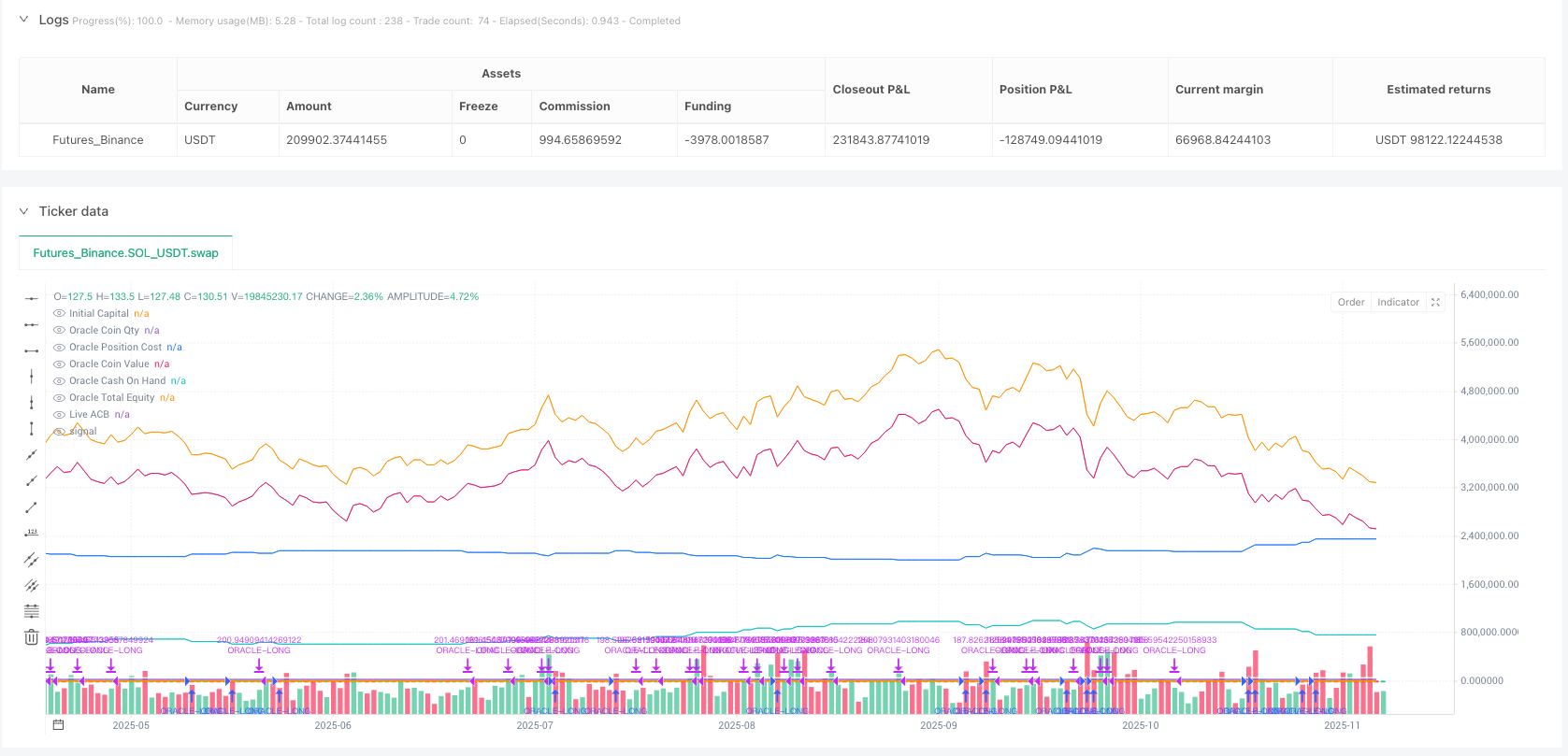

回测数据直接打脸传统定投:5%下跌触发买入,3.9%上涨触发卖出,但关键在于波动引擎会根据ATR动态调整买入阈值。市场波动越大,买入门槛越高,最高可调整40%。这意味着在高波动期间,策略会等待更大的跌幅才入场。

传统DCA策略的问题是无脑买入,而这套协议的核心逻辑是只在真正的机会窗口开火。通过ATR(14)计算当前波动率,然后动态调整longThreshPct参数。比如正常5%跌幅买入,但如果当前波动率达到20%,实际买入阈值会提升到6%。

8种预设配置,每种都有明确的收益预期

BTC周期积累模式:5%跌幅买入,6%仓位,500美元固定金额,适合长期持有者。 BTC短期套利模式:3.1%跌幅买入,10%仓位,6000美元固定金额,75%利润门槛卖出。 ETH波动收割:4.5%跌幅买入,15%仓位,允许成本线下方买入,30%利润门槛。

每种配置都经过回测验证,不是拍脑袋决定的参数。SOL配置35%利润门槛,XRP配置10%利润门槛,这些差异反映了不同资产的波动特性和流动性差异。

集群封印机制:解决DCA策略最大痛点

传统DCA最大问题是不知道什么时候停止买入。这套协议用”集群封印”解决:要么价格从平均成本上涨3.9%,要么连续10个周期没有符合条件的买入机会,就封印当前积累集群。

封印后的平均成本线成为卖出参考基准。只有价格突破封印成本线+利润门槛(30%-75%不等),才会触发卖出。这避免了无休止的买入和过早的获利了结。

安静柱机制更是神来之笔:如果连续10个周期都没有触发买入条件,说明市场已经企稳,应该准备收割而不是继续积累。

飞轮效应:让利润为下次买入服务

启用飞轮模式后,每次卖出的利润会重新投入到现金池,增加下次买入的弹药。这不是简单的复利,而是让策略在牛市中获得更强的火力。

举例:初始10万美元,第一轮积累获利20%,卖出后现金池变成12万美元。下次买入时,6%仓位就是7200美元而不是6000美元。随着时间推移,这种滚雪球效应会显著放大收益。

但飞轮也有代价:牛市后期会因为现金池过大而买入过多,需要严格控制单次买入上限。

风险控制:三重保险机制

第一重:成本线上方买入控制。可以设置只在平均成本下方买入,避免追高。 第二重:最小金额限制。每次买入/卖出都有最小美元金额要求,避免无意义的小额交易。 第三重:波动引擎调节。高波动期间自动提高买入门槛,低波动期间降低门槛。

但这套策略在震荡市表现一般。如果市场长期横盘,既无法触发大幅下跌买入,也无法达到利润门槛卖出,资金会被长期锁定。

实战建议:选对市场是关键

这套协议最适合有明确趋势的市场,特别是加密货币的周期性行情。在熊市末期开始积累,牛市中期开始收割,效果最佳。

不要在以下情况使用:1)高频震荡的股票市场 2)缺乏明确趋势的外汇市场 3)流动性极差的小币种。

历史回测显示风险调整后收益优于简单定投,但这不代表未来必然盈利。任何量化策略都存在失效风险,需要持续监控和调整。

//@version=6

// ============================================================================

// ORACLE PROTOCOL — ARCH PUBLIC clone (Standalone) — CLEAN-PUB STYLE (derived)

// Variant: v1.9v-standalone (publish-ready) 25/11/2025

// Notes:

// - Keeps your v1.9v canonical script intact (this is a separate modified copy).

// - Single exit mode: ProfitGate + Candle (per-candle) — no selector.

// - Live ACB plot toggle only (sealed ACB still operates internally but is not shown).

// - No freeze-point markers plotted.

// - Sizing: flywheel dynamic sizing remains the primary source but fixed-dollar entry

// and min-$ overrides remain available (as in Arch public PDFs/screenshots).

// - Volatility Engine (VE) applies ONLY to entries; exit-side VE removed.

// - Manual equity top-up removed (flywheel auto-updates cash).

// - VE ATR length and max-vol fields are fixed (not exposed in UI).

// ============================================================================

strategy("Oracle Protocol — Arch Public (Clone) • v1.9v-standalone (publish)",

overlay=true,

initial_capital=100000,

commission_type=strategy.commission.percent,

commission_value=0.1,

pyramiding=9999,

calc_on_every_tick=true,

process_orders_on_close=true)

// ============================================================================

// 1) PRESETS (Arch PDFs)

// ============================================================================

grp_oracle = "Oracle — Core"

oraclePreset = input.string(

"BTC • Cycle Accumulation",

"Recipe Preset",

options = [

"BTC • Cycle Accumulation",

"BTC • Cycle Swing Arbitrage",

"BTC • Short Target Accumulation",

"BTC • Short Target Arbitrage",

"ETH • Volatility Harvesting",

"SOL • Volatility Harvesting",

"XRP • Volatility Harvesting",

"SUI • Volatility Harvesting"

],

group = grp_oracle)

var float longThreshPct = 0.0

var float exitThreshPct = 0.0

var bool onlySellAboveCost = true

var bool recipe_buyBelowACB = false

var float sellProfitGatePct = 0.0

var float entryPct = 0.0

var float exitPct = 0.0

var float fixedEntryUsd = 0.0

var float fixedExitUsd = 0.0

if oraclePreset == "BTC • Cycle Accumulation"

longThreshPct := 5.0

exitThreshPct := 3.9

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 50.0

entryPct := 6.0

exitPct := 1.0

fixedEntryUsd := 500

fixedExitUsd := 500

else if oraclePreset == "BTC • Cycle Swing Arbitrage"

longThreshPct := 5.9

exitThreshPct := 3.5

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 49.0

entryPct := 10.0

exitPct := 50.0

fixedEntryUsd := 10000

fixedExitUsd := 15000

else if oraclePreset == "BTC • Short Target Accumulation"

longThreshPct := 3.1

exitThreshPct := 2.5

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 30.0

entryPct := 10.0

exitPct := 10.0

fixedEntryUsd := 6000

fixedExitUsd := 5000

else if oraclePreset == "BTC • Short Target Arbitrage"

longThreshPct := 3.1

exitThreshPct := 2.5

onlySellAboveCost := true

recipe_buyBelowACB := true

sellProfitGatePct := 75.0

entryPct := 10.0

exitPct := 100.0

fixedEntryUsd := 10000

fixedExitUsd := 5000

else if oraclePreset == "ETH • Volatility Harvesting"

longThreshPct := 4.5

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := true

sellProfitGatePct := 30.0

entryPct := 15.0

exitPct := 40.0

fixedEntryUsd := 6000

fixedExitUsd := 20000

else if oraclePreset == "SOL • Volatility Harvesting"

longThreshPct := 5.0

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 35.0

entryPct := 7.0

exitPct := 5.0

fixedEntryUsd := 5000

fixedExitUsd := 5000

else if oraclePreset == "XRP • Volatility Harvesting"

longThreshPct := 4.5

exitThreshPct := 10.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 10.0

entryPct := 17.0

exitPct := 50.0

fixedEntryUsd := 8000

fixedExitUsd := 5000

else if oraclePreset == "SUI • Volatility Harvesting"

longThreshPct := 5.0

exitThreshPct := 5.0

onlySellAboveCost := true

recipe_buyBelowACB := false

sellProfitGatePct := 10.0

entryPct := 5.0

exitPct := 10.0

fixedEntryUsd := 5000

fixedExitUsd := 15000

// ============================================================================

// 2) EXTRAS & VOLATILITY SPLITS (CLEAN PUBLIC VARIANTS)

// - Volatility engine inputs are fixed and not exposed in the UI

// ============================================================================

// UI group for extras (keeps flywheel toggle visible)

grp_extras = "Oracle — Extras"

useFlywheel = input.bool(true, "Reinvest Realized Profits (Flywheel)", group = grp_extras)

// Volatility engine: ENTRY only (VE params fixed, not shown)

useVolEngineEntry = input.bool(true, "Enable Volatility Engine (Entries only)", group = grp_extras)

// Fixed/hidden VE parameters (not exposed in UI per your request)

atrLen_fixed = 14

maxVolAdjPct_fixed = 40.0

// NOTE: manual_equity_topup removed for publish variant — flywheel handles auto top-up

buyBelowMode = input.string(

"Use Recipe Setting",

"Buy Below ACB Mode",

options = ["Use Recipe Setting", "Force Buy Below ACB", "Allow Buys Above ACB"],

group = grp_extras)

// ============================================================================

// 3) QUIET BARS (cluster seal) — unchanged behavior, UI visible

// ============================================================================

grp_qb = "Oracle — Quiet Bars (Cluster Seal)"

useQuietBars = input.bool(true, "Enable Quiet-Bars Seal", group=grp_qb)

quietBars = input.int(10, "Quiet Bars (no eligible buys)", minval=1, group=grp_qb)

// ============================================================================

// 4) SELL MODE — SINGLE ARCH EXIT (ProfitGate + Candle) ONLY

// (no selector; fixed behavior to match Arch public)

// ============================================================================

grp_sell = "Oracle — Sell Behaviour"

// no sellMode selector in this publish variant — fixed logic below

// ============================================================================

// 5) DISPLAY & PLOTS (simplified)

// - only Live ACB toggle remains visible.

// - sealed ACB and freeze points are intentionally not plotted.

// ============================================================================

grp_display = "Oracle — Display"

showLiveACB = input.bool(true, "Show Live ACB", group = grp_display)

acbColor = input.color(color.new(color.yellow, 0), "ACB Line Color", group = grp_display)

showExitGuides = input.bool(false, "Show Exit Guide Lines", group = grp_display)

// ============================================================================

// 6) 3C SIZING & MINIMUMS / OVERRIDES

// - primary sizing source is flywheel (cash ledger).

// - but fixed-entry USD and min-$ overrides remain (per Arch public).

// ============================================================================

grp_3c_sz = "Oracle — Sizing"

use3C = input.bool(true, "Enable 3Commas JSON Alerts", group = grp_3c_sz)

botTag = input.string("ORACLE", "Bot Tag / Pair Hint", group = grp_3c_sz)

// Keep min$/fixed entry & exit overrides visible (Arch style)

useMinEntry = input.bool(true, "Use Min $ on Entry", group = grp_oracle)

useMinExit = input.bool(true, "Use Min $ on Exit", group = grp_oracle)

manualMinEntry = input.float(0.0, "Manual Min $ Entry (0 = use recipe)", group = grp_oracle, step = 10)

manualMinExit = input.float(0.0, "Manual Min $ Exit (0 = use recipe)", group = grp_oracle, step = 10)

grp_override = "Oracle — Amount Override"

entryUsd_override = input.float(0.0, "Entry USD Override (0 = none)", group = grp_override, step = 10)

exitUsd_override = input.float(0.0, "Exit USD Override (0 = none)", group = grp_override, step = 10)

// ============================================================================

// 7) VOLATILITY ENGINE VALUES (ENTRY only)

// - VE uses fixed internal params (atrLen_fixed, maxVolAdjPct_fixed).

// - VE not applied to exits in this publish variant.

// ============================================================================

atrVal = ta.atr(atrLen_fixed)

volPct = atrVal / close * 100.0

volAdj = math.min(volPct, maxVolAdjPct_fixed)

longThreshEff = longThreshPct * (useVolEngineEntry ? (1 + volAdj/100.0) : 1)

// exit threshold is NOT adjusted by VE in this variant:

exitThreshEff = exitThreshPct

// ============================================================================

// 8) POSITION STATE & HELPERS

// ============================================================================

var float q = 0.0 // live coin quantity

var float cost = 0.0 // live position cost ($)

var float live_acb = 0.0 // live average cost (cost / q)

var float realized = 0.0

// Flywheel cash ledger (realised cash available for reinvest) — auto only

var float cash = na

if na(cash)

cash := strategy.initial_capital

// Cluster / gating state (sealed base) — sealed_acb still used internally but not shown

var bool clusterOpen = false

var float sealed_acb = na // frozen when a cluster seals (sealed accumulation base)

var int lastEntryBar = na

var int lastEligibleBuyBar = na // for quiet-bars seal

var int sell_steps_done = 0 // number of incremental exits already taken since gate armed

var float last_sell_ref = na // last sell price used for pullback re-arm (not used here)

var bool mode_single_sold = false // lock for Single per Rally (internal use)

// Helpers (array returns)

f_add_fill(_qty, _px, _q, _cost) =>

// returns newQty, newCost, newACB

_newCost = _cost + _qty * _px

_newQty = _q + _qty

_newACB = _newQty > 0 ? _newCost / _newQty : 0.0

array.from(_newQty, _newCost, _newACB)

f_reduce_fill(_qty, _px, _q, _cost) =>

// returns newQty, newCost, newACB, sellVal, costReduced, proportion

_sellVal = _qty * _px

_prop = _q > 0 ? _qty / _q : 0.0

_costReduced = _cost * _prop

_newCost = _cost - _costReduced

_newQty = _q - _qty

_newACB = _newQty > 0 ? _newCost / _newQty : 0.0

array.from(_newQty, _newCost, _newACB, _sellVal, _costReduced, _prop)

// ============================================================================

// 9) BUY SIGNALS & BUY-BELOW MODE

// ============================================================================

dropFromPrev = close[1] != 0 ? (close - close[1]) / close[1] * 100.0 : 0.0

wantBuy = dropFromPrev <= -longThreshEff

needBuyBelow = recipe_buyBelowACB

if buyBelowMode == "Force Buy Below ACB"

needBuyBelow := true

else if buyBelowMode == "Allow Buys Above ACB"

needBuyBelow := false

canBuyBelow = not needBuyBelow or (needBuyBelow and (live_acb == 0 or close < live_acb))

// Track “eligible” buys (quiet-bars gate references opportunity, not just fills)

if wantBuy and canBuyBelow

lastEligibleBuyBar := bar_index

// ============================================================================

// 10) SIZING (flywheel-driven; keep fixed/min-dollar options for entry & exit)

// ============================================================================

baseAcct = cash // flywheel only in this variant

// entry as percentage of baseAcct (dynamic) with fixed/min-dollar fallback (Arch-style)

entryUsd = baseAcct * (entryPct / 100.0)

// Entry min floor (keep manual/fixed options per Arch)

if useMinEntry

entryFloor = manualMinEntry > 0 ? manualMinEntry : fixedEntryUsd

entryUsd := math.max(entryUsd, entryFloor)

// override priority

entryUsd := entryUsd_override > 0 ? entryUsd_override : entryUsd

// entry qty

eQty = close > 0 ? entryUsd / close : 0.0

// Exit sizing: percentage of HOLDINGS (Arch) with min-$ fallback (unchanged)

exitQty_pct = q * (exitPct / 100.0)

exitFloorQty = close > 0 ? ( (manualMinExit > 0 ? manualMinExit : fixedExitUsd) / close ) : 0.0

xQty_base = math.max(exitQty_pct, exitFloorQty)

xQty = math.min(xQty_base, q)

xQty := exitUsd_override > 0 and close > 0 ? math.min(exitUsd_override / close, q) : xQty

// ============================================================================

// 11) ENTRY — opens/extends accumulation cluster; resets SELL steps

// Cash gate: only execute buy if cash >= entryUsd and on confirmed bar close

// ============================================================================

newEntry = false

entryCost = eQty * close

hasCash = entryCost > 0 and cash >= entryCost

if barstate.isconfirmed and wantBuy and canBuyBelow and eQty > 0 and hasCash

strategy.entry("ORACLE-LONG", strategy.long, qty=eQty, comment="ORACLE-BUY")

_fill = f_add_fill(eQty, close, q, cost)

q := array.get(_fill, 0)

cost := array.get(_fill, 1)

live_acb := array.get(_fill, 2)

cash -= entryCost

lastEntryBar := bar_index

lastEligibleBuyBar := bar_index

if not clusterOpen

clusterOpen := true

sealed_acb := na

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

// set sealed_acb initial for cluster if na

if na(sealed_acb)

sealed_acb := live_acb

newEntry := true

// ============================================================================

// 12) CLUSTER SEAL — Exit-Threshold OR Quiet-Bars

// - On sealing, we freeze sealed_acb internally (not plotted).

// ============================================================================

riseFromLiveACB = live_acb > 0 ? (close - live_acb ) / live_acb * 100.0 : 0.0

sealByThresh = riseFromLiveACB >= exitThreshEff

barsSinceElig = na(lastEligibleBuyBar) ? 10000 : (bar_index - lastEligibleBuyBar)

sealByQuiet = useQuietBars and (barsSinceElig >= quietBars)

sealed_changed = false

if clusterOpen and (sealByThresh or sealByQuiet)

clusterOpen := false

// freeze sealed base as the last live_acb at seal time (preserve cycle anchor)

sealed_acb := live_acb

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

sealed_changed := true

// ============================================================================

// 13) SELL LOGIC — SINGLE ARCH EXIT: ProfitGate + Candle (Per-Candle)

// - Profit gate base: use sealed refBase if present, otherwise live_acb (no toggle).

// - VE not applied to exits in this variant.

// ============================================================================

refBase = na(sealed_acb) ? live_acb : sealed_acb

riseFromRef = refBase > 0 ? (close - refBase) / refBase * 100.0 : 0.0

sellAboveOK = not onlySellAboveCost or close > live_acb

profitRefBase = refBase // sealed if available, else live_acb (no UI toggle in this variant)

// Basic profit gate price/boolean (uses profitRefBase)

profitGateLevelPrice = profitRefBase * (1 + sellProfitGatePct / 100.0)

profitGateCrossed = profitRefBase > 0 ? (close >= profitGateLevelPrice) : false

// Candle-based rise (percent move relative to previous close)

riseFromPrev = close[1] != 0 ? (close - close[1]) / close[1] * 100.0 : 0.0

candleRiseOK = riseFromPrev >= exitThreshEff

// Final allow-sell boolean for this publish variant (ProfitGate + Candle)

var bool allowSellThisBar = false

allowSellThisBar := false

allowSellThisBar := profitGateCrossed and candleRiseOK and xQty > 0 and q > 0 and sellAboveOK and barstate.isconfirmed

// Perform sell if allowed

actualExitQty = 0.0

if allowSellThisBar

actualExitQty := xQty

if actualExitQty > 0

strategy.close("ORACLE-LONG", qty = actualExitQty, comment = "ORACLE-SELL")

_r = f_reduce_fill(actualExitQty, close, q, cost)

q := array.get(_r, 0)

cost := array.get(_r, 1)

live_acb := array.get(_r, 2)

sellVal = array.get(_r, 3)

cRed = array.get(_r, 4)

tradePnL = sellVal - cRed

realized += tradePnL

cash += sellVal

sell_steps_done += 1

last_sell_ref := close

mode_single_sold := true

if q <= 0

// fully sold - reset sealed base and steps (internal)

sealed_acb := na

sell_steps_done := 0

mode_single_sold := false

last_sell_ref := na

// Re-arm logic (simplified): allow new sells only after retrace below refBase by exitThreshEff or if fully sold

if barstate.isconfirmed

if mode_single_sold

retrace_condition = not na(refBase) ? (close < refBase * (1 - exitThreshEff/100.0)) : false

if retrace_condition or q == 0

mode_single_sold := false

sell_steps_done := 0

last_sell_ref := na

// ============================================================================

// 14) BALANCES & 3C JSON (flywheel-based sizing)

// ============================================================================

cash_on_hand = math.max(cash, 0)

coin_value = q * close

total_equity = cash_on_hand + coin_value

base_for_3c = cash_on_hand // flywheel only in this publish variant

entryUsd_3c = base_for_3c * (entryPct / 100.0)

if useMinEntry

entryUsd_3c := math.max(entryUsd_3c, (manualMinEntry > 0 ? manualMinEntry : fixedEntryUsd))

entryUsd_3c := entryUsd_override > 0 ? entryUsd_override : entryUsd_3c

// ============================================================================

// 15) PLOTS (Data Window + Live ACB only + optional guides)

// - Sealed ACB and freeze markers intentionally NOT plotted in this variant.

// ============================================================================

plot(strategy.initial_capital, title="Initial Capital", color=color.white)

plot(q, title="Oracle Coin Qty", precision = 6)

plot(cost, title="Oracle Position Cost")

plot(coin_value, title="Oracle Coin Value")

plot(cash_on_hand, title="Oracle Cash On Hand")

plot(total_equity, title="Oracle Total Equity")

plot(live_acb > 0 and showLiveACB ? live_acb : na, title="Live ACB", color=color.new(color.orange,0), linewidth=2, style=plot.style_line)

// Exit guide lines reference refBase but are optional (kept for debugging/visual confirmation)

guide_exit_line = showExitGuides and not na(refBase) ? refBase * (1 + exitThreshEff/100.0) : na

guide_gate_line = showExitGuides and not na(refBase) ? refBase * (1 + sellProfitGatePct/100.0) : na

plot(guide_exit_line, title="Exit Threshold Line", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_linebr)

plot(guide_gate_line, title="Profit Gate Line (ref base)", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_linebr)

// Also plot the profit gate price computed from profitRefBase (if guides enabled)

plot(not na(profitRefBase) and showExitGuides ? profitRefBase * (1 + sellProfitGatePct/100.0) : na, title="Profit Gate (ref base)", display=showExitGuides ? display.all : display.none, linewidth=1, style=plot.style_line)