概述

该策略是一个结合了相对强弱指数(RSI)和平均真实波幅(ATR)的多层次动态成本均摊(DCA)交易系统。它主要通过识别市场超卖条件进行分批建仓,并利用ATR动态调整止盈位置,实现波段操作获利。策略具有风险分散、成本优化和收益稳定等特点。

策略原理

策略运行在4小时或日线级别,核心逻辑包括以下几个方面: 1. 入场信号基于RSI低于30的超卖判断,最多允许4次分批建仓 2. 每次建仓金额基于200美元总风险额度,根据2倍ATR动态计算持仓规模 3. 持仓管理采用动态平均成本跟踪,实时计算多次建仓后的均价 4. 止盈设置为均价上方3倍ATR,随市场波动性自适应调整 5. 通过标记线实时显示均价和止盈位置,便于视觉跟踪

策略优势

- 风险控制精确 - 通过预设风险金额和ATR动态调整,实现对单笔交易风险的精确控制

- 建仓灵活 - 分批建仓机制既能降低成本又能充分把握机会

- 止盈智能 - 基于ATR的动态止盈既保证了利润又适应市场波动

- 可视化强 - 均价线和止盈线的实时显示提供直观的交易参考

- 适应性好 - 策略参数可根据不同市场特征灵活调整

策略风险

- 连续超卖风险 - 市场持续下跌可能导致建仓次数过多 解决方案:严格执行最大建仓次数限制,必要时设置止损

- 止盈设置风险 - 过高的止盈倍数可能导致错过获利机会 解决方案:根据市场特征动态调整ATR倍数

- 资金管理风险 - 分批建仓可能占用过多资金 解决方案:合理设置风险限额和建仓规模

策略优化方向

- 入场信号优化

- 增加趋势判断指标,避免在强势下跌中过早建仓

- 结合成交量指标,提高超卖判断的可靠性

- 止盈机制完善

- 引入trailing stop机制,更好地锁定利润

- 考虑分批止盈,提高获利的灵活性

- 风险控制增强

- 添加总体回撤控制

- 优化资金分配算法

总结

该策略通过RSI和ATR指标的结合,实现了一个兼具风险控制和收益稳定的交易系统。分批建仓机制提供了成本优化的可能,而动态止盈的设计则确保了收益的合理兑现。虽然存在一些潜在风险,但通过合理的参数设置和优化方向的实施,策略的整体表现将得到进一步提升。

策略源码

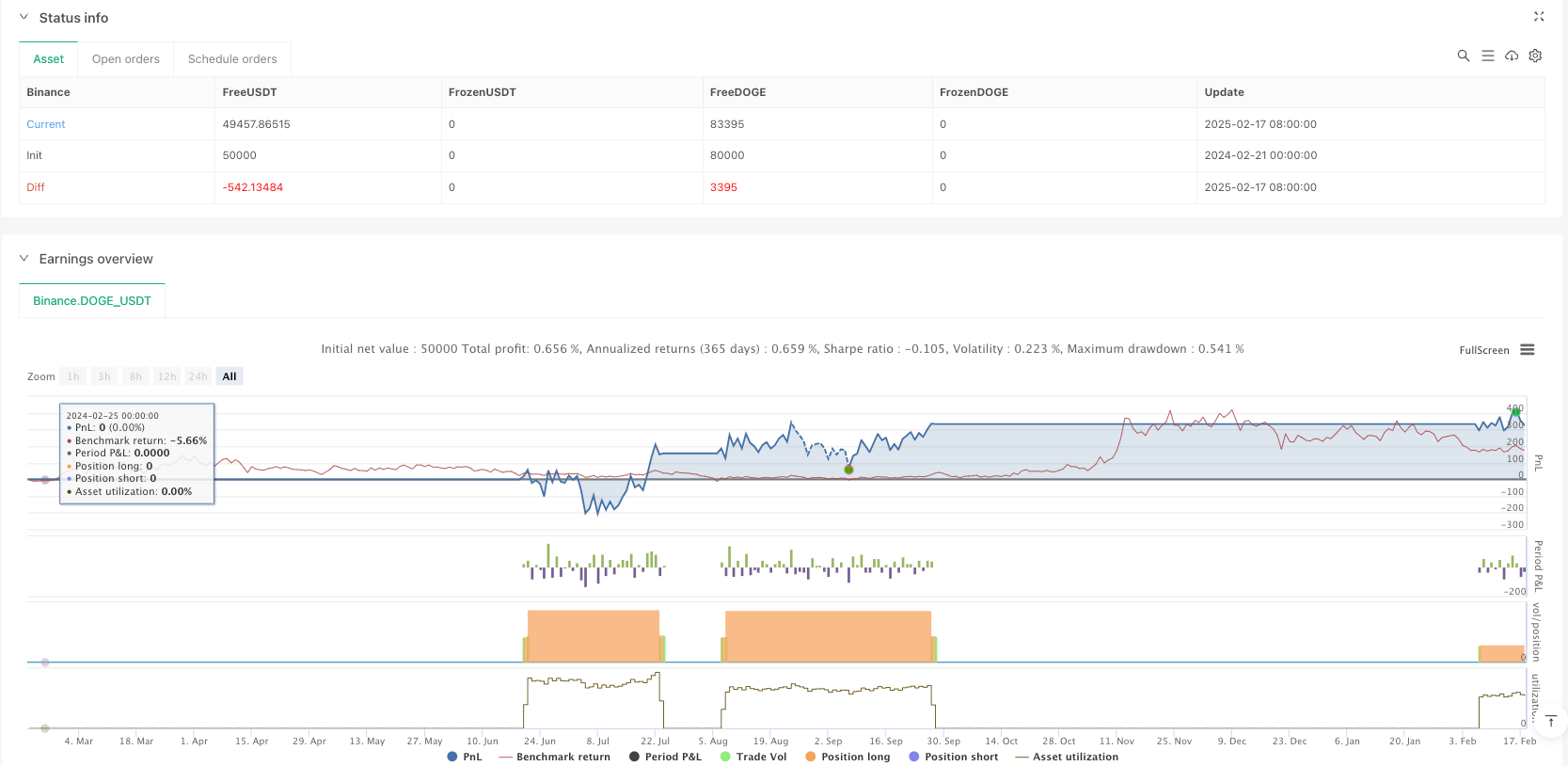

/*backtest

start: 2024-02-21 00:00:00

end: 2025-02-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Binance","currency":"DOGE_USDT"}]

*/

//@version=6

strategy("DCA-Based Swing Strategy (Risk $200) with Signals", overlay=true)

// === Main Indicators ===

// RSI for identifying oversold conditions

rsi = ta.rsi(close, 14)

// ATR for volatility estimation

atr = ta.atr(14)

// === Strategy Parameters ===

// Risk management

riskPerTrade = 200 // Total risk ($200)

atrRisk = 2 * atr // Risk in dollars per buy (2 ATR)

positionSize = riskPerTrade / atrRisk // Position size (shares)

// DCA Parameters

maxEntries = 4 // Maximum of 4 buys

takeProfitATR = 3 // Take profit: 3 ATR

// === Position Management ===

var float avgEntryPrice = na // Average entry price

var int entryCount = 0 // Number of buys

var line takeProfitLine = na // Take profit line

var line avgPriceLine = na // Average entry price line

// === Buy and Sell Conditions ===

buyCondition = rsi < 30 and entryCount < maxEntries // Buy when oversold

if (buyCondition)

strategy.entry("DCA Buy", strategy.long, qty=positionSize)

// Update the average entry price

avgEntryPrice := na(avgEntryPrice) ? close : (avgEntryPrice * entryCount + close) / (entryCount + 1)

entryCount += 1

// Display "BUY" signal on the chart

label.new(bar_index, low, "BUY", style=label.style_label_up, color=color.green, textcolor=color.white, size=size.normal)

// Update lines for average entry price and take profit

if (not na(takeProfitLine))

line.delete(takeProfitLine)

if (not na(avgPriceLine))

line.delete(avgPriceLine)

takeProfitPrice = avgEntryPrice + takeProfitATR * atr

// Sell condition: Take profit = 3 ATR from average entry price

takeProfitPrice = avgEntryPrice + takeProfitATR * atr

if (close >= takeProfitPrice and entryCount > 0)

strategy.close("DCA Buy")

// Reset parameters after closing

avgEntryPrice := na

entryCount := 0

// Remove lines after selling

if (not na(takeProfitLine))

line.delete(takeProfitLine)

if (not na(avgPriceLine))

line.delete(avgPriceLine)

相关推荐