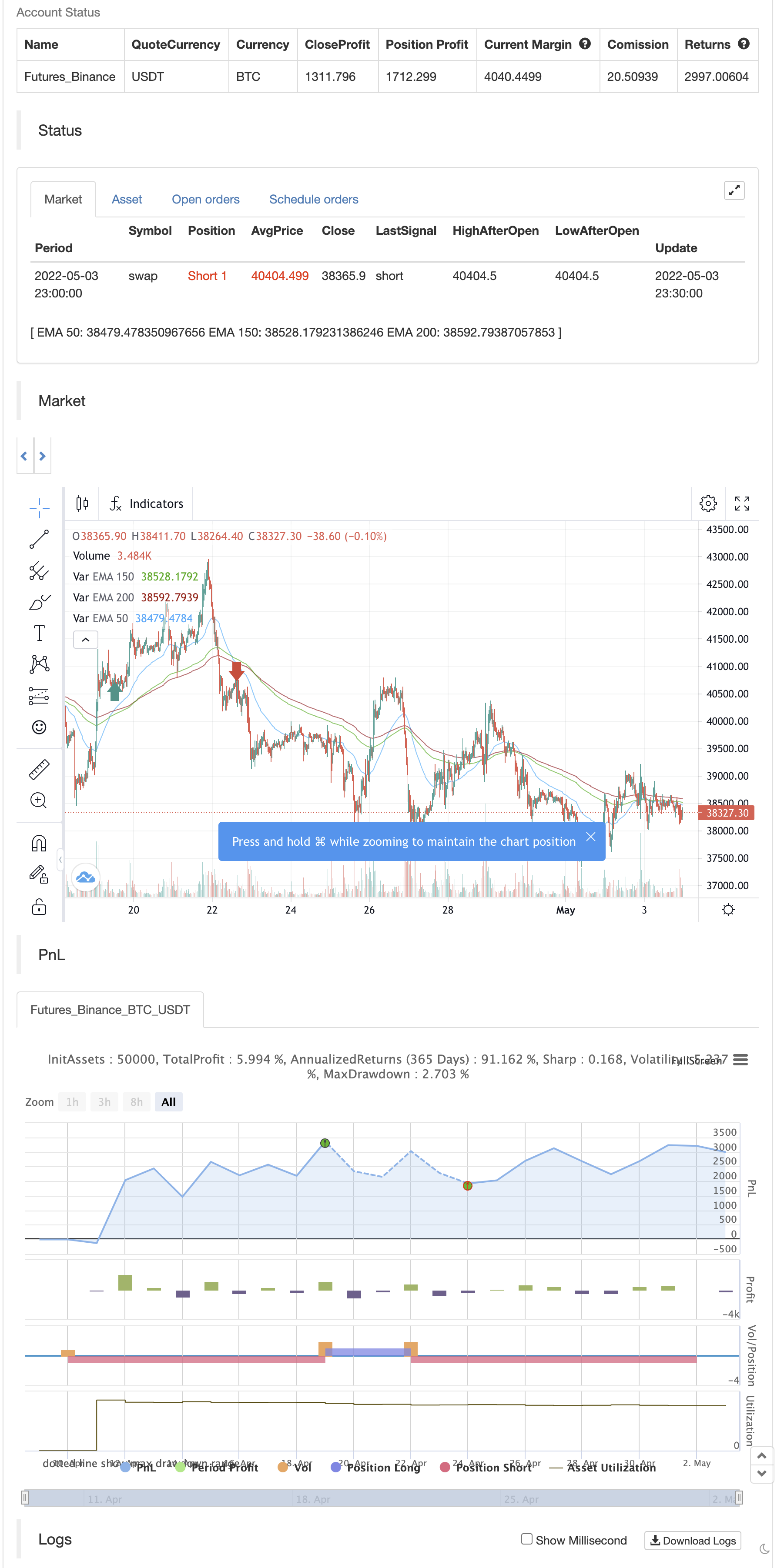

long 50>200 ema short 50<200 ema

tyvm have a nice day

backtest

策略源码

/*backtest

start: 2022-04-10 00:00:00

end: 2022-05-03 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//@Author: AdventTrading

//Modified by viraltaco_

// This indicator was made to allow three moving averages to be displayed

// without needing to use up 3 charting indicators individually

strategy(title = "Triple EMA + MACD", shorttitle = "tEMACd", overlay = true, default_qty_value = 750)

// Checkbox's for the other 2 MA's

line_2 = input(true, title = "Enable 2nd MA")

line_3 = input(true, title = "Enable 3rd MA")

len_1 = input( 50, minval = 1, title = "First length")

len_2 = input(150, minval = 1, title = "Second length")

len_3 = input(200, minval = 1, title = "Third length")

src_1 = input(close, title = "First source")

src_2 = input(close, title = "Second source")

src_3 = input(close, title = "Third source")

tit_1 = "EMA 50"

tit_2 = "EMA 150"

tit_3 = "EMA 200"

plot(ema(src_1, len_1), title = tit_1, color = #10aaff)

plot((line_2) ? ema(src_2, len_2) : na, title = tit_2, color = #10ad00)

plot((line_3) ? ema(src_3, len_3) : na, title = tit_3, color = #ad0010)

//strategy("MACD Strategy", overlay=true)

fastLength = input(26)

slowlength = input(49)

MACDLength = input(2)

SMema = ema(src_1, len_1)

LGema = ema(src_3, len_3)

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

if (crossover(delta, 0) and SMema > LGema)

strategy.entry("MacdLE", strategy.long, comment="MacdLE")

if (crossunder(delta, 0) and SMema < LGema)

strategy.entry("MacdSE", strategy.short, comment="MacdSE")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

相关推荐